Carta Series C Deal Memo

Jan-Erik Asplund

Jan-Erik Asplund

What follows is Arjun Sethi's original 2017 deal memo for his Series C investment in Carta, which was known at the time as eShares.

eShares Series C Memo

June 2017

Contributors: Arjun Sethi, Brendan Moore, Andrew Artz, Sakya Duvvuru

- Fundamental human need: Capitalism

- 25% of the world’s pop: No, but supporting the companies that provide value to > 25% of the world pop

- $100B company by 2045: Maybe

- Special people: Yes

- Asymmetric information: Yes - aggregated insights on valuations / rounds, etc.

- North star: Number of digital certificates accepted from listing on the platform

Summary

eShares is a central repository for asset ownership (i.e. cap table management) for private companies -- using this system of record as a starting point they have extended their reach into compliance (409a), approvals, financings and liquidity programs. They are building the financial rails to bring the relative efficiency, liquidity and transparency of public markets to the private market. In addition, they continue to move upstream, aiding private companies towards their entry into the public capital markets. We view them as a (small) tax on the private capital markets worldwide and potentially more in the future. The company is currently at ~12M ARR and projects to hit ~21M in ARR by end of 2017.

Situation overview

- eShares is raising a $25m-$30M Series C. They have previously raised $24M from Spark Capital and Union Square Ventures. Series A, $7M was at a $25M post and the Series B, $18M was at a $77M post.

- Henry Ward (CEO) is a serial entrepreneur who founded the company in 2012 along with Manu Kumar from K9 Ventures. Manu wrote the company its first check. This is Henry’s first company that has achieved significant scale. The company has a total of 233 people w/ offices in Palo Alto (75), San Francisco (99), Seattle (22) and Rio (37).

Product

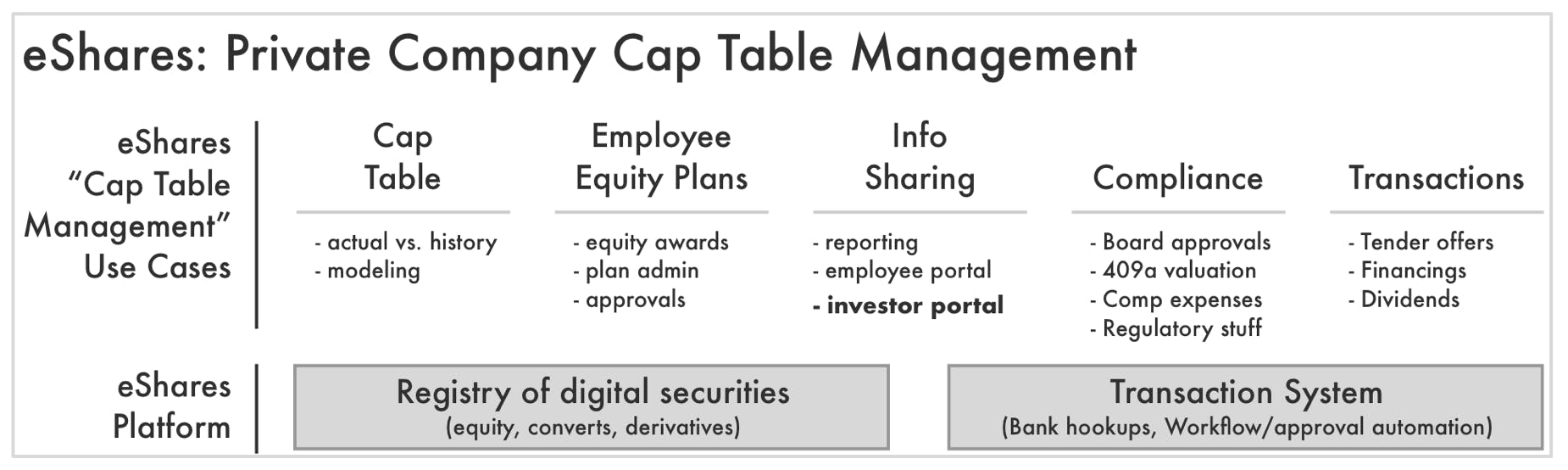

eShares’ core product today is a cap table management platform that has two key components:

- Registry: eShares issues electronic certificates for each security or derivative and maintains the registry (i.e. acting as a transfer agent for private companies - they’re also a registered transfer agent)

- Transactions: transactions are tracked but also initiated and approved within the platform, eventually in its entirety (i.e. acting as paying agent and eventually the brokerage)

The eShares approach enables customers to experience levels of automation that is simple and convenient within a workflow, whereas other cap table tools require manual entry before it ‘knows’ a transaction has happened.

