How Docker 2.0 went from $11M to $135M in 2 years

Jan-Erik Asplund

Jan-Erik Asplund

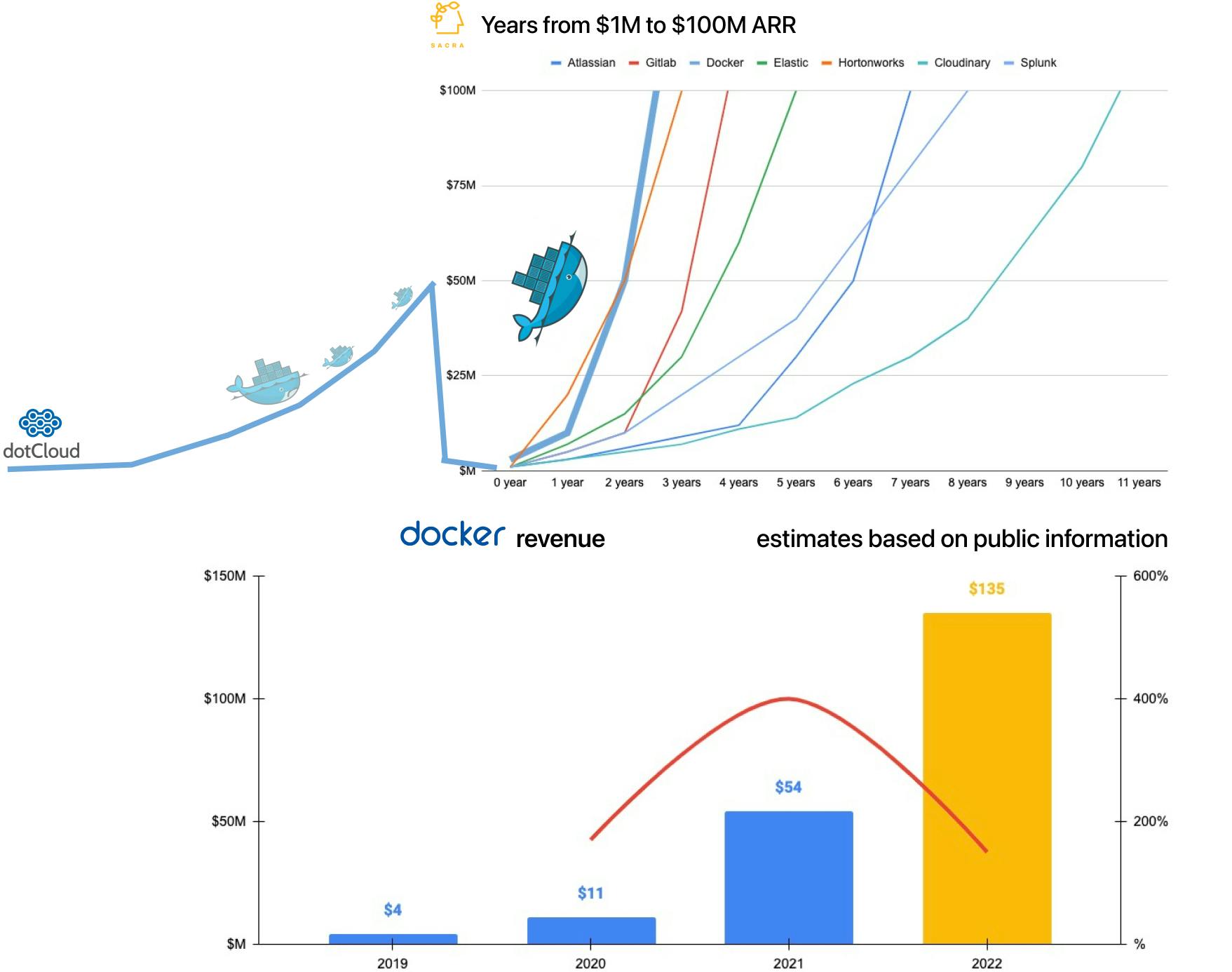

TL;DR: Just 2 years after laying off 80% of their team and being left for dead, we estimate Docker is now at $135M+ ARR growing roughly 150% YoY—and rebuilding Docker 2.0 as a bottom-up, developer-first company. For more on Docker’s future, check out our interview with Docker CEO Scott Johnston along with our Docker profile and dataset.

Note: All revenue and growth rates estimated by Sacra from publicly available information.

Check out our weekly email for more insights like this into private companies.

Success!

Something went wrong...

