Kapital: the $72M/year Nubank for SMBs

Jan-Erik Asplund

Jan-Erik Asplund

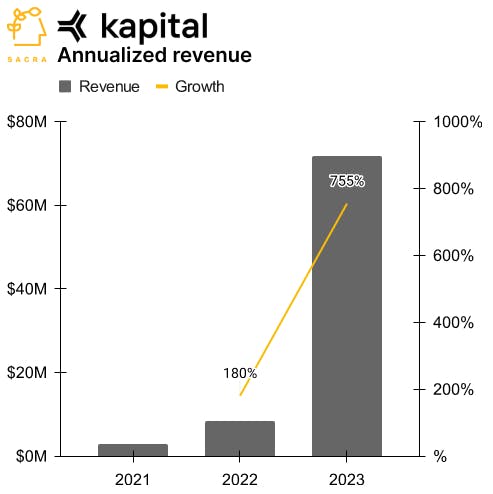

TL;DR: Sacra estimates that Mexican B2B neobank Kapital hit $72M in annualized revenue in 2023, up 755% year-over-year. Like Brazil’s Nubank, Kapital is using the lack of competition in Mexico as an opportunity, vertically integrating a banking and finance backoffice superapp for everything from lending, banking and corporate card to expense management, bill pay, payroll, FP&A, inventory management and more. For more, check out our interview with Kapital co-founders Rene Saul and Fernando Sandoval and our Kapital dataset.

Key points from our report:

- To fight rampant tax fraud, Mexico passed a law in 2010 that required all of the country’s 4.5M SMBs to file e-invoices for all their purchases—and as a byproduct, it created a national digital ledger of B2B payments data. In a country where fewer than 1/2 of adults have bank accounts and the majority of businesses still transact in cash, mandatory e-invoicing has forced businesses online to send and receive e-invoices.

- Kapital launched as a B2B neobank in Mexico in 2020, using revolving lines of credit as a hook to get SMBs to plug in their e-invoices and monitor their cash flow using Kapital’s SaaS dashboard, hitting 35,000 users in 3 months. Because interchange rates are 0.5-0.9% in LatAm, Kapital chose not to clone Brex and Ramp, but instead, charge for their SaaS dashboard via subscription (~$40/month) and earn interest revenue on lending (50-70% margins across LatAm).

- Sacra estimates that Kapital hit $72M in annualized revenue in 2023, growing 755% year-over-year—largely powered by their $50M acquisition of the Mexican bank Banco Autofin (~$45M in annualized revenue in 2023)—with roughly 60% of revenue from lending and 40% from SaaS. Compare to Brazilian consumer-focused neobank Nubank (NYSE: NU) which has grown to $2.1B of revenue, up 53% year-over-year, capturing half of the checking accounts in Brazil while spending just $5 in average CAC because ~85% of customers come in organically through word-of-mouth.

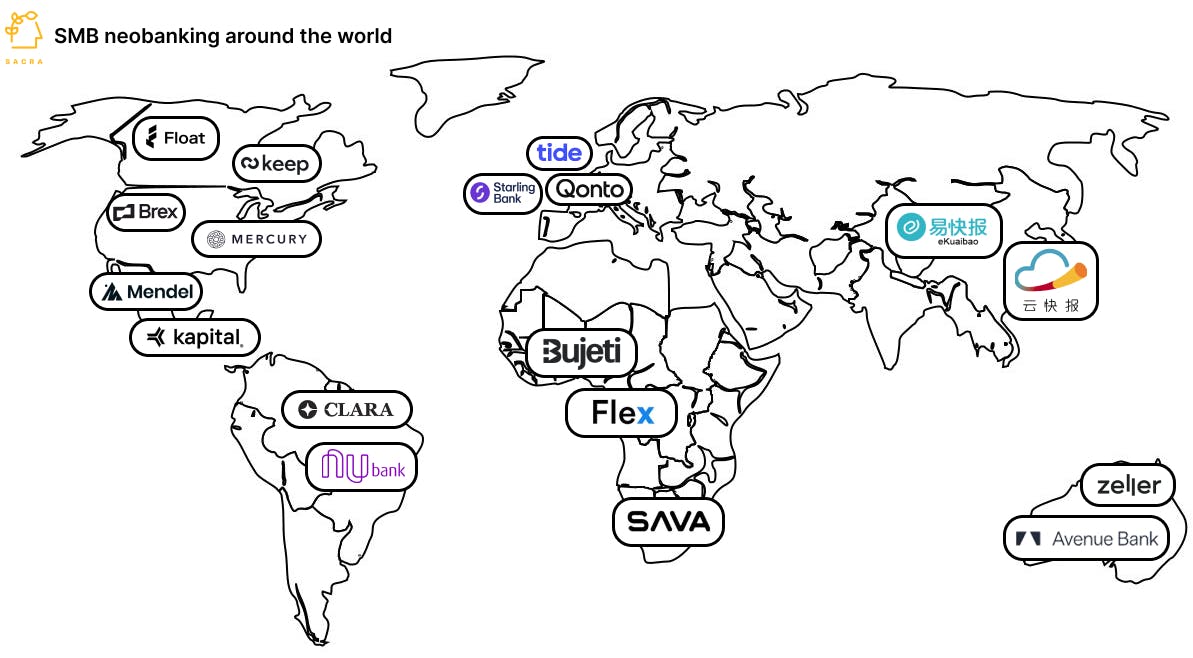

- With 20-50 banks per country in LatAm vs. roughly 80,000 in the U.S alone—and few of those focusing on SMBs (99.5% of all companies in LatAm)—there’s room for many winners among SMB-focused neobanks like Kapital, full-service neobanks that do SMB like Nubank and Banco Inter (NASDAQ: INTR), and other B2B expense management companies like Clara and Mendel. Kapital has expanded to Colombia, Peru and Chile so far, using channel partnerships with local chambers of commerce to keep CAC down (paying only when a business signs up) while cross-sell drives net dollar retention and LTV—compare to consumer neobanks that have to pay for ads and have limited upside because of high competition on verticals like lending, crypto, and stocks.

- Just as China leapfrogged PCs to go straight to mobile with WeChat eating up digital payments for 140M+ SMBs, LatAm is leapfrogging the proliferation era of B2B finance and backoffice SaaS and jumping straight to multiproduct superapps like Kapital, with line of sight into eating up $1.5T+ of business payments across the region. Unlike a Mercury or Brex which an SMB in the U.S. integrates with 5 other tools to power its backoffice, the lack of competition in LatAm means that Kapital has the opportunity to be the bank, vertically integrate the backoffice, and eat up corporate card, expense management, bill pay, payroll, FP&A, inventory management and more.

For more, check out this other research from our platform:

- René Saul and Fernando Sandoval, co-founders at Kapital, on the fintech opportunity in LatAm

- Kapital (dataset)

- Immad Akhund, CEO of Mercury, on the business models of fintechs vs. banks

- Mercury: the unbundling of Silicon Valley Bank

- Chime: the $1.85B/year could-be superapp

- Raghunandan G, CEO of Zolve, on cross-border banking in India

- Swastik Nigam, CEO of Winvesta, on building cross-border fintech

- Matt Brown. co-founder of Bonsai, on the rise of vertical ERPs

- Varo (dataset)

- Mercury (dataset)

- Monzo (dataset)

- N26 (dataset)