Crusoe at $276M revenue

Jan-Erik Asplund

Jan-Erik Asplund

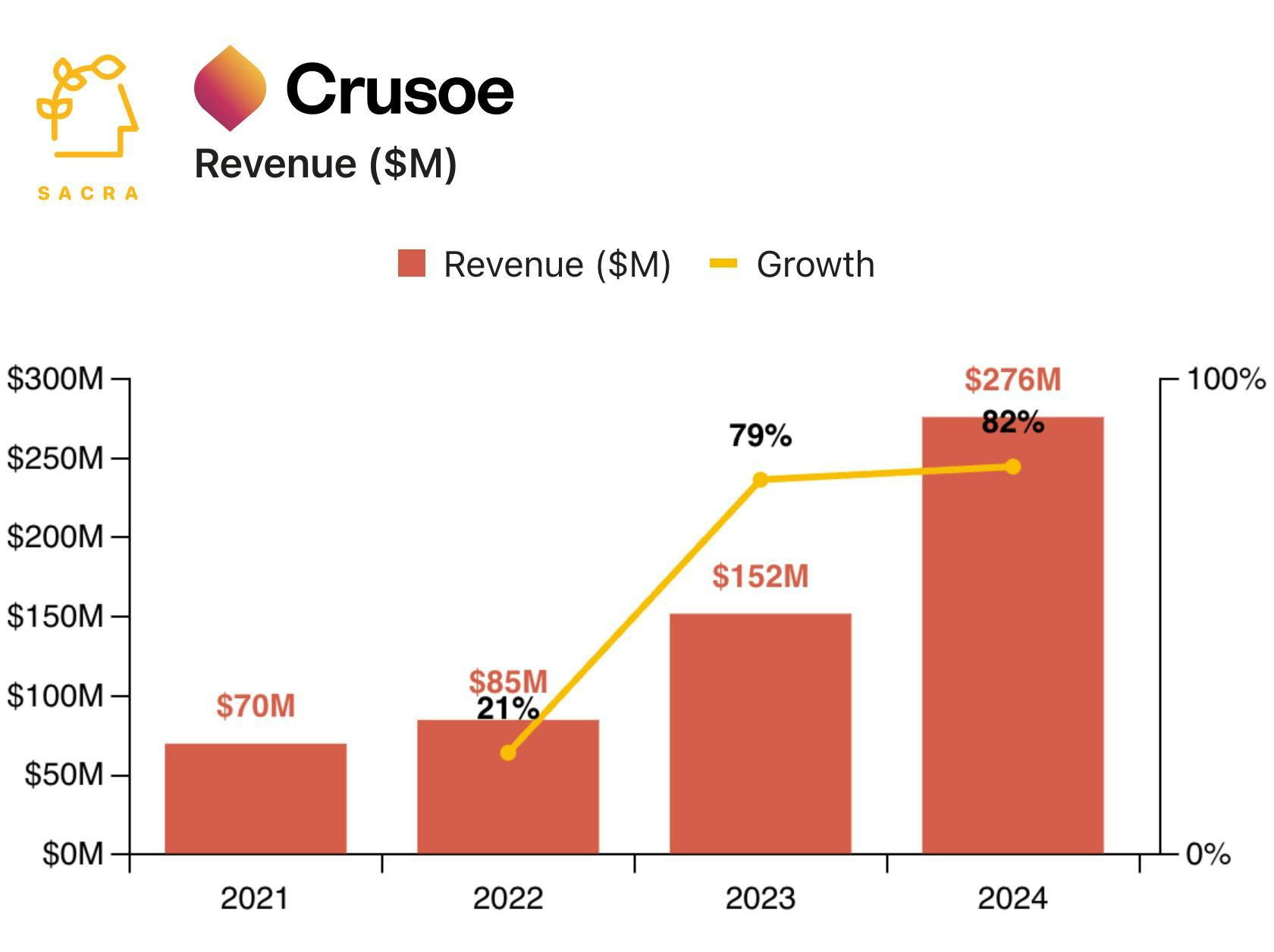

TL;DR: Sacra estimates that Crusoe will generate $276M in revenue in 2024, up 82% YoY. Powered by cheap electricity from stranded natural gas, Crusoe pivoted away from its origins in Bitcoin mining to meet demand for AI compute in 2023—today, they’ve become the #2 GPU cloud behind CoreWeave in terms of capital raised. For more, check out our full report and dataset on Crusoe.

Key points via Sacra AI:

- Like CoreWeave (founded in 2017), Crusoe (founded in 2018) started as a cryptocurrency mining company predicated on structurally cheaper access to energy—amassing GPUs during the crypto downturn in 2019 that it started renting out to VFX studios and ML companies. Crusoe powers its data centers with “stranded” natural gas generated during oil drilling, which is uneconomical to transport and would typically be burned off into the atmosphere (resulting in fines), partnering with oil companies like Exxon & Devon to get electricity at 1/13th the standard cost.

- After pivoting to meet demand for cloud GPU compute for AI in 2023, Sacra estimates Crusoe generated $276M in revenue in 2024, up 82% from $152M in 2023, with 45% of revenue from its AI cloud business ($124M, up 460% YoY) and about 55% from its crypto mining business ($152M, up 17% YoY). Last week’s $600M Series C led by Founders Fund puts Crusoe at $5B+ in total raised across debt and equity, with a $2.8B valuation or 10x revenue.

