- Valuation Model

- Expert Interviews

- Founders, funding

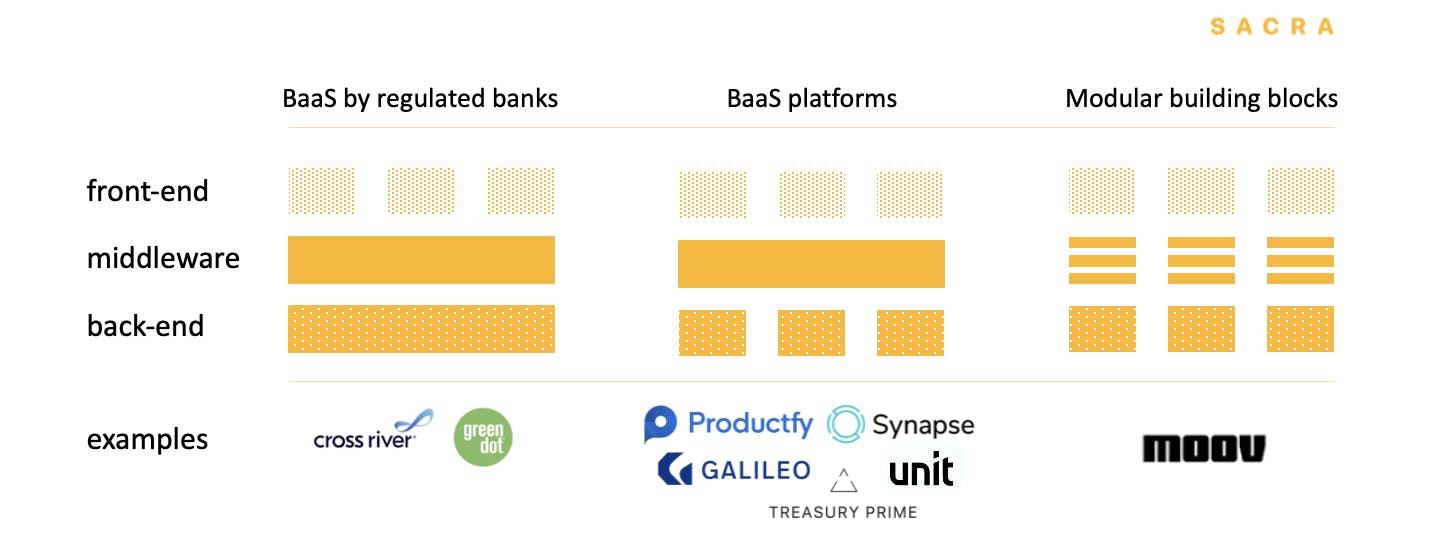

What are the advantages and disadvantages of different BaaS models for BaaS platforms and their FinTech clients?

Anonymous

BaaS business development executive

At the end of the day, these players are operating in banking as a service. There are subtleties to how they do it. I won't spend too much time on No.1. The simple answer is there's many more banks that offer this in the US, Celtic bank, Web bank, Bancorp Bank, Sutton bank, Lincoln savings bank, Hatch bank, Radius bank, many banks do this.

But ultimately the key message there is that they're all banks. They'll all take you somewhere between 18 to 24 months to get something live with them.

And typically in the States, the FinTechs, e.g. Chime, all have their own banking technology stack, that is they have their own KYC partner, their own core ledger system, and likely their own card issuer, like a Galileo.

Ultimately they have the responsibility to run and operate these services. And Cross River is probably the only one because they've got some nice APIs, but certainly the point being is that from an actual logistical perspective, the bank essentially allocates a single ledger entry for the FinTech and it's the Fintech's responsibility to capture and maintain and manage the breakdown of each virtual account number that it issues out to their end users.

The FinTech, i.e. category two above, they report each individual ledger entry to the bank, which then wraps it up in their own system to then report out to the federal reserve and FDA and insurance providers to get that FDIC coverage.

BaaS platforms in category two have their own KYC. Synapse built that in-house; Unit partners with somebody else, Treasury Prime partners with Alloy, for example.

But ultimately, they all have their KYC process for onboarding users approved by the bank, audited by the bank. And they all have their own BSA officers in order to maintain and monitor that KYC account opening process as well as ongoing account management and AML systems as well.

So Galileo is a slightly different beast in that they are a card issuer. They do have partners that they can go to work with banks. In the Chime example, Galileo actually works with Marqeta, for their card issuing piece. But ultimately, Galileo was one particular cog, rather than the entire stack. What you'll get from Treasury Prime, Bond, Synapse, Unit, Synctera and Productfy is that they take care of all the underlying technology processes, compliance, operational stuff with the bank. They've done a lot of work upfront.

For example, Unit just did a great announcement recently around their Unit Go service, meaning a developer can sign up with Unit and essentially be testing and developing services the same day in the live banking network.

The reason they do that is because there are buckets pre-approved by the bank partners. And that FinTech particularly falls into that bucket based upon the user type, product type, product volumes, et cetera, then they're basically pre-approved and they can run through.

So with Moov, they have quite a different approach to the same problem and that they're not providing a platform, but they are similar to the way that red hat sold Linux. Linux is an open-source free system. However, if you want to support, like enterprise-grade support, red hat basically built a support engine around it. So you could still use their flavor of Linux for free, when you download it. But if you want support, you're paying a monthly subscription for that.

That's what Moov is essentially doing for financial services. They provide their converters, I would call them their plug-ins, their founders have done a great job, basically building these converters for over 80 odd, different core banking system types, such that if a FinTech developer says, I want to go and work with this credit union in Alabama then chances are, if the credit union uses one of the 80 different technology, core banking providers that Moov has already connected into, it makes that technology integration much simpler.

And so that's where Moov is not a platform, but certainly it's taking a different model as not trying to be the gatekeeper. It's not trying to be the entire white-glove service that Synapse is probably providing. Each building block could be a converter for KYC, a converter for your accounts, a converter for loans. So each of the main products and propositions makes up the steps required in order to offer a bank account to an individual or a small business.

A developer would still have to talk to MasterCard, still have to talk to the bank, the KYC provider, et cetera.

While with Synapse, with Unit, with Treasury Prime, et cetera, they all sit in the middle, such that if a developer comes and with all due respect to them, doesn't know financial services, then they can get all of their questions answered. It can go a lot faster than just going straight to a bank and having to ping pong back and forth with a bank all the time.