Sweden’s $215M/year telehealth giant

Jan-Erik Asplund

Jan-Erik Asplund

TL;DR: Kry has grown into one of the top telehealth players in Europe at an estimated $215M in yearly revenue—now, armed with an AI chatbot for diagnosis and treatment, they’re positioned to continue their invasion of continental Europe. For more, check out our interview with Johannes Schildt & Claes Ruth, CEO and CFO of Kry and our Kry report and dataset.

Key points from our research:

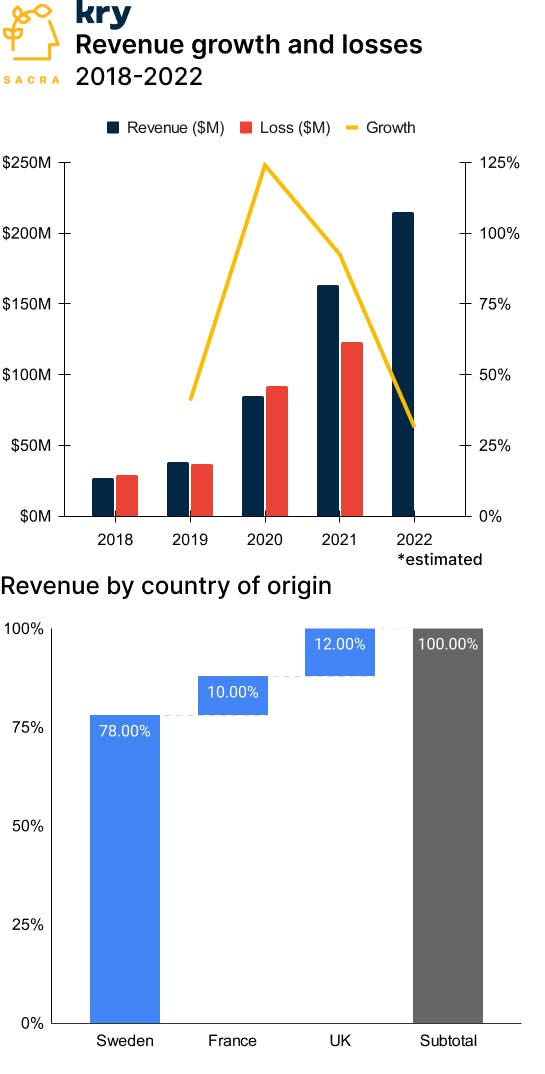

- Telehealth usage grew 38x worldwide in the first year of COVID—as European national health services raced to set up telehealth-friendly reimbursement structures, Kry emerged as one of the top digital healthcare providers in Europe, growing 124% from $38M revenue in 2019 to $85M in 2020 and then 92% to $164M in 2021. Kry drove fast adoption and built a destination site for telehealth by hiring their own doctors and nurses—1,300+ of them as of 2023—to provide video consultations via mobile app within ~30 minutes, 365 days a year vs. waiting 1-3 months to get an appointment at a brick-and-mortar clinic.

- With barriers to entry lowered and competitors flooding into telehealth during the pandemic, the market took a bearish sentiment post-COVID, with Teladoc (NYSE: TDOC) falling by 70% ($294 to $89 per share), Amwell (NYSE: AMWL) falling nearly 86% ($35 to $5 per share), and Hims (NYSE: HIMS) falling 75% (from $24 to under $6 per share). As many of the smaller telehealth privates were forced to consolidate, conduct huge layoffs, and shut down, Kry was able to grow its own market share.

- Today, Kry generates revenue in three ways: video consultations (national payers like the NHS pay Kry either on a per-service basis or increasingly, via a subscription fee for the number of citizens enrolled in their services month-to-month), sales of their “Zoom for telehealth” SaaS product to doctors, and referral payments from partners like pharmacies and labs. The majority of Kry's revenue (78%) comes from its home country Sweden, followed by the UK (12%) and France (10%).

- Sacra estimates that Kry is at $215M in revenue as of 2022, up 31% year-over-year—with the macro shifting to prefer profitable companies, Kry have reduced EBITDA burn by 70%+ over the last 12 months past year and expect to be profitable in all geographies by 2024. Like Kry, smaller telehealth companies have partnered with national healthcare services, but they’ve lacked the scale to do it profitably.

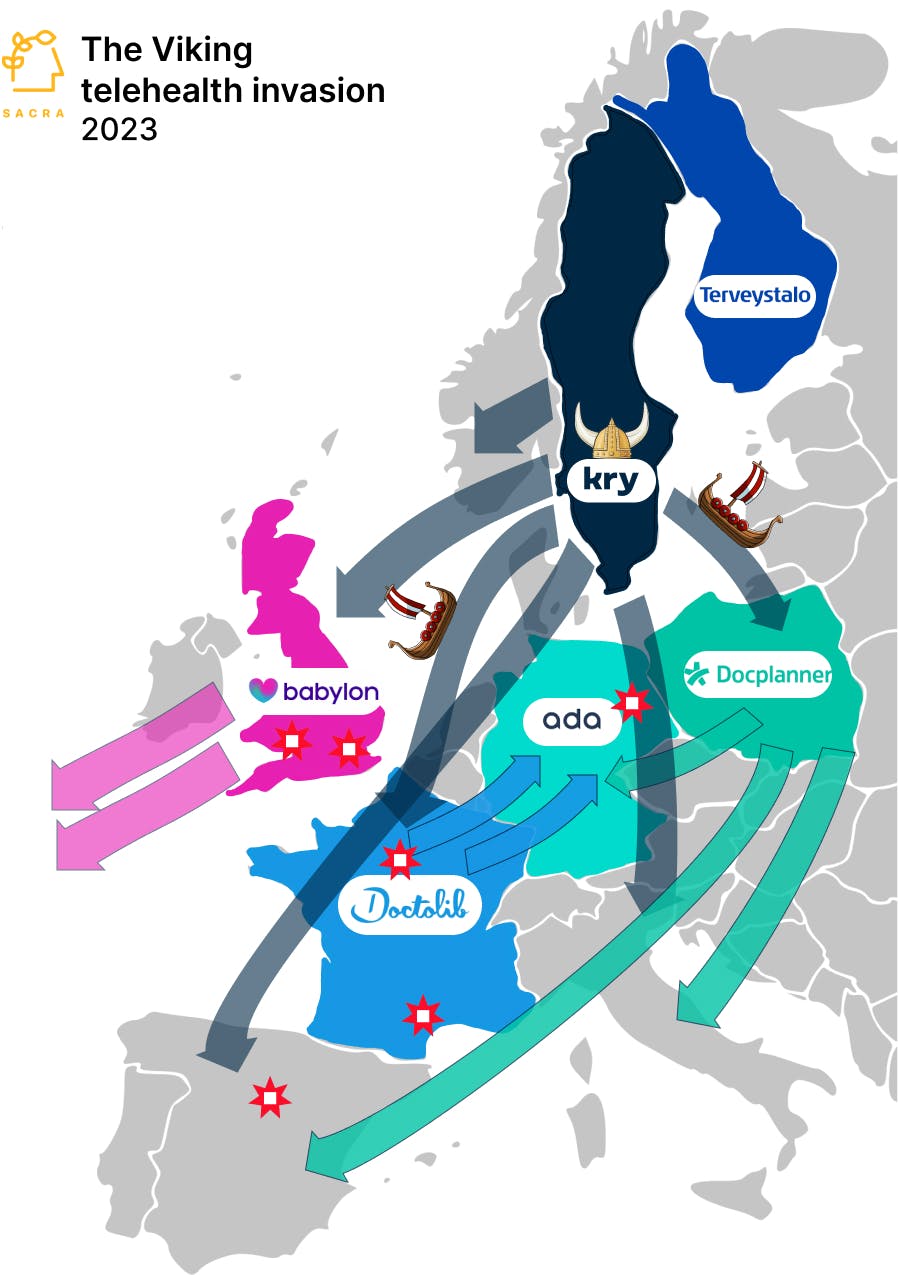

- Like the locally forged resistance faced by Vikings in their raids across Europe, Kry faces regional threats from established and well-capitalized players such as Doctolib ($815M raised) in France, Ada Health ($189.5M raised) in Germany, Babylon Health ($1.1B revenue in 2022) in the UK, and DocPlanner ($140.5M raised) in Poland. National healthcare payers encourage competition and support more than one regional and inter-regional platform to avoid dependence on a single service, both creating the opening for geographic expansion and threatening any success that’s been hard won.

- Meanwhile, the high cost of treatment and patient acquisition continues to drive growing losses across telehealth, with Kry’s losses growing to $123M despite $164M in revenue according to Swedish filings. Compare to Oak Street (acquired by CVS in 2023) which lost $510M on $2.16B in revenue in 2022, One Medical (acquired by Amazon in 2023) which lost $101M on $1.05B, and Teladoc, which lost $13.7B on $2.4B in revenue.

- For telehealth companies that have already invested millions in building big teams, AI threatens to disrupt the model by enabling new competition with a much smaller headcount base. On a per-doctor basis, AI enables far more resolutions via GPT-4 chatbots trained on medical journals and ICD-10 codes.

- Because national payers pay Kry on a subscription basis per the number of citizens they help, Kry’s incentives align with diverting needless, costly clinic visits, driving a virtuous cycle where their ability to instantly resolve issues with AI chat enables them to scale top-of-funnel patient volume faster. While Kry’s revenue today is split between 50% from fee-for-service models like in France and 50% from capitated subscription models like in Sweden, they expect AI to push more national payers toward subscription models over the coming years.

- In the bull case, Kry’s AI chatbot aggregates patient demand for telehealth while catalyzing their ownership of the end-to-end experience, funneling down high-value patients with chronic conditions or conditions that need in-person treatment to its clinics and growing scale and ARPU at the same time. Companies running physical clinics like One Medical have high ARPU (~$1,200) but scale slower with ~30% gross margins, pure telehealth companies have lower ARPU (~$30) but scale faster with ~70% margins, while Kry’s hybrid approach allows it to scale patient volume fast while expanding ARPU by adding more clinics.

For more, check out this other research from our platform:

- Kry (dataset)

- Johannes Schildt & Claes Ruth, CEO and CFO of Kry, on the AI future of telehealth

- Lifen (dataset)

- Ro ($300M revenue in 2022)

- Quartet Health

- Marc Atiyeh, CEO of Pawp, on building telehealth for pets

- Liana Guzmán, CEO of Folx, on the $400B market for LGBTQIA healthcare

- Brendan Keeler, Senior PM at Zus Health, on building infrastructure for digital health