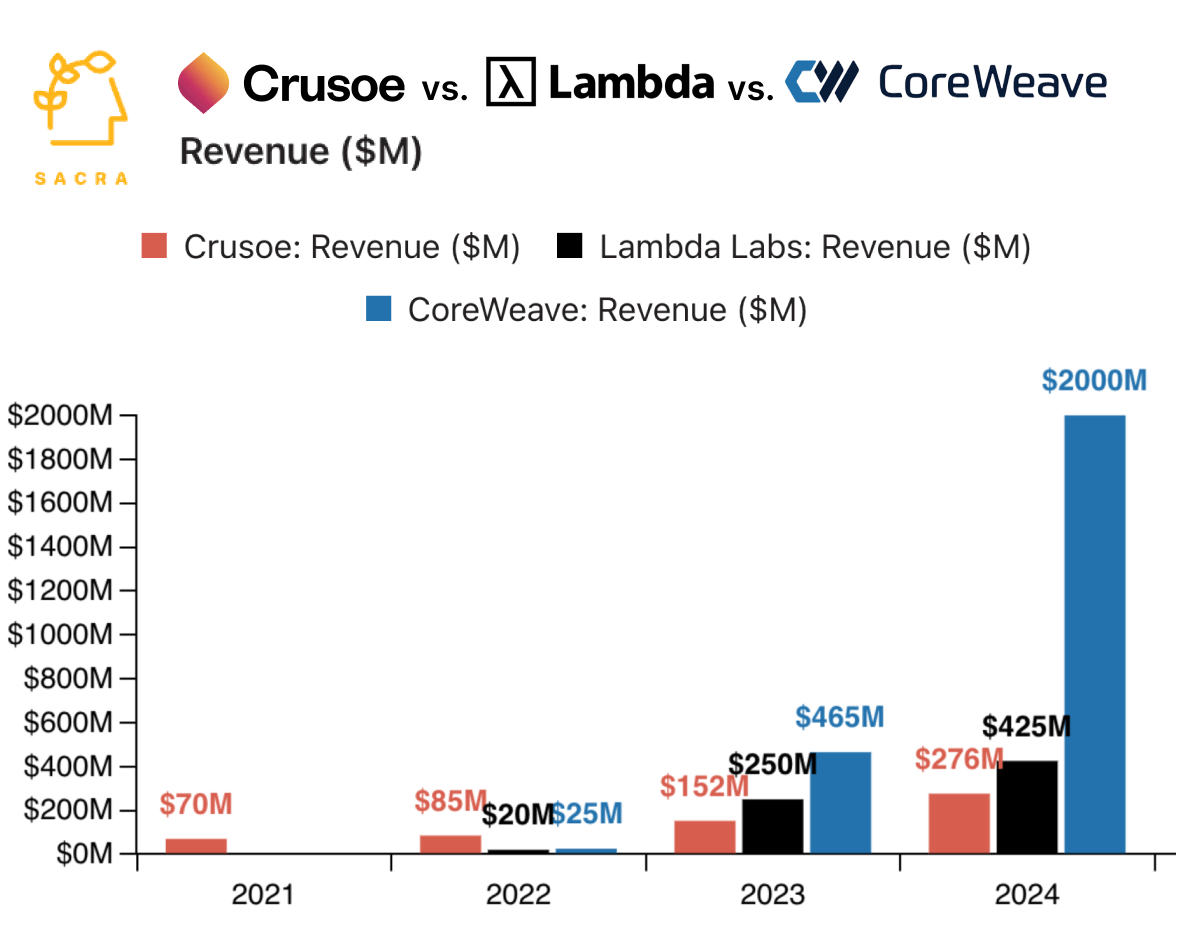

- Crusoe’s model of building its own data centers near sources of cheap, stranded energy is capital-intensive ($3.4B for its new West Texas data center) but pays back in 2-3 years with projected 45% IRR and a 5x return on investment that jumps to 8.7x when using leverage. Compare this to the co-location model used by Lambda Labs ($425M ARR, up 70% YoY) and the hybrid model used by CoreWeave ($2B in revenue, up 330% YoY) which allows them to spin up data centers faster and at less upfront cost, but costs more over time with lease payments making up ~60% of opex.

For more, check out this other research from our platform:

- Crusoe (dataset)

- CoreWeave (dataset)

- Lambda Labs (dataset)

- Together AI (dataset)

- CoreWeave: the $465M/year cloud GPU startup growing 1,760% YoY

- GPU clouds growing 1,000% YoY

- Samiur Rahman, CEO of Heyday, on building a production-grade AI stack

- Scale (dataset)

- OpenAI (dataset)

- Anthropic (dataset)

- Geoff Charles, VP of Product at Ramp, on Ramp's AI flywheel

- Mike Knoop, co-founder of Zapier, on Zapier's LLM-powered future

- Oscar Beijbom, co-founder and CTO of Nyckel, on the opportunites in the AI/ML tooling market

- Cristóbal Valenzuela, CEO of Runway, on the state of generative AI in video

- Thilo Huellmann, CTO of Levity, on using no-code AI for workflow automation

- Dave Rogenmoser, CEO and co-founder of Jasper, on the generative AI opportunity

- Chris Lu, co-founder of Copy.ai, on the future of generative AI