Fanatics at $7B revenue

Jan-Erik Asplund

Jan-Erik Asplund

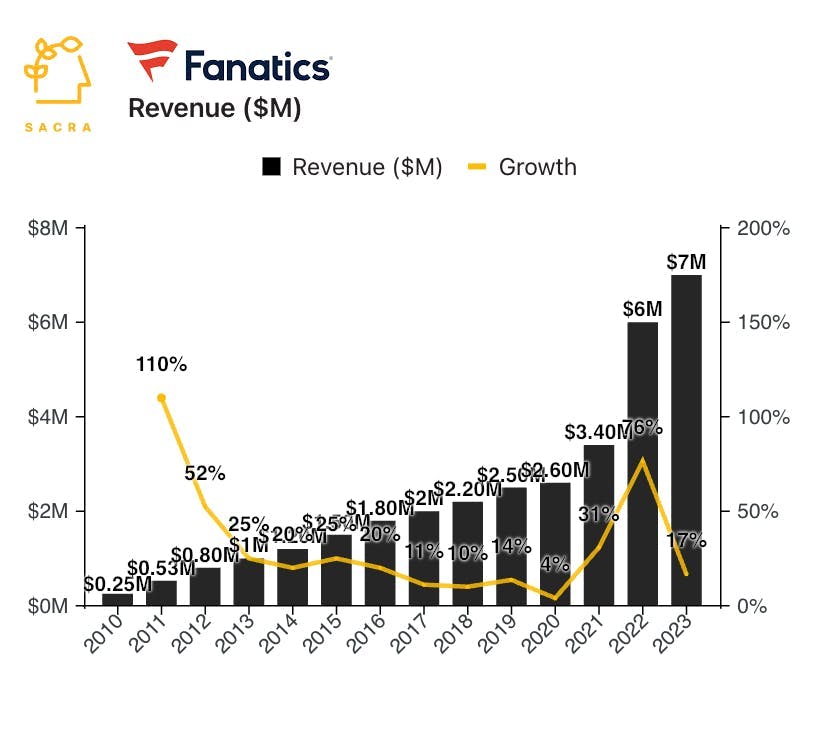

TL;DR: Fanatics (2011) has transformed from a Jacksonville-based sports apparel store into a vertically-integrated ecommerce platform doing a Sacra-estimated $7B in revenue in 2023 (up 17% YoY)—but with core retail growth slowing and leagues like the NFL finally opening up to Amazon, Fanatics is now betting big on betting, collectibles, and live experiences. For more, check out our full report and dataset on Fanatics and our interview with licensed sports product consultant Scott Sillcox.

Key points via Sacra AI:

- Fanatics (1995) has made its name as the ecommerce partner to the most valuable sports leagues and teams in the world including the National Football League (NFL), National Basketball Association (NBA) and Major League Baseball (MLB), generating ~80% of its revenue from: 1) powering the ecommerce storefronts for over 900 teams, leagues and colleges and taking a cut of revenue, and 2) wholesaling apparel, including Nike-branded jerseys, to retailers like Walmart and Target. In 1995, Michael Rubin launched GSI Commerce, an ecommerce-storefront-as-a-service serving big brands (Ralph Lauren, Dick’s Sporting Goods) and major sports leagues (NFL, MLB, NBA)—in 2011, Rubin sold GSI to eBay for $2.4B, bought back the sports division, and began aggressively rolling up licensees, apparel manufacturers, and retailers, including the Jacksonville-based Fanatics, to become a vertically integrated one-stop shop for sports teams and leagues to sell online.

