DataSnipper at $45M ARR

Jan-Erik Asplund

Jan-Erik Asplund

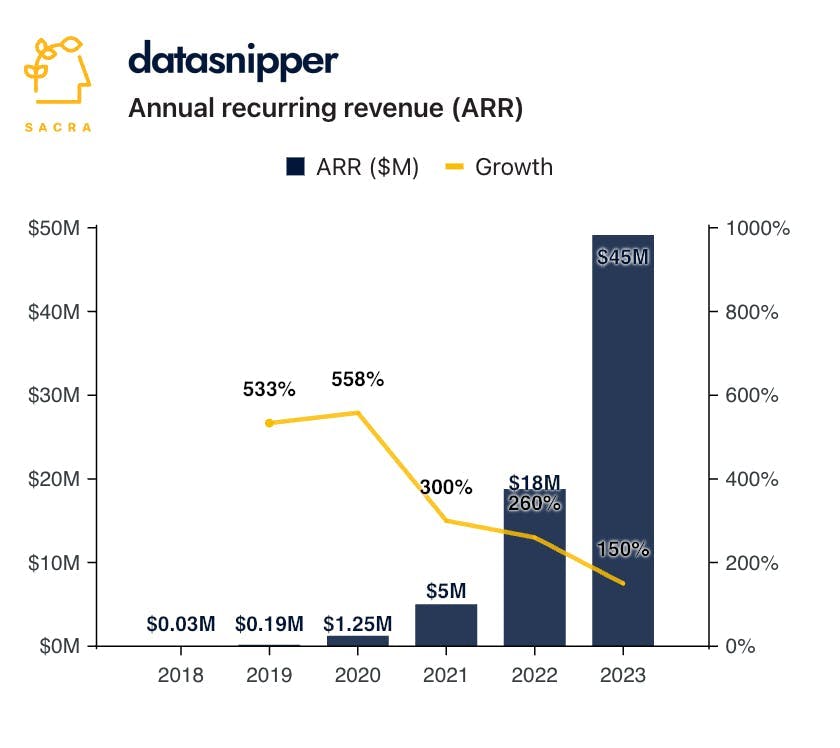

TL;DR: Sacra estimates that DataSnipper hit $45M in annual recurring revenue (ARR) in 2023, up 150% YoY, as their Excel add-in for external auditors landed contracts with the Big 4 accounting firms. The product’s Excel-centricity is its biggest strength, but will also be a challenge to overcome as they look to expand into the finance backoffice. For more, check out our full report and dataset on DataSnipper.

Key points via Sacra AI:

- Founded in 2017 in Amsterdam as an Excel add-in, DataSnipper helped external auditors with repetitive data entry tasks around moving data from PDFs, images and Word docs into Excel by letting them upload documents, snip fields, and have them OCRed and added as tabular data into Excel. DataSnipper integrates easily into junior auditors’ Excel-centric workflow for cross-checking and validating numbers, with a natural seat expansion motion (at $175 per seat per month) once it gets uptake and its users’ work needs to be reviewed by others in the organization.

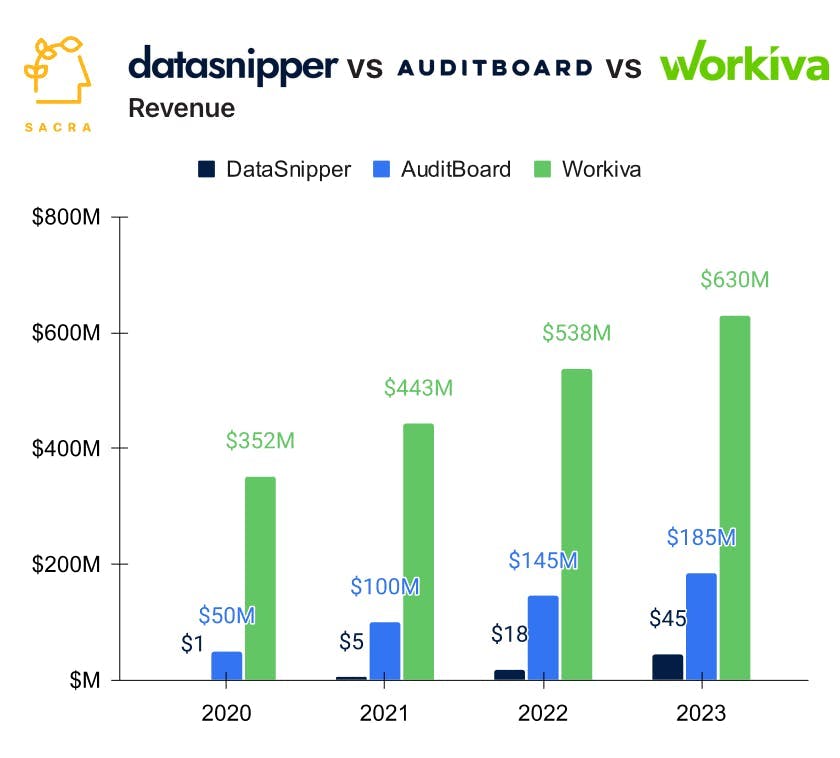

- Sacra estimates that DataSnipper hit $45M in annual recurring revenue (ARR) in 2023, up 150% YoY from $18M in 2022, as they expanded into the United States and landed contracts with the Big 4 accounting firms in the United States—EY, PwC, KPMG, and Deloitte. Compare to auditing SaaS AuditBoard (acquired by Hg for $3B in 2024) which hit $200M in ARR in early 2024, up 33% YoY, at the time of their acquisition and financial reporting platform Workiva (NYSE: WK), which generated $630M revenue in 2023, up 17% YoY.

- DataSnipper’s upside hinges on going in-house and powering finance back office use cases like financial statement prep, internal audits, and tax advisory where data extraction and reconciliation is a major pain point. DataSnipper's largest strength, its Excel-centricity, is here one of its biggest risks, as its add-on form factor limits its ability to go upmarket and facilitate collaboration, decision-making, and analysis higher up in the organization.

For more, check out this other research from our platform:

- DataSnipper (dataset)

- Tim Flannery, co-founder of Passthrough, on building TurboTax for private fund investing

- Christina Cacioppo, CEO of Vanta, on the value of SOC 2 compliance for startups

- Sam Li and Austin Ogilvie, co-CEOs of Laika, on the compliance-as-a-service business model

- Shrav Mehta, CEO of Secureframe, on building a TurboTax for security compliance

- Siqi Chen, CEO of Runway, on building browser-based collaborative FP&A

- Bobby Pinero, CEO of Equals, on bringing joy to finance teams

- Taimur Abdaal, CEO and co-founder of Causal, on the future of the "better spreadsheet"