CoreWeave of Europe

Jan-Erik Asplund

Jan-Erik Asplund

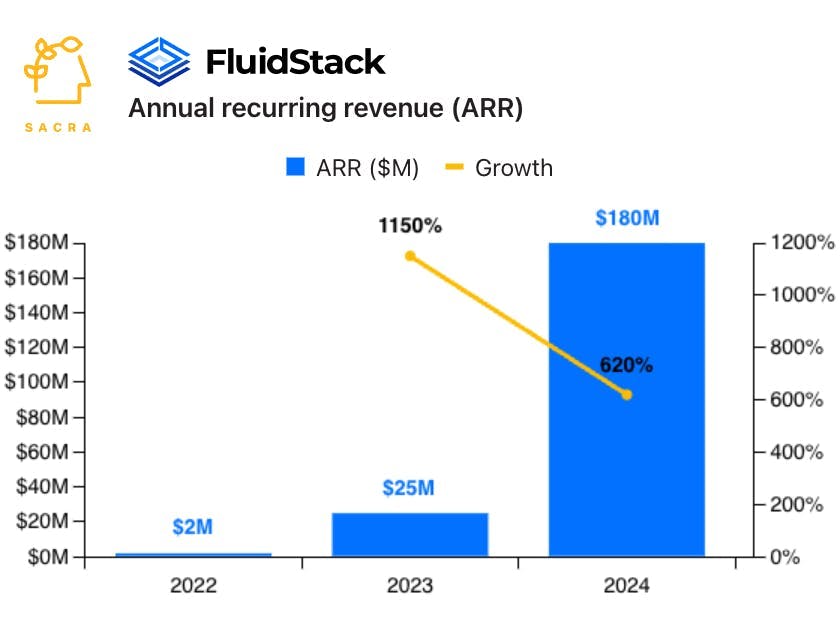

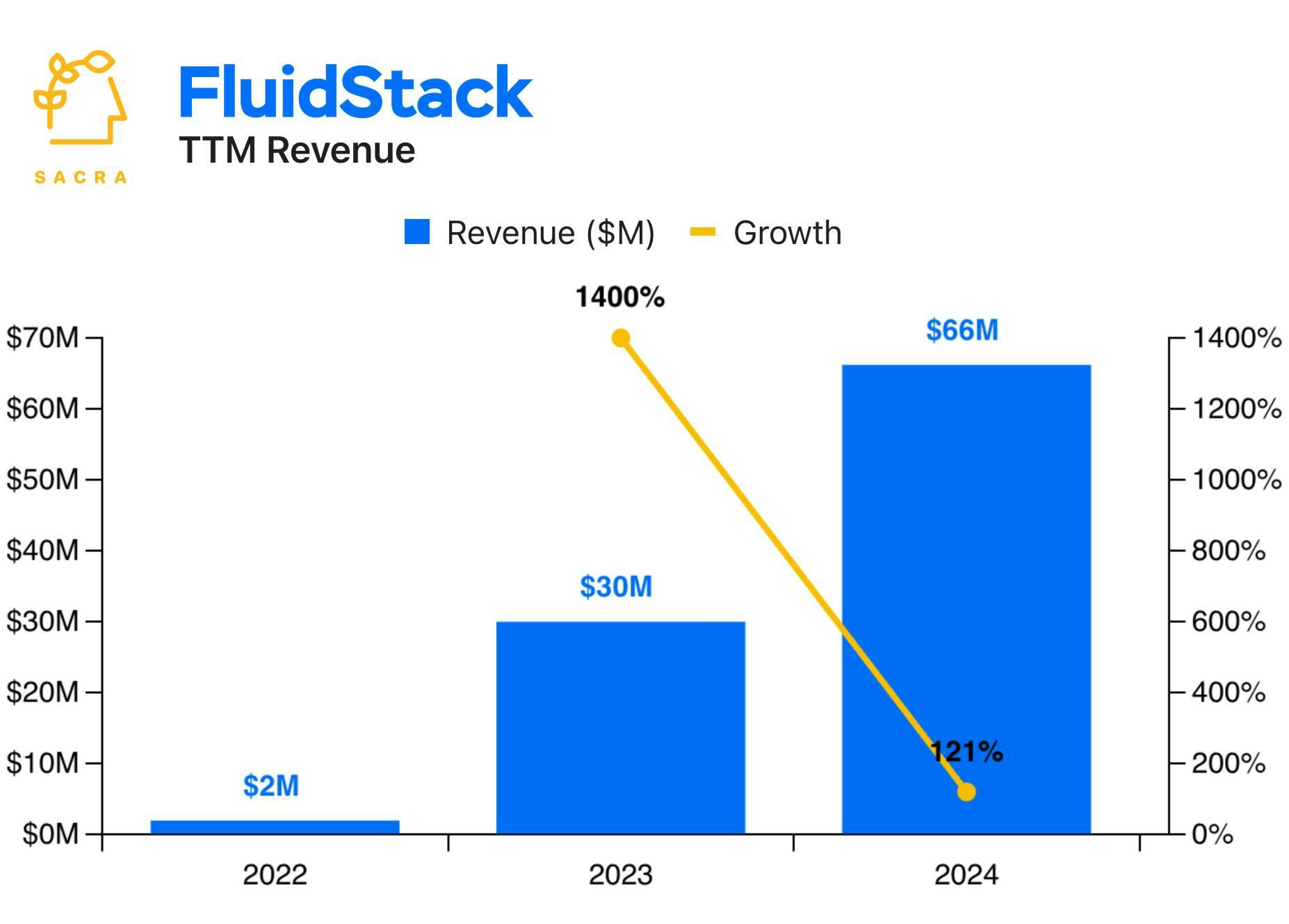

TL;DR: After launching in 2017 as an “Airbnb for bandwidth”, Fluidstack is now building the largest national sovereign AI cluster in Europe for the French government. The aspiring “CoreWeave of Europe” hit a Sacra-estimated $180M in annual recurring revenue (ARR) in 2024, up 620% YoY. For more, check out our full report and dataset.

Founded in 2017 as an "Airbnb for bandwidth," Fluidstack pivoted in 2021 into a platform marketplace connecting AI startups with underutilized GPUs—as demand for compute exploded in the years post-ChatGPT, Fluidstack launched Private Cloud to serve dedicated GPUs to larger customers like Meta.

Now, the startup is partnering with the French government to build out the largest AI datacenter on the continent.

- In February 2025, Fluidstack signed a memorandum of understanding (MoU) with the French government to provide the GPUs for a €42 billion ($46B) nuclear-powered data center housing 500,000 chips in what will become Europe’s largest national sovereign AI cluster. The 1 gigawatt, decarbonized data center represents Europe’s answer to xAI's Memphis Colosseum (100,000 GPUs) and OpenAI's $500B Stargate project, and is expected to go live in 2026 with full integration into the French nuclear grid via partnership with state electricity operator RTE.

- With its ~85% gross margin Private Cloud business growing to 62% of revenue ($112M ARR) and expected to rise to 93% by 2027 while its platform marketplace model falls to 38% of revenue at 13% gross margins ($68M ARR), Sacra estimates Fluidstack hit $180M in annualized revenue at the end of 2024, up 620% YoY. Fluidstack’s customer mix began with serving short-term GPU rentals to AI startups like Character.ai ($193M raised) and Poolside ($626M raised) and is now shifting towards platforms like Meta and nation-states, turning it from a low-margin broker to a high-margin compute utility.