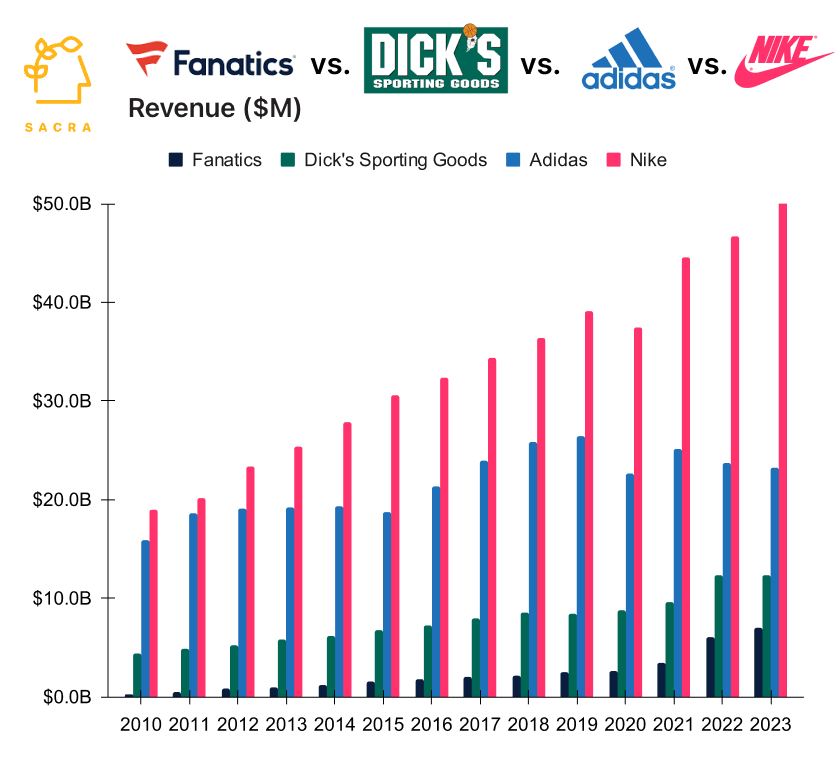

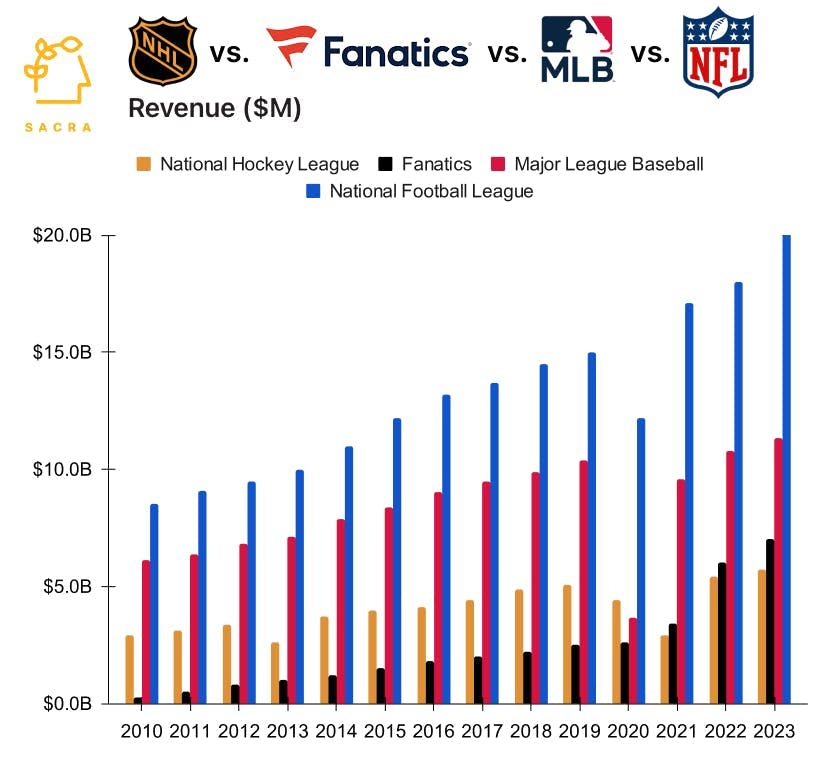

- Revenue exploded from $3.4B in 2021 to $7B in 2023 (up 17% YoY) as Fanatics (SoftBank, $4.8B total raised) went on an acquisition spree, buying trading card giant Topps ($1B in revenue in 2022) and gambling company PointsBet’s US business ($130M in revenue in 2023), riding a COVID-era surge of interest in baseball cards and sports betting. In terms of revenue scale, Fanatics is now in between league partners like the NHL ($5.7B revenue in 2023, up 5.6% YoY) and NFL ($20B, up 12.2% YoY)—on the apparel side, it’s growing faster than companies like Adidas (FWB: ADS, $23B, down 2% YoY) and closing the gap with Dick’s Sporting Goods (NYSE: DKS, $12B, up 0.65% YoY), but its partner Nike is still king (NYSE: NIKE, $51B, up 9% YoY).

- As the ecommerce backend behind every team store, Fanatics has cheaply (~$19 CAC) built a customer list of 100M+ sports fans that they can cross-sell into higher-margin businesses across their family of brands, including Topps (collectibles, $32B market), WinCraft (non-apparel merchandise, $15B), Fanatics Betting & Gaming (sports gambling, $11B), and Fanatics Events (live events, $5B). At Fanatics’ scale today—accounting for 35% of all licensed sports merchandise sales in the US—mutual concentration risk has become a problem with its league partners, pushing leagues toward fragmenting distribution rights across multiple partners, turning Fanatics into just another retailer.

For more, check out this other research from our platform:

- Scott Sillcox, sports licensing consultant, on the economics of Fanatics' contracts

- Fanatics (dataset)

- Shein (dataset)

- Sean Frank, CEO of Ridge, on the state of ecommerce post-COVID

- ShipBob: TikTok's $500M/year fulfillment arm

- Rokt: the $480M/year ad network behind Uber & Lyft

- Klaviyo: the $665M/year HubSpot for ecommerce

- Tyler Scriven, CEO of Saltbox, on co-warehousing and D2C ecommerce

- Brian Whalley, Co-Founder of Wonderment, on Klaviyo's product-market fit

- Sampad Swain, CEO of Instamojo, on building ecommerce infrastructure for D2C 2.0