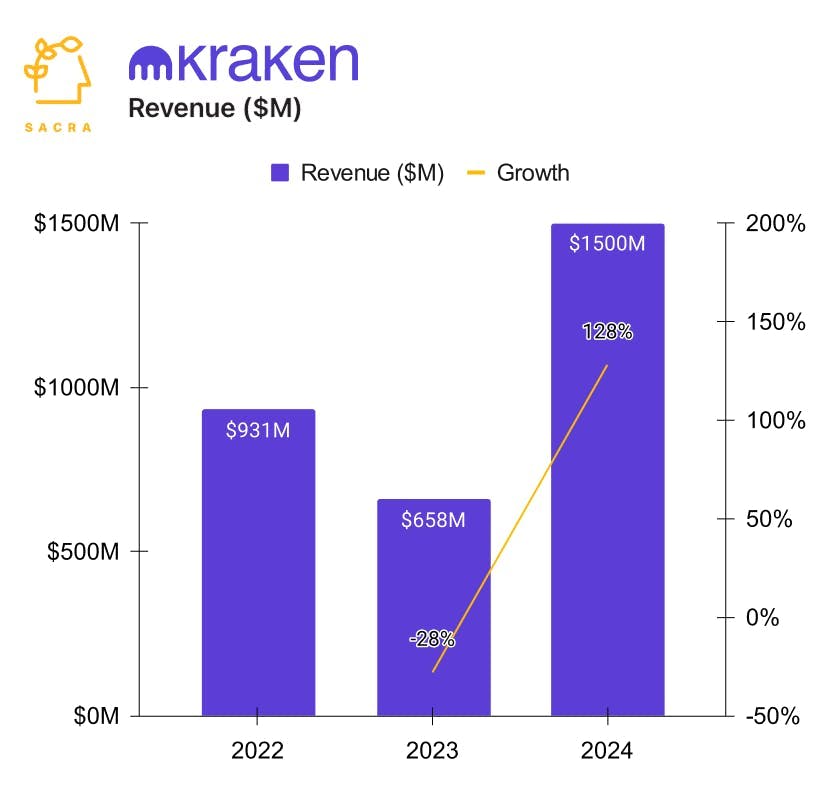

Kraken at $1.5B up 128% YoY

Jan-Erik Asplund

Jan-Erik Asplund

TL;DR: After the crypto decline in 2022-2023, Kraken posted a Sacra-estimated $1.5B in revenue for 2024 (up 128% YoY) as trading volumes rapidly re-accelerated. With a core customer base of professional traders and institutions, Kraken is now building, and partnering with developers to build, apps and services on top of their exchange. For more, check out our full Kraken report and dataset, as well as our interviews with Arjun Sethi [2025] and David Ripley [2022], co-CEOs of Kraken.

We last covered Kraken in early Q3 2024 when we projected, based on rebounding crypto trading volumes, that it would hit $1.2B in revenue for 2024—undershooting Kraken’s $1.5B in revenue for 2024 based on the post-election Nov-Dec ‘24 runup.

Key points from our Kraken update:

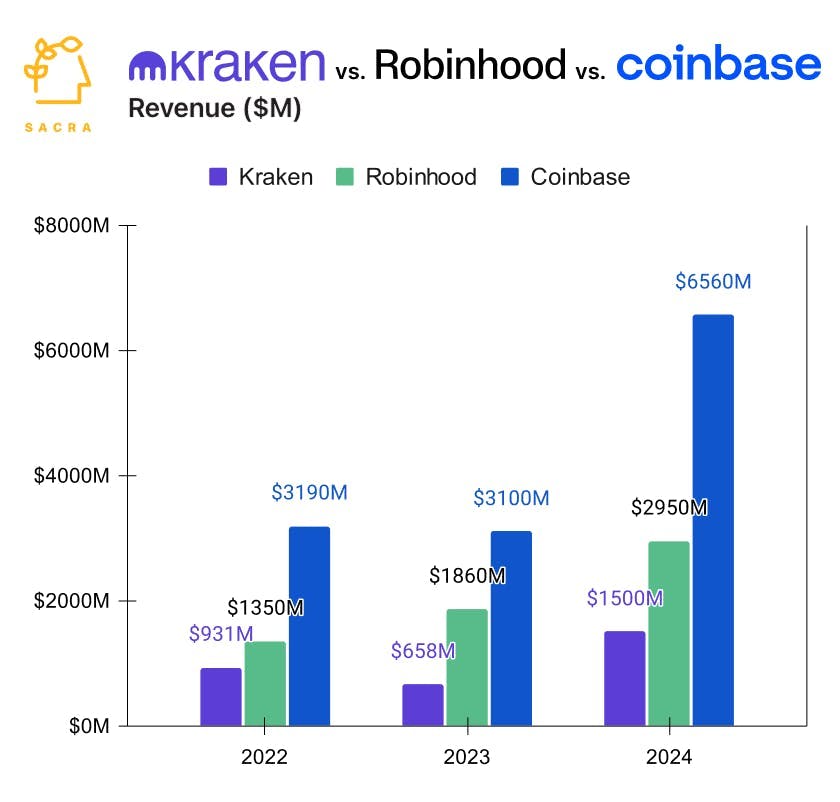

- Sacra estimates that Kraken hit $1.5 billion in revenue for 2024, growing 128% year-over-year from $660 million in 2023, valued at $5.5B as of their 2020 Series B for a 14.5x multiple on $380M EBITDA in 2024—compare to Coinbase (NASDAQ: COIN) at $6.6B of revenue in 2024, growing 111% YoY, with a $54B market cap for a 16.4x multiple on $3.3B EBITDA, and Robinhood (NASDAQ: HOOD) at $2.9B of revenue in 2024, growing 58% YoY, with a $39.6B market cap for a 27.7x multiple on $1.43B EBITDA.

- At an average revenue per user (ARPU) of $2,023—outpacing competitors like Coinbase ($825 ARPU) and Robinhood ($164 ARPU)—Kraken has cemented its positioning for professional crypto traders, against Coinbase’s broader retail crypto adoption and Robinhood’s mass-market accessibility across every asset class.

- With the exchange as the platform, Kraken’s approach is to build—and partner with developers to build—apps and services on top that leverage the deep liquidity pools on the exchange (at $665B in trading volume, Kraken has 50% of Coinbase’s volume with 22% the revenue), emphasizing global B2B payments and money movement via stablecoins.

For more, check out this other research from our platform:

- Kraken (dataset)

- Chainalysis

- Arjun Sethi, co-CEO of Kraken, on building the Nasdaq of crypto

- David Ripley, COO of Kraken, on the future of cryptocurrency exchanges

- Auston Bunsen, Co-Founder of QuickNode, on the infrastructure of multi-chain

- Q&A with Raihan Anwar and Colby Holliday from Friends with Benefits

- Farooq Malik and Charles Naut, co-founders of Rain, on stablecoin-backed credit cards