Here are the key points from our research on Docker:

- Circa 2008-2010, platform-as-a-service (PaaS) companies like Heroku (acquired by Salesforce for $212M) and dotCloud (the precursor to Docker) launched to build abstractions on top of Amazon Web Services’s (AWS) primitives of cloud compute and storage to streamline the application development workflow—it's from dotCloud's PaaS that the new cloud development primitive of Docker containers emerged. Where AWS was enabled by the virtualization of the underlying hardware, containerization allowed for the encapsulation of application code into discrete units and abstraction of the underlying dependencies and operating system, enabling the rise of dev ops and orchestration. (link)

- Within 7 months after open sourcing Docker from dotCloud, Docker experienced extreme product-market fit, with 140,000 container downloads, 6,700 Github stars, 800+ forks, 200 contributors, 150+ projects built on top of Docker, along with companies like Rackspace, eBay and CloudFlare using Docker internally—by 2014, support for Docker containers was integrated into developer platforms like AWS, Google Cloud and Microsoft Azure. While Heroku initially launched for Ruby on Rails only, dotCloud differentiated itself by allowing developers to mix and match different languages and frameworks—Python, Java, PHP, etc.—with different data services—MySQL, Redis, MongoDB, etc—which its internal service Docker enabled. (link)

- Docker became a core utility for cloud development and dev ops with 37B+ containerized applications downloaded by early 2018, fueled by the meteoric rise of microservices and the rise of mobile—companies like Netflix and Uber ran on 10,000s of microservices, contrasted with the monolithic code bases at previous generation companies like eBay. Docker’s Linux containers emphasized portability, composability, and scalability, which made them the default delivery platform for developers building apps on microservices. (link)

- While Docker as a standard was becoming wildly successful, Docker as a business struggled to commercialize—employing the prevailing open source strategy of top-down sales tailored to enterprise needs of the kind that got Red Hat (acquired by IBM for $34B) to $1.2B ARR by 2014—which mostly consisted of selling orchestration solutions (Docker Swarm and Kubernetes) into ops. Docker was spending large amounts of go-to-market time, money, and headcount educating and persuading ops to spend money with them, when the majority of the love, consumption, and usage was coming from developers. (link)

- However, Google won orchestration by open sourcing its container orchestration solution Kubernetes—making free what Docker Swarm bet on as its primary revenue center—while bundling its own managed solution into its infrastructure-as-a-service (IaaS) Google Cloud. By investing heavily into the open source Kubernetes project through the Cloud Native Computing Foundation (CNCF), Google, Amazon, Microsoft and IBM set themselves up to monetize Kubernetes by offering it as a managed solution—in contrast to Docker, which looked to monetize it more immediately. (link)

- 11 years in and with $335M invested, Docker was at sub-$75M ARR in 2019—Docker would end up spinning off their unsuccessful Docker Enterprise/Swarm businesses to Mirantis. Mirantis provides enterprises with a Kubernetes-as-a-service offering that’s built on the technology acquired from Docker. (link)

- In late 2019, Docker recapped the company, took $35M in fresh capital from Benchmark and Insight and named Chief Product Officer Scott Johnston as CEO with the new strategy to use Docker’s large install base and ubiquitous brand to sell directly into developers—instead of ops—and align their monetization with the part of the organization getting value from the product. With this new bottom-up strategy, Docker followed in the footsteps of other successful PLG, land-and-expand companies like MongoDB ($1B run rate) and GitLab ($452M revenue) that indexed on the rise of devs empowered to buy their own hosted tools. (link)

- After going from ~420 employees to 60 post-pivot, Docker 2.0 rebooted with no salespeople and a PLG sales motion that opened commercial relationships with their now-20M+ install base by capturing the credit card of the end-user developer for low-priced ($5/$9/$24 per user per month) seats—as a wedge into seat expansion in the org. In 2018, when Github was acquired by Microsoft for $7.5B, each of their 28 million authenticated users was valued at about $260 apiece (today, Github is at 83 million developers). (link)

- Post-pivot, Docker’s growth ramp has been steep—they grew 254% YoY from ~$11M ARR in late 2020 to ~$135M at the end of 2022 just by flipping Docker Hub and Docker Desktop to paid for businesses. Per figures published by Tribe Capital, Docker’s net dollar retention went from 80% to 120% over 1-2 months at the end of 2020—comparable to GitLab at 130% as of Q3 FY23. (link)

- The proliferation of dev tools is driving toolchain consolidation, and Docker’s positioning on the developer desktop at the point of creation gives them a strong position to build a comprehensive developer productivity suite—e.g. unit testing, debugging, collaboration—designed for safety to expand to higher per-seat price points. The need for safer devops has spiked amidst the rise of security breaches and high-profile hacks—analysis by Gitlab puts the total size of the market at $40B, with 85% of organizations using 2-10 devops tools and 69% looking to consolidate. (link)

- Docker is the brand synonymous with the container standard with an approach to monetization that indexes the company on the continued growth of microservices, software and the demand for software engineers, with 45 million devs set to enter the market in the next decade. Today, Docker serves mainly back-end, server-side and full-stack engineers, but the company wants to expand to all developer segments, including front-end, AI/ML engineers, and others. (link)

For more, check out our interview with Scott Johnston, CEO of Docker, our full Docker profile and dataset, and this other research from our platform:

- Joe Zeng, software engineer at Statsig, on using Docker

- Databricks (dataset)

- Fivetran (dataset)

- Vercel, Netlify, and the consumerization of developer tools

- Bucky Moore, Partner at Kleiner Perkins, on Jamstack's big upside case

- Jason Lengstorf, VP of Developer Experience at Netlify, on Jamstack's anti-monolith approach