Business development executive at a BaaS platform on differentiation and competitive dynamics in BaaS

Nan Wang

Nan Wang

Questions

- Could you please speak about the banking-as-a-service value chain?

- What are the revenue / monetization models?

- Could you please talk about what are the pros and cons of different BaaS models below, from both the BaaS platforms’ perspective and their FinTech clients’ perspective?

- Please talk about the growth drivers for BaaS providers?

- It sounds like the FinTech players own the customer relationship so they can be more differentiated. But then if we go down to the infrastructure layer, how to think about the commoditization risk?

- In terms of switching costs, I've also heard consumer-facing FinTech players switching off from a developer API platform because they outgrow what the developer API can provide. Could you please speak about what you observe here?

- I think Ramp initially used a card processor called Lithic and then recently they switched to Stripe because of Stripe's investment in them. Do you think despite the switching costs, Ramp switched because of more synergy with Stripe in the future?

- What are the signals of high-quality businesses of developer API businesses?

- How do API providers think about scaling with their FinTech clients?

- Brex began as an issuer processor, and then gradually moved into software for small businesses with invoice reconciliation, back-office software, and Brex now monetizes through SaaS as well. Do you see this type of payment plus software as a big growth driver in the future?

- What do you think about the regulatory environment? And to what extent the developer API providers are less exposed to future changes in regulation?

- How do you see competition between the developer API providers evolve in the next two years?

- Are there any questions or areas you think are very important and we haven't talked about?

- If I can just recap, the key points in terms of future growth and how to think about profitability at maturity. So there's this verticalization. What I'm hearing from you in terms of building out the stack in the product offering to own more of the value chain. So the API provider doesn't pay to other third parties. Is that fair?

Interview

Could you please speak about the banking-as-a-service value chain?

The infrastructure model and business proposition of banking-as-a-service is that BaaS providers can offer services to small businesses, which include fairly well known neobank that provide services to small businesses in the States.

Let's just say a coffee shop, they want to have a small business bank account, but if they don't want it to get fleeced for $25 a month from Bank of America or someone, they will go to this particular neobank and open up a small business bank account, they'll go through a similar onboarding process: name, company name, company, EIN, and company address, director’s name as a more beautiful user experience.

BaaS platforms tell them what KYC information to capture. And then BaaS platforms provide that underlying banking platform for them to open up bank accounts. So at that point we will then help them issue a branded card, so the bit of plastic, or a virtual card that can be tokenized into Apple Pay or Google Pay, et cetera.

All these BaaS platforms, the likes of Unit, Synapse, Galileo, will then provide Fintechs the ability to extra out that branded Mercury. So Mercury, the small business neobanks want to receive a payment into their routing and account number, then that would be via a code number.

If that small business user was using an online website and was working with a Stripe, for example, Stripe would be taking the payment from the website and they would be sending it to the bank account that Synapse etc is facilitating for them.

So the value proposition of BaaS platforms is that they allow you to open up deposit accounts, savings accounts, clearing accounts, debit cards, credit cards, loans, and basically any financial product that you can get from a bank, they will offer it to a developer via APIs.

What are the revenue / monetization models?

There are three very consistent revenue models.

1. A monthly subscription fee. I wouldn't share any particular numbers, but if you want access to a deposit account, that'll cost the developer $10,000 a month. If the developer would like to offer a card program, it might be an additional $5,000 a month. The subscription fee is based upon the services that the developer would like to offer.

2. The second piece is a per monthly fee per user, or a per user fee per month. So if you have a million customers, then you might be getting charged 10 cents per customer per month for having access to the platform. And that's fairly consistent for BaaS platforms.

So you could be paying $15,000 for your subscription fee and then $100,000 a month for your user fees.

3. And then every time you do a transaction, whether it be an ACH, a wire or a check, there is some sort of fee associated with that. It could be as low as 2 cents could be as high as $5 or $30 for an international wire. But there's some sort of fee per transaction.

That's how the BaaS platforms make their money.

There are ways for FinTech to make money. And while I don't know exactly what they charge like hypothetically, if this FinTech was charged 5 cents for an ACH transfer, they might charge 10 cents to the end-user and they're still making 5 cents per transaction. And they're still 10 times better than what Bank of America charges me for example.

