Cribl at $200M ARR

Jan-Erik Asplund

Jan-Erik Asplund

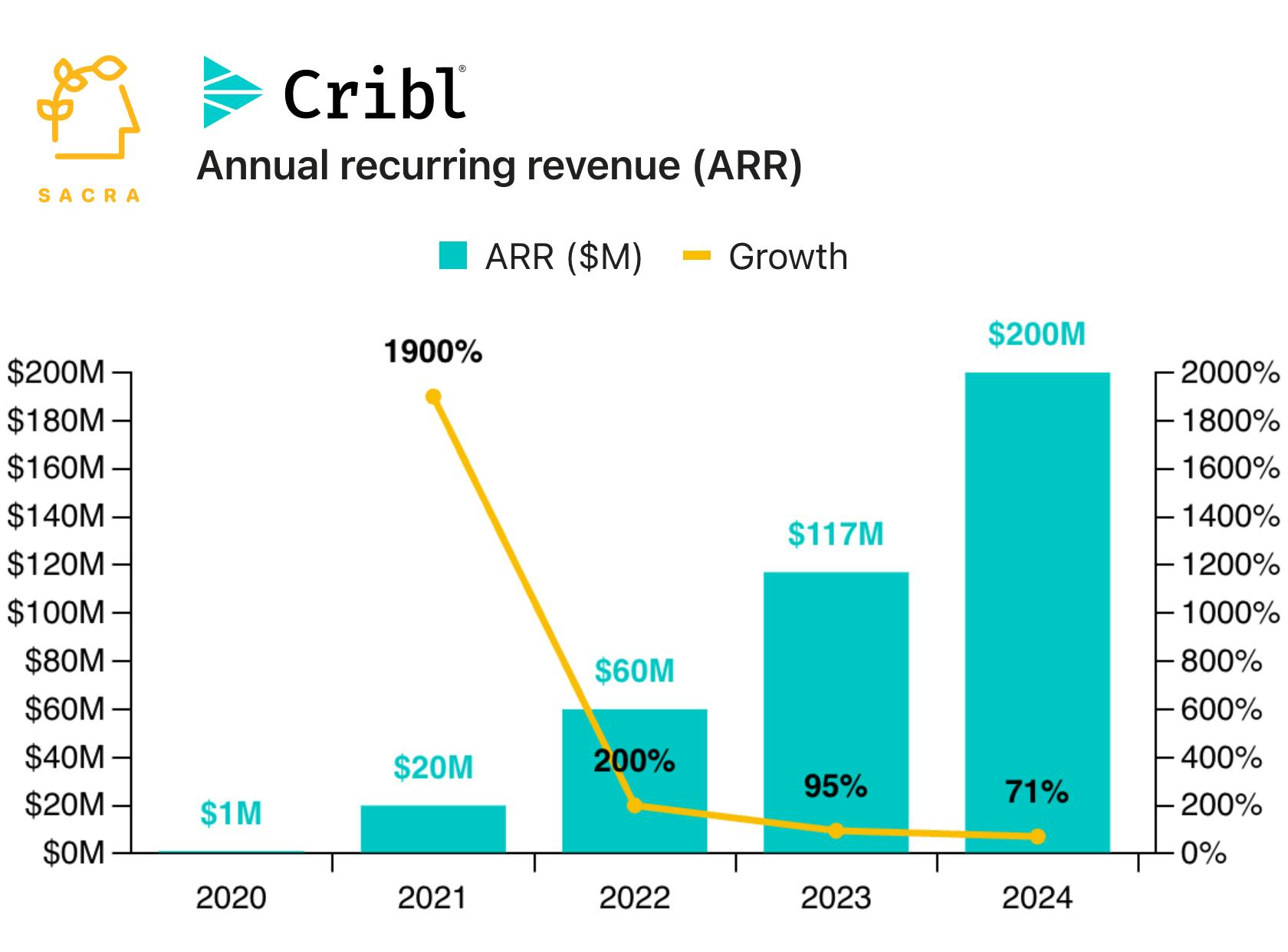

TL;DR: By saving companies 30-90% on their Splunk bills, Cribl’s data router went from $1M to $100M annual recurring revenue (ARR) in 4 years. In 2024, Sacra estimates Cribl hit $200M in ARR, growing 71% year-over-year. For more, check out our full report and dataset on Cribl.

When we last covered Cribl in April, it had passed $120M in annual recurring revenue growing 100% year-over-year.

Founded in 2018 by ex-Splunk employees, Cribl's core product trims unnecessary metadata from customers’ logs before its ingested it into platforms like Splunk, charging ~$500K/yr for 5TB of daily data ingest to save customers $4M/yr in Splunk.

After reaching $200M in ARR in 2024, growing 71% YoY, Cribl is continuing to expand outside observability and data routing, launching its own storage solution in Cribl Lake.

Here’s our end-of-year 2024 Cribl update with key points via Sacra AI

- Sacra estimates that Cribl reached $200M in annual recurring revenue (ARR) in 2024, up 71% YoY from $117M ARR at the end of 2023, valued at $3.5B as of their August 2024 Series E for a 17.5x revenue multiple. Compare to Datadog (NASDAQ: DDOG) at $2.53B in trailing twelve months revenue (TTM), up 19% YoY, valued at $51.6B for a 20.4x multiple, Elastic (NYSE: ESTC) at $1.37B TTM revenue, up 13% YoY, valued at $12B for a 8.8x multiple, and Splunk (NYSE: CSCO) at $4.7B in annual recurring revenue (ARR), up 10% YoY, accounting for 20% of Cisco’s total product revenue after their acquisition closed in March.

- After launching as a data router that helps companies save money on data stored in Splunk, Cribl in 2024 vertically integrated backwards into building its own data storage offering—Cribl Lake—that lets IT teams store petabytes of telemetry data at lower costs while maintaining searchability. With Cribl Lake, Cribl is continuing its strategy of attacking and counter-positioning against the incumbents’ cash cow business model of monetizing on data volume, both trimming the total volume of data that must be stored and offering up to 1TB of daily data ingestion for free.

- With the proliferation of cybersecurity tools increasing the data enterprises have to store by 28% CAGR, Cribl in 2024 partnered with key security platforms like Wiz, CrowdStrike, Azure, and AWS—with Cribl saving their customers money on storage, but in turn, with them becoming preferred destinations for the data customers route through Cribl. With 145% net revenue retention and presence in 43 of the Fortune 100, Cribl says it is positioning to go public in the next 2 years—while targeting cash flow positivity in 2025.

For more, check out this other research from our platform:

- Cribl (dataset)

- Wiz (dataset)

- Israel's YC of cybersecurity

- Snyk (dataset)

- Valimail (dataset)

- Rubrik: the Netflix of data backups

- Zachary Friedman, associate director of product management at Immuta, on security in the modern data stack

- Sam Li and Austin Ogilvie, co-CEOs of Laika, on the compliance-as-a-service business model

- Christina Cacioppo, CEO of Vanta, on the value of SOC 2 compliance for startups

- Shrav Mehta, CEO of Secureframe, on building a TurboTax for security compliance

- How Vanta, Secureframe and Laika are arming the rebels of B2B SaaS

- Rubrik (dataset)

- BigID (dataset)

- Lacework (dataset)

- Noname Security (dataset)

- Netskope (dataset)