Fanatics at $8.1B

Jan-Erik Asplund

Jan-Erik Asplund

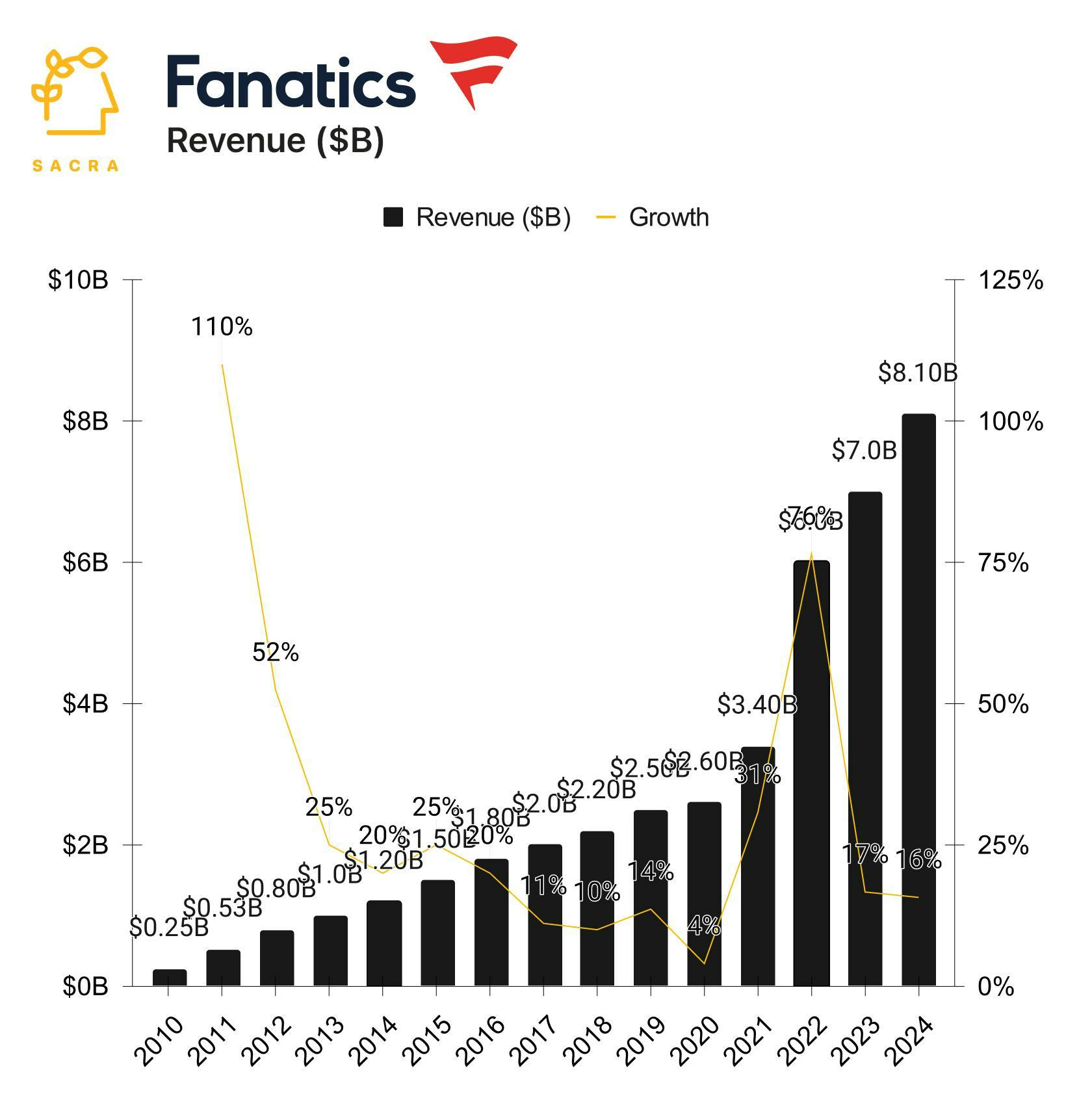

TL;DR: With its structural CAC advantage vs. traditional online betting sites, Fanatics is channeling the free cash flow from its profitable commerce & collectibles businesses into gambling, cross-selling its 100M+ commerce customers into the $148B sports betting market. Sacra estimates that Fanatics revenue hit $8.1B in 2024, up 15% YoY. For more, check out ourfull report anddataset onFanatics, as well as our interview with sports licensing consultant Scott Silcox.

We first covered Fanatics in early 2024 when the company had reached $7 billion in revenue for 2023, growing 17% year-over-year from 2022.

Here’s our end-of-year 2024 Fanatics update via Sacra AI:

- Sacra estimates that Fanatics generated $8.1 billion in revenue for 2024, growing 15% year-over-year from $7 billion in 2023, with the company in talks to do a secondary round at a $25B valuation (a 19% discount from its last-round valuation of $31B as of December 2022) for a 3.1x revenue multiple.

- Fanatics revenue consists of Fanatics Commerce (apparel and merchandise) at 77% of revenue ($6.2B in revenue) growing 8% YoY, Fanatics Collectibles at 20% ($1.6B) and growing 40% YoY, and its nascent gambling arm Fanatics Betting & Gaming at 3% of revenue ($300M), growing the fastest at 50% YoY.

- With the $148B upside of the fast-growing (up 24% YoY) sports betting market, Fanatics is channeling its free cash flow into Fanatics Betting & Gambling, targeting casual bettors that incumbents like FanDuel and DraftKings view as unprofitable ($200-$300 CAC) by cross selling them into sports betting from its 100M+ customer ecommerce ecosystem—which has structurally low CAC ($19) and an existing FanCash loyalty points program.

For more, check out this other research from our platform:

- Fanatics (dataset)

- Scott Sillcox, sports licensing consultant, on the economics of Fanatics' contracts

- Shein (dataset)

- Sean Frank, CEO of Ridge, on the state of ecommerce post-COVID

- ShipBob: TikTok's $500M/year fulfillment arm

- Rokt: the $480M/year ad network behind Uber & Lyft

- Klaviyo: the $665M/year HubSpot for ecommerce

- Tyler Scriven, CEO of Saltbox, on co-warehousing and D2C ecommerce

- Brian Whalley, Co-Founder of Wonderment, on Klaviyo's product-market fit

- Sampad Swain, CEO of Instamojo, on building ecommerce infrastructure for D2C 2.0