Gong at $300M ARR

Jan-Erik Asplund

Jan-Erik Asplund

TL;DR: After a slowdown amid sales team hiring freezes in 2023, Gong's revenue growth re-accelerated in 2024 as they increased attach rate and expanded their average contract value (ACV) across their 4,500 customers. Sacra estimates that Gong crossed $300M annual recurring revenue (ARR) in January 2025, up 28% YoY. For more, check out our full report, dataset and our previous report on Gong.

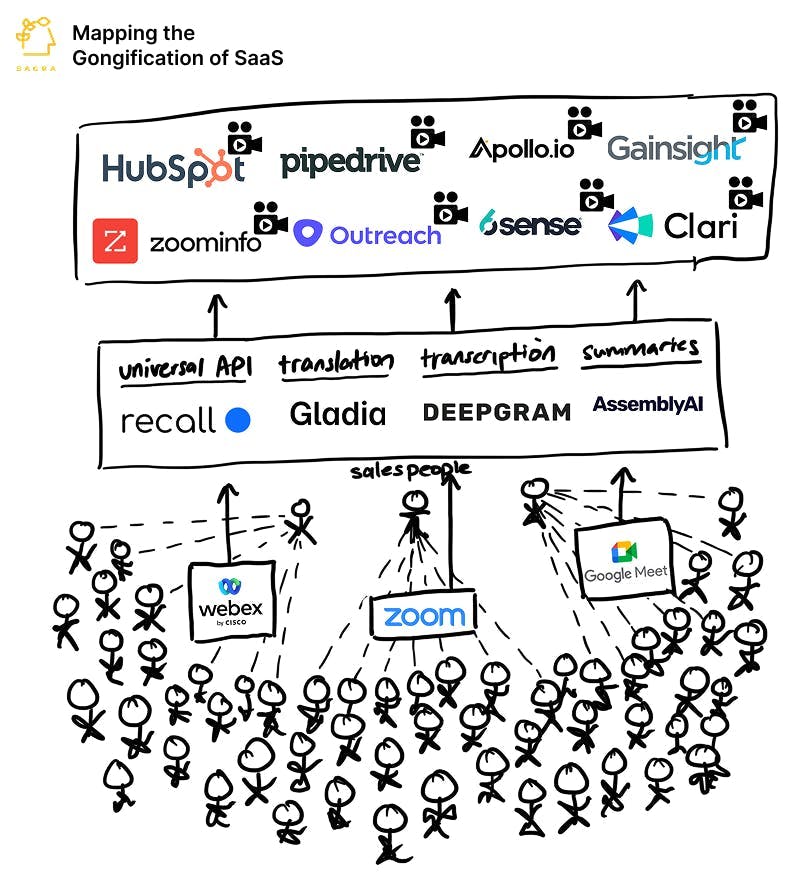

We last covered Gong in fall 2023 as call recording was becoming ubiquitous not just in sales but across other categories like CRM, go-to-market, and customer success in what we called the Gongification of SaaS. We projected that they would hit $285M in annual recurring revenue (ARR) by year end—overshooting our now revised estimate of $232M in ARR.

Here’s our end-of-year Gong update with key points via Sacra AI:

- Gong’s annual recurring revenue (ARR) exploded during COVID when all sales activity moved online, decelerated post-COVID and hit a bottom in 2023 when growth dipped to 16% year-over-year (YoY), before reaccelerating to 28% YoY growth in 2024—with Sacra estimating that Gong crossed $300M in ARR in January 2025, with their last valuation of $7.25 billion at their 2021 Series E yielding a 24x multiple on today’s ARR (down from the ~54x revenue multiple at the time of the raise).

- Like in customer service SaaS, widespread layoffs & hiring freezes in sales during 2023 (15%-25% reductions in sales headcount) negatively impacted Gong’s previously reliable ~140% net dollar retention based on seat expansion, plus the revenue ops category became increasingly competitive with call recording becoming a part of every sales product including Apollo.io, Zoominfo, Outreach, 6sense, HubSpot and more.

- By extracting structured data from customers’ call recordings via the AI-powered Gong Data Engine (2024) and feeding it into Gong Forecast (revenue ops) and Gong Engage (sales engagement), Gong is leveraging AI at the core of its multiproduct strategy to make its rich repository of data useful across a range of use cases, increasing attach rate (25% of customers buying multiple products) and revenue per seat to drive its 2024 re-acceleration.

For more, check out this other research from our platform:

- Gong (dataset)

- Gongification of SaaS

- Nico Ferreyra, CEO of Default, on building an end-to-end inbound sales platform

- Austin Hughes, CEO and co-founder of Unify, on the death of the SDR

- How Clearbit sold to HubSpot

- Apollo at $100M ARR

- Matt Sornson, co-founder & ex-CEO at Clearbit, on vertically integrated data and workflow tools in sales and marketing

- Apollo (dataset)

- Pinecone

- Adam Brown, co-founder of Mux, on the future of video infrastructure

- Matt Redler, ex-CEO of Panther, on the competitive positioning of Deel vs. Remote vs. Rippling

- Lenny Bogdonoff, co-founder and CTO of Milk Video, on the video infrastructure value chain

- Len Markidan, CMO at Podia, on the future of business video

- Ben Ruedlinger, CINO at Wistia, on the video hosting infrastructure stack