Product market fit

The business has validated product market fit for its market of venture-backed private company cap table management:

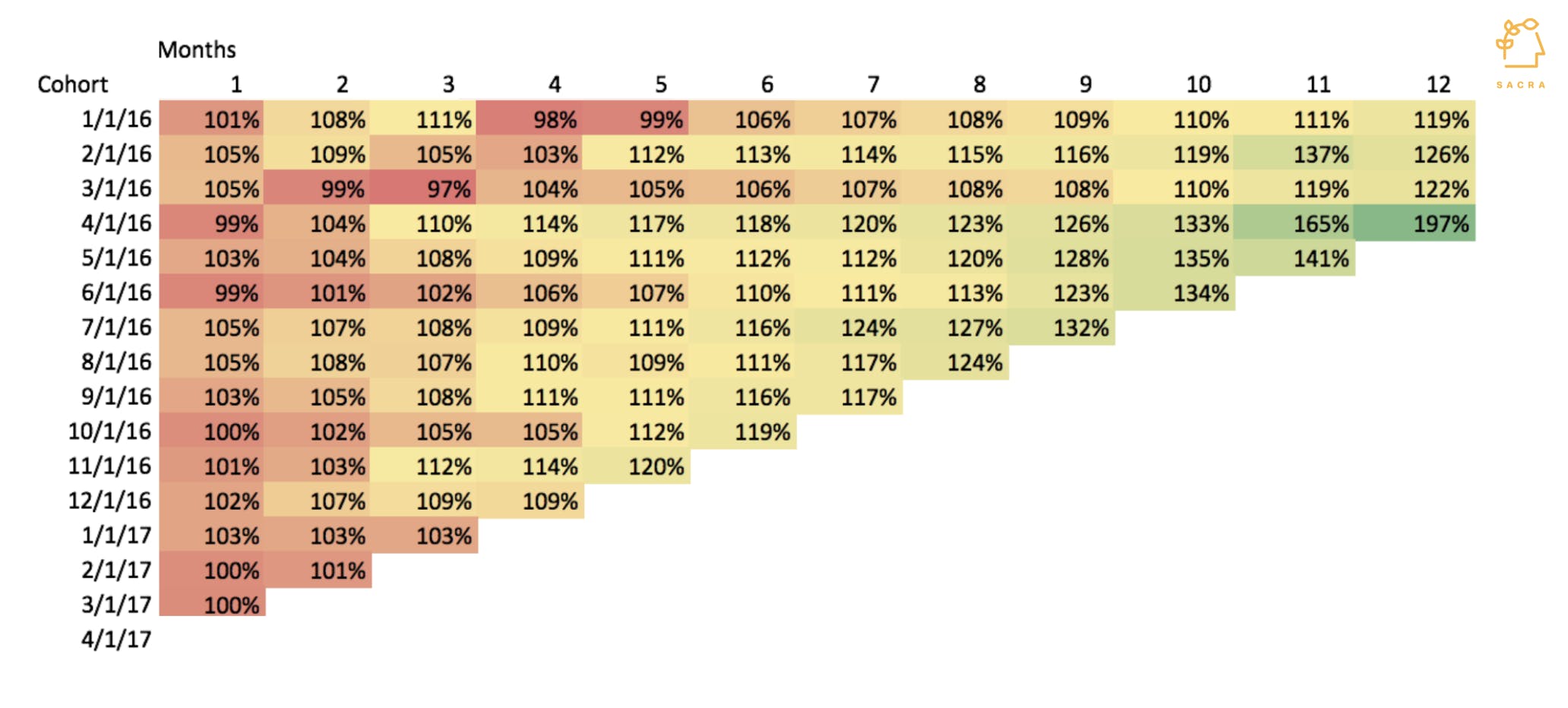

1. Net Revenue Retention

Net revenue retention is stabilizing around 130% one year out, which is top quartile.