Regarding interchange, that’s where FinTech can make money. If I go back to that coffee shop, every time that coffee shop is making a card transaction to sell a coffee, Stripe is probably charging them 5 cents, or Square is charging them 2.5 cents.

So if it was a $10 coffee, to make the math simple for me, then they'd be getting charged 25 cents, 30 cents, something along those lines. So the coffee shop would receive $9.70 from that transaction that would go into their account, held at Synapse.

Synapse does not charge the coffee shop. They don't make money from that particular float. However, when that coffee shop is then wanting to grow to use their own branded card to buy the coffee beans, to pay the electricity bills, then that's when there's an interchange that BaaS platforms will participate in.

So when the coffee shops use their card to go and buy $1,000 worth of coffee beans, then that's $25 that is being charged. So the coffee bean person gets $975. And that $25 is split amongst whoever they're using to process the payment, is split amongst a bank that's using the processor, it's split amongst the Visa/MasterCard themselves, it split amongst the BaaS platforms. And then BaaS platforms share that with FinTech.

So the FinTech themselves might be getting 1-2% for every card swipe that happens. So when that coffee bean customer went and bought $1,000 worth of coffee beans, the Fintech is getting say 10 to $15 themselves. Now they can either keep that as revenue, or they can then pass that through to the customer as cash back for your purchase. You’ve just earned 1, 1.5%.

Ultimately it's the FinTechs that get the largest portion. So because it's their customer, it's their relationship. They've done the hard work, arguably, wherever FinTech has 100,000 customers.

Visa and MasterCard have hundreds of millions of cards. So their business models of let's just make small, incremental little payments and if they get 0.5%, 20 cents per transaction, that's hundreds of millions of transactions a second, not too bad for them.

The bank typically gets a sizeable portion of interchange, specifically banks that have less than $10 billion in assets as per the Durbin amendment, that was there to help the banks get revenues, but the way that these players have arranged it, I like to think that Synapse is one of the better ones in this mix is that we've simply negotiated with the bank to say: look, the FinTech is bringing new customers that you would never normally get. You can benefit from the deposits. You can lend them out. We don't ask for any of that lending revenue. So let the FinTech take this interchange revenue for themselves.

So ultimately as it is 2.5% charged at that checkout, that $25, I can say 1.5% roughly will go to the FinTech, leaving 1% for BaaS, the bank, Visa MasterCard, Stripe or Square. So you can imagine that FinTech is getting the majority of it.

Could you please talk about what are the pros and cons of different BaaS models below, from both the BaaS platforms’ perspective and their FinTech clients’ perspective?

