Glean at $200M ARR

Jan-Erik Asplund

Jan-Erik Asplund

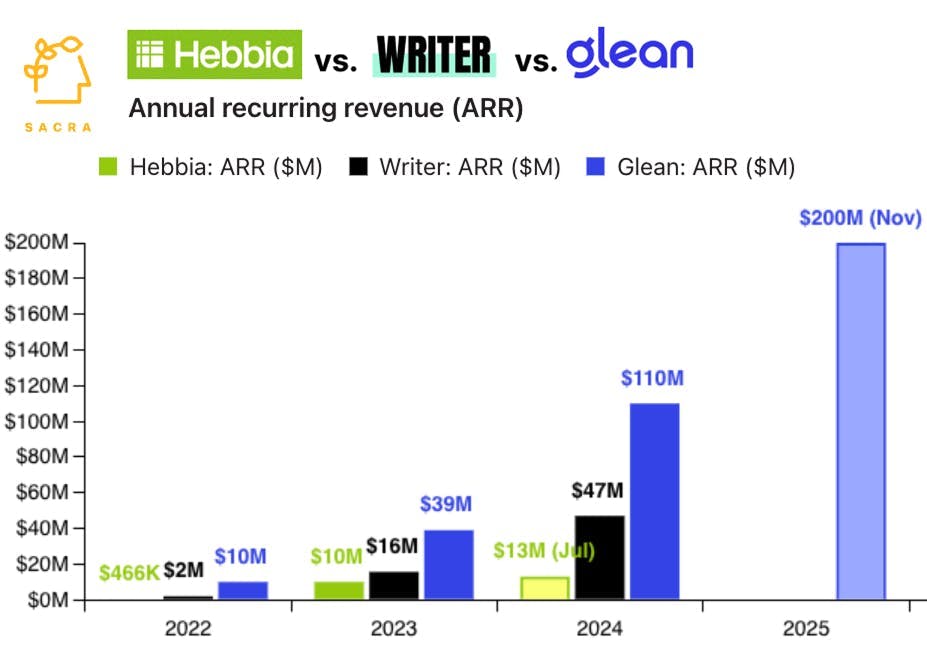

TL;DR: Over the last year, Glean doubled from a Sacra-estimated $100M annual recurring revenue (ARR) to $200M ARR & launched its new no-code agent builder, which is emerging as an internal tools platform eating up no-code builders like Retool, Airtable, and Zapier but also vibe coding tools like Lovable, Replit and Bolt.new. For more, check out our full report and dataset on Glean.

We first covered Glean in November 2024 at $100M ARR as it rode the AI wave from NLP-powered enterprise search to chat-based copilots, growing 182% YoY. One year later, Glean has launched Autonomous Agents, with customers building agents for SDR outreach, compliance checks, and finance workflows.

Key points from our January 2026 update via Sacra AI:

- On the back of seat expansion inside enterprises and the launch of its no-code agent builder, Sacra estimates Glean hit $200M annual recurring revenue (ARR) at the end of November 2025, doubling from $100M in November 2024, raising a $150M Series F (Kleiner Perkins) in June 2025 at a $7.2B valuation for a 36x revenue multiple.

- Productivity gains from Glean search are "soft"—saving even ~2 hours per week per person doesn't reduce headcount—with the clearest hard savings coming from cost avoidance as teams build agents in Glean instead of buying separate SaaS tools in the form of internal tools SaaS like Retool, Airtable, and Zapier and vibe coding apps like Replit, Lovable and Bolt.new.

- Microsoft Copilot and Google Gemini remain Glean's largest competitive threats, with Microsoft projecting $5B in Copilot revenue for 2025 and $11B for 2026 while claiming 90% Fortune 500 adoption, and Google dropping Gemini pricing from $32 to $14/user/month by bundling it into all Workspace plans—forcing Glean to differentiate on its ability to unify data across all enterprise apps like Slack, Zendesk, Confluence, Notion & Jira rather than just Microsoft 365 or Google Workspace, making it a better fit for companies that aren't all-in on a single vendor's ecosystem.

For more, check out this other research from our platform:

- Glean (dataset)

- Glean at $100M ARR

- Glean for law

- Danny Wheller, VP of Business & Strategy at Hebbia, on vertical vs horizontal enterprise AI

- Hebbia (dataset)

- Writer (dataset)

- Zapier (dataset)

- Airtable (dataset)

- Anthropic (dataset)

- OpenAI (dataset)

- Mike Knoop, co-founder of Zapier, on Zapier's LLM-powered future

- Will Bryk, CEO of Exa, on building search for AI agents

- Retool: the $82M ARR internal app builder

- Anthropic vs. OpenAI

- Zapier: The $7B Netflix of Productivity [2021]

- Former Zapier partner on Zapier's commoditization of SaaS [2021]

- Airtable: The $7.7B Roblox of the Enterprise [2021]