- After securing approval from Macquarie and other lenders to borrow up to $10B against the 100,000 GPUs on its platform—more debt capacity than CoreWeave raised in its entire pre-IPO lifetime ($8.1B)—Fluidstack now has the collateral & financing necessary to compete with cash-rich hyperscalers (which currently dominate ~80% of the European cloud market) and stake a claim to being the “CoreWeave for Europe". In a Europe where regulatory pressure for data sovereignty and reduced American cloud dependence is intensifying while CoreWeave & Crusoe are at capacity serving OpenAI, Fluidstack has the opportunity to seize leadership of the cloud GPU market in the EU.

For more, check out this other research from our platform:

- Fluidstack (dataset)

- Crusoe (dataset)

- CoreWeave (dataset)

- Lambda Labs (dataset)

- Together AI (dataset)

- CoreWeave: the $465M/year cloud GPU startup growing 1,760% YoY

- GPU clouds growing 1,000% YoY

- Samiur Rahman, CEO of Heyday, on building a production-grade AI stack

- Scale (dataset)

- OpenAI (dataset)

- Anthropic (dataset)

- Geoff Charles, VP of Product at Ramp, on Ramp's AI flywheel

- Mike Knoop, co-founder of Zapier, on Zapier's LLM-powered future

- Oscar Beijbom, co-founder and CTO of Nyckel, on the opportunites in the AI/ML tooling market

- Cristóbal Valenzuela, CEO of Runway, on the state of generative AI in video

- Thilo Huellmann, CTO of Levity, on using no-code AI for workflow automation

- Dave Rogenmoser, CEO and co-founder of Jasper, on the generative AI opportunity

- Chris Lu, co-founder of Copy.ai, on the future of generative AI