Jasper: the $72M ARR Google Suite of generative AI

Rohit Kaul

Rohit Kaul

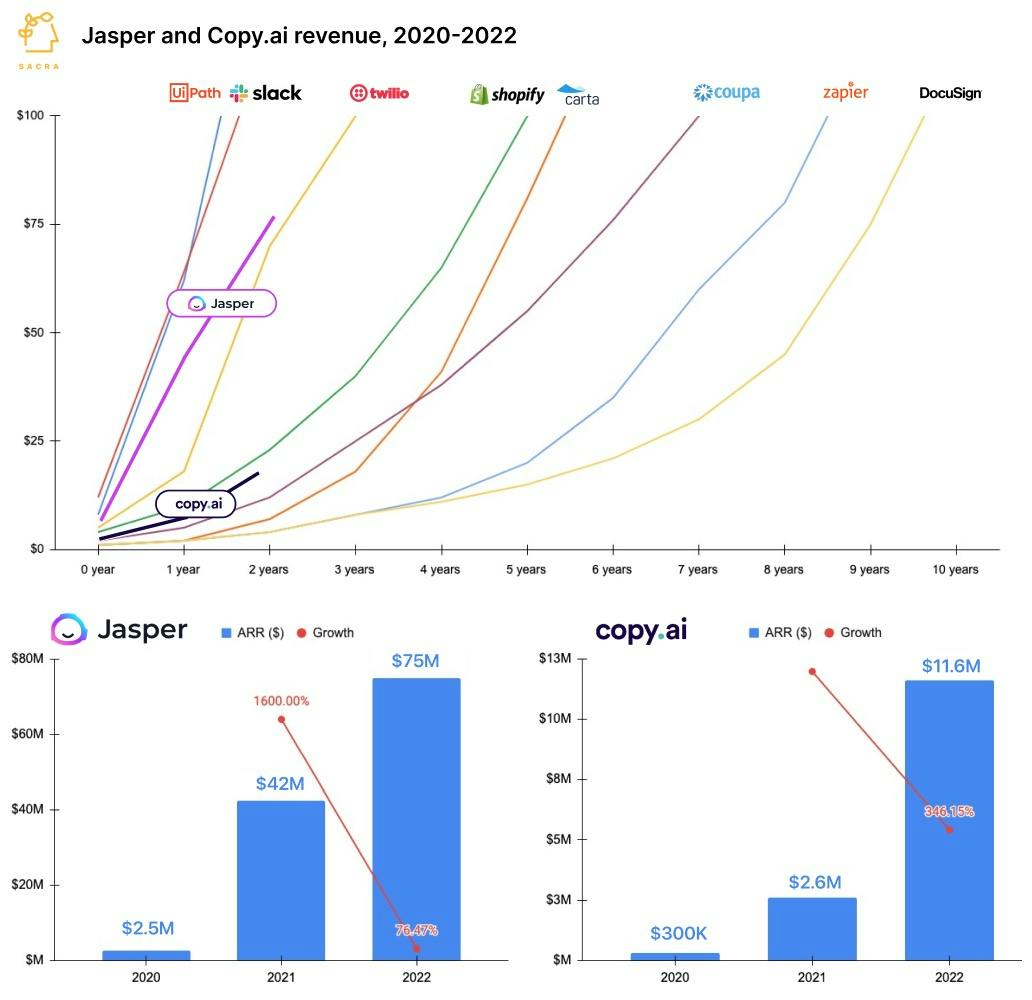

TL;DR: Generative AI copywriting apps Jasper ($72M ARR) and Copy.ai ($11M ARR) grew fast by productizing GPT-3 for marketers, but now they have competition from fast-follower startups renting the same foundational models and web 2.0 behemoths like Google and Microsoft with massive distribution. Check out our coverage of Jasper (dataset) and Copy.ai (dataset), and read our interviews with Dave Rogenmoser, CEO and co-founder of Jasper and Chris Lu, co-founder of Copy.ai for more.

Check out our weekly email for more insights like this into private companies.

Success!

Something went wrong...