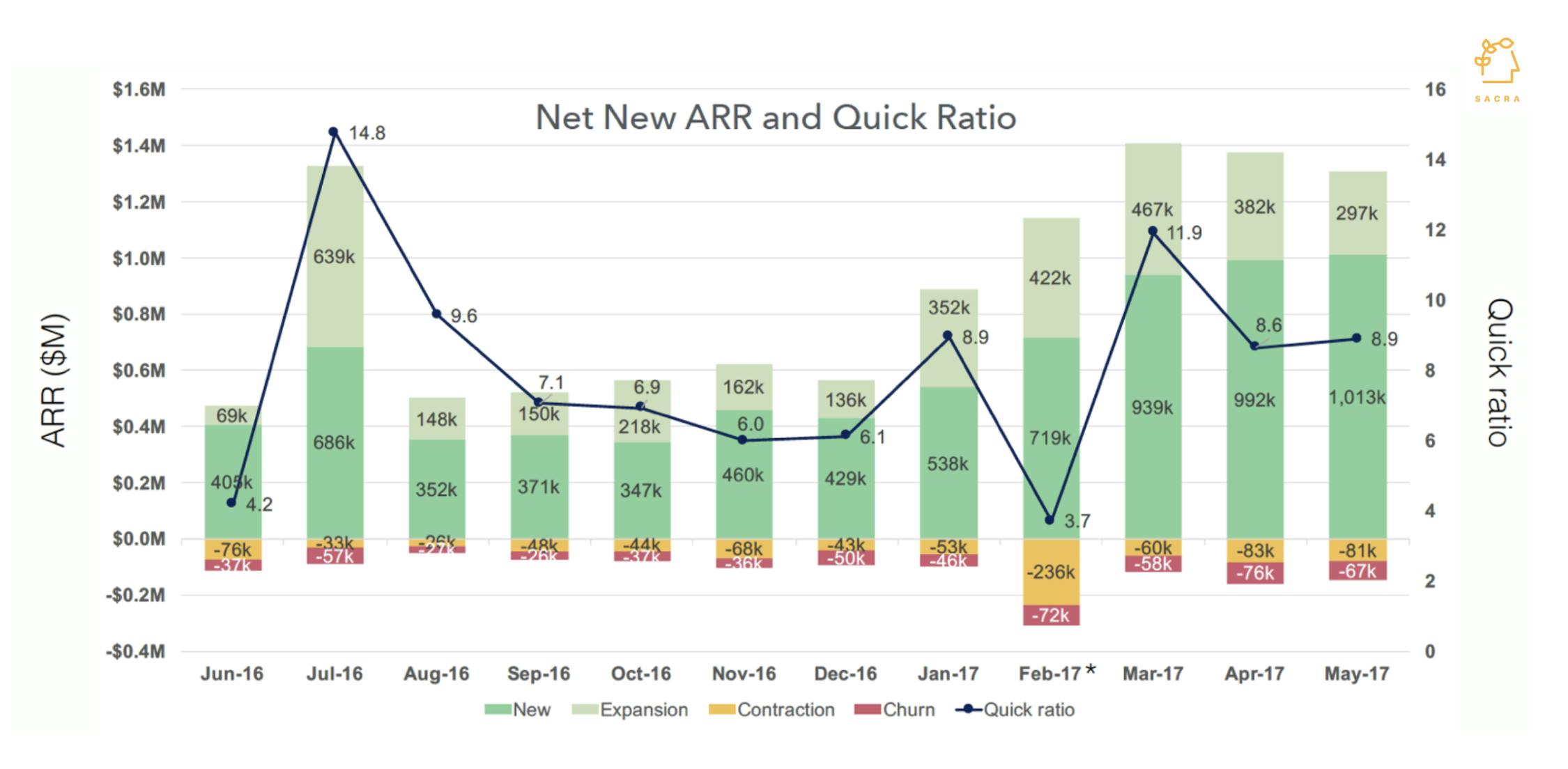

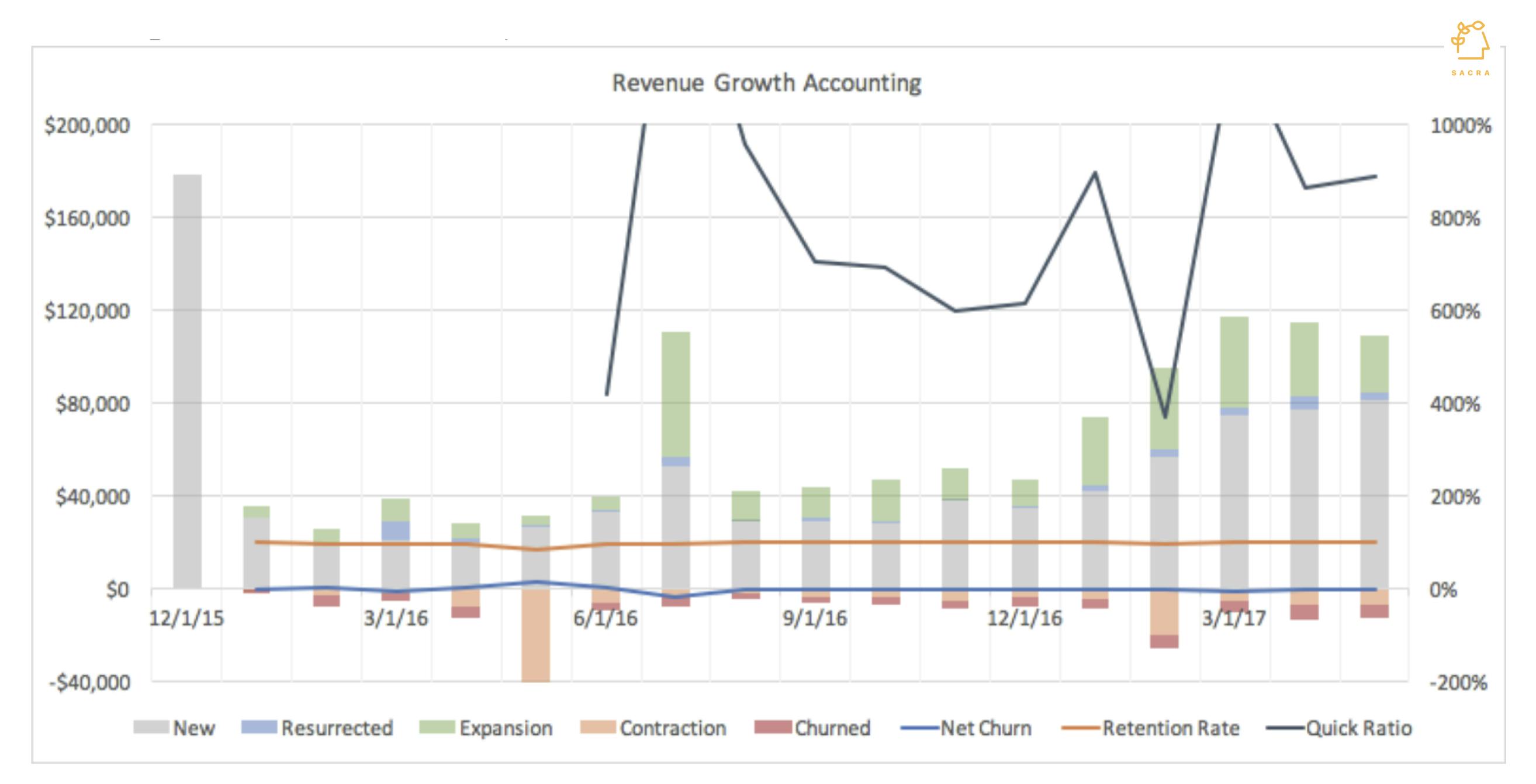

2. Net New ARR and Quick Ratio

New customer growth is accelerating and existing customers are paying more resulting in best in class quick ratios (avg. QR > 6 in the last 12 months).

