Function Health at $100M/year

Jan-Erik Asplund

Jan-Erik Asplund

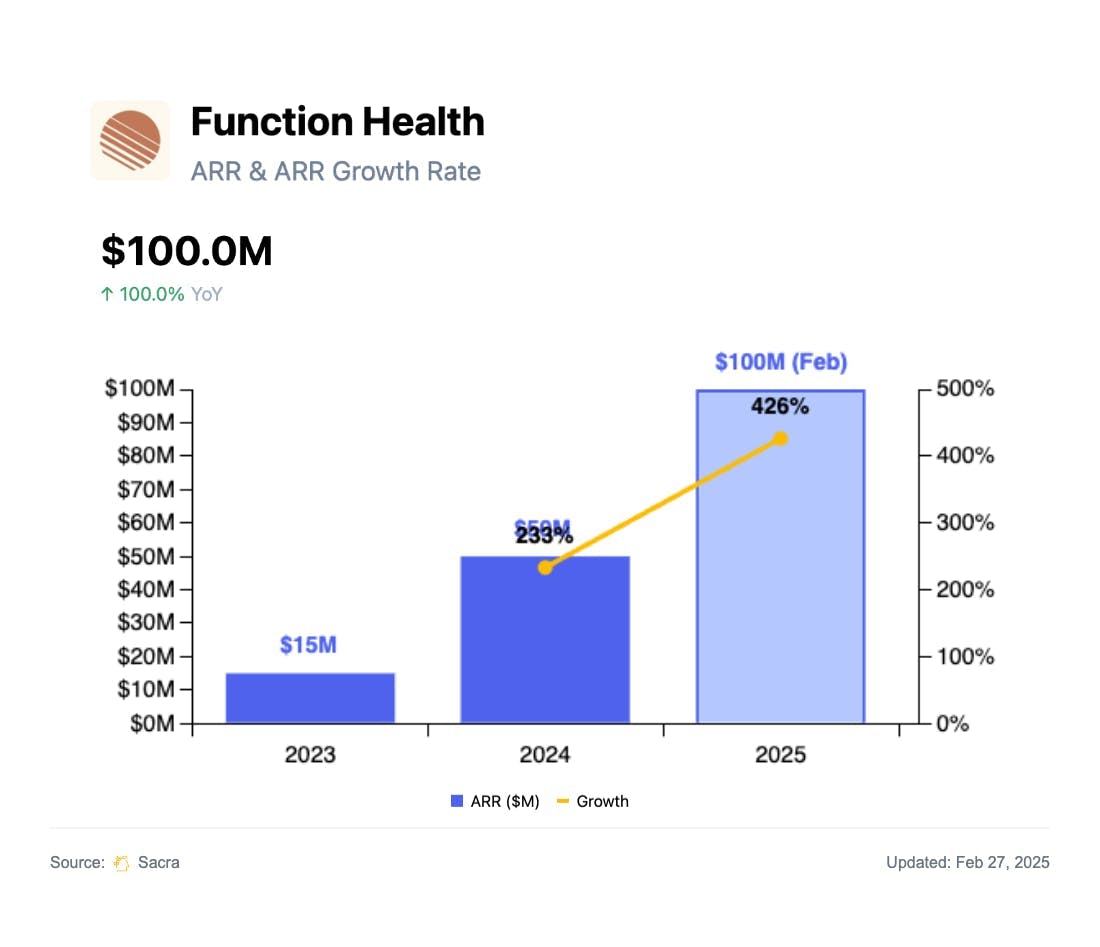

TL;DR: With the rise of consumer interest in longevity and health optimization, Function Health is building a $499/year bundle for 100+ biomarker blood tests, below-cost MRIs and cancer screenings. Sacra estimates Function Health grew to a $100M revenue run rate in February 2025, up 450% year-over-year with approximately 200,000 subscribers. For more, check out our full report and dataset on Function Health.

Function Health is a $100M/year consumer blood testing startup offering a $499/year subscription for comprehensive blood testing—now expanding into imaging and genomics as it builds a unified platform for self-directed health tracking.

We’ve covered the rise of consumer-led and tech-enabled healthcare across diagnostics, wearables, and telehealth—from Hone Health’s $55M/year testosterone business and Noom’s expansion into GLP-1s at $1B ARR to BillionToOne’s $153M/year business for pregnancy and and Oura’s push into longitudinal tracking with $225M in 2023 revenue.

Key points on Function Health via Sacra AI:

- Everlywell (2015) found product-market fit by making insurance-excluded lab tests available to consumers for cash out of pocket—which combined with a post-COVID surge of consumer interest in longevity via influencers like Andrew Huberman and Peter Attia in 2023—inspired the founding of Function Health (2023) as a D2C blood testing company with a single, 100+ biomarker panel focused on longevity. Function monetizes through a $499/year direct-to-consumer subscription that gives members two rounds of lab testing via Quest Diagnostics’ national draw network, with additional revenue coming from upsells on specialty panels (e.g. hormones, cardiovascular, micronutrients) and full-body MRI scans ($499).

- Growing to a 300K person waitlist by 2023, powered by celebrity doctor co-founder Mark Hyman's reach to 2.5M Instagram followers and celebrity co-investors celebrities like Matt Damon and Zac Efron, Sacra estimates Function grew to a $100M revenue run rate in February 2025, up 450% year-over-year, with about 200,000 total subscribers. Compare to the underlying test provider Quest Diagnostics (NYSE: DGX) at $9.87B in full-year 2024 revenue, up 7% YoY, with a $19.7B market cap for a 2x revenue multiple, public telehealth and testing giant Hims (NYSE: HIMS) at $1.48B in full-year 2024 revenue, up 69% YoY, with a $11.7B market cap for a 8x revenue multiple, and D2C testosterone testing startup Hone Health at $55M in annualized revenue at the end of 2023, up 83% YoY.

- Moving beyond blood testing, Function Health’s acquisition of Ezra (May 2025) has it bundling full-body MRI scanning into its membership product at $499/scan (down from $1,495 pre-acquisition), expanding its product surface area as pure-play blood testing is commoditized by lower-cost providers like Instalab ($250), Mito ($360), and Private MD Labs ($377). While Everlywell has expanded into telehealth and Hims & Hers (NYSE: HIMS) acquired blood-testing startup Trybe Labs to support its core prescribing business to boost ARPU, Function Health is staying away from treatment, focusing on building a high-margin software layer with minimal regulatory drag, aggregating data from labs, wearables, imaging, and genomics to build a recurring-use consumer platform for personalized health, where 23andMe has largely remained a one-off product.

For more, check out this other research from our platform:

- Function Health (dataset)

- Maven Clinic at $268M ARR

- BillionToOne at $153M/yr

- Commure at $105M ARR

- Oura at $225M

- Virta Health at $175M revenue

- Noom at $1B ARR

- Hone Health: the $55M/year D2C testosterone startup

- Sweden’s $215M/year telehealth giant

- Johannes Schildt & Claes Ruth, CEO and CFO of Kry, on the AI future of telehealth

- Ro and the telehealth capital cycle

- Marc Atiyeh, CEO of Pawp, on building telehealth for pets

- Kathryn Cross, CEO of Anja Health, on the future of stem cell therapy

- Liana Guzmán, CEO of Folx, on the $400B market for LGBTQIA healthcare

- Brendan Keeler, Senior PM at Zus Health, on building infrastructure for digital health