Epic Games: the $4B/year metaverse company

Jan-Erik Asplund

Jan-Erik Asplund

TL;DR: Fortnite has made Epic Games $27B of high-margin revenue off in-app purchases, but growth has now gone negative with falling engagement and Apple cutting Fortnite out of its walled garden. Now, Epic Games is betting that they can escape the hit-driven dynamics of the gaming industry by building a metaverse. For more, check out our reports on Epic Games (dataset) and Rec Room (dataset).

Key points from our report:

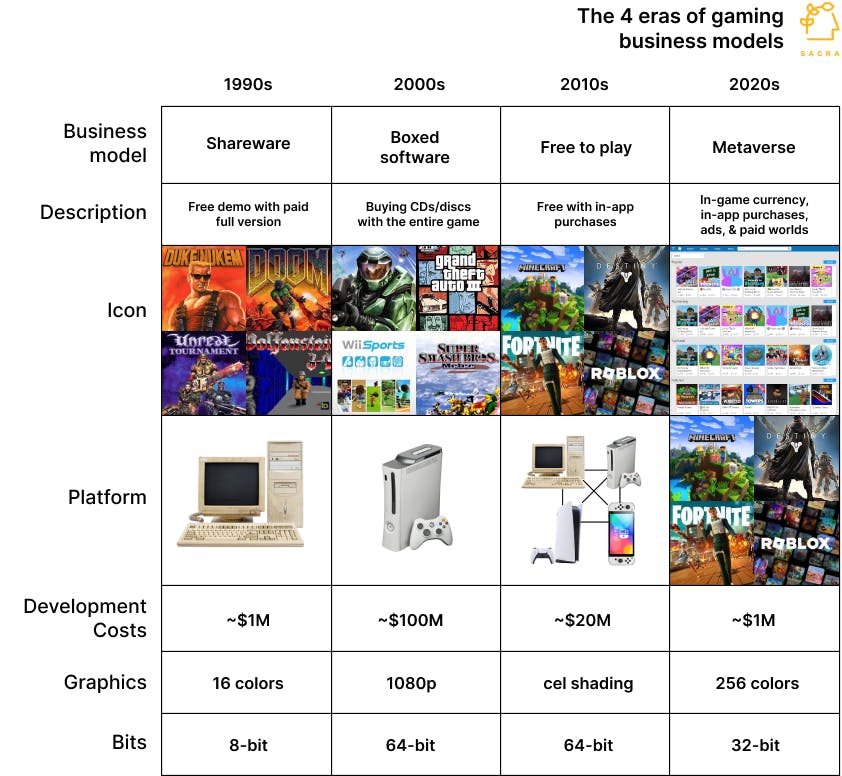

- Apogee Software (1987) kickstarted the modern video game publishing industry with free-to-download shareware games like Duke Nukem, laying the foundation for id Software (1991) with Doom and Wolfenstein and Epic Games (1991) with Unreal and Unreal Tournament. These companies distributed free-to-play demos of their games over BBSes, and then took orders for the full versions over the phone and fulfilled them via mail order.

- PC piracy eroded the shareware business model, and Epic Games retooled as a console developer—their first hit, Gears of War, grossed $100M and cost only $12M to develop, but profits on the franchise shrank with each sequel. Gears of War 3 made as much as the original but cost 5x as much to make—a trend across the industry where the cost of developing console games grew 10x every ten years.

- The massive success of free online games monetized on in-app purchases like League of Legends ($1B in revenue in 5 years) inspired Epic Games’s launch of Fortnite, which would go on to hit 10M players in 2 weeks. By monetizing digital add-ons and cosmetics instead of laborious new content, live-services games can get compounding, long tailed revenue and up to 30-50% operating margin vs. the 10-15% of traditional AAA game publishers.

