$55M/year mom & pop BaaS

Jan-Erik Asplund

Jan-Erik Asplund

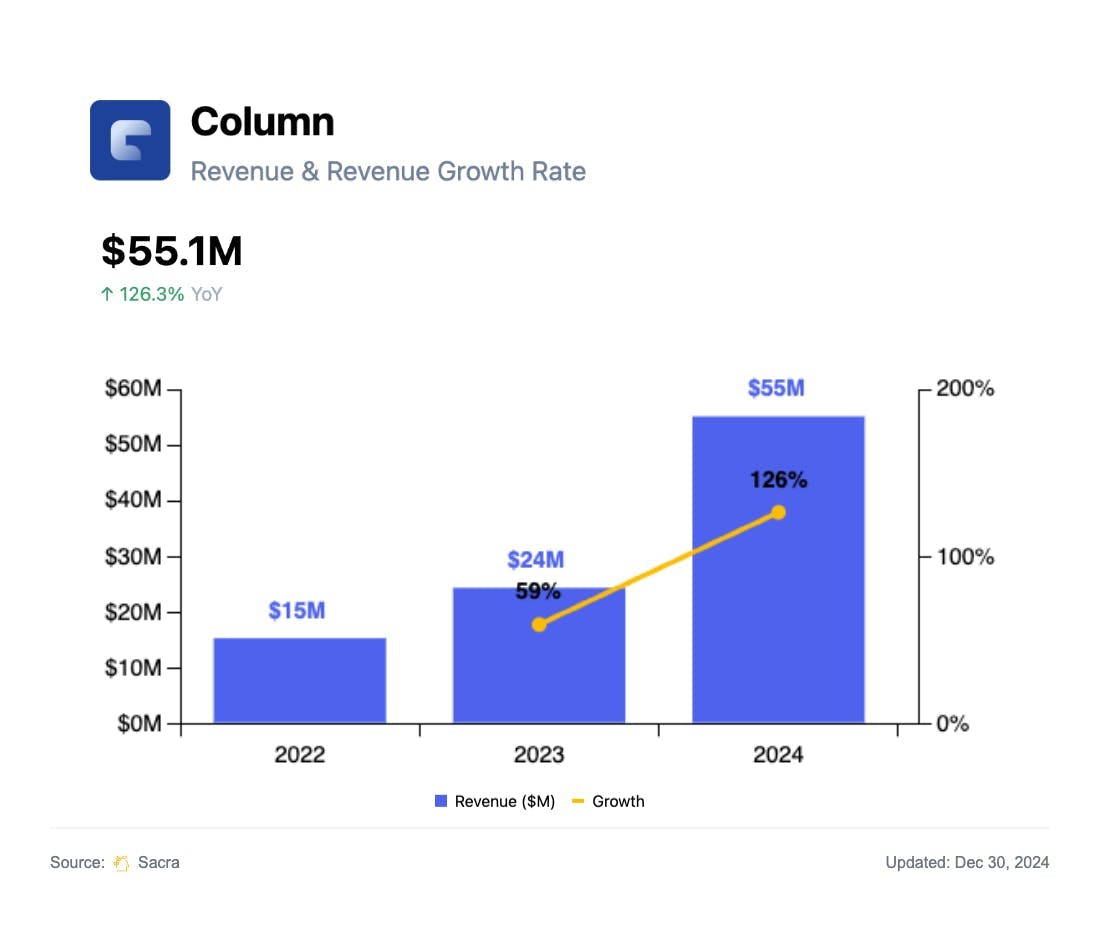

TL;DR: With regulators tightening the screws on middleware banking-as-a-service players, top fintechs like Brex and Mercury are migrating to vertically integrated community banks with API cores like Column and Lead Bank. Sacra estimates that Column generated $55.1M in revenue in 2024, up 126% year-over-year. For more, check out our full report and dataset on Column.

With Mercury ($500M in annualized revenue) announcing its migration off Evolve / Synapse to Column last October, Column now powers both Brex and Mercury—two of the biggest neobanks in the U.S.

To learn more, we decided to take a deeper dive into Column, founded in 2021 by husband & wife team William (co-founder of Plaid) and Annie Hockey.

Key points via Sacra AI:

- Unlike middleware banking-as-a-service (BaaS) platforms like Synapse (filed for Chapter 11 in April 2024) that connected fintechs with deposit-hungry community banks, Column (2021) bought its own 20-year-old community bank in Chico, California and retrofitted it with an API to give fintechs direct access to open FDIC-insured accounts, move real-time funds over Fedwire, and issue branded debit & credit cards. With charter, payment rails, ledger, and compliance stack all inside one roof, Column wins deals on the speed and lower complexity that come from replacing a three-vendor stack with one, monetizing via usage fees ($0.50/ACH, $5/wire, $1/check) and 20-30% of interchange while passing the rest to its fintech clients.

- In 2024, as Brex migrated its business checking accounts to Column and Mercury began migrating users to Column (and other partners like Choice Bank) after former banking partner Evolve Bank received a cease-and-desist order, Sacra estimates that Column grew to $55M in revenue in 2024, up 130% YoY, with $28M from interest income on deposits and $27M from non-interest income like interchange and usage fees. Column is indexed on the upside of fintechs like Mercury at $500M in annualized revenue in 2024, up 97% year-over-year from $254M in 2023, and Brex at $319M of revenue in 2023, up 48% from $215M in 2022.

- With no outside investors and a national charter funded by founder William Hockey’s secondary sales of Plaid stock, Column has the time optionality to grow its community-bank-cum-BaaS carefully—driving revenue for a small number of “blue chip” fintechs like Brex and Mercury, rather than scaling top-line by onboarding the long tail of fintechs and creating escalating compliance risk. Positioned against BaaS platforms like Unit, Synctera, and Treasury Prime, Column and Lead Bank are the only chartered U.S. banks with BaaS APIs, with Lead Bank generating $180M in revenue in 2024 (68% interest, 32% non-interest) while serving customers like Affirm (NASDAQ: AFRM) and Ramp ($648M annualized revenue in 2024).

For more, check out this other research from our platform:

- Column (dataset)

- Lead Bank (dataset)

- Mercury (dataset)

- Brex (dataset)

- Ramp (dataset)

- Immad Akhund, CEO of Mercury, on the business models of fintechs vs. banks

- Mercury: the unbundling of Silicon Valley Bank

- The neobank capital cycle

- The future of interchange

- Fernando Sandoval, co-founder of Kapital, on tropicalizing Brex for LatAm

- Ramp's LLM workflow

- Geoff Charles, VP of Product at Ramp, on Ramp's AI flywheel

- Karim Atiyeh, co-founder and CTO of Ramp, on the future of the card issuing market

- Banking-as-a-Service: The $1T Market to Build the Twilio of Embedded Finance

- Contractor Payroll: The $1.4T Market to Build the Cash App for the Global Labor Market

- Corporate card flippening

- Art Levy, Chief Business Officer at Brex, on the strategy of Brex Embedded

- Brex: the $400M/year anti-Amex