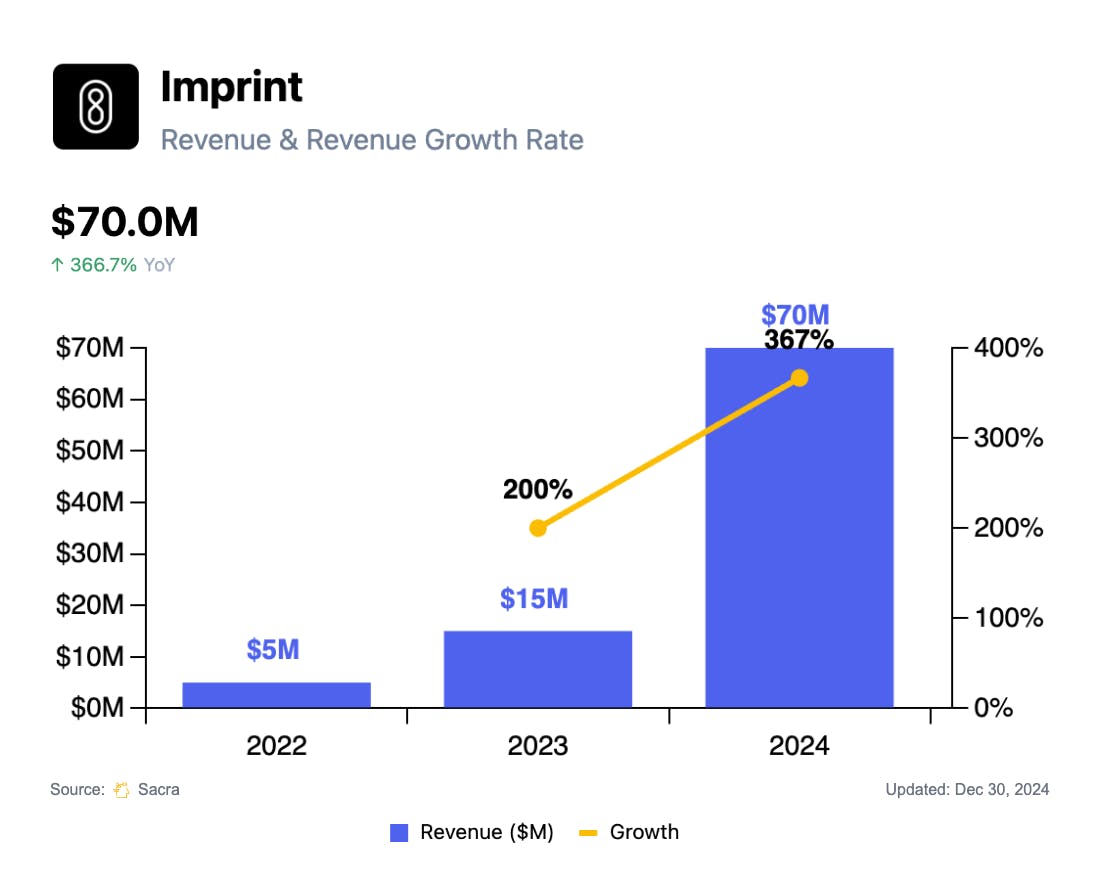

Imprint at $70M/yr growing 367% YoY

Jan-Erik Asplund

Jan-Erik Asplund

TL;DR: Betting that it can beat legacy banks Chase, Citi & Barclays on speed-to-market, product & cardholder experience, Imprint (founded in 2020) helps brands like H-E-B (#1 grocer in Texas) launch custom, co-branded cards in 3 months (vs 12-18) with SKU-level rewards. After poaching Brooks Brothers & Eddie Bauer from its competition, Sacra estimates that Imprint hit $70M in revenue in 2024, up 367% YoY. For more, check out our full report and dataset on Imprint.

Key points via Sacra AI:

- Imprint (2020) helps brands like H-E-B & Holiday Inn Vacations launch custom Visa & Mastercard co-branded card programs with fast speed-to-market and highly targeted rewards systems that traditional banks can’t match with legacy tech, shipping programs in as little as 3 months (vs 12-18) and delivering SKU-level rewards specificity (e.g., 5% cash back only on H-E-B private label products). Initially launching with a secured charge card requiring full balance payment each billing period, Imprint quickly evolved from that wedge to focus on co-branded open loop (e.g. Visa & Mastercard) credit cards that charge standard market interest rates, monetizing on interest income (60% of revenue), interchange (35%) and annual card and late fees (5%).

- After poaching Brooks Brothers from Citi (NYSE: C) (and originally launched on Synchrony) and Eddie Bauer from Bread Financial (NYSE: BFH) in 2024, Sacra estimates that Imprint hit $70M in revenue in 2024, up 367% YoY, with $75M in Series C financial raised from Keith Rabois at Khosla Ventures at a $600M valuation, giving it a 8.6x revenue multiple. Compare with incumbents Synchrony (NYSE: SYF) at $24.2B in 2024 revenue, up 15% from $21B in 2023 revenue trading at a market cap of $23.4B or 1x revenue and Bread Financial at $3.8B in 2024 revenue, down 11% from $4.3B in 2023 trading at a market cap of $2.46B or less than 1x revenue along with large banks like JPMorgan Chase (NYSE: JPM), Citi and Barclays (NYSE: BCS), which have access to cheap funding sources, massive loyalty franchises, and unrivaled distribution.

- With 400K cardholders across at least 9 programs, Imprint’s cards win with consumers when 1) a shopper’s spend has significant concentration and frequency at a single brand, 2) an instant, no-risk sign-up can be embedded inside the checkout flow and combined with immediate discounts or perks, and 3) brand partners underwrite granular rewards that can out-punch 1% to 2% cash-back economics of generic cash-back cards. With minimal penetration into digital native brands (e.g., DoorDash with Chase)—where purchase frequency & spend volume vs. reward costs make or break card economics—Imprint is expanding into co-branded deposit accounts centered around retail partners' physical locations like H-E-B, targeting underserved Americans who regularly visit those storefronts, mirroring how Walmart (NYSE: WMT) has offered financial services like check cashing and money orders through its nationwide store network.

For more, check out this other research from our platform:

- Imprint (dataset)

- Klarna (dataset)

- Revolut (dataset)

- Monzo (dataset)

- Neobank capital cycle

- The future of interchange

- Roy Ng, EVP, Chief Business Officer at FIS, on the future of BaaS

- Karim Atiyeh, co-founder & CTO of Ramp, on the future of the card issuing market

- Bo Jiang, co-founder & CEO of Lithic, on the power of the cards as a digital payment rail

- Anthony Peculic, Head of Cards at Cross River Bank, on building a fintech one-stop shop

- Fintech Fastlane: The Unit Economics of the Banking-as-a-Service Toll Road

- Banking-as-a-Service Unit Economics and TAM