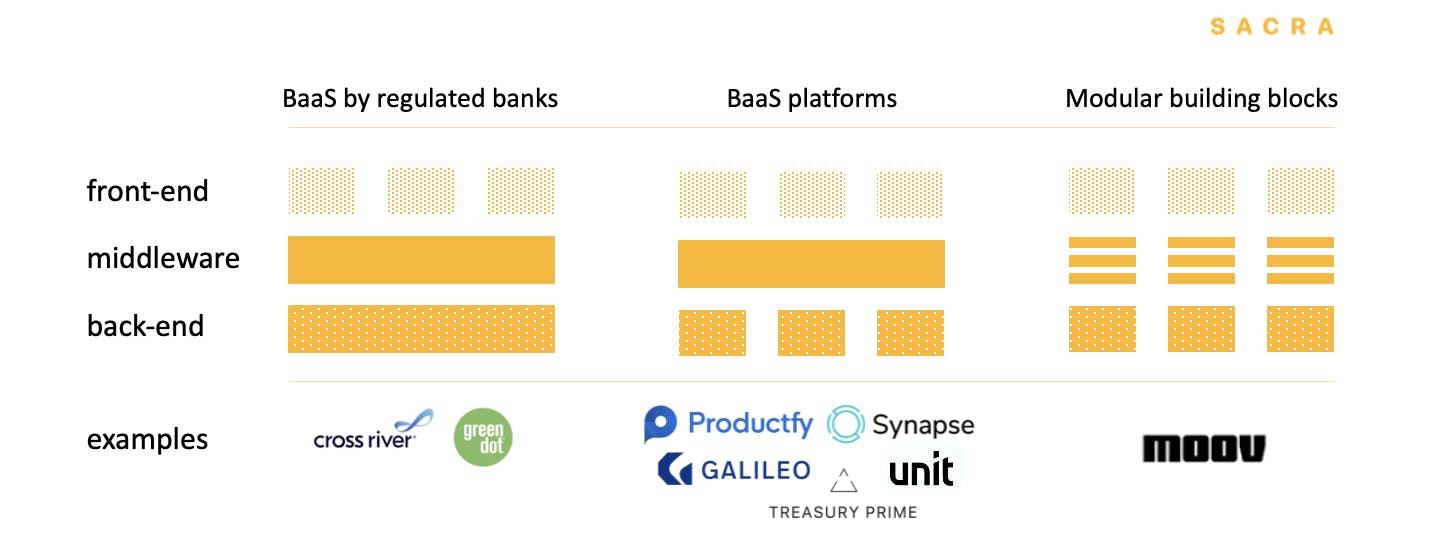

At the end of the day, these players are operating in banking as a service. There are subtleties to how they do it. I won't spend too much time on No.1. The simple answer is there's many more banks that offer this in the US, Celtic bank, Web bank, Bancorp Bank, Sutton bank, Lincoln savings bank, Hatch bank, Radius bank, many banks do this.

But ultimately the key message there is that they're all banks. They'll all take you somewhere between 18 to 24 months to get something live with them.

And typically in the States, the FinTechs, e.g. Chime, all have their own banking technology stack, that is they have their own KYC partner, their own core ledger system, and likely their own card issuer, like a Galileo.

Ultimately they have the responsibility to run and operate these services. And Cross River is probably the only one because they've got some nice APIs, but certainly the point being is that from an actual logistical perspective, the bank essentially allocates a single ledger entry for the FinTech and it's the Fintech's responsibility to capture and maintain and manage the breakdown of each virtual account number that it issues out to their end users.

The FinTech, i.e. category two above, they report each individual ledger entry to the bank, which then wraps it up in their own system to then report out to the federal reserve and FDA and insurance providers to get that FDIC coverage.

BaaS platforms in category two have their own KYC. Synapse built that in-house; Unit partners with somebody else, Treasury Prime partners with Alloy, for example.

But ultimately, they all have their KYC process for onboarding users approved by the bank, audited by the bank. And they all have their own BSA officers in order to maintain and monitor that KYC account opening process as well as ongoing account management and AML systems as well.

So Galileo is a slightly different beast in that they are a card issuer. They do have partners that they can go to work with banks. In the Chime example, Galileo actually works with Marqeta, for their card issuing piece. But ultimately, Galileo was one particular cog, rather than the entire stack. What you'll get from Treasury Prime, Bond, Synapse, Unit, Synctera and Productfy is that they take care of all the underlying technology processes, compliance, operational stuff with the bank. They've done a lot of work upfront.

For example, Unit just did a great announcement recently around their Unit Go service, meaning a developer can sign up with Unit and essentially be testing and developing services the same day in the live banking network.

The reason they do that is because there are buckets pre-approved by the bank partners. And that FinTech particularly falls into that bucket based upon the user type, product type, product volumes, et cetera, then they're basically pre-approved and they can run through.

So with Moov, they have quite a different approach to the same problem and that they're not providing a platform, but they are similar to the way that red hat sold Linux. Linux is an open-source free system. However, if you want to support, like enterprise-grade support, red hat basically built a support engine around it. So you could still use their flavor of Linux for free, when you download it. But if you want support, you're paying a monthly subscription for that.

That's what Moov is essentially doing for financial services. They provide their converters, I would call them their plug-ins, their founders have done a great job, basically building these converters for over 80 odd, different core banking system types, such that if a FinTech developer says, I want to go and work with this credit union in Alabama then chances are, if the credit union uses one of the 80 different technology, core banking providers that Moov has already connected into, it makes that technology integration much simpler.

And so that's where Moov is not a platform, but certainly it's taking a different model as not trying to be the gatekeeper. It's not trying to be the entire white-glove service that Synapse is probably providing. Each building block could be a converter for KYC, a converter for your accounts, a converter for loans. So each of the main products and propositions makes up the steps required in order to offer a bank account to an individual or a small business.

A developer would still have to talk to MasterCard, still have to talk to the bank, the KYC provider, et cetera.

While with Synapse, with Unit, with Treasury Prime, et cetera, they all sit in the middle, such that if a developer comes and with all due respect to them, doesn't know financial services, then they can get all of their questions answered. It can go a lot faster than just going straight to a bank and having to ping pong back and forth with a bank all the time.

Please talk about the growth drivers for BaaS providers?

We don't really track interchange revenue that closely. I mean, we do, of course, but it's not our main revenue source. It's per user fees, monthly subscriptions.

So in theory, there's two types of growth for BaaS providers.

One is just the number of platforms using our service, so that 10 -15 K per month. But arguably there's only a finite number of companies in the US that can support that.

Two, there's the per user fees. So ultimately we want to see our platforms grow and become successful and provide them the support and infrastructure to do so, because let them do the hard work of customer acquisition, to be frank, and then we can then benefit and rise with them.

It sounds like the FinTech players own the customer relationship so they can be more differentiated. But then if we go down to the infrastructure layer, how to think about the commoditization risk?

It's fairly high, but then at the same time, there's fairly high switching costs. So you really, really have to want to change because every time you change, your customers will get a new account number and routing number, because it'll change to a different bank, which is a pain.

Imagine having to change all your own sort code and account number with whoever you bank in the UK, then you have to change all your cards because every time you go to a new bank, you have to then get a new pin number because every bank will sponsor a unique pin for each FinTech developer.

So there are very high switching costs to move from one to the other.

It's not unheard of. We know that Galileo uses Synapse as their path for customer acquisition, because they tried to cherry pick our biggest and high profile customers. But then Galileo has got its own problems with stability and servicing. So there is a continual tension between all the players e.g. Galileo, Synapse, Unit, Treasury Prime.

But ultimately at the end of the day, one could say a bank account is a bank, wherever you get it from. It's always going to have the same features, deposit, insurance, while interest rates are so low right now, arguably close to zero, if not zero, there's no real differentiation there.

And so many of the things that we look at and specifically as we were looking to avoid becoming commoditized, is that product mix to keep ahead of what our competitors are doing. So it's more than just an account and trying to get better stability, better pricing, better customer service, or platform support, better platform stability, just uniqueness when it comes to, like I mentioned, the Unit Go service, where developers can launch on the same day a financial product, as an app.

That's why they're doing that to get developers to use their services and therefore they can have that stickiness for wanting to keep them for a long time.

Certainly, there is a very quick commoditization happening. And so it's differentiation on the more value added services you can offer. Can you help them fight fraud? Can you make sure that they've got better education to launch their services faster? Can you give them a more stable platform to offer those services? Can you differentiate to learn that product mix? It's probably the biggest pains that you'll have, but ultimately, in three years time, do I think there's room for 4 or 5? Sure. But certainly, I don't see there being 10 or 11 or 12 Banking-as-a-service providers in the States.

In terms of switching costs, I've also heard consumer-facing FinTech players switching off from a developer API platform because they outgrow what the developer API can provide. Could you please speak about what you observe here?

You can switch, but if you look at Chime, as the darling of the industry, they've raised hundreds of millions of dollars to do that.

If you look at a platform like any of these providers, they've lost customers, I mean, they could do better. But if you think about the alternatives, where FinTechs have to have their own KYC provider, they have to have their own core ledger, they have to have their own card processor.

So arguably Galileo is probably the most particular out of all these, because you don't want to build your own card processor. Synapse did this because of differentiation and innovation, but your standard consumer facing Fintech doesn't want to build their own car processor.

Even then, you look at the teams that will be required to support that, not just the technical team, but the operational team, the compliance team, the support team. If you've got a million customers and you're paying 10 cents a month for each one, it's like $100,000 a month costs paid to Synapse for example, or any of these BaaS providers. That's still a lot less than what it will be to have your own stack.

So I think in some regard, these companies that do move off, they're not moving off from a cost benefit perspective because our job is to make sure that there is more cost effective to stay with one of us, for example, but in many regards it's flexibility, it's having the feeling of having control of your own destiny.

Synapse has four or five different bank partners now that they move accounts into, simply because arguably, they want to have that diversification, that commercial contractual diversification. It doesn't mean that Synapse has outgrown the initial bank partners, but it does mean they can get better comfort and sleep at night. And knowing that if a bank has issues and touch wood, they haven't thankfully, that's kind of why I say we should have that differentiation.

I think Ramp initially used a card processor called Lithic and then recently they switched to Stripe because of Stripe's investment in them. Do you think despite the switching costs, Ramp switched because of more synergy with Stripe in the future?