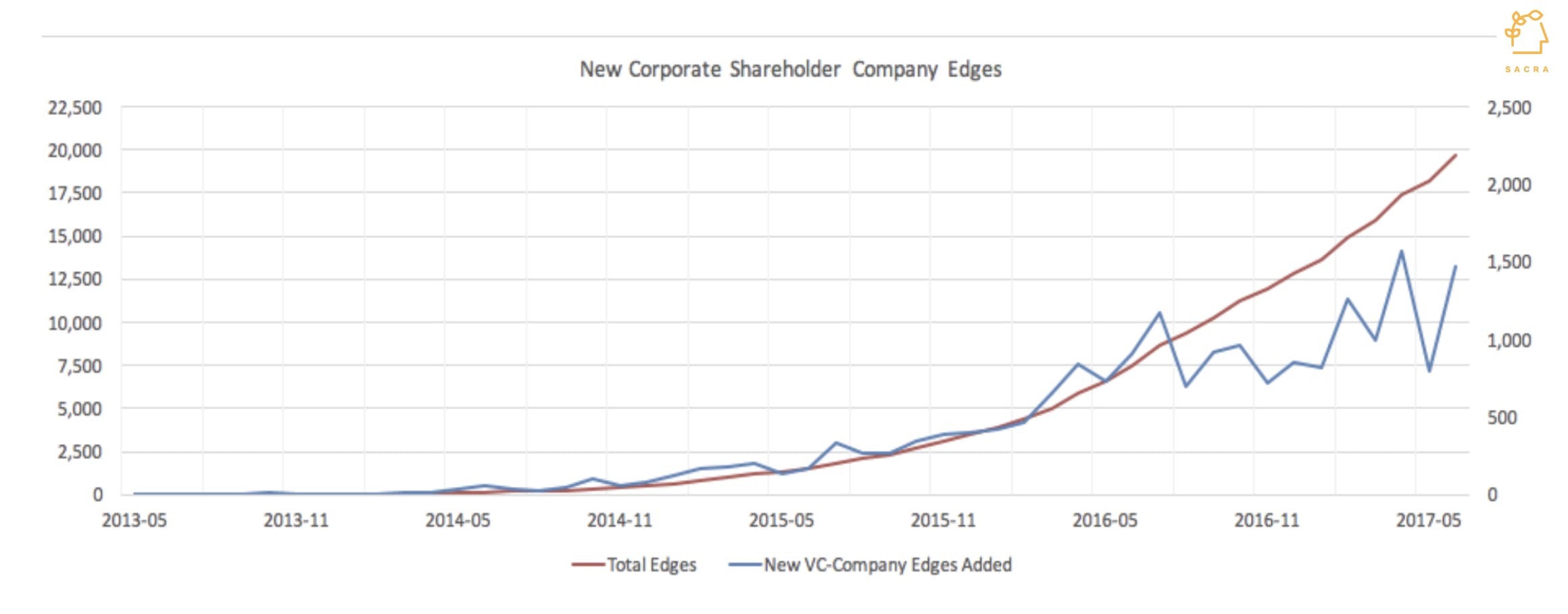

3. Early signs of network effect

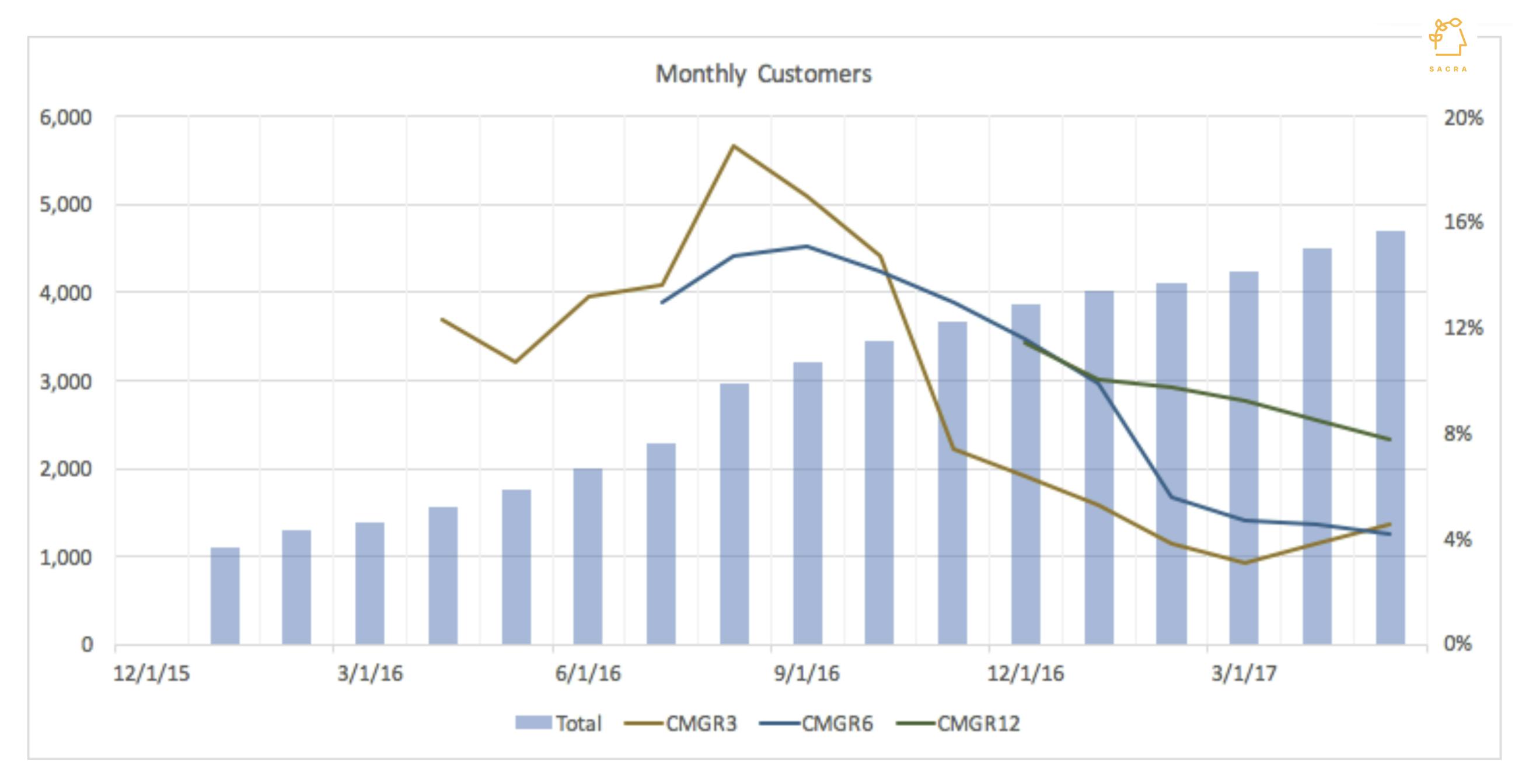

The number of company <> investor edges is growing in both size and density: the CMGR12 is 4% for incr. monthly edges and 7% for corporate shareholders. 20K edges across 5K stakeholders (each has ~4 holdings). With lock in on both sides of the market, companies will be less likely to change providers.

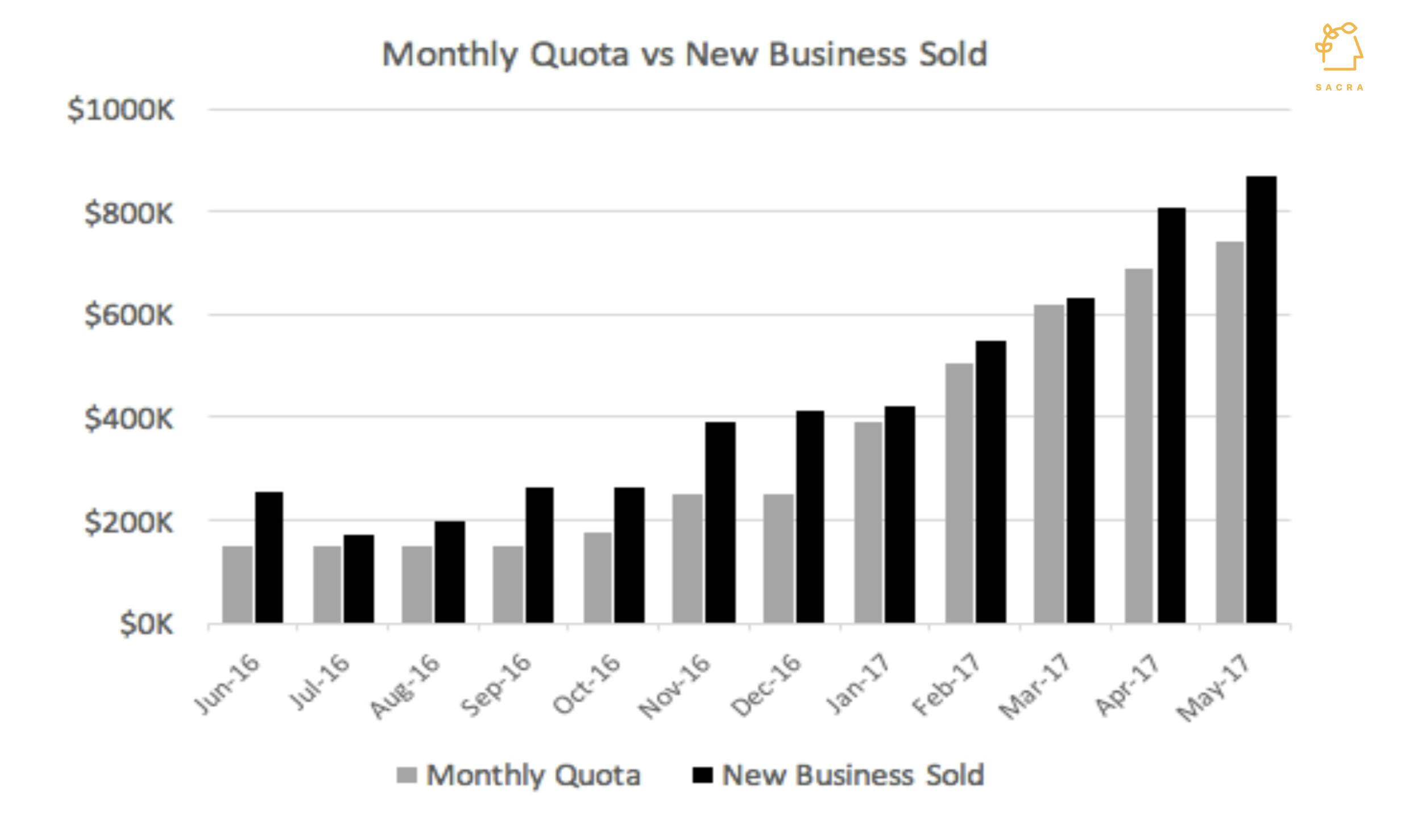

4. Over-attainment on sales productivity

We have rarely observed a company outsell its monthly quota capacity. This suggests that salespeople have it too easy and are “shooting fish in a barrel”. In other words there are probably more leads than they know what do with, i.e. there is more latent business for the current product & within the existing customer base.

Revenue

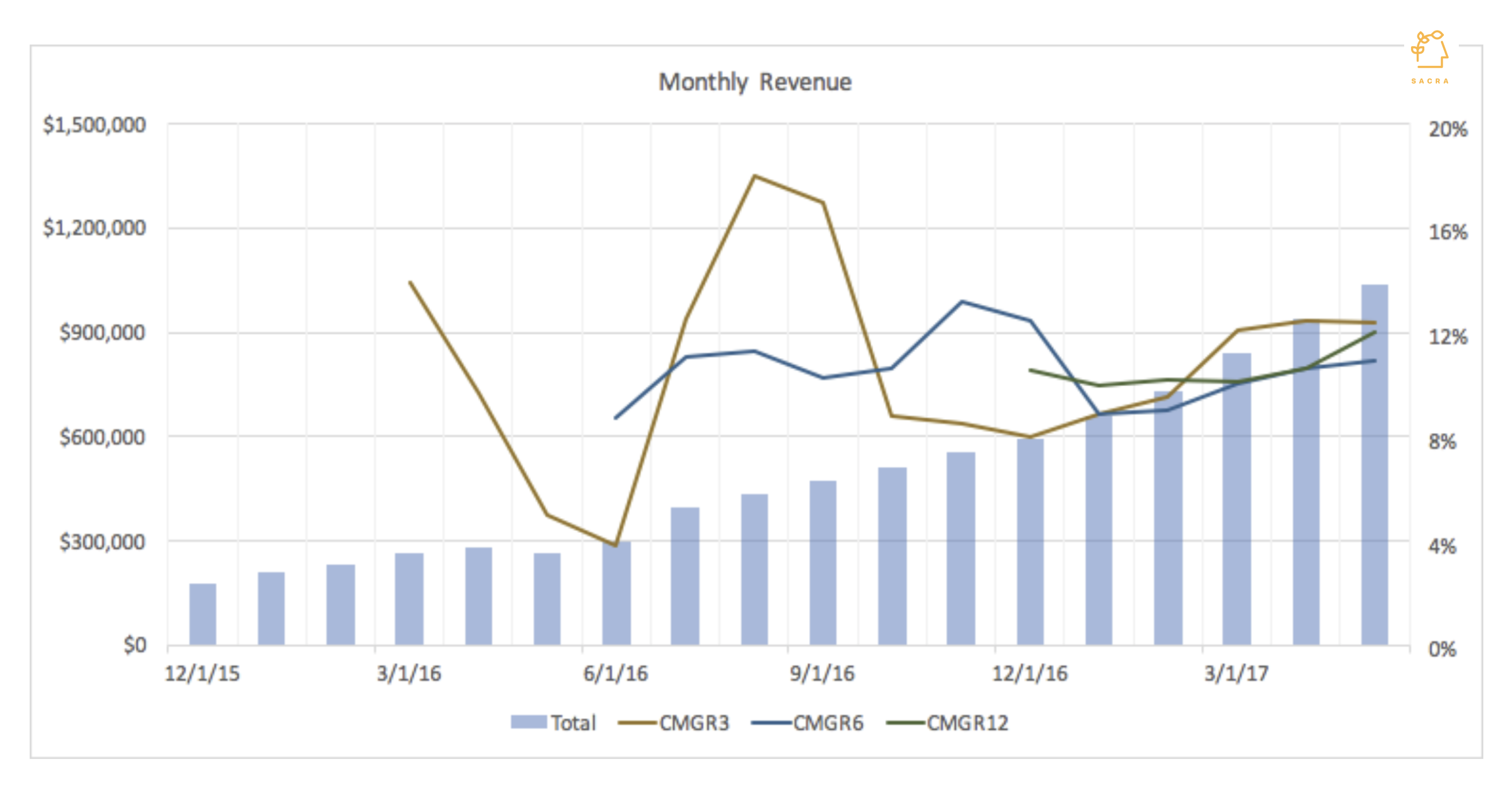

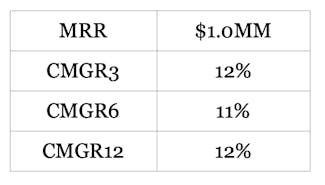

eShares ARR has been growing at 8-12% CMGR so far, which is attributable to logo growth and price increases. Future growth will come from scaling up sales/onboarding and a continued shift to more optimized pricing.

- Product is a subscription service that varies between $2-11K per year based on the size of the company

- The focus has been the venture market and they have achieved $12M of ARR, expecting to be at $21M by Dec ‘17

- Revenue is split roughly equal, 33%, between small, mid and large companies

Profitability

Gross margin: eShares currently sits at XX%+ gross margin, which has been steadily improving as the company optimizes its operations.

We believe gross margin could increase further to XX%+ because the company has yet to offer higher grossing software products to the existing customer base (i.e. outside of the existing cap table + 409a subscription bundle) and will have some attach rate: a) Board Management b) Investor update c) Data rooms d) employee management/comp

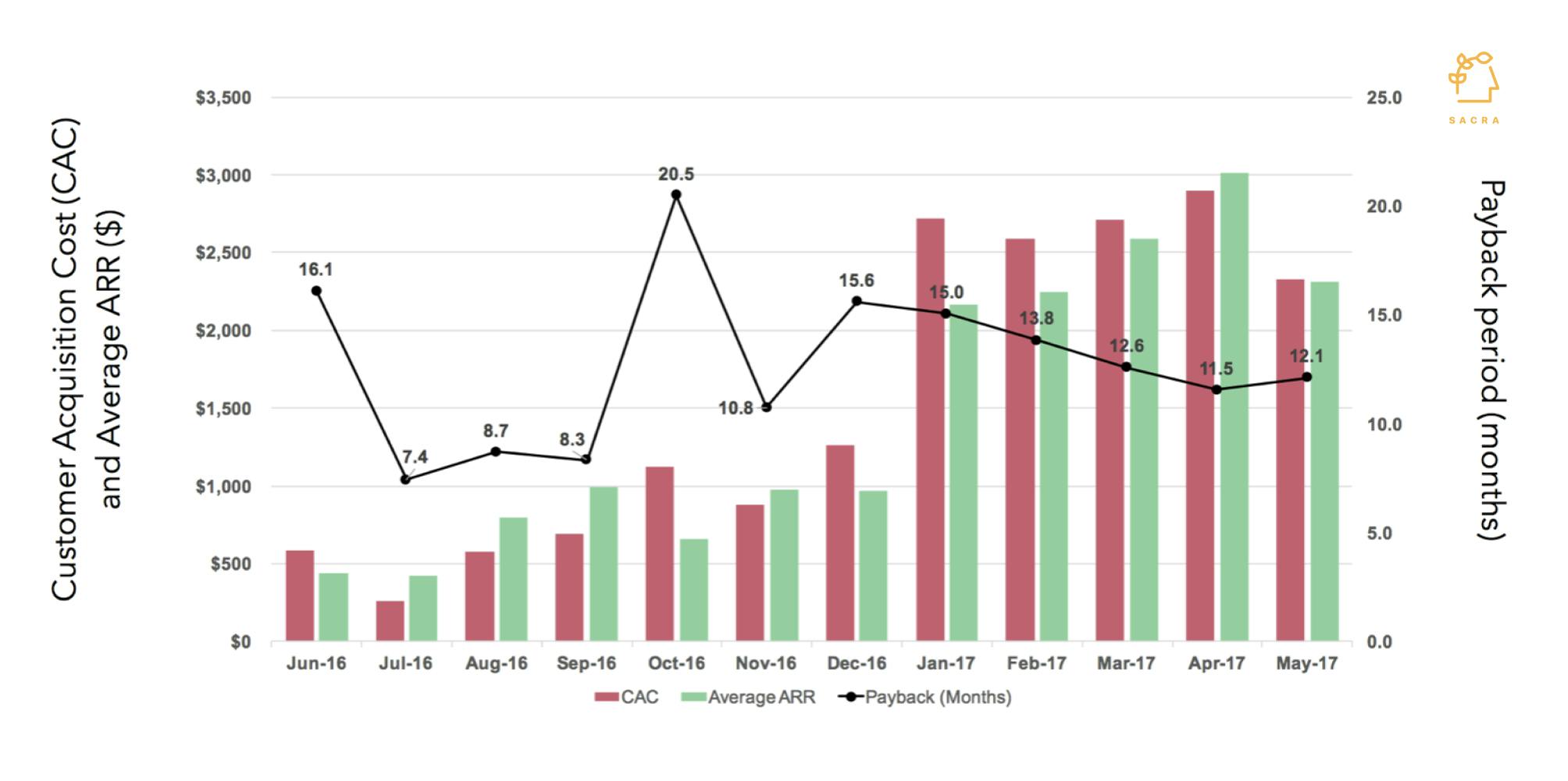

Unit economics: This product requires a sales team; the unit economics imply a ~12 month payback today which the business can afford given the low churn of 15% per year (~6 year lifetime).

Market and competition

Competition:

On the company side (cap table management / registry / ESOP / board):

- On the private side, eShares sees people switch from Capshare and will generally win 2-4 deals from Solium/Certent per month with the later stage companies, but generally most companies with <100 stakeholders are coming from spreadsheets.

- On the public side, competitors include Computershare, AST and equity brokerage partners (e.g. ML, Schwab, etc.) to provide registry, ESOP and transaction/dividend facilitation. eShares can be a system of record and facilitator for these services on their platform; existing customers going public soon have a preference for eShares to continue being their partner because it allows the company to avoid having to split tasks across several systems.

On the GP/LP side (fund management):

- There are several entrenched competitors in the fund management and administration space including Ipreo (iLevel), Investran, eFront, etc. Stickiness is typically in favor of these incumbents, but eShares’ playbook of forcing their way in via free portfolio dashboard makes this easier if critical mass is felt. Specifically, an investor with holdings in an eShares-powered company will use a free eShares investor dashboard to manage and view that investment, regardless of the fund management system. The more companies are powered by eShares, the more it makes sense for the investor to consolidate its own operations, including fund management, on eShares as well.

Product roadmap

- VC companies - already on a path to dominate

- PE companies - enterprise product is early validation of having the requisite feature set to power larger companies and of the unit economics through CAC; just need to scale out the sales/onboarding team

- Public companies - some of their early customers are beginning to consider IPOs, and eShares has already put in place a roadmap to service them. Specifically, eShares only really needs to add employee stock ownership plan (“ESOP”) functionality to be able to compete in the public sphere

Line of sight to $3.4B+ TAM

We are excited about this company because there is a line of sight to a much bigger TAM with adjacent opportunities that are currently performed by humans or old incumbents. See Appendix 2 for TAM Math. Our base case $3.4B includes a line of sight to 3 other market segments:

- Companies at various stages → $2.4B total

- GPs including VC and PE firms → $380M total

- LPs → $570M total

Team

Many team members are ex-founders. The team prefers this structure because they want owners of every category and to be held accountable. The product teams / heads of initiatives act as pseudo GMs. Product is not centralized as it is in traditional web/mobile 2.0 companies. Key management leads for this company are Henry Ward (CEO), Joshua Merill (CPO) and Alessandro Chesser (Head of Private Markets).

Key risks and concerns

Product and Revenue

The biggest issue is the possibility the company does not expand into the other adjacent markets and their growth stagnates at $50M-$75M. Getting into the public markets is a huge task, with compliance and regulations. The legal and compliance side is a HUGE execution risk, similar to that of Zenefits or Lumity. Currently the company has a SV startup mentality that could possibly get into the way. With private companies there is the ability to learn on the job because ownership doesn’t change much but on the public equity side we should not underestimate the amount of time and complexity it will take to win and build momentum in the market. On the flip side it’s also the opportunity because the competition is scarce, legacy oriented and not as entrenched.

Henry is an outspoken CEO with strong and contrarian beliefs. He believes that every functional aspect of a company can be run better and that people should be working for his company for 10+ years. Up until early 2017, the belief of the leadership was to build a company differently -- reinventing product management, engineering and sales.

Recommendation

There is a high likelihood that eShares can dominate a relatively small TAM market (VC backed companies) and build a $100m revenue business. We like this Series C, because the downside is limited and the upside is amorphously unbounded because of the many adjacent opportunities.

Platform Team

Product-Market Fit

- Monthly revenue retention is near perfect (99%), resulting in negative net churn (-2%).

- Expansion is relatively low (3%), suggesting that there may be room for additional upselling new products into the sticky customer base.

- LTV in recent cohorts (2017) have trended up significantly (~1.5-2x) due to eShares raising prices. (It also corresponds with higher CAC, which started to include onboarding services in its calculation.)

- Payback for CAC is about 12 months now (after price raise), though eShares gets the money upfront when customers sign up for the annual contract.

Sales team

This section was removed.