Destinus at $70M/year

Jan-Erik Asplund

Jan-Erik Asplund

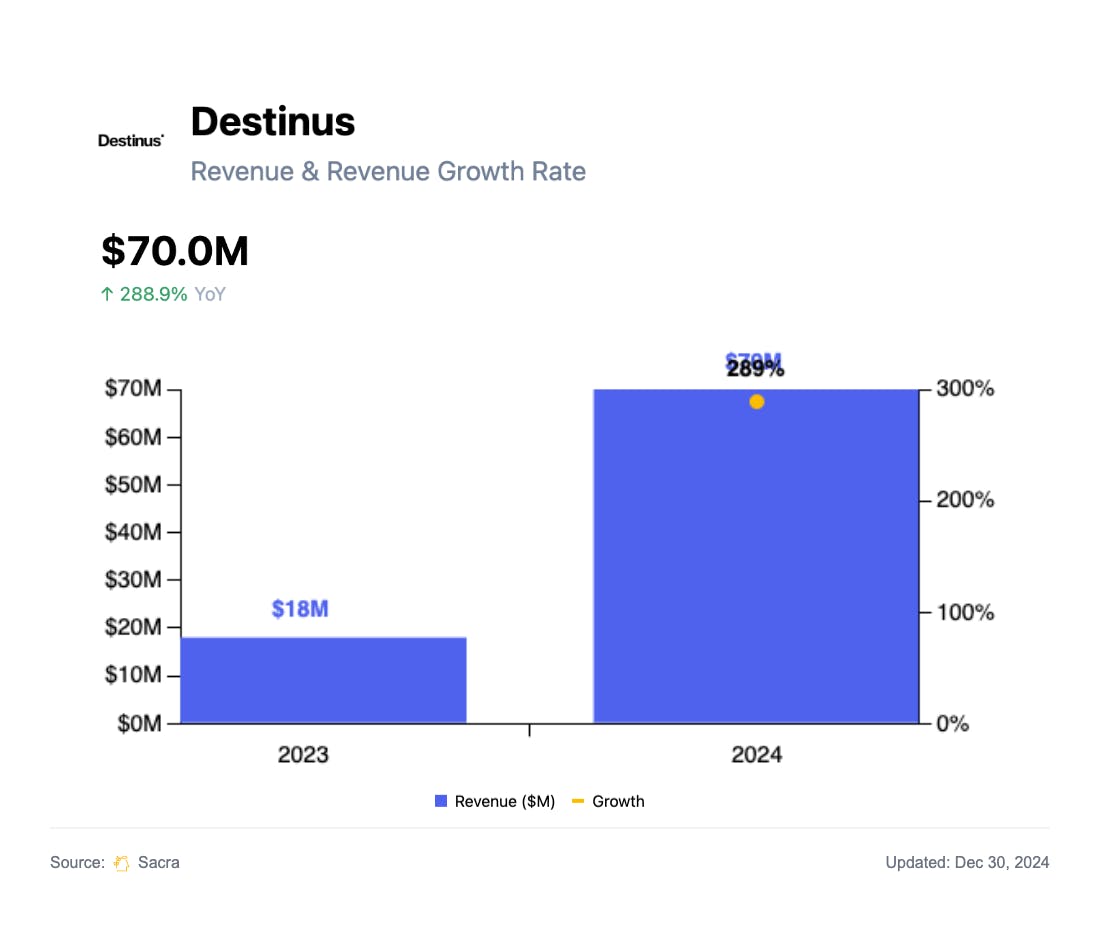

TL;DR: Europe’s rearmament will pour hundreds of billions into EU domestic defense tech companies like Destinus, Helsing and Rheinmetal (XETRA: RHM) and American startups like Anduril with localized supply chains. Sacra estimates Destinus generated $70M in revenue in 2024, up 289% year-over-year from $18M in 2023, fueled primarily by sales of autonomous drones. For more, check out our full report and dataset on Destinus.

Recently, we looked at how a post-Trump, Europe-rearming world is creating a new opportunity for Anduril to localize and sell into Europe (March 2025).

With that in mind, we decided to look into Destinus—a European space and defense startup founded in 2021 by Russian-born aerospace entrepreneur Mikhail Kokorich (renounced his Russian citizenship in 2024), previously the founder of space logistics startup Momentus (IPO in 2020 via SPAC, currently NYSE: MNTS with <$10M market cap).

Key points via Sacra AI:

- Destinus (founded in Switzerland in 2021) is a frontier tech company whose stated goal is to build the first hydrogen-powered hypersonic aircraft (2x the speed of the Concorde)—for cargo, civilian transport and defense—that has commercialized its R&D roadmap by building & selling drones into military applications, primarily to Ukraine. Like Anduril, Destinus sells vertically integrated, off-the-shelf systems under fixed-price contracts—a model increasingly favored in Europe as governments look to avoid the delays and cost overruns of big cost-plus projects like the £1.35B Watchkeeper (UK) and the €7.1B Eurodrone (Germany, France, Italy, Spain).

- With the world’s biggest drone producers in China (DJI), America (Anduril), and Russia (Geoscan), demand has surged for a European answer, helping Destinus to a Sacra-estimated ~$70M in 2024 revenue, up 280% from ~$18M in 2023. Compare to defense-autonomy platform Shield AI at $267M in 2024 revenue (up 64% YoY), next-gen defense prime Anduril at $1B in 2024 revenue (up 138% YoY), and incumbent contractor Lockheed Martin (NYSE: LMT) at $72B in trailing twelve months (TTM) revenue, up 1% YoY.

- The EU’s reindustrialization push will send contracts both to homegrown players like Destinus ($29M seed raised, Quiet Capital), Helsing ($937M raised, Prima Materia), and Rheinmetall ($11.9B TTM revenue, up 36% YoY) and to U.S. companies that build localized supply chains in the EU like Anduril ($1B in 2024 revenue, up 138% YoY) with European defense budgets up 30% since 2021 to €326B and an additional €800B in spending on the table. With over €40M in grants from Spain—including a co-funded hydrogen engine test site near Madrid—and supply chains in Eastern Europe, Destinus is leveraging local regulatory support, subsidies, and labor cost advantages to build out R&D infrastructure and flight facilities across Europe.

For more, check out this other research from our platform:

- Destinus (dataset)

- Anduril (dataset)

- Anduril at $1B/yr

- America First vs. American Dynamism

- SpaceX (dataset)

- Starlink at $4.1B/year growing 121%

- SpaceX's app layer

- Anduril, SpaceX, and the American dynamism GTM playbook

- Anduril: the $342M/year Nintendo of American dynamism

- The biggest mistake defense startups make

- Ross Fubini, Managing Partner at XYZ Capital, on the defense tech opportunity

- Shield AI (dataset)

- Scott Sanders, chief growth officer at RRAI, on the defense tech startup playbook