I would imagine that, yes, there's a strategic alignment. Perhaps Stripe could be using Ramp to be the first adopter for cool stuff that they launch and things like that. So there's a more strategic fit. Likewise, in the same answer of outgrowing a company or a partner, outgrowing doesn't necessarily mean that it can't provide you the solution and services, it just might be a better fit. But the switching costs, I would sincerely hope that, A, Ramp probably didn't have millions of customers using those services. B, when you're spending money like this, like this corporate card service, being given a new virtual card number to spend on your subscriptions per month is not that painful in comparison.

And so when cards expire at the end of their couple of year period, you have to do it anyway. So it's not as if it's a massive switching cost. Perhaps with the investment and some incentives from Stripe, it could make sense.

What are the signals of high-quality businesses of developer API businesses?

It varies. I think there's probably three measurement areas that if I were looking at from a FinTech perspective, the first is just purely technology. Are the developer docs updated regularly? Are these developer docs developer friendly? Meaning they can go and do some trial and error in a sandbox. Is the sandbox open to play with, or is it hidden behind a paywall or a firewall?

For example, Synapse was the first ones to have an open developer spec and you could go and play in their sandbox for free. So it helped people to sign up.

That's the technology perspective. You can go into the structuring of the requests themselves, so looking at the details of the API, as it were laid out, is it consistent? Are there clear error messages defined? So there's like tech mindset there. Look at their status page, are they having regular incidents? So wearing a developer hat there. Is there some good coverage? Are they well regarded within the relevant FinTech ecosystems? Is there any bad stuff out there?

If you reach out to the salesperson, do they acknowledge and get back to you quickly?

Does the salesperson take the time to appreciate your business? oOr are they just trying to churn through numbers and not really good grasp of the product you're trying to build?

And then finally, do they have a high number of Fintechs using their service? Can you get a referral from one of their customers? There is a mixture of three there I guess. One is the technology piece; One is the operational piece and one is just a general word of mouth, reputational aspect of it as well.

How do API providers think about scaling with their FinTech clients?

There's a couple of things there. One is obviously ensuring the technology scales and making sure that they have the right infrastructure to grow. So we have to make sure that our services can scale accordingly as well.

Secondly, there's obviously the pricing piece you want to incentivize and reward.

And then third, there is what I would say is the softer side of getting out ahead. I mean, transparently, none of the BaaS platforms has done this before, but we do see issues such as making sure that FinTech has the right customer services structure in order to scale, do they have the right processes? Are we able to give them based upon what we've seen others do? So you could see it as a generic, best practice to date. That’s probably the three biggest issues I've seen.

Brex began as an issuer processor, and then gradually moved into software for small businesses with invoice reconciliation, back-office software, and Brex now monetizes through SaaS as well. Do you see this type of payment plus software as a big growth driver in the future?

For the platforms, for sure. Because ultimately everything you just mentioned Brex doing there can be done off a simple deposit account. That's the intelligence on top of it. It's the analysis of the transactions to integrate into an accounting system. It's the decision when it comes to lending perhaps.

We can obviously provide the lending criteria and the lending license and the lending infrastructure and the payments infrastructure, but Brex uses their unique intelligence and insights to offer these value-added services.

Ultimately there's only so much developer APIs want to do. There is only so much platforms want them to do. Because they want to have some unique features and unique differentiation for themselves and what we can help with as access to value added services and partners. So take an integration with a foreign exchange provider, like a Transferwise, Wise and currency cloud.

Platforms can then integrate with, what arguably is a large implementation, one of these partners and absorb the monthly fee. But the platforms then pass the capabilities on to their Fintech clients so that they don't have to have multiple integrations with Currency Cloud or Wise.

BaaS platforms can do those wider integrations that benefit the majority of their clients or a sizeable amount, but there's always that unique services that Brex or others want to offer themselves that would benefit from a Currency Cloud integration. That's only one small part of their overall strategy.

What do you think about the regulatory environment? And to what extent the developer API providers are less exposed to future changes in regulation?

There are two aspects to it. We work very closely, we've got a compliance team that does just that with our bank partners and they are very hardworking and diligent. We get audited ourselves by the regulators on behalf of the bank.

As you can imagine, since we are offering regulated services, we have to work very closely with the bank in order to make sure that they are compliant with whatever the regulator is asking. And so to that regard, there is a very close relationship there with them.

Then you've got the more, you could say, national impact, where there was a recent change of how these sources of deposits are categorized or being core versus brokered deposits.

And that means that banks would be more or less willing to take those deposits based upon that categorization. And that impacts us significantly because to know that they are categorized as core, it means that the bank can do a lot more with them when it comes to lending out and investments. Therefore, less costs, more revenue for them. So banks are very eager to now take those deposits and we work very closely with the bank to help understand, respond and operate under those regulatory changes.

And that's even aside from the traditional AML and KYC regulation as well that we have to abide by.

So it's very important for these banking-as-a-service providers and platforms to do all that because transparently it hides all of that from the Fintechs because it's not a fun job, basically.

How do you see competition between the developer API providers evolve in the next two years?

I guess I'd go back to that answer earlier. As the core deposit account opening and card issuance is becoming commoditized, it basically comes down to a mixture of what is that product mix? For example, Synapse is the only one that can do lending currently.

They have to take advantage of it, because they've gone out and taken 18 months to get all the lending licenses across the 50 states. So they have flexibility when it comes to credit card issuance, unsecured loan issuance. So in some regards we will always be trying to keep ahead of those loans. So the product mix is one piece.

And the other, there is that developer experience, is onboarding timely?

And then finally there's a whole post sales experience as they're a good customer service. Is there a real-time chat window? So when stuff does fail and it happens to us all, how was it handled?

We'll always be continuing to give a better post sale developer experience. And then finally that post-sale support and guidance will be key because ultimately an API to open up a deposit account is going to be the same across all these platforms, it's all the same product that's offered.

Are there any questions or areas you think are very important and we haven't talked about?

What you probably should consider is the underlying cost model for these services. I maybe should have touched upon it in the differentiation piece earlier, but when I was specifically comparing Synapse to the likes for the Treasury Prime, I alluded to the fact that they use Marqeta as card issuer.

For the KYC provider, they've got a very different commercial model and cost model because every time they onboard a user, they have to pay a lawyer fee. Every time they want to do a transaction, they share revenue with Marqeta. Every time they issue a card catalog, charge them a fee, because Synapse has built all that in-house because Moov doesn't build any of that. It's very different underlying cost models for these differences.

I'm being maybe too Frank, I think Treasury Prime's doing a great job getting traction. But I would guesstimate that they're losing money on most customers because they are doing like a $10,000 a month fee or deposit accounts.

It's up to, I think a thousand customers free and three local ACH. I know who their underlying bank partners are. And I know what their underlying costs are, there is no way that that can be profitable for them. And so that's very much the old VC hockey stick. Lose money for a long time and subsidize it through further funding.

In the future, maybe that's what underlying cost model perhaps is wondering if you take like the Moov example. I think they're fantastic in that they are not having to deal with any of the heartache of dealing with banks, but they're making it easier for the technologists to integrate and launch services, but it doesn't take away from the phone.

Developers then have to speak with a bank. They'll still, still have to abide by the bank's compliance processes and onboarding, which might cut down some months over that 12 to 16 month lunch period. But you're still looking at a nine to 12 month launch period with them rather than six weeks or same day as it comes to synapse and then unit.

So that's a bit of a rambling. Sorry. So Nan, about what we may have not covered off, but. It was the first piece that came to mind when there was anything that was missed.

If I can just recap, the key points in terms of future growth and how to think about profitability at maturity. So there's this verticalization. What I'm hearing from you in terms of building out the stack in the product offering to own more of the value chain. So the API provider doesn't pay to other third parties. Is that fair?

Yeah, that's fair. I mean, are those expensive third parties? You want to disintermediate them and provide value for being in the middle and at the end of the day, that's to your lane of thinking, if a FinTech can get services elsewhere for cheaper, that's when they'll switch and. But it just means that we'd have to be sure that we can do it for them and have those economies of scale because we're doing it for them and hundreds of others.

Disclaimers

This transcript is for information purposes only and does not constitute advice of any type or trade recommendation and should not form the basis of any investment decision. Sacra accepts no liability for the transcript or for any errors, omissions or inaccuracies in respect of it. The views of the experts expressed in the transcript are those of the experts and they are not endorsed by, nor do they represent the opinion of Sacra. Sacra reserves all copyright, intellectual property rights in the transcript. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any transcript is strictly prohibited.