HoneyBook at $135M ARR

Jan-Erik Asplund

Jan-Erik Asplund

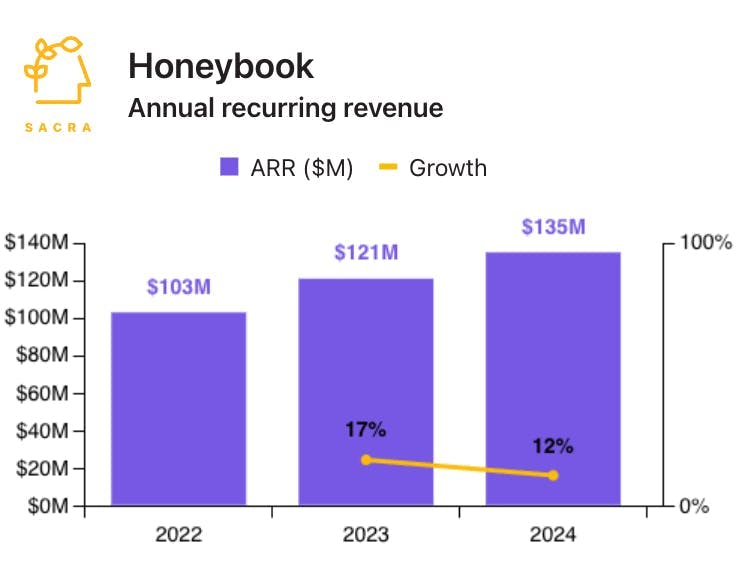

TL;DR: HoneyBook continues to expand its business management platform for independent service providers with embedded financial services and AI tools, positioning itself as an end-to-end vertical ERP for solopreneurs. Sacra estimates that HoneyBook hit $140M ARR in March 2025, maintaining a 12% growth rate through 2024 and early 2025. For more, check out our full report and dataset on HoneyBook.

When we last covered HoneyBook, it had reached $103M in revenue in 2022, shortly after raising a $250M Series E at a $2.4B valuation from Tiger Global Management.

Founded in 2013, HoneyBook is a SaaS platform that helps independent service providers like photographers, event planners, and interior designers capture leads, send proposals, e-sign contracts, process payments, and handle email communications—replacing the fragmented tech stack most solopreneurs cobble together.

Here's our HoneyBook update with key points via Sacra AI:

- Sacra estimates that HoneyBook reached $140M in annualized recurring revenue (ARR) as of March 2025, showing a moderation in growth from 17% in 2023 to 12% in 2024 and early 2025 as the company shifts focus from user acquisition to monetization through new embedded financial services and AI-powered workflow enhancements.

- HoneyBook's strategic expansion into embedded financial services through the launch of HoneyBook Finance in 2024—integrating a debit card, checking account, and money management tools—represents a significant evolution from its initial client management focus to a vertical ERP for independent service providers, mirroring a broader industry shift where vertically-focused software platforms increasingly absorb both workflow and cash flow to deliver higher-margin financial products to their users.

- With the addition of AI capabilities across its platform, including automated meeting notes, email drafting, and smart workflow automations, HoneyBook is making a play to become the all-in-one B2B AI platform for solopreneurs—leveraging the comprehensive nature of its product to deliver AI features throughout the client lifecycle rather than requiring users to stitch together disparate point solutions or craft their own ChatGPT prompts for different business functions.

For more, check out this other research from our platform:

- Honeybook (dataset)

- EquipmentShare (dataset)

- Workrise (dataset)

- ServiceTitan (dataset)

- Jobber (dataset)

- Roy Ng, EVP, Chief Business Officer at FIS, on the future of BaaS

- ServiceTitan: the $577M/year vertical SaaS for your lawn

- Matt Velker, CEO of OpenWrench, on the taxonomy of the maintenance services SaaS space

- Matt Brown, Co-Founder of Bonsai, on the rise of vertical ERPs

- Warren Brown, VP of Product at Order, on 4 ways to monetize payments in vertical SaaS

- Alexis Rivas, CEO of Cover, on building the Tesla for homebuilding

- Q&A with Dan Spinosa and Drew Stanley from Fixable on building a managed marketplace for DIYers