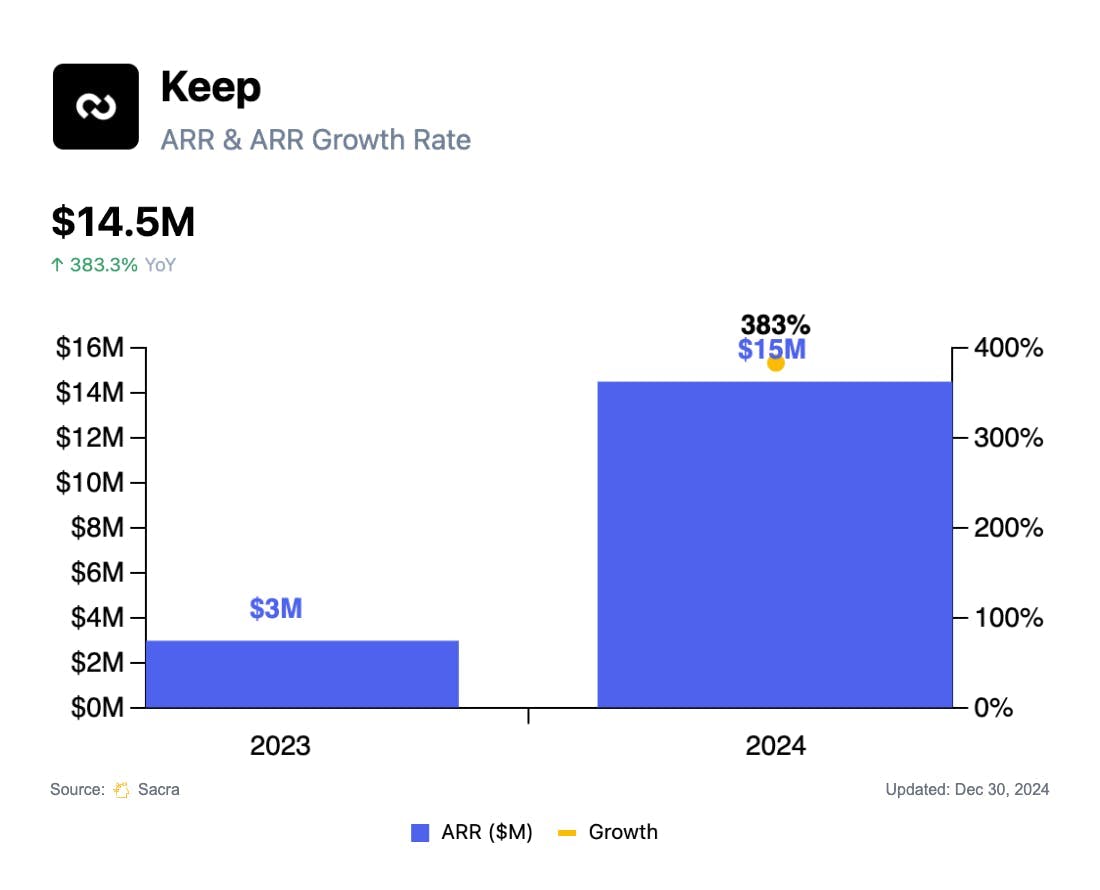

Keep at $14M/year growing 383% YoY

Jan-Erik Asplund

Jan-Erik Asplund

TL;DR: Keep launched in 2023 as Canada's Brex, targeting SMBs with lower deposit balances (~$50K vs. $2M+ for U.S. startups) but steady interchange revenue. Sacra estimates Keep reached $14M in annualized revenue in 2024, competing alongside Float and Loop to capture Canada's 1.2M SMBs before American players expand north. For more, check out our full report and dataset on Keep.

Key points via Sacra AI:

- Keep launched in 2023 as the "Brex for Canada," bundling corporate Visa cards ($10-50K credit limits) bundled with multi-currency accounts (USD, EUR, GBP, MXN) for banking like a local, foreign exchange for global payments (3-5% cheaper than traditional banks), and expense management. Keep monetizes primarily via interchange fees (~1.8-2.0% on Canadian business cards, similar to U.S. rates but 6x higher than the EU's 0.3% capped rates), supplemented by interest on deposits/fees on capital advances and FX spreads on its multi-currency payment features.

- After launching Keep Capital (2024) for short-term loans of up to $1M, underwritten via data on cash flows and deposits—targeting the 1.2M Canadian SMBs who struggle to get credit from Canada’s Big Five banks without personal guarantees—Sacra estimates that Keep hit $14M in annualized revenue. Compare to Brex at $319M of annualized revenue in 2023, up 48% YoY, and Ramp at $648M of annualized revenue in 2024, up 133% YoY, Mercury at $500M in annualized revenue in 2024, up 97% YoY, and Kapital at $184M in annualized revenue in 2024, up 156% YoY.

- Unlike U.S. neobanks and corporate cards (Brex, Mercury) that built on VC-backed startups, Keep primarily serves Canadian SMBs that generate steady revenue but need working capital, creating a fundamentally different risk profile with lower deposit balances (~$50K average vs. $2M+ for U.S. startup customers) but more predictable interchange revenue. Keep, Float, and Loop—the only native corporate card players in Canada—now have a window to win Canada's 1.2M SMBs before the market becomes as saturated as the dogpile of corporate card companies in the U.S.

For more, check out this other research from our platform:

- Keep (dataset)

- Mercury (dataset)

- Brex (dataset)

- Ramp (dataset)

- Kapital (dataset)

- Art Levy, Chief Business Officer at Brex, on the strategy of Brex Embedded

- Immad Akhund, CEO of Mercury, on the business models of fintechs vs. banks

- Fernando Sandoval, co-founder of Kapital, on tropicalizing Brex for LatAm

- Anthony Peculic, Head of Cards at Cross River Bank, on building a fintech one-stop shop

- Bo Jiang, CEO of Lithic, on the power of the cards as a digital payment rail

- Geoff Charles, VP of Product at Ramp, on Ramp's AI flywheel

- Karim Atiyeh, co-founder and CTO of Ramp, on the future of the card issuing market

- Mercury: the unbundling of Silicon Valley Bank