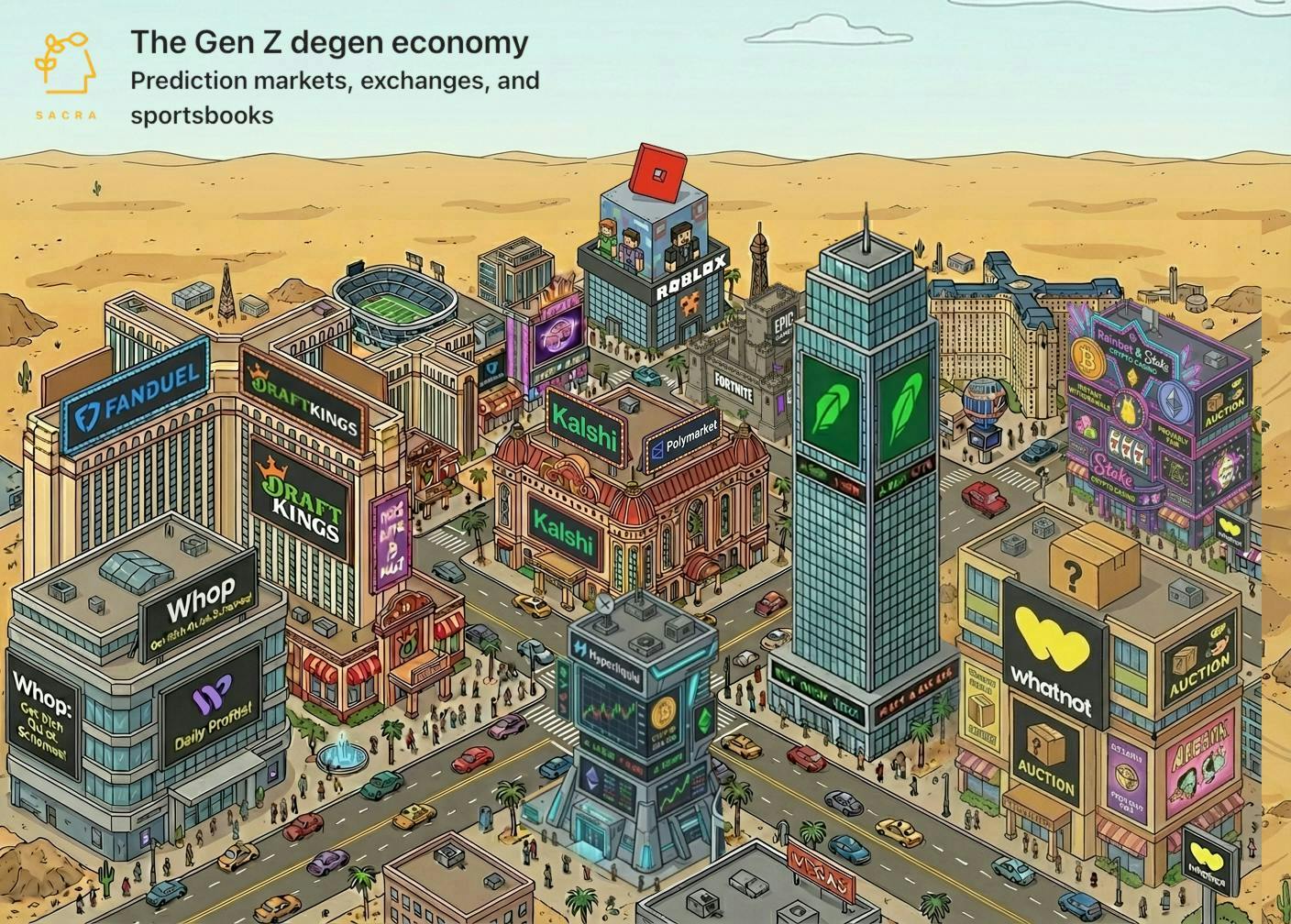

Gen Z degen economy

Jan-Erik Asplund

Jan-Erik Asplund

TL;DR: As regulatory barriers fall and federal CFTC oversight preempts state gambling laws, prediction markets like Kalshi and Polymarket are evolving from politics-focused platforms into the infrastructure layer powering sports event contracts—colliding with traditional sportsbooks like DraftKings and FanDuel in a race to control the $30B+ U.S. sports wagering market. For more, check out our reports on Kalshi (dataset) and Polymarket.

