Instabase: the $46M/year Palantir of banking

Jan-Erik Asplund

Jan-Erik Asplund

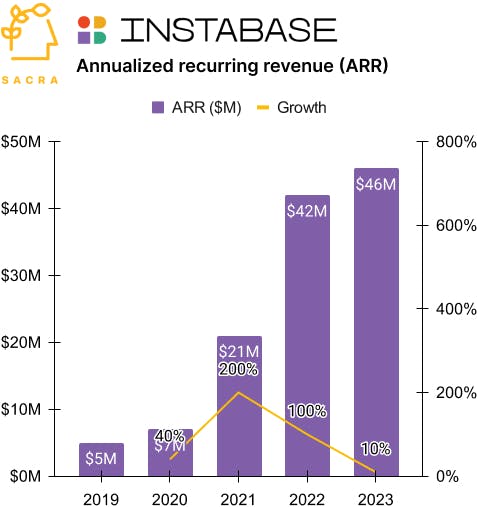

TL;DR: Sacra estimates that Instabase hit $46M ARR (up 10% year-over-year) in 2023 with their low-code app platform used by banks, insurance companies, and hospitals to turn paper documents into structured data and build workflows around it. As LLMs disrupt OCR businesses everywhere, they’re now retooling around AI, building the self-serve Palantir anyone can use to build apps on top of their proprietary, unstructured data. For more, check out our full dataset and sources on Instabase.

Key points from our research:

- Instabase (2015) found initial product-market fit using optical character recognition (OCR) and their own machine learning (ML) language model to help banks turn stacks of paystubs, bank statements, and IDs into structured data and build workflows for credit and KYC checks around it. After 2 years, Instabase had a handful of startup customers paying $2,000/month—in 2018, they signed Standard Chartered (LSE: STAN) to a $1.5M contract, fired their startup customers, brought on 3 more banks, and hit $5M ARR by the end of 2019.

- Sacra estimates that Instabase hit $46M ARR in 2023, up 10% year-over-year, serving about 45 enterprise customers across banking, insurance, and healthcare with their hybrid consulting-software model for an average contract value of $1.02M. Compare to “Instabase of defense” Palantir (NYSE: PLTR) at $2.2B ARR, up 20%, with about 500 customers for ACV of $4.4M, and enterprise AI platform C3 AI (NYSE: AI) at $313M ARR, up 18%, with 287 customers for ACV of $1.09M.

- Instabase’s upside hinges on expanding their TAM from credit checks and loan underwriting to enterprise-wide use cases like invoice processing, identity verification, and processing legal contracts. Where GPT-4 gives you core building blocks, Instabase is verticalized to solve a specific set of problems across a wide range of customers, enabling it to be easier-to-use to build fully-featured applications.

For more, check out this other research from our platform: