Glean for law

Jan-Erik Asplund

Jan-Erik Asplund

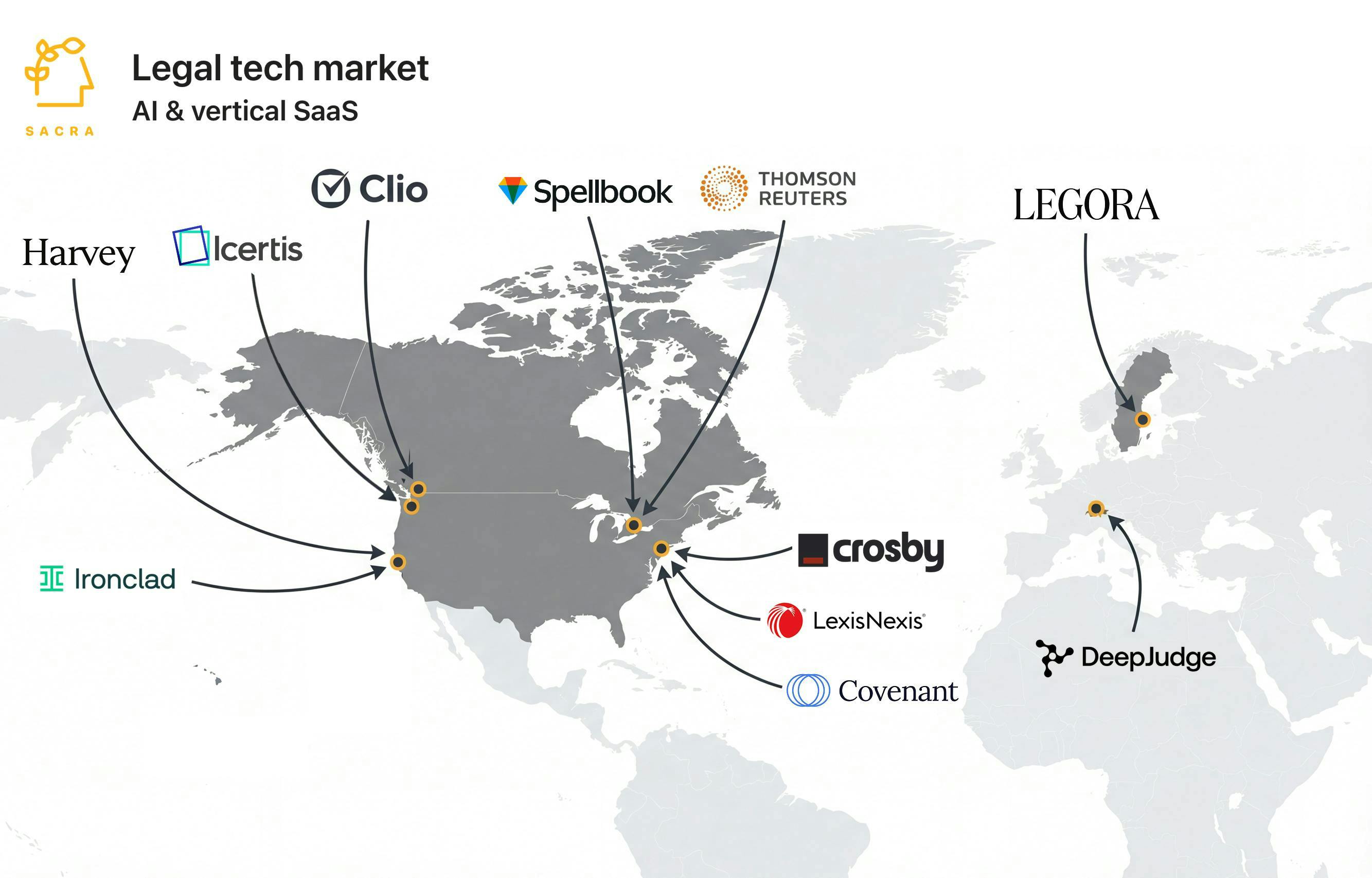

TL;DR: As frontier models commoditize legal reasoning and undermine Harvey's vertical AI thesis, legal tech is fragmenting into workflow-specific wedges—contract drafting & review (Spellbook), AI law firms (Crosby), and enterprise search infrastructure (DeepJudge)—while incumbents like Clio ($1B vLex acquisition) and Thomson Reuters ($650M Casetext acquisition) race to vertically integrate AI into their existing moats. For more, check out our full reports on Harvey (dataset), Clio (dataset), Ironclad (dataset), and Icertis (dataset).

Key points via Sacra AI:

- Risk averse and structurally disincentivized from adopting productivity SaaS given the billable hour business model, lawyers have lagged in the adoption of software with the exception of Thomson Reuters's Westlaw ($2.9B revenue) and RELX's LexisNexis ($1.9B revenue), a ~$5B/yr and 50+ year old legal research duopoly built on a data moat of 1B+ cases, statutes, and treatises with hand-made annotations and citations. One of the largest private legal tech companies (currently $300M ARR growing 47% YoY & valued at $5B), Clio (founded 2007) initially faced headwinds on storing sensitive client data in the cloud, with gradual adoption coming over time as 20+ bar associations gave cloud storage the greenlight, consumer cloud storage proliferated (Dropbox, 2007), and SMBs widely adopted cloud productivity tools (Google Docs, 2006).

- Harvey emerged as the first big vertical AI startup in 2023, founded by Winston Weinberg (ex-O'Melveny & Myers) and Gabriel Pereyra (ex-DeepMind research scientist), growing from launch to $150M annual recurring revenue (ARR) by November 2025 as the first GPT-4 powered legal AI assistant with domain-specific fine-tuned models. Initially positioned as an AI copilot for biglaw firms with the highest paid lawyers doing the most sophisticated legal work, Harvey shifted logos towards corporate in-house counsel and legal services firms like PricewaterhouseCoopers (tax compliance) and Adecco Group (outsourced legal support) that handle higher volumes of more routine legal work at lower price points and where AI-driven efficiency gains translate more directly into margin expansion.

- Frontier models commodified legal reasoning ability as a competitive differentiator, with Google Gemini 2.5 Pro, OpenAI o3, and Anthropic Sonnet 3.7 all beating Harvey's proprietary model on Harvey's own BigLaw Bench and forcing Harvey to shift toward agentic workflows that chain multiple off-the-shelf models together, with ~10% of its team now dedicated to ex-lawyers in "forward-deployed" customer success roles focused on driving change management and utilization. Legora ($265M raised, General Catalyst, Benchmark and Y Combinator), Harvey's European fast-follower, avoided the expensive effort of fine-tuning models entirely, going directly to market with off-the-shelf frontier models targeted at international law firms.

- With the vertical model thesis in retreat, legal AI is fragmenting based on customer focus and workflow-specific wedges—with contract drafting, review & redlining emerging as a major use case with clear product-market fit, where AI can accelerate revenue & dealmaking by compressing 1-2 day turnaround times to 20 minutes, save money by reducing associate billable hours, and integrate into existing workflows via Word add-ins and email. Vertically integrated AI law firms like Crosby (MSA, DPA, NDA review for startups) and Covenant (LPA review for private fund investors) deliver legal services directly, vertical AI SaaS companies like Spellbook (commercial contract review for in-house & firm lawyers) sell software to lawyers, and contract lifecycle management incumbents like Ironclad ($150M ARR) and Icertis ($350M ARR) layer AI onto their existing workflow ownership.

- Winning vertical AI for law across all workflows (and commanding the “platform” budget) will hinge on enterprise AI search that spans both (1) firm work product in iManage-like DMSs (that critically enforces access controls & ethical walls) and (2) primary-law corpora in Westlaw and LexisNexis, so AI answers are grounded in the right documents & citations (minimizing hallucinations) and can feed context across every workflow. Harvey Vault takes a curated-set approach—lawyers manually pull matter documents from iManage into Vault to query & ramp quickly—while DeepJudge ($52M raised, Felicis) is going DMS-native, prioritizing the deepest iManage integration and best in-place search/collections, and Clio is vertically integrating practice & document management with legal research, acquiring the 3rd largest legal research database in vLex for $1B.

For more, check out this other research from our platform:

- Harvey (dataset)

- Clio (dataset)

- Ironclad (dataset)

- Crosby

- Spellbook

- Legora

- Harvey at $75M ARR

- Harvey at $50M ARR

- Ironclad at $150M ARR

- DeepJudge

- Shubham Datta, VP of Corporate Development at Clio, on Clio's $1B acquisition of vLex

- Luminance at $30M ARR

- Clio at $300M/year

- Danny Wheller, VP of Business & Strategy at Hebbia, on vertical vs horizontal enterprise AI

- Glean at $100M ARR