Key points via Sacra AI:

- Prediction markets have emerged as a new way for millions of Americans to bet on sports & elections, exploiting a legal loophole where CFTC-approved “event contracts” sidestep state gambling laws entirely, allowing Kalshi to launch across all 50 states in 2021 (even those where online sports gambling is illegal). The strategy echoes those of FanDuel & DraftKings, which grew to a combined ~$520M in revenue by 2018 arguing that their daily fantasy sports offerings were a “game of skill,” not a game of chance, giving them 1) the legal cover to operate in 40+ states at a time when online sportsbooks were banned, and 2) a 5 million person strong user base into which to distribute online sportsbook products when they became legal in 2018.

- The 2024 U.S. presidential election was the breakout moment for prediction markets, with crypto-native prediction market Polymarket's trading volume exploding from $73M in 2023 to $9B in 2024 (over $3.3B wagered on the Trump vs. Harris race alone) but sports has become the engine sustaining growth post-election with Kalshi's monthly volume hitting $4B+ in October and November with 90% of that from sports. For prediction markets, sports betting offers structural advantages because outcomes resolve in hours or days rather than months for political bets (allowing capital to recycle rapidly) and games happen year-round across multiple leagues (creating consistent liquidity)—for users, prediction markets offer far lower fees on sports bets (0% on Polymarket & ~1.5% on Kalshi vs. sportsbooks’ 4-5% vig).

- While their consumer apps have driven public awareness of prediction markets, Kalshi & Polymarket are now jockeying to be the infrastructure & liquidity layer of events contracts as sportsbooks (DraftKings, FanDuel), crypto exchanges (Coinbase, Kraken), social media platforms (X) and investing apps (Robinhood) all partner with them to offer prediction markets on their own platforms. Acquiring a CFTC-licensed exchange costs $100M+ and takes years of regulatory work (Polymarket paid $112M for QCEX in July 2025), making it cheaper for platforms to plug into existing infrastructure than build their own, while liquidity network effects mean that the 1-2 platforms that capture the most order flow become the default venues that everyone else must connect to.

- The key risk is that prediction markets are now under direct attack from states protecting billions in gambling tax revenue, with Nevada, New York, and multiple other states issuing cease-and-desist letters to Kalshi arguing that sports event contracts are illegal gambling under state law, setting up what industry observers expect to be a Supreme Court showdown in 2027. The core legal question is whether prediction markets are more like stock exchanges (peer-to-peer trading, no house edge, federal jurisdiction) or sportsbooks (the house always wins, state jurisdiction)—with billions in state gambling tax revenue hanging on the answer.

- Prediction markets sit within a broader generational shift toward gambling-adjacent products capturing Gen Z’s appetite for variable-outcome, high-dopamine entertainment, from perpetual futures trading (Hyperliquid, Axiom) to livestream mystery box auctions (Whatnot), get-rich-quick course marketplaces (Whop), offshore crypto casinos (Stake, Rainbet) and gaming lootboxes (Roblox, Epic Games). With the legalization of online sports betting in 2018, DraftKings & FanDuel were able to convert their daily fantasy user bases into sportsbook customers, helping them grow from a combined ~$520M in revenue (2018) to ~$11B as of 2024, with sports betting now generating 60%+ of revenue (vs. their original fantasy sports products at 5-7%).

For more, check out this other research from our platform:

- Polymarket vs Kalshi

- Trevor John, co-founder of Underdog Fantasy, on the business model of fantasy sports

- Arjun Sethi, co-CEO of Kraken, on building the Nasdaq of crypto

- Whatnot at $359M/yr

- David Ripley, COO of Kraken, on the future of cryptocurrency exchanges

- Duncan Cock Foster, co-founder of Nifty Gateway, on NFTs as luxury goods

- Stan vs Whop

- Underdog Fantasy

- eToro vs Robinhood