Key points from our research:

- Jasper ($1.5B) reached $42.5M in ARR in the first 12 months of launch, growing 30% MoM—it’s expected to cross $75M in 2022. Jasper started out as a tool to write Facebook and Google ad copy, but got a head start by opening up Jasper to the pre-existing community of marketers from the founders’ startup and grew by acquiring customers through paid ads. (link)

- Copy.ai (raised $14M) went from $2M ARR to $10M in 14 months growing 20% MoM over the last 6 months, and is projected to end 2022 at ~$11.6M ARR. After building five MVPs built on GPT-3, Copy.ai found traction with their copywriting tool—CEO Paul Yacoubian drove much of their initial growth with a series of viral “building in public” tweets. (link)

- Generative AI copywriting apps found initial traction with non-native English speaking freelancers using it for a kind of labor geo-arbitrage where they'd mark up and sell content on Upwork/Fiverr, and it quickly crossed the chasm to native-English speaking SMBs. These apps simplify content writing through pre-built templates for their customers’ core use cases like product descriptions, company bio, social posts, blog posts, etc. (link)

- Jasper and Copy.ai essentially resell OpenAI’s ($20B) GPT-3 output at ~60% gross margin by embedding fine-tuned GPT-3 text generation into copywriting workflows. Similar to how Vercel and Netlify repackage and resell AWS’s storage, compute, and CDN with a dev-friendly UX wrapper, Jasper and Copy.ai abstract away bare metal usage of OpenAI and resell it with user friendly presets and UX. (link)

- The generative AI market is crowded, with 50+ text and image processing startups launched in the last 18 months and all of them renting foundational models from companies like OpenAI and Stability AI ($1B), which are now commoditizing the app layer by making it cheap and friction-free to build generative AI apps. Every time a user generates a word, these apps pay a fee to OpenAI, much like Spotify pays record labels every time someone plays a song. (link)

- Web 2.0 incumbents like Microsoft (NASDAQ: MSFT) and Google (NASDAQ: GOOGL), with their own proprietary foundational AI models, have the advantage of not paying foundational layer tax and bundling AI as a feature for near-free in their apps by spreading the model’s cost over billions of users. Microsoft’s foundational model MT-NLG has 530B parameters, and Google’s PaLM has 540B parameters, making them strong competitors to GPT-3 with 175B parameters. (link)

- While Microsoft Office, Google Workspace and Adobe Creative Cloud (NASDAQ: ADBE) have the power of distribution and bundlenomics, non-AI native incumbents risk stapling AI on as a "feature" a la Microsoft Clippy rather than weaving AI into the foundation of the products. Because incumbents are constrained by their existing product design, they’re at a disadvantage compared to AI-native apps when it comes to building a cohesive, end-to-end AI product experience.

- Building on their lead means staying ahead of rapid advances in foundational models from companies like OpenAI and Stability AI as GPT-3 gives way to GPT-4 and new use cases are unlocked at the foundational layer. Iteration speed on product is paramount for generative AI companies which lack a technology moat. (link)

- Jasper is aiming to use their fine-tuned models to build a unified AI experience widget, baked into all enterprise workflows like sales & marketing, support, HR, legal, and finance, similar to how Grammarly ($13B) hooks into any app where users interact with text. Jasper's Chrome extension is the first step towards this, and it expects 95% of future usage to happen inside other apps rather than its standalone web app. (link)

- Copy.ai sees AI-powered content as a wedge into building a HubSpot-like growth automation platform that hooks into your software stack and automates decision making with a human in the loop. Rather than just e.g. writing Facebook ads, Copy.ai would run and A/B test them, start/pause campaigns as needed, bid for impressions on its own, and modify the campaign text and creative to get better results. (link)

- Where the last generation of creator tools like Figma ($20B) and Canva ($26B) built moats by converting low barriers to adoption into network effects, generative AI apps’ moats will come from being deeply embedded into workflows and converting feedback data into finely-tuned AI models trained on customer data. Copy.ai and Jasper's existing lead gives them access to proprietary user feedback and engagement data that can allow them to produce the most customized fine-tuned models for their use cases, entrenching them similar to how Google created RankBrain to do machine learning on user engagement data after PageRank had been commoditized. (link)

- Once the foundational models evolve to making human-like decisions, these apps get the chance to execute a new type of labor arbitrage by automating decisions, which gives them much larger returns than copywriting. Jasper and Copy.ai then upgrade from simple workflow widgets to a second brain that powers businesses. (link)

For more, check out our full interviews with Dave Rogenmoser, CEO and co-founder of Jasper, Chris Lu, co-founder of Copy.ai, and this other research from our platform: