Beacons: The Storefront for the Multi-SKU Creator that's Growing 3X Monthly

Jan-Erik Asplund

Jan-Erik Asplund

We created this research report on Beacons's business alongside the company's equity crowdfunding campaign on Republic. Sacra has not received compensation from Beacons for the report. However, Sacra relies in part on the willingness of the companies that are the subject of research to discuss information relevant to the reports with Sacra, and this may give Sacra an incentive to write favorable reports. Click here to read our complete disclaimers.

A hub for the modern creator

Join our list for access to more of our exclusive private markets research and company coverage.

Success!

Something went wrong...

The new prototypical online creator is a conglomerate, not a contractor.

Instead of selling their time in the form of a single SKU, they’re productized and diversified. They record videos, and they do paid fan shoutouts, and they sell merchandise—or they write an email newsletter, and they do consulting, and they run an online course.

This new kind of creator makes more money, makes it more sustainably, and can connect more authentically with their fans. And like Shopify did for the independent retailers fighting back against Amazon, a whole industry has emerged to help these multi-SKU creators make a living.

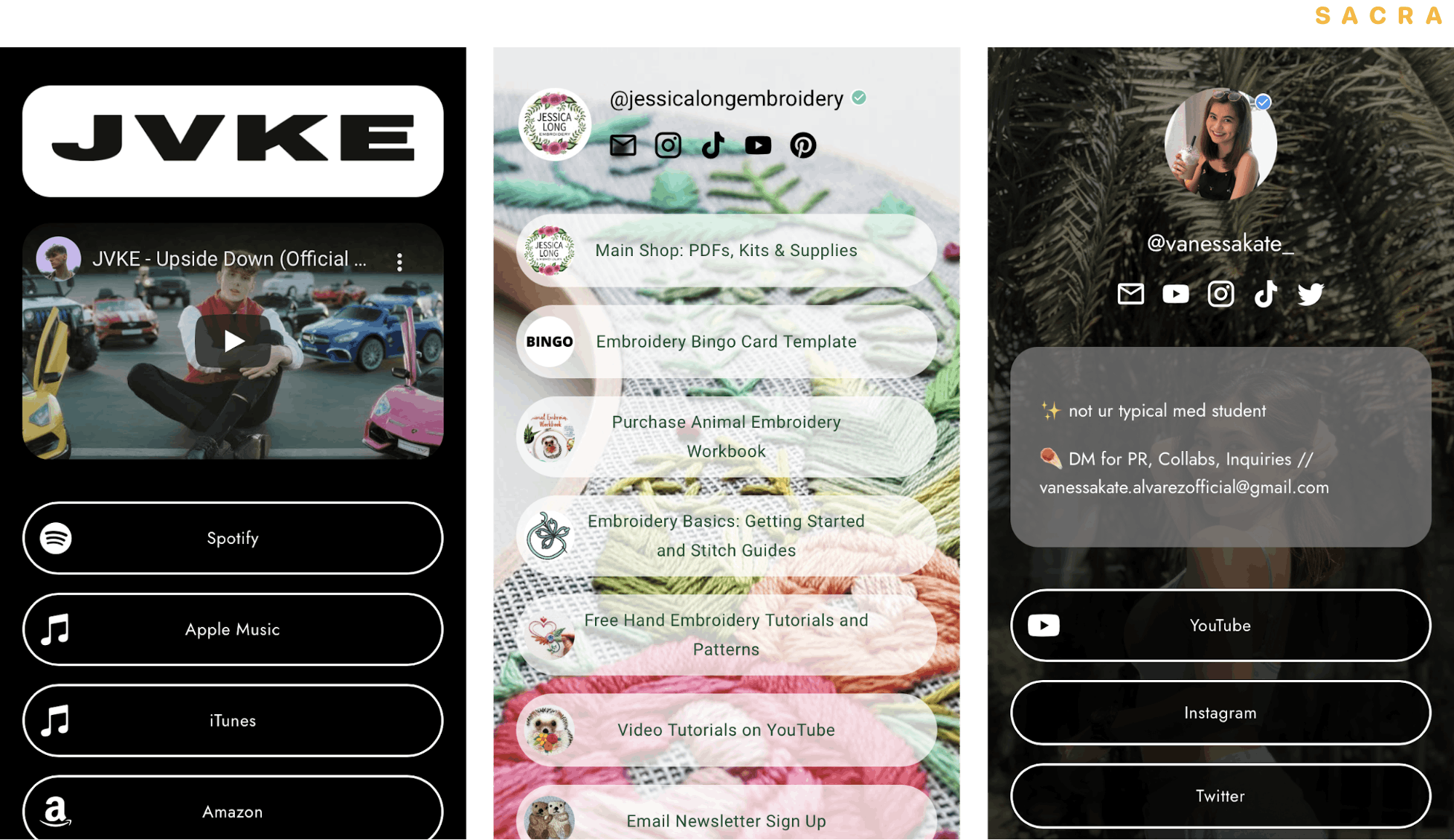

Through their Beacons page, creators can link fans to their profiles on other platforms, sell goods directly, and accept donations.

One newer tool in this space is Beacons, a mobile website generator that gives creators a way to use the one link allowed in a TikTok, Instagram or Twitter bio to better engage with and monetize their fans. With their Beacons page, creators can consolidate all of their work in one place, communicate with the people consuming their content, and use data to figure out what’s working and what’s not.

While link-in-bio tools may look small, Beacons serves as a central hub for the modern online creator: it’s mobile-native, designed specifically for creators with multiple SKUs (or multiple products), helping bridge the gap between the platforms where creators get attention and the platforms where they monetize their creations.

YouTube and Facebook discovered more than a decade ago how huge a business you could build if you could connect consumers hungry for content with creators hungry for a platform. Then the incentives of those platforms took over. For the majority of creators, they became inhospitable and impossible to build a sustainable business on.

Beacons, today, is one of a handful of businesses in the creator economy fighting for the opportunity to reshape that relationship—to change how consumers connect with creators, and in so doing, craft a better experience for the former and a more sustainable future for the latter.

With Beacons, creators can still use TikTok, Instagram and Twitter to build up an audience, but they can then engage and monetize that audience on their own terms: sell their merch directly to them, accept tips, or bring them back to their Patreon or Gumroad or Cameo or OnlyFans accounts.

And rather than rent an audience on social media in exchange for ad revenue, they can control their own relationships. TikTok, Instagram and Twitter may help them get attention, but they monetize that attention with the Beacons links in their bios, bringing their fans back to where they can engage more personally and get paid directly.

It’s still early days for the multi-SKU creator era, but the rapid growth of this ecosystem and Beacons particularly—especially over the last year—suggests that the trend we’re seeing of people striking out on their own to become not just another freelancer but a full-fledged “business of 1” is only going to become more and more popular.

Key points

- Beacons is a “link in bio” product that serves as a multi-SKU creator’s storefront, bridging the gap between upstream discovery from social media platforms and downstream monetization through different content SKUs.

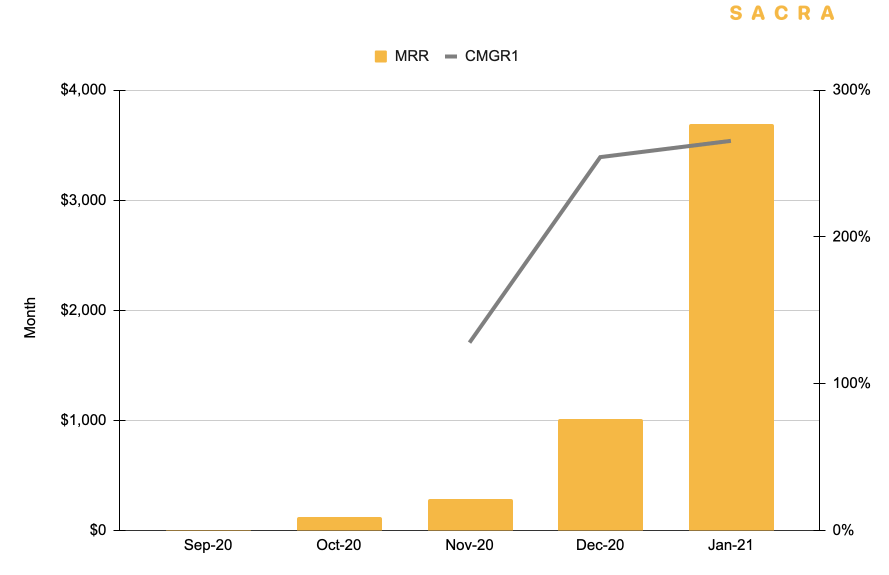

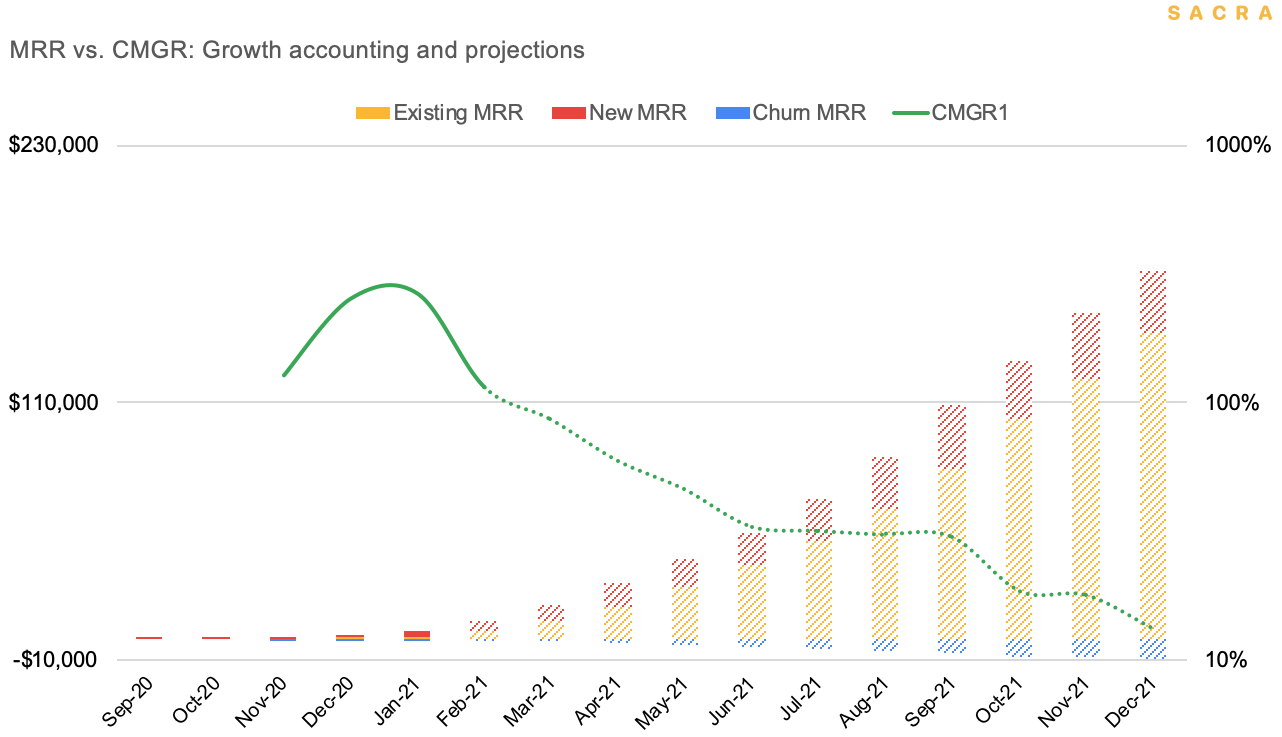

- Beacons has grown extremely quickly to $3.7k MRR at a rate of 209% month over month for the last 3 months. At this rate, Beacons will cross $1M in ARR within 3 months by the end of April 2021.

- Beacons serves a huge need for diversification on the part of creators into other products and services and not just the "single SKU" of monetizing via ad revenue share on a single platform like YouTube, where 97% of creators make less than $17,000 per year in revenue.

- Creators who productize and repackage their time across different SKUs that they monetize increase their conversion rates and drive higher average ARPU (average revenue per user).

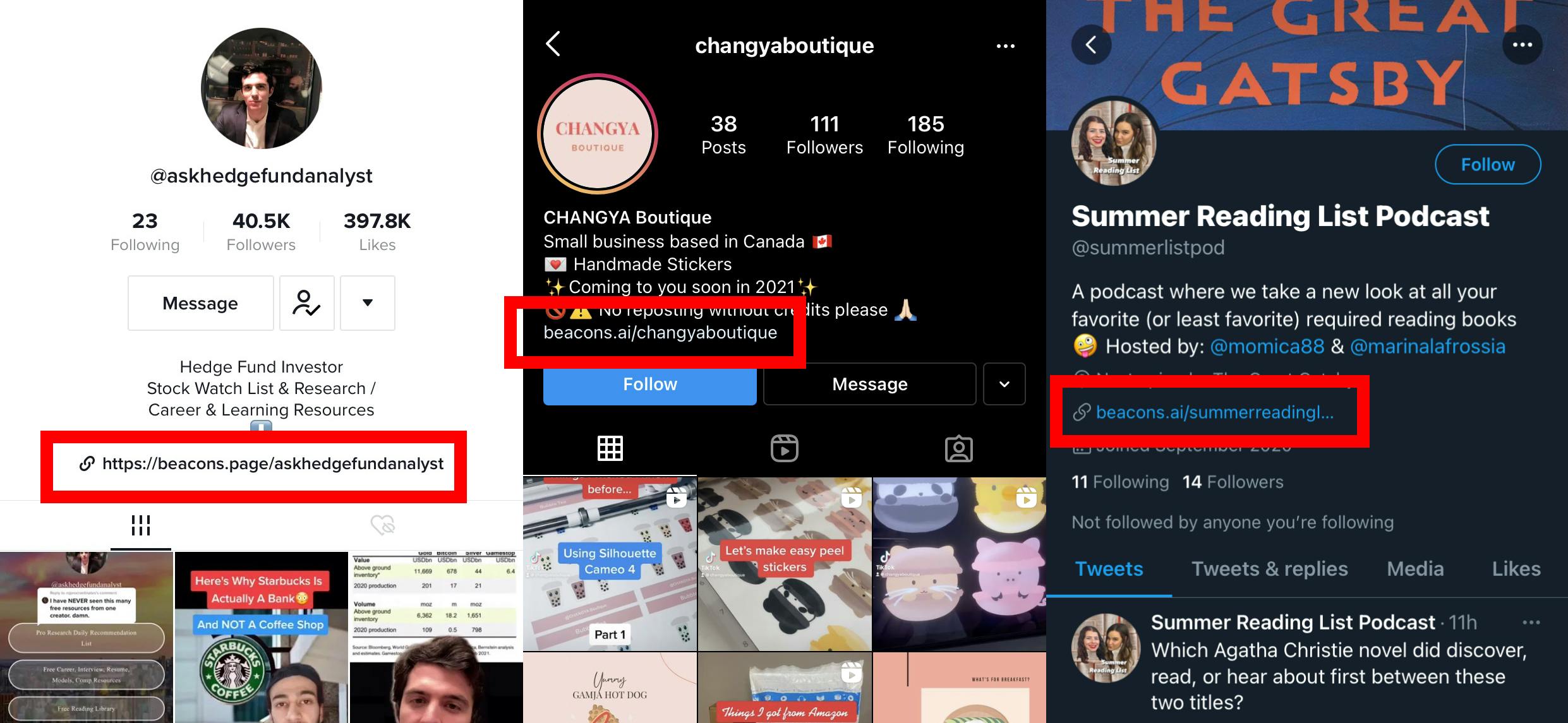

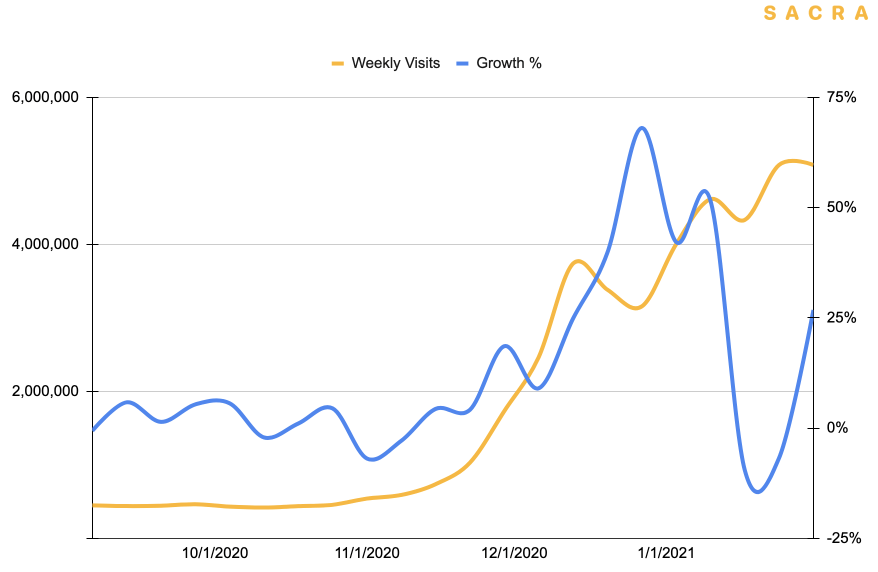

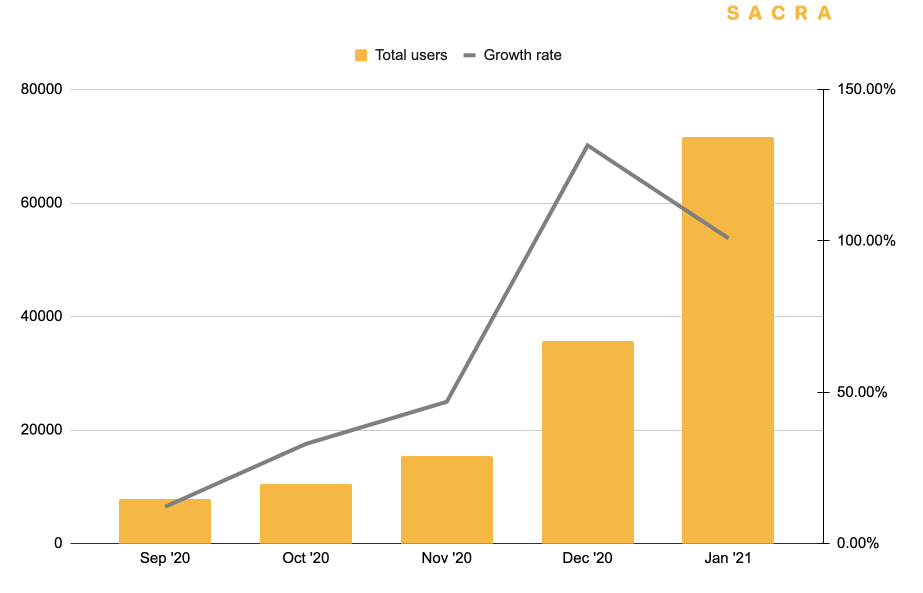

- Beacons’ growth is powered by a viral growth loop that’s resulted in 90% month-over-month user growth in the last 3 months where users who see a Beacons link then click through to create their own website and then add that link to their link in bio. Currently, it has 70,000+ users who have created a Beacons page, generating 5,000,000 page views per week—more than Glossier, Casper, and Warby Parker combined.

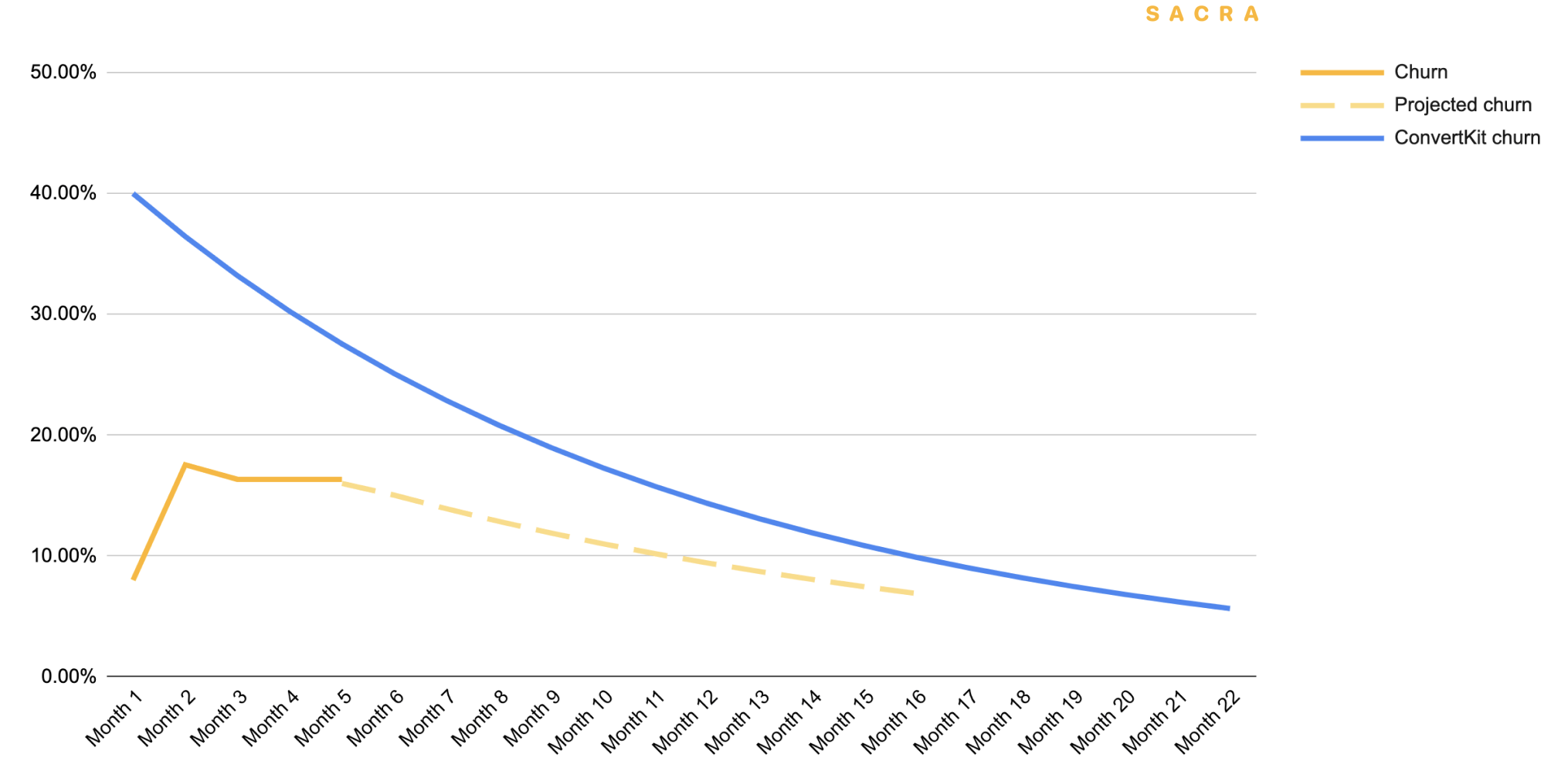

- Beacons has high gross revenue churn at 16-18% monthly, over 3x higher than creator email product ConvertKit, which churns 5% of revenue monthly. However, investors passed on companies like Shopify for their initial high churn and ConvertKit has been able to bring its churn to 5% from 20%+ monthly.

- In our base case, Beacons hits 1M users and $2M in annually recurring revenue by the end of 2021. In our bear case, platforms either remove the single link in bio which cuts Beacons off at the knees, or Beacons does not solve its churn problem and then growth plateaus before declining.

- In the bull case, Beacons expands on its mobile website builder experience to build a competitor to Squarespace ($1.7B), Webflow ($2.1B), and Wix ($15B+) with a chance to go after Shopify ($163B) as the mobile storefront for the multi-SKU creator.

Beacons Valuation, Revenue, and Comps

Members

Unlock NowUnlock this report and others for just $50/month

Beacons Valuation, Revenue, and Comps

Members

Unlock NowUnlock this report and others for just $50/month

Product: A block-based link-in-bio website generator for creators

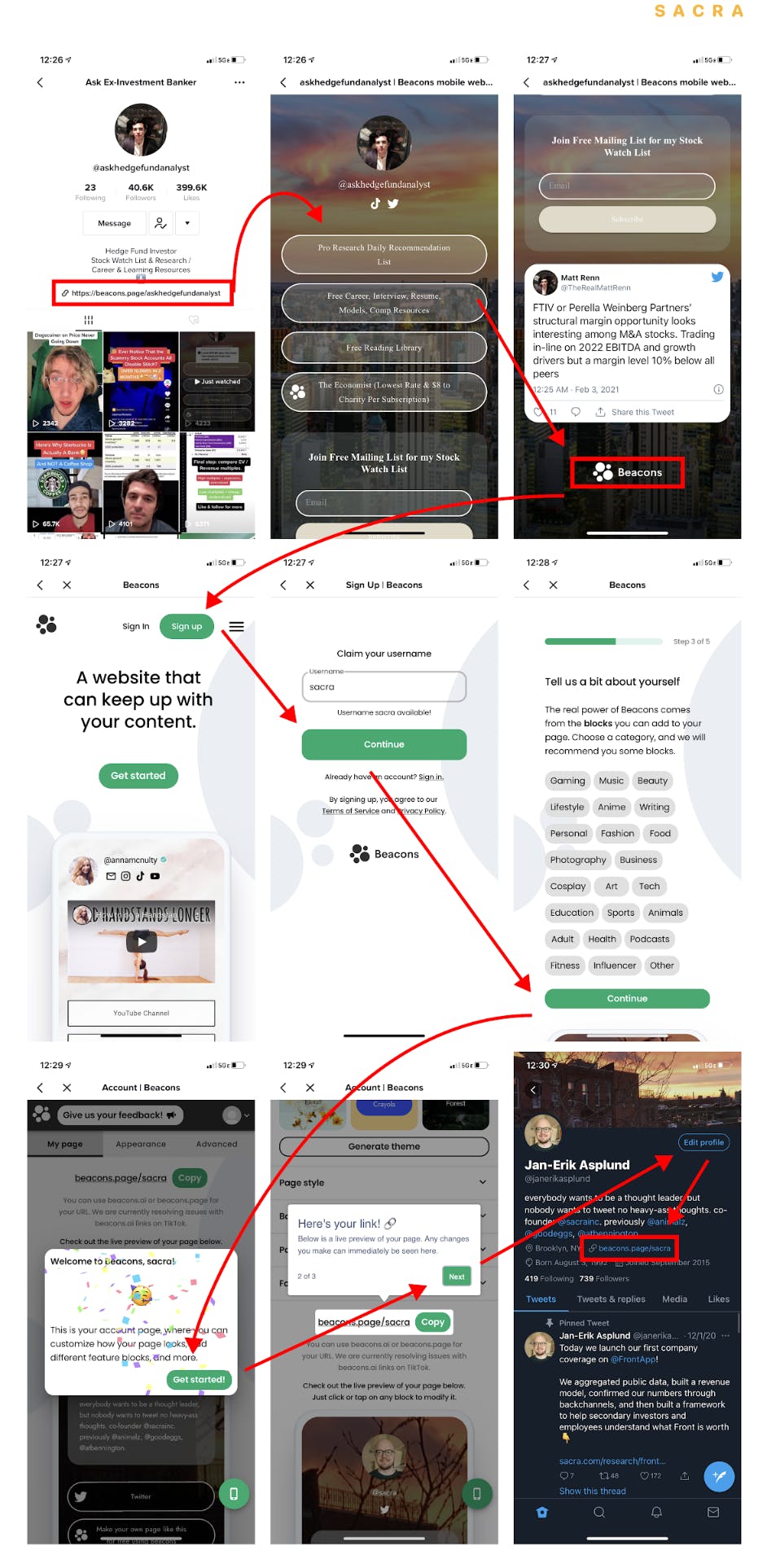

Beacons.ai allows creators to easily put a single link in their social media bio and use that link to bring fans to a simple personal website.

TikTok, Instagram and Twitter all permit users to add a single link into their bio.

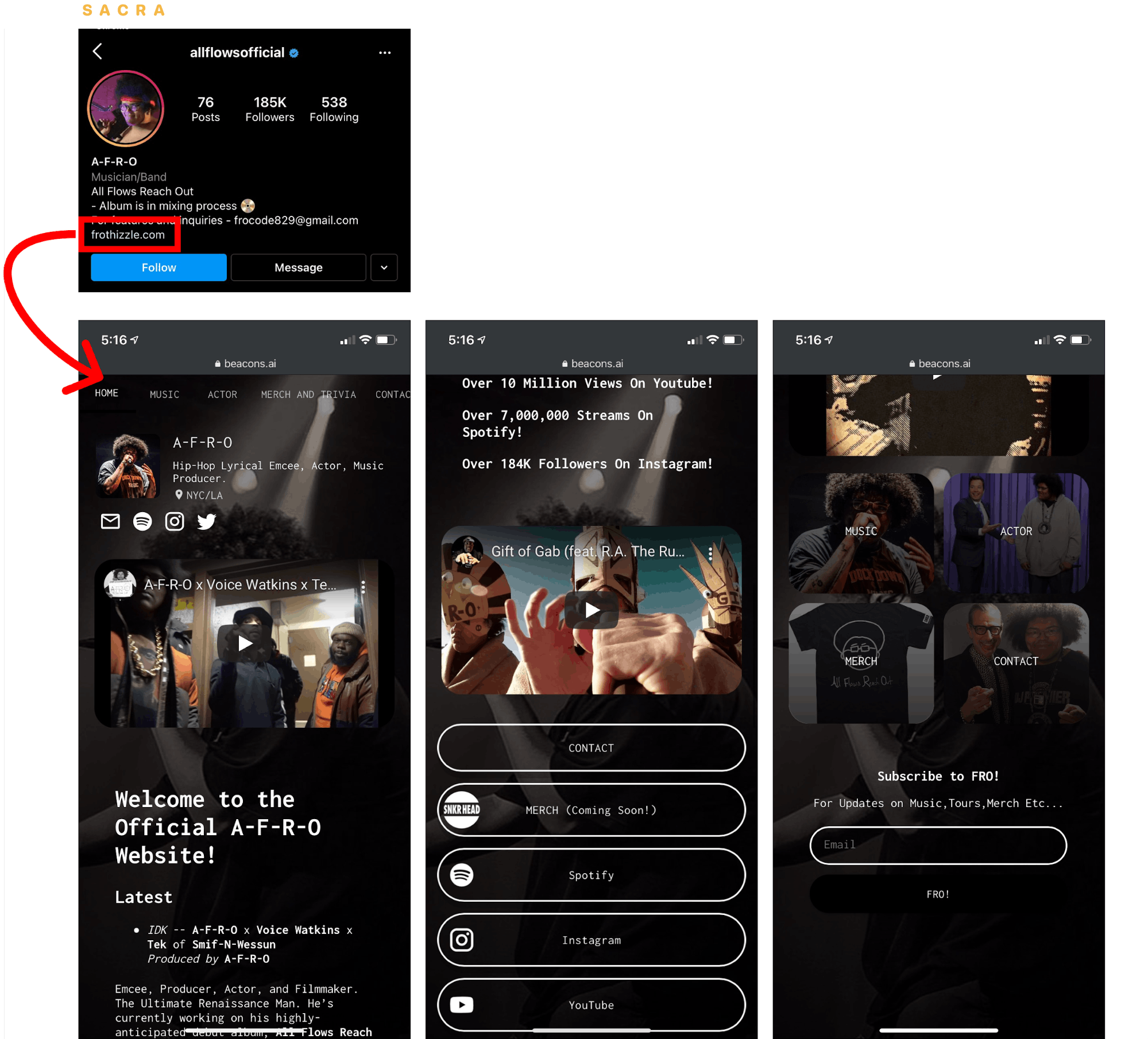

On their personal Beacons landing page, creators can insert links to their profiles on other platforms, sell digital goods via a Stripe integration, capture emails or SMS, and embed videos or audio.

Beacons links can be modified to have custom domains branded to a creator’s name or business.

Every Beacons site is a simple, single-column page optimized for mobile, which creates continuity for users from the mobile apps where they’re most likely to come across a Beacons link—TikTok, Instagram, and Twitter.

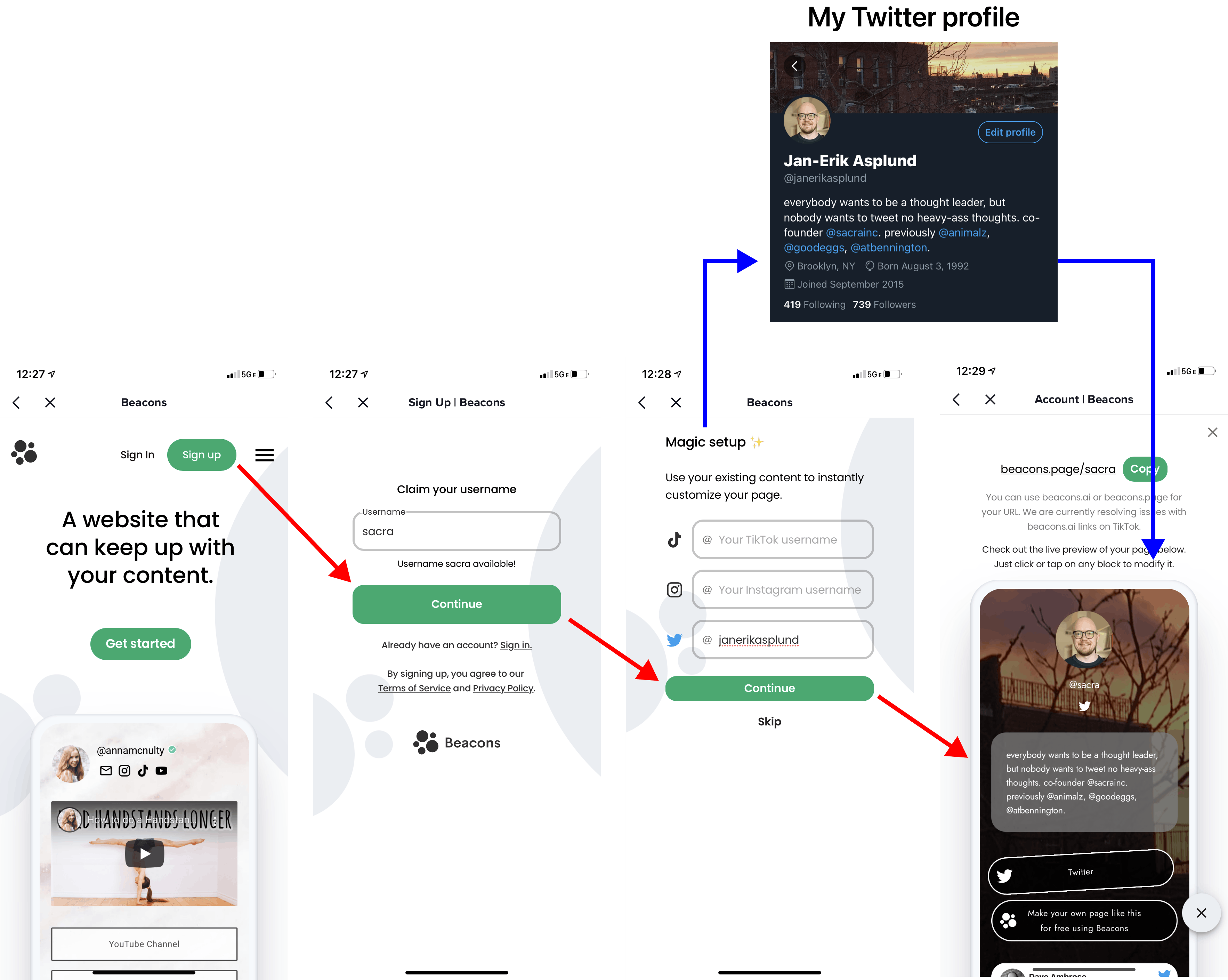

The Beacons onboarding process starts by asking you to pick your handle, which will become your Beacons URL, as well as prompting you for your TikTok, Instagram, and Twitter profiles. Beacons then auto-generates you a page. It chooses the background from among your most highly engaged pictures on Instagram. It pre-populates your page with links based on what you're already linking to on your social profiles. And within 5 taps, you have a site that's customized to you—with a background that you like and all the links to your other profiles that you would be putting in anyway.

When you start your Beacons page with a link to your Twitter, Beacons will automatically pull and embed your Twitter profile picture, cover photo, and your last tweet (in block form).

Beacons will also pre-populate your page with a few blocks. For example, if you link your Twitter feed, Beacons will automatically embed a block showing your last tweet and linking to your Twitter account. The purpose of this is twofold: 1) it gives you a quick, hands-on introduction to the different types of blocks on the platform, and 2) even if it's not perfect, the fact that the blocks are on your page means you can tweak them to your liking rather than starting off from scratch as you would on Linktree.

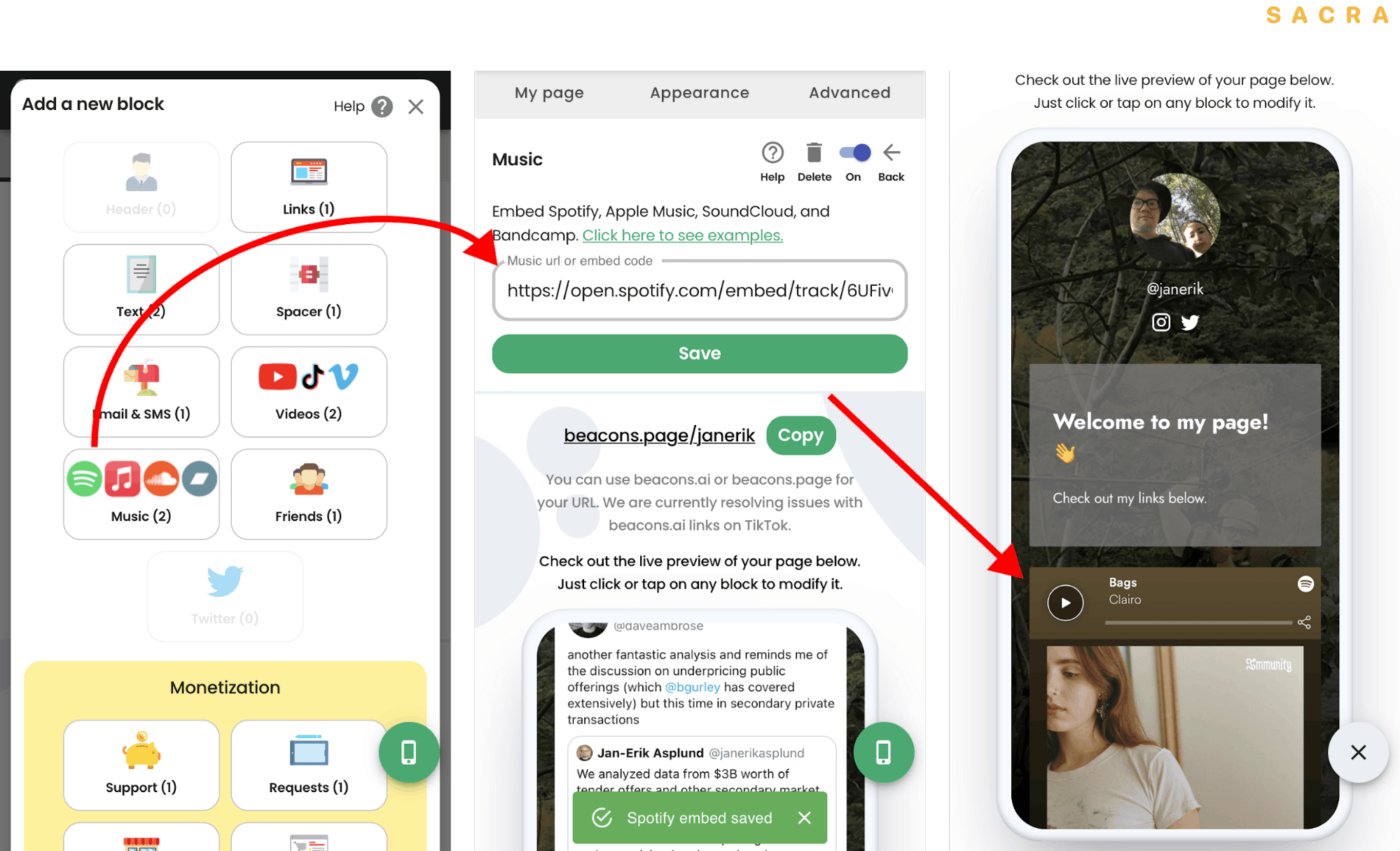

Some blocks act as links out to other platforms, while others add tipping or content directly to a Beacons page.

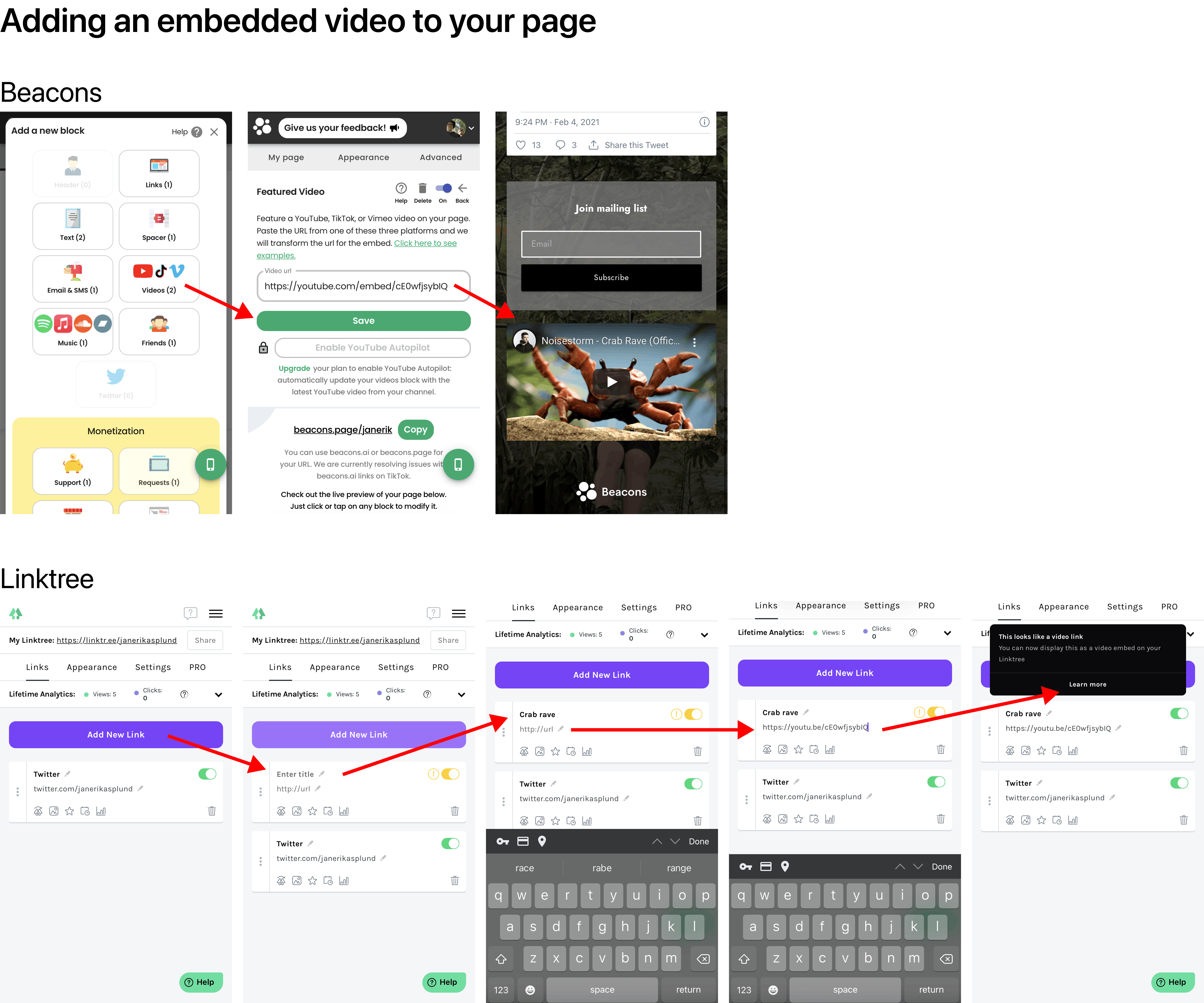

One of the big differences between Beacons and a page generator like Linktree is the fact that the core abstraction of the product is the "block", not the "link". A link is a piece of text you click to get somewhere else; a block is embedded in the page, and as such can have additional functionality beyond acting as a redirect. Blocks can play music, trigger videos, and display photos, but they can also perform more complex tasks like integrating with external services like Stripe to allow for donations or purchases or opening up a message channel between creator and fan. Blocks are how websites are built on sites like Wix or Squarespace—links are 1-dimensional and can only be used to route people from one destination to another.

Adding an embedded video to your Beacons page is possible in three taps.

Using the core abstraction of "blocks" vs. "links", Beacons makes it both faster for users to get up and running (compared to a link-driven product like Linktree) and allows for more customization and more types of content.

Business: A B2C SaaS product with an efficient growth loop

Beacons is still early, but it’s already eating into Linktree’s market share in the “link in bio” space.

The core growth loop, facilitated by their fast onboarding process with its quick time-to-value, has allowed them to triple their revenues each of the last three months.

Free-to-paid conversion is still low, and churn is high, though for tools selling to individuals in the creator space, these are not unusual problems.

Where Beacons goes from here will depend on whether they can continue to eat into the market share of Linktree and other competitors, whether they can bring down their churn over time, and whether they can improve their freemium conversion funnel and more reliably convert their users to paid.

1. Revenue model: The dynamics behind 3X monthly revenue growth and 16-18% churn

Beacons is a subscription SaaS business with a freemium customer acquisition model. Its basic product is free, and its “Entrepreneur plan”, which includes extra creator tools and analytics, costs $10/month.

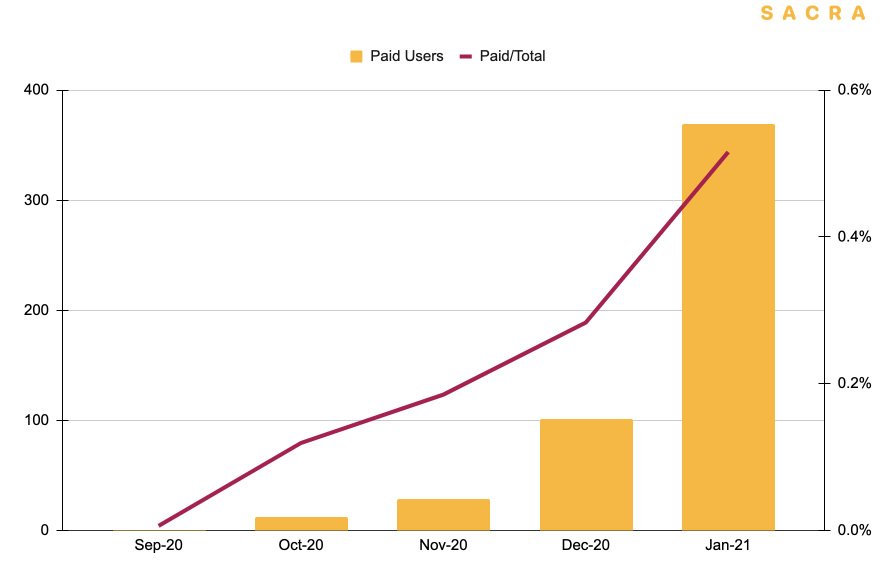

Beacons is currently on average tripling its paid user base every month.

Beacon signed its first paying customers in September 2020, and as of January 2021, it has $3,700 MRR with 369 paying customers. Its revenue compound monthly growth rate (CMGR) as measured over the last 3 months is extremely high at 210%.

Even presuming their growth slows down, Beacons could end 2021 with about $2M in ARR.

Measuring Beacons’s growth compounded over the last three months actually obscures the fact that growth has accelerated through December and January. At the exponential rate Beacons is growing, a 90% CMGR6 by June along with a 0.5% conversion rate improvement would put Beacons at $46K MRR.

Beacons currently has a high churn rate at around 16-18% churn monthly. However, high churn is not unusual for creator products selling to individuals or even SMBs.

Shopify churned through 5.5% of its businesses every month early on, but it made up for it by being able to acquire new ones extremely cheaply—a trait that Beacons shares.

ConvertKit, an email tool for creators, was churning 40% of its revenue every month in November 2014. But over time, churn flattened out and became asymptotic. Today, they churn less than 5% of their revenue every month.

ConvertKit started with monthly churn around 40% but managed to decrease it over time to 10%.

Time can be the SaaS company's friend here. As cohorts of users in a product age, they tend to become less likely to leave. They've already integrated all of their other tools with your product, they may have registered an email address or domain name they're using with you, they may have thousands of customer conversations saved on your platform—they're highly unlikely to switch away unless they have a substantial reason to leave. As those locked-in cohorts age and add up, your churn rate will naturally decrease: as long as you're able to ensure that your customers actually do tend to stay locked-in over time and you get the graph of your churn to go asymptotic.

To ensure that their churn graph would go asymptotic, ConvertKit made various important improvements to their product that are exactly the kind of tactics that the Beacons team might take in the future to reduce their own churn: they made improvements to app stability, improved their support response times, made personalized onboarding welcome videos, and created more targeted content to help their customers better use their product.

2. Growth: How Beacons keeps LTV:CAC high even given their high churn

The core Beacons growth loop relies on social proof and an onboarding process that makes it extremely fast to set up your own site:

- A user clicks on a Beacons link in a creator’s bio while browsing TikTok, Instagram or Twitter

- On the creator’s page, they find a link that takes them to Beacons and prompts them to sign up and create their own page

- After claiming their username and entering a few key pieces of information like links to their socials, Beacons generates a site and gives them a link to copy into their clipboard and add to their own bio

The Beacons onboarding process is designed for distribution in two ways: it gets you your own website as quickly as possible, and then it gives you the link so you can insert it in your own bio and drive even more traffic to the site.

With a website builder like Webflow, it can be days or weeks before you have a site you can share. With Linktree, the site auto-generated during onboarding is empty, and users must manually fill it out with links before it can be useful. Beacons’ onboarding, on the other hand, emphasizes speed, giving users a share-ready link within minutes.

Thanks to the nature of Beacons’s simple growth loop, more visits to Beacons sites generates more new user accounts, which in turn generates more views (and more revenue).

Over the last quarter, Beacons page views more than tripled with a CMGR3 of 120%. This is powerful for two reasons:

Fast growth in page views means the growth loop is accelerating, because more people are clicking on Beacons links and getting exposed to the page creation process themselves—page view growth begets page view growth, and user growth begets user growth.

In addition, the faster the growth loop runs, the more efficient Beacons’ growth can be because it reduces the need to spend money on customer acquisition.

As of January 2021, Beacons has 70K+ registered creators.

User growth has accelerated steadily over the last 6 months, hitting 100%+ month-over-month in December.

The company has strong momentum in customer growth. Total creators signed up on Beacons roughly doubled every month between November 2020 and January 2021.

Beacons’s freemium conversion rate of 0.5% is low compared to Dropbox or Evernote, both of which convert to paid at around 4%, but about the same as Google Drive.

Paid users currently only account for 0.5% of total users. This has been growing about 0.1% per month, but is still substantially lower than the 2-4% average freemium conversion rate.

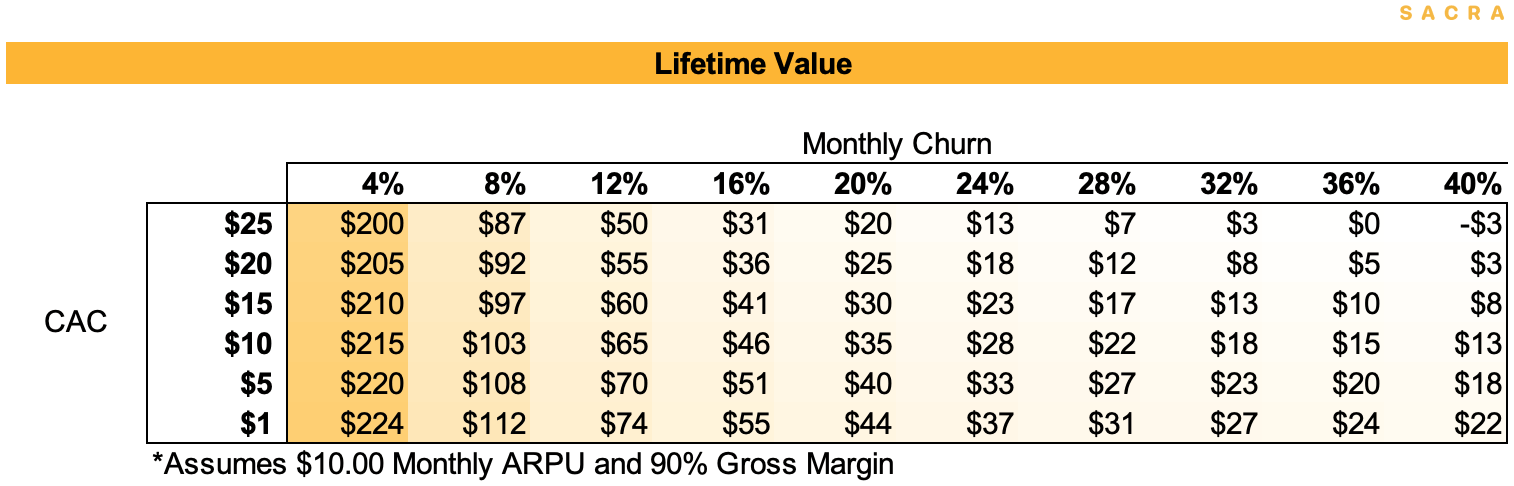

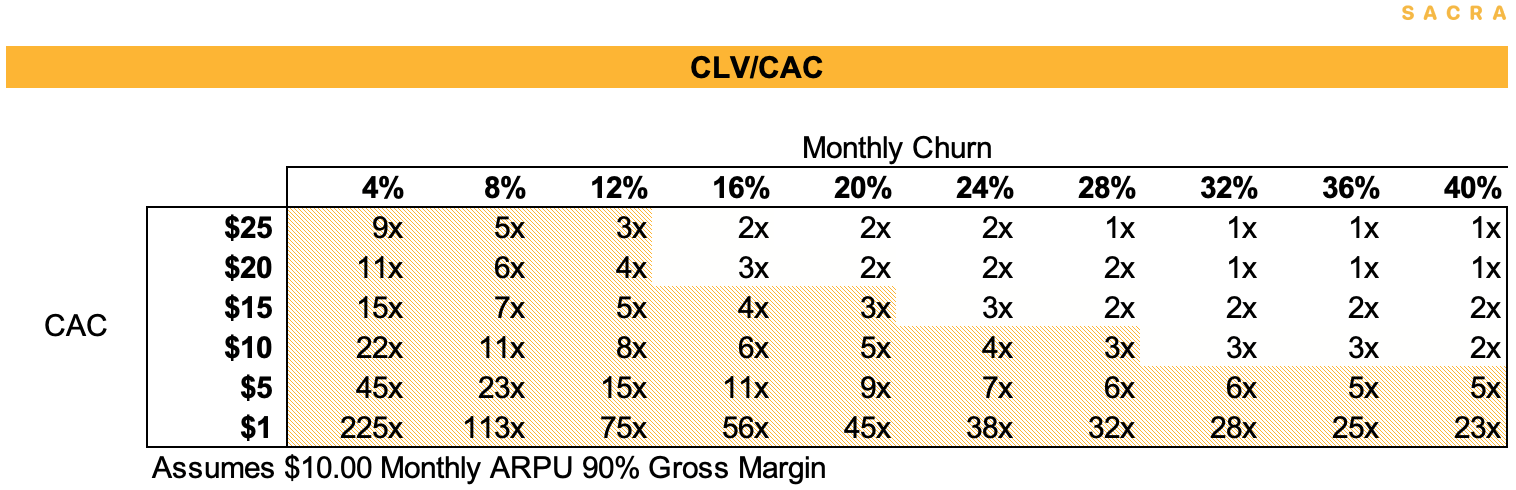

Beacons’s ability to maintain a low CAC means that even relatively high churn can produce highly favorable CLV/CAC ratios.

However, Beacons’s low cost of customer acquisition and high growth make both this conversion rate and their relatively high churn tolerable.

If we assume $10 MRR per customer at 90% gross margin and 16% monthly churn, the lifetime value of a customer is at least between $30-55. Despite a high churn, for $5 - 15 CAC per user, the lifetime value to CAC ratio is between 4-11x.

This is with Beacons only monetizing about 0.5% of its users. If Beacons increases that by 5x or 10x over the next year, their conversion rate from freemium will be able to drive significant MRR into the future.

3. Scenario analysis: How Beacons could go to zero and how they could become the next Shopify

When you invest with a Republic SAFE, you’re signing a contract with the fundraising company that entitles you to equity—an ownership stake in the company—upon the completion of either an IPO/sale or their next round of equity fundraising. The two main terms to be aware of are the valuation cap and discount:

- Beacons’s SAFE has a $20M valuation cap, which represents the maximum price you’ll pay for your investment. If Beacons later raises money or sells at a higher valuation, you’ll receive the same number of shares that you paid for at the $20M price—and the rest will be your upside.

- Beacons’s SAFE also has a 20% discount. This means that when they raise their next round or there's another 'trigger event' (IPO/sale), you get shares at a 20% discount to what the new investors or buyers are going to be paying.

With Beacons's $20M valuation on $48K in annually recurring revenue, you're paying about 400x on ARR. That's high, but you should keep in mind that investors in public and private equities are always paying forward a bit for growth. With Beacons's rate of growth now, our base case predicts Beacons will be at $2M ARR growing 16% month-over-month by the end of the year. At that point, that $20M valuation (a 10x ARR multiple) will be low relative to other private companies in the creator ecosystem that are raising money.

🐻 Bear case: Growth plateaus and declines due to churn or platform changes

Beacons has been built on the back of TikTok which has allowed it to grow quickly, but also presents significant platform risk.

- Beacons is premised on the idea of 1 single link in bio, no more and no fewer. If platforms stop letting creators put links in their bio, that would adversely affect creators’ ability to drive traffic to their Beacons pages.

- Link-in-bio tools have also been accidentally affected by platform changes before, when in January 2020, TikTok mistakenly began flagging both Linktree and Beacons links-in-bios as dangerous.

The rapid growth itself comes with risk if Beacons does not bring down its churn rate. Currently, its churn is being masked by its rapid new user acquisition based on TikTok’s overall platform growth.

However, the rate of new user acquisition will decline over time and if churn has not been lowered, Beacons will begin to plateau and then start shedding customers.

In both bear cases above, Beacons will either run out of money and shut down or run out of money and get acquired for less than the capital invested into the company. That means investors will receive a fraction of their investment or nothing.

📈 Base case: Beacons builds a better Linktree and grows to $2M in ARR by the end of 2021

In our base case, Beacons continues to grow quickly and cut into Linktree’s market share in the link-in-bio space.

Linktree, which had 2.8 million users and $3M in ARR in August of 2019, had 9 million users as of last month. Assuming they've been able to grow their ARR proportionately, we can estimate that they're at or near $10M in ARR today.

However, Beacons has been tripling its revenues every month over the last 3 months, in large part thanks to their viral growth loop that brings in new users with little investment needed in customer acquisition.

Our base case also assumes that Beacons will continue to grow revenue at a rate of 30% CMGR on its way to hitting 1M total customers by the end of 2021 with a paid conversion rate of 1.6%. By the end of the year, that gets Beacons to $2M in annually recurring revenue.

🚀 Bull case: Beacons becomes the default storefront for the multi-SKU creator

Beacons could be building the mobile website creator of the future.

Squarespace, Wix and now Webflow have all built billion-dollar businesses helping businesses and individuals more easily build websites to promote their companies and themselves. What none of them have is a truly mobile-first builder experience.

A decade ago, when the average American spent about 6x as much daily time on a desktop or laptop as they did on their smartphone, it made sense to build a desktop-first website builder. Today, though, the average American spends more of their device time on their smartphone by about 2x.

Beacons has built a mobile-first website builder that is easy and intuitive to use, and while it’s relatively light on features today, they have line of sight towards an opportunity that mobile trends show could be just as big as any of the other website builders:

- Squarespace ($1.7B)

- Webflow ($2.1B)

- Wix ($15.7B)

Long-term, with Beacons’s degree of integration into payments and multi-SKU creators, they could be onto something even bigger—the mobile Shopify ($163B).

Analysis: A storefront for the multi-SKU generation

Over the last decade, the creator economy has gone from a few giant platforms—Facebook, YouTube, Instagram, Twitch, Spotify—to hundreds of different tools for every aspect of a creator’s work, from making content to marketing it to distributing it.

Part of what's driving this fragmentation is that creators have discovered that going independent with just one "product" often isn't enough to generate a real income—hence what Hunter Walk coined the "multi-SKU creator".

The multi-SKU creator isn't all-in on just one product, though one product may wind up being the most lucrative for them. Instead, they apply their skills across various domains and use the various platforms and tools in the creator economy to put together multiple different product or service offerings.

But while this unbundling of the value chain around creation and distribution has opened up a lot of opportunities for creators, it's also complicated the process of actually getting started and running your business as a creator. And whenever an industry becomes burdened with complexity, systems that were unbundled begin to be rebundled.

We're just now beginning to see this reaggregation picking up in the creator economy, raising one big question: when the fragmented product landscape of the creator economy comes back together, what will it look like?

1. How YouTube and Instagram built a creator economy for the 1%

Platforms like YouTube and Instagram flipped the dynamic between creator and consumer that had defined the media and publishing industry for over a century.

Instead of distribution—printing the newspaper, broadcasting the show, putting out the magazine—being the expensive part of the process, suddenly, distribution was free.

Instead of a cable network looking for the right star to put on their primetime television show, suddenly there was talent everywhere—so much talent that the problem was not figuring out how to deliver it to viewers but how to sustain an audience’s attention amidst all the noise.

YouTube was the first platform to understand how to win in a world where distribution was free and talent was everywhere: by focusing on creating the best possible experience for consumers.

The early platforms won because they aggregated demand—the consumers of content—and made it possible for creators to have an audience.

By building the best, fastest viewing and uploading experience on the internet, YouTube attracted a critical mass of users.

That critical mass of users attracted content creators, who wanted their content to be seen by the most possible people.

As YouTube attracted creators, it attracted more fans, creating a self-reinforcing loop that helped it become the dominant video platform on the internet.

This same cycle played out with Facebook, Instagram and Twitch: they started by building a superior user experience, and leveraged that to become the dominant content aggregator in their space.

But while these platforms have given opportunities to millions of creators, their main priority and focus has always been the consumer—and that’s led to friction between the platforms and their creators.

YouTube’s dominance, for example, allowed them to open up monetization for creators, giving the people uploading video to YouTube the opportunity to get a share of their ad revenues. But when you allow ads to run during your YouTube videos, you don’t negotiate your own rates or choose what kinds of ads will play—you accept whatever YouTube unilaterally decides. YouTube can decide to cut your rate, or they can decide to demonetize your videos entirely.

The relationship between the platforms and their creators is less like a partnership and more like a landlord and their tenants. And most of the tenants are not making a substantial amount of money:

- 98.6% of artists on Spotify make about $400 a year on average, while the other 1.4% make $90,000.

- On TikTok, some creators getting hundreds of thousands of views earn just a few dollars a day, while top accounts earn $100,000-$200,000 a year

- 97% of YouTube creators make less than $17,000 per year in advertising revenue, while a small handful make more than $10M a year

By focusing relentlessly on the consumers of content, platforms like YouTube were able to build huge user bases and eventually, huge profit-making advertising machines.

But what has emerged from this strategy is a highly skewed distribution of income where a few creators make millions and most of them make barely anything at all. A good deal for platforms and a handful of creators; a bad deal for everyone else.

2. Arming the rebels: how creators are taking back control

Despite the problem of the absent middle class in the platform-based creator economy, the biggest backlash against the platforms came from the biggest, most popular creators. From big publishers on Facebook to popular vloggers on YouTube, creators began to realize that they were creating more value for their platforms than they were being compensated for.

In 2014, Taylor Swift removed her entire back catalog of songs from Spotify, including her latest album, 1989, because she felt the service inadequately valued her music. In the same year, cellist Zoe Keating revealed revenue figures that showed her making $60,000+ from sales of her music on Bandcamp and the iTunes Store and just $1,700 from more than 400,000 Spotify streams (plus $1,000 from 1.9 million views of her videos on YouTube).

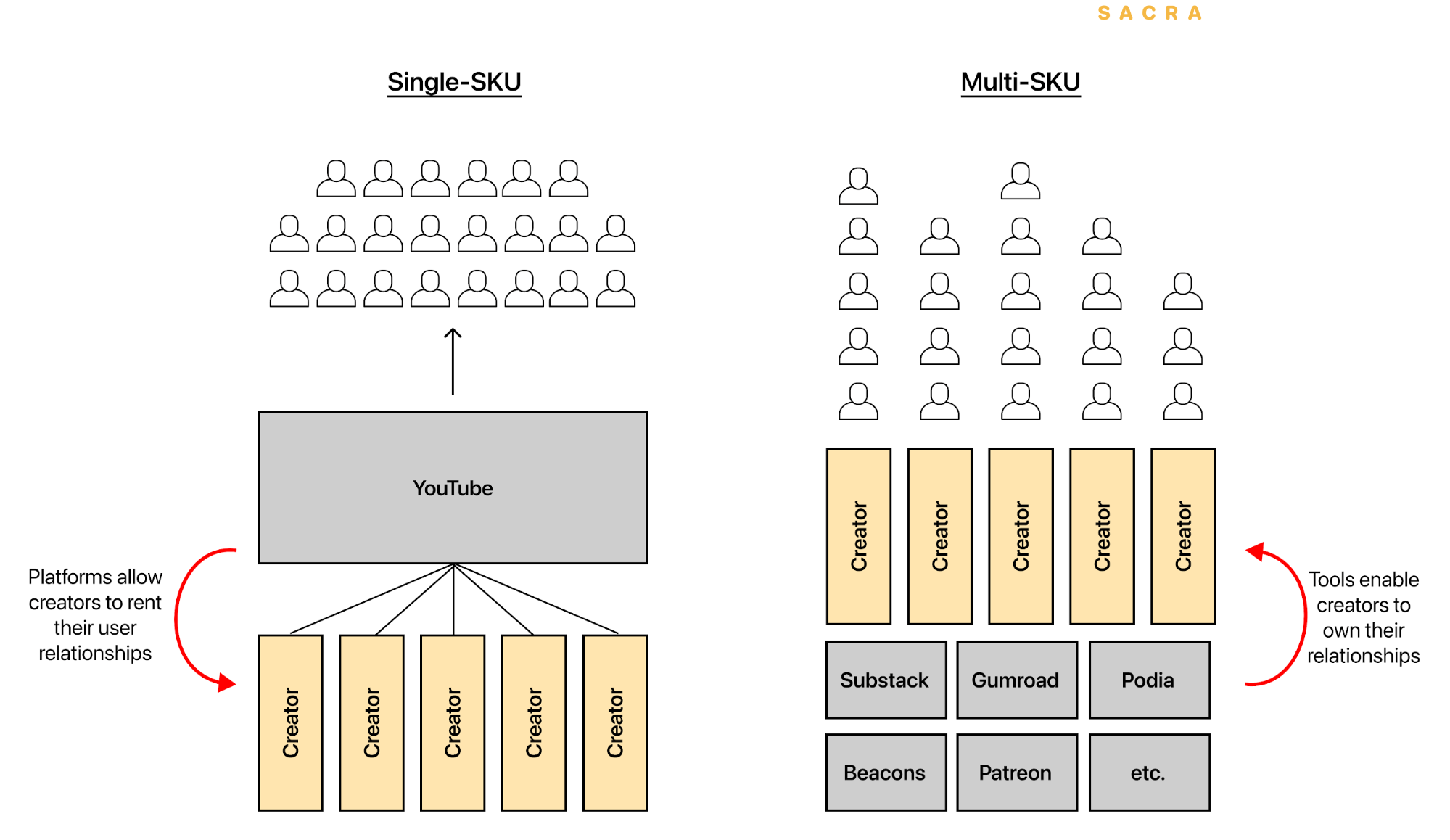

Out of these early conflicts between the platforms and their creators came a drive towards greater control. Similar to how Shopify helped independent businesses take on Amazon by giving them access to the same kind of logistics and e-commerce tech, a new creator movement, symbolized by companies like Gumroad, Substack, and Patreon, emerged to give creators the tools they need to build better businesses less dependent on YouTube and Instagram.

Instead of mediating between creators and their audiences, the new wave of creator tools support creators in their goal of forming close relationships and engaging with their fans.

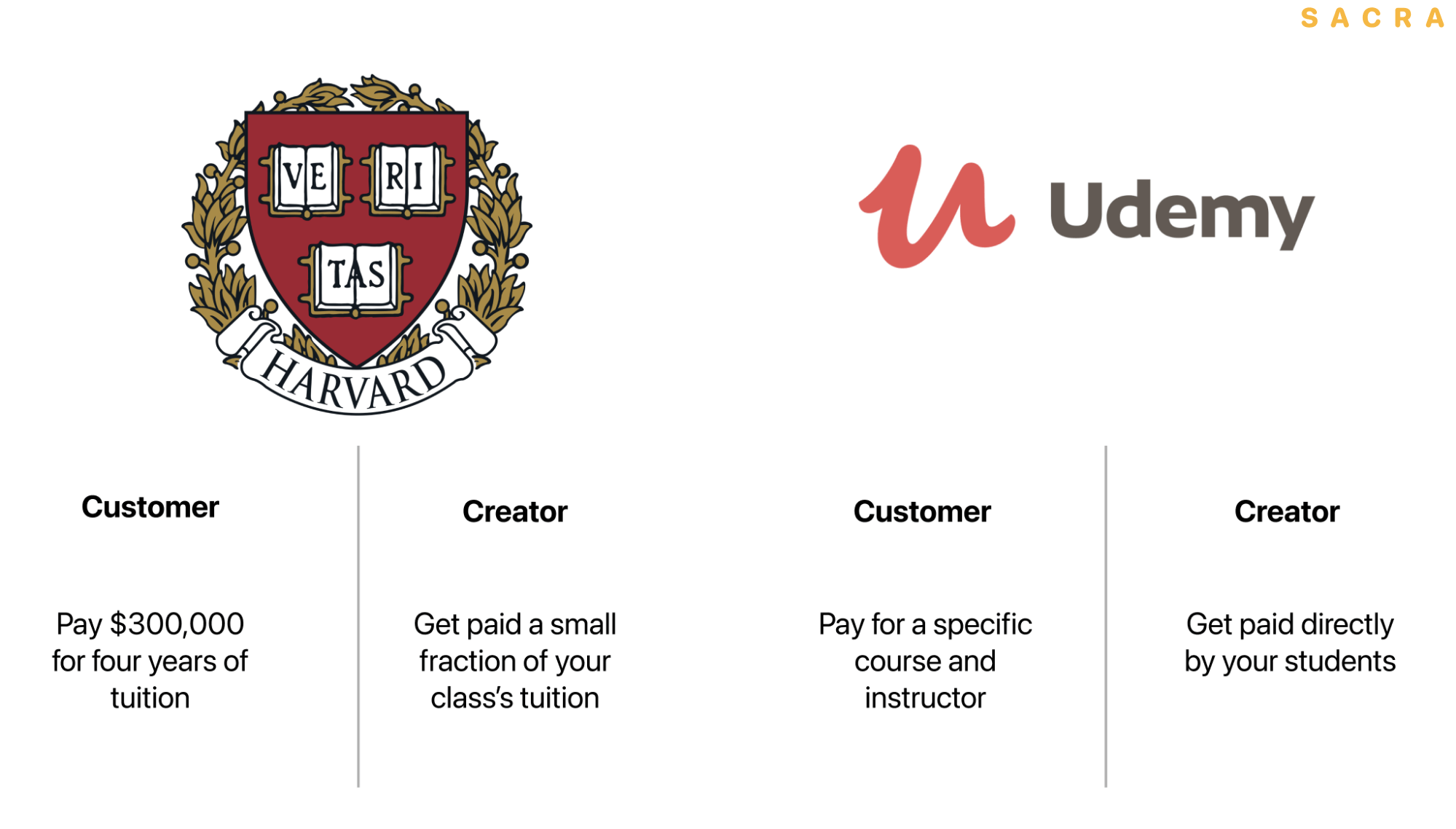

Just as technology made it possible for YouTube to distribute video content at virtually zero cost all around the world, disrupting traditional media companies, tools like Udemy have made it possible for amateur educators to distribute video course content all around the world, disrupting traditional educational providers.

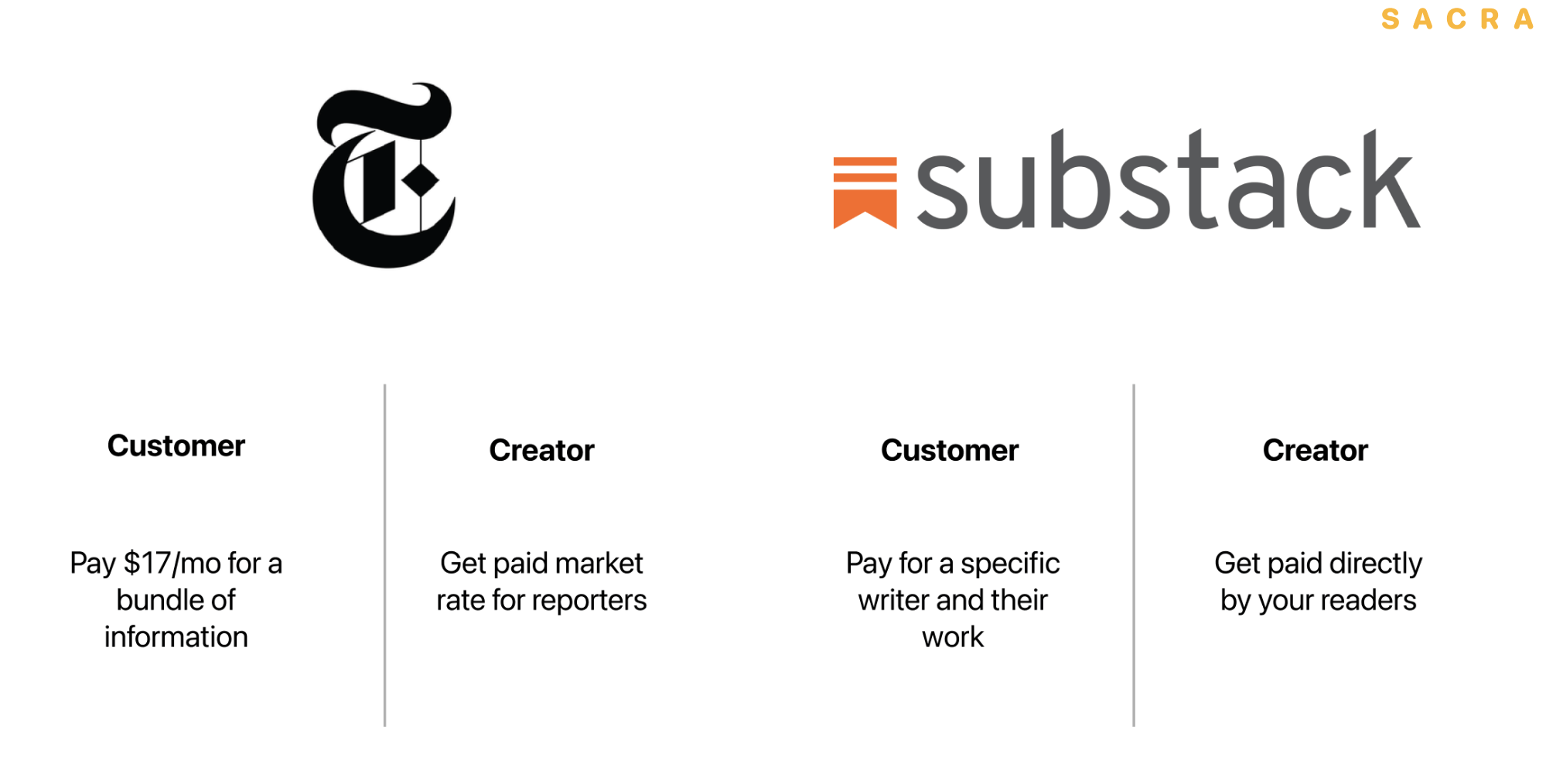

Meanwhile, tools like Substack have made it possible for a writer with expertise in a particular space to escape the publishing world and connect directly with their audience.

Creators still use the big platforms for discovery because they offer the best opportunity to get in front of people and find new potential fans. The difference is that they’re no longer reliant on the platforms for monetization, which ultimately puts them in better alignment. By decoupling the content they make in order to get top of funnel traffic from the content they sell, they can focus on distributing the former through the big platforms and distributing the latter through their own channels.

There are two primary benefits to expanding the range of products that you offer as a creator:

- Better diversification: You spread your income over a greater variety of sources, which protects you in the event that a platform or market change affects any one revenue stream

- Higher ARPU (average revenue per user): You increase conversion rates across the long tail of your fanbase by selling products at different price points for different customer types while also driving up the total amount spent by your superfans

Today, a top writer who decides to start a Substack can make a far better salary sending their content directly to their readers than they would working for a large publication, but they can make even more if they combine it with expert consulting, speaking engagements, and creating online courses.

Prominent writers, livestreamers and YouTube creators have led the way on the “multi-SKU” approach, but a whole ecosystem of tools for multi-SKU creators has emerged in their wake—and their “business of 1” approach is beginning to trickle down to the broader mass of creators.

3. Solving for multi-SKU creators: bridging discovery and content creation with a new storefront

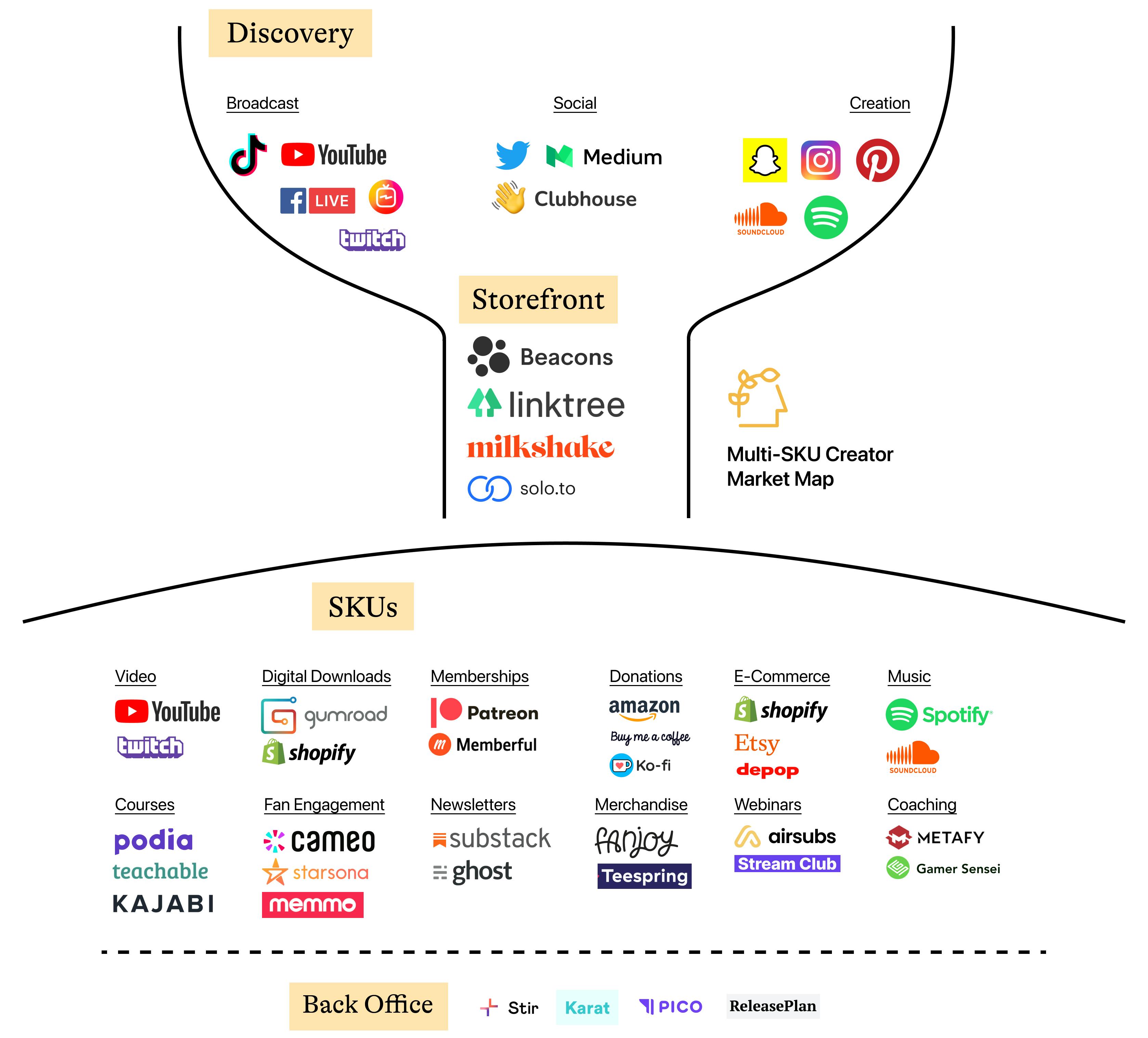

There is a deep market of tools for multi-SKU creators today. These tools help multi-SKU creators repackage their content into different forms and distribute it, market and promote it, and keep up with all the back-office needs of being an independent entrepreneur.

The result of this vast market of tools has been a large-scale unbundling of what was once a platform-centric creator economy.

Five years ago, a YouTuber ago might have run their entire ‘business of 1’ through YouTube. Today, that same creator might chop up clips of their content for TikTok, redirect traffic to their personal site through Beacons, sell their own branded merchandise via Shopify, and offer fan interactions via Cameo.

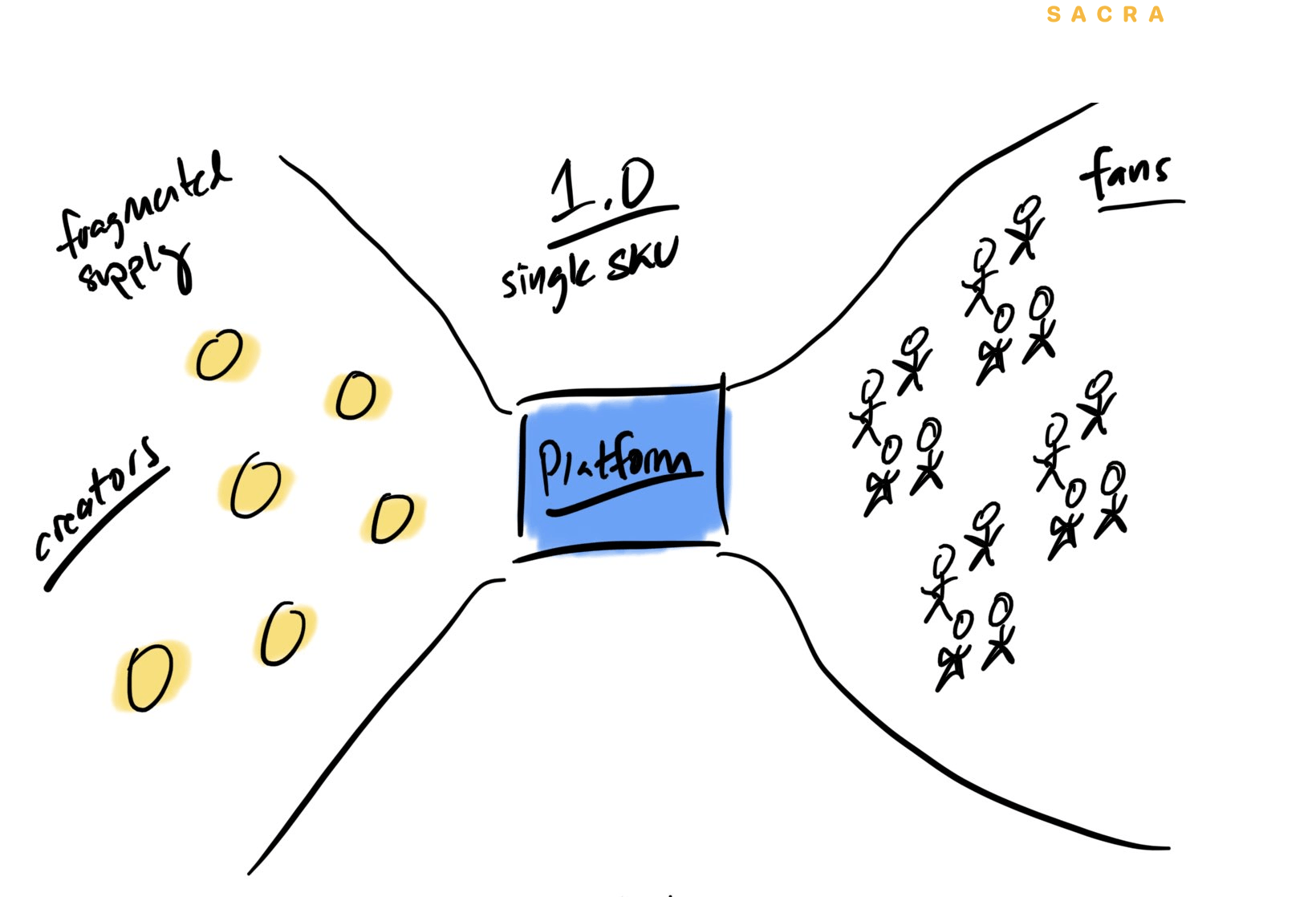

Discovery of new creators happens mostly on social media platforms upstream, while monetization happens in the SKUs downstream; Beacons and similar tools act as the storefront at the center

Social media platforms are still important for discovery in this world, but tools like Beacons and Linktree operate as the storefront that bridges the discovery function and a creator’s various SKU by leveraging the one link allowed in an Instagram/TikTok/Twitter user’s bio.

When a user taps on that link, they get access to all of a creator’s other content within a small, mobile-friendly website, allowing the creator to use social media to gain exposure while at the same time grow their personal off-platform audience.

Today, we’re seeing a re-bundling across the creator ecosystem as Beacons and other storefront tools implement features of SKU products, such as letting creators get paid for personalized content and helping them sell digital products or build a shoppable TikTok feed.

There are a few reasons this “re-bundling” makes sense in the context of a multi-SKU creator ecosystem:

- Simplicity: Running your online business and brand on various different tools can be difficult to manage—and launching a new platform can be like starting a new business altogether

- Single source of truth: A single platform allows creators to analyze their customer acquisition, engagement and retention in one place rather than having that information dispersed across different tools with varying access to data

As more and more creators move from a single-SKU to multi-SKU approach, the appeal of a single hub from which to manage every aspect of your online brand and business will increase. Storefronts, as the bridge between social-driven fan acquisition and content delivery, will be well-positioned to capture this opportunity.

The future of Beacons

The creator of the future looks much more like a small business than a freelancer—a fact which brings economic advantages and challenges.

Multi-SKU creators don’t rent out the big platforms and sell their time. They turn their time and energy into different products for different customers, generating multiple revenue streams.

At the same time, loosening their dependence on the platforms and striking out on their own means that they need to manage how they allocate capital, figure out how to keep their fans engaged and coming back, and build and refine their acquisition machine.

Tools like Beacons serve the challenges of these multi-SKU creators, helping them start, grow, and sustain their businesses. And as more and more creators strike out on their own and start their own businesses of 1, the opportunity set in front of companies like Beacons will only get bigger and bigger.

Appendix

Disclaimers

- Sacra has not received compensation from the company that is the subject of the research report.

- Sacra relies in part on the willingness of the companies that are the subject of the research reports to discuss information relevant to the reports with Sacra. This may give Sacra an incentive to write favorable research reports, because companies may be less likely to discuss such information with Sacra if it publishes unfavorable research reports. Sacra may, when preparing a research report, rely to a large extent on information provided by the company that is the subject of that research report, and on publicly available information about that company.

- Sacra generally does not take steps to independently verify the accuracy or completeness of this information, other than by speaking with representatives of the company when possible.

- This report contains forward-looking statements regarding the companies reviewed as part of this report that are based on beliefs and assumptions and on information currently available to us during the preparation of this report. In some cases, you can identify forward-looking statements by the following words: “will,” “expect,” “would,” “intend,” “believe,” or other comparable terminology. Forward-looking statements in this document include, but are not limited to, statements about future financial performance, business plans, market opportunities and beliefs and company objectives for future operations. These statements involve risks, uncertainties, assumptions and other factors that may cause actual results or performance to be materially different. We cannot assure you that any forward-looking statements contained in this report will prove to be accurate. These forward-looking statements speak only as of the date hereof. We disclaim any obligation to update these forward-looking statements.

- This report contains revenue and valuation models regarding the companies reviewed as part of this report that are based on beliefs and assumptions on information currently available to us during the preparation of this report. These models may take into account a number of factors including, but not limited to, any one or more of the following: (i) general interest rate and market conditions; (ii) macroeconomic and/or deal-specific credit fundamentals; (iii) valuations of other financial instruments which may be comparable in terms of rating, structure, maturity and/or covenant protection; (iv) investor opinions about the respective deal parties; (v) size of the transaction; (vi) cash flow projections, which in turn are based on assumptions about certain parameters that include, but are not limited to, default, recovery, prepayment and reinvestment rates; (vii) administrator reports, asset manager estimates, broker quotations and/or trustee reports, and (viii) comparable trades, where observable. Sacra’s view of these factors and assumptions may differ from other parties, and part of the valuation process may include the use of proprietary models. To the extent permitted by law, Sacra expressly disclaims any responsibility for or liability (including, without limitation liability for any direct, punitive, incidental or consequential loss or damage, any act of negligence or breach of any warranty) relating to (i) the accuracy of any models, market data input into such models or estimates used in deriving the report, (ii) any errors or omissions in computing or disseminating the report, (iii) any changes in market factors or conditions or any circumstances beyond Sacra’s control and (iv) any uses to which the report is put.

- This research report is not investment advice, and is not a recommendation or suggestion that any person or entity should buy the securities of the company that is the subject of the research report. Sacra does not provide investment, legal, tax or accounting advice, Sacra is not acting as your investment adviser, and does not express any opinion or recommendation whatsoever as to whether you should buy the securities that are the subject of the report. This research report reflects the views of Sacra, and the report is not tailored to the investment situation or needs of any particular investor or group of investors. Each investor considering an investment in the company that is the subject of this research report must make its own investment decision. Sacra is not an investment adviser, and has no fiduciary or other duty to any recipient of the report. Sacra’s sole business is to prepare and sell its research reports.

- Sacra is not registered as an investment adviser, as a broker-dealer, or in any similar capacity with any federal or state regulator.

...