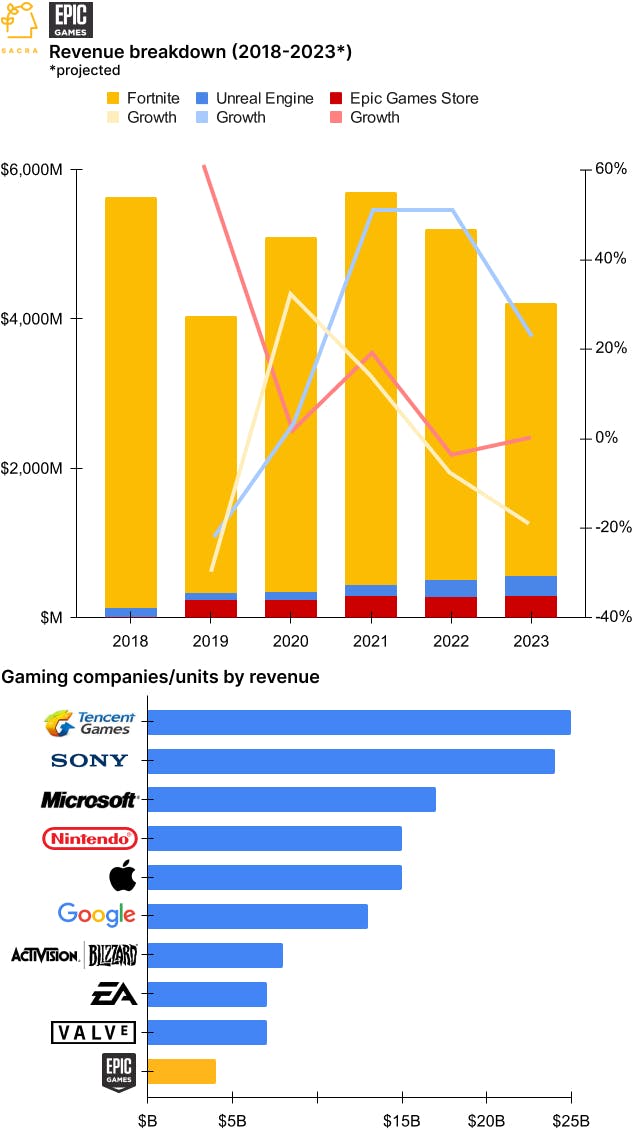

- Epic Games generated $5.6B of revenue in 2018, with $5B of that from Fortnite, but Sacra estimates that revenue fell to $5.2B in 2022 as Fortnite declined in users and conversion for a 6x revenue multiple on their $31.5B valuation. Compare to the continually growing Roblox, which hit $2.2B of revenue in 2022, up 16% after 108% growth the year before (8x multiple on $17B market cap), and Unity, which hit $1.39B revenue in 2022, up 25%, after 44% the year before (8x multiple on $11.5B market cap).

- Fortnite’s user base and revenue shrank in 2022-3, showing that free to play games with continuous new content creation are not immune to the traditional hit-driven dynamics of gaming. The nature of live-service and online games like Rec Room and Roblox is that they consume a lot more attention than regular games— Roblox is at 2+ hours per day—creating a zero-sum dynamic where attention flows from declining properties towards growing ones.

- 73M exclusively iOS Fortnite players lost access to the game when Apple cut off Epic Games’s distribution via the App Store for attempting to bypass their 30% take rate on all purchases made in-game. Walled garden App Stores like Apple and Google pose the biggest threat to Epic’s core business model of creating games with the potential for a long-tail of revenue across the widest, cross-platform install base possible.

- Underlying the app layer of Fortnite, Epic Games has two infrastructure products—Unreal Engine, the game and VFX engine they license to developers/films/TV that competes with mobile-focused engine Unity ($1.39B revenue in 2022), and Epic Games Store, their gaming app store competitor to Valve’s Steam. The game industry is ~$120B per year, limiting Epic’s revenue off Unreal Engine to $6B at their 5% take rate—expanding to film & TV adds another $90B to that TAM.

- To escape the hit-driven dynamics of gaming, Epic Games is now turning Fortnite into the centerpiece of a Roblox-like metaverse, with expanded tools for creators to build Fortnite worlds that are cross-compatible with other experiences within the Epic Games catalog. Epic Games is today one of the largest independent publishers in the world with full-stack potential—between their games, their app store, their game engine, and their metaverse—in their play to become Valve, Activision (acquired for $68.7B for a 8x multiple on their $8.1B revenue), Roblox (currently trading at 9x), and Unity (currently trading at 6x) all in one.

For more, check out this other research from our platform: