Aviron and the Xbox of connected fitness

Jan-Erik Asplund

Jan-Erik Asplund

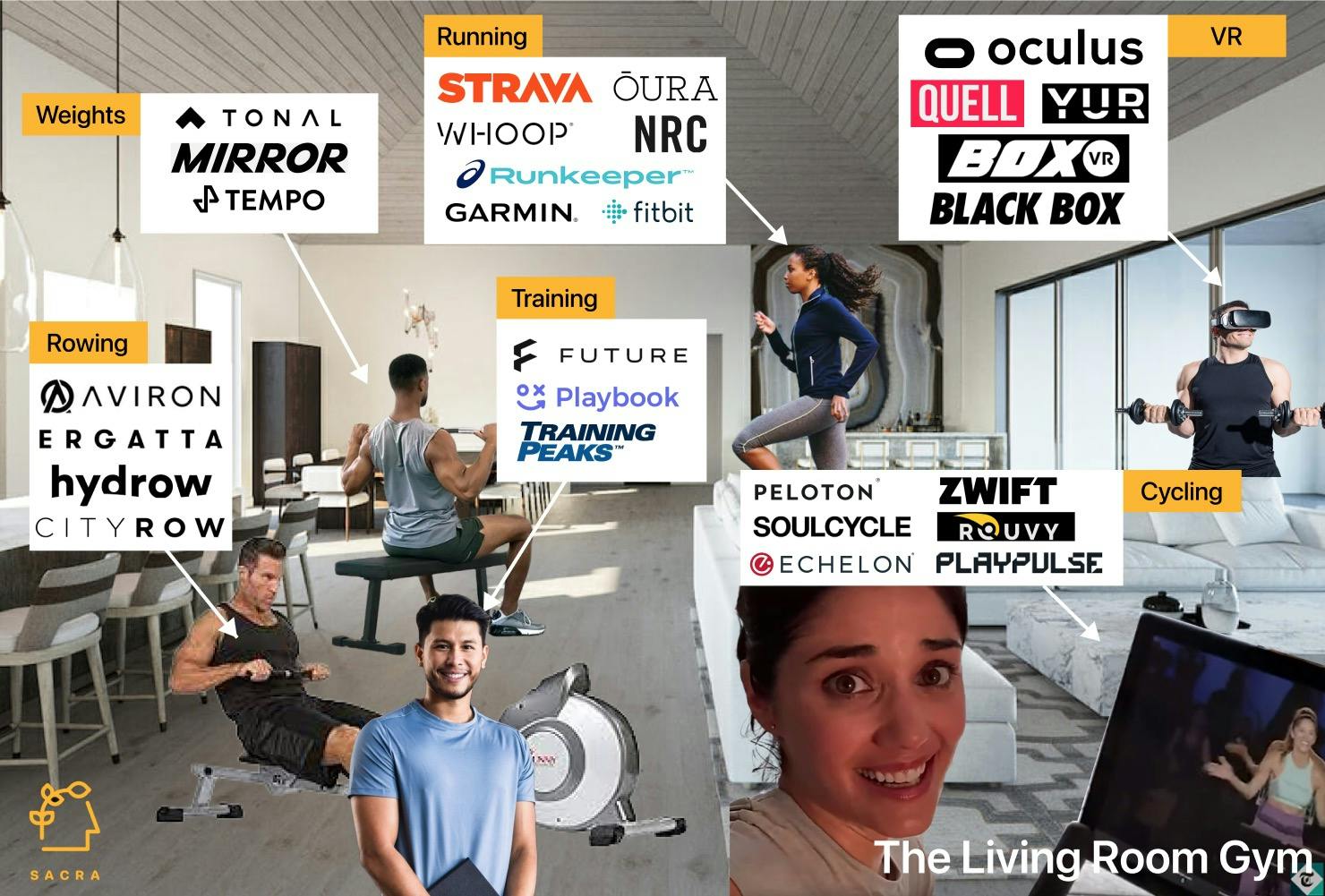

TL;DR: Post-COVID headwinds broke the unit economics of connected fitness—now, we’re seeing startups vie to build the core fitness "gaming console" of this emerging ecosystem with software margins and platform upside. Check out our interview with Andy Hoang, the co-founder and CEO of Aviron, for more, as well as reports on Voodoo (with dataset), Rec Room, and Animoca Brands.

Get more private company metrics, insights, and analysis in your inbox.

Success!

Something went wrong...

- NordicTrack’s ski machine (1975) and Bowflex’s 2000X (1986) kickstarted the home fitness era, and machines for doing different kinds of exercises at home—running, elliptical, rowing, weights—proliferated on the market. Today, Nautilus (NYSE: NLS) manufactures Bowflex machines as well as products from their own brand, Universal, Schwinn Fitness, and Modern Movement. (link)

- In 2007, home fitness jumped from the basement and garage into the living room with the launch of Wii Fit, which went on to sell a total of 43.8M copies and become Nintendo’s best-selling game of all time. With the Wii, Nintendo vertically integrated its own console hardware with motion tracking and its own software to create a novel fitness experience on a gaming platform. (link)

- Peloton (NASDAQ: PTON) took spin classes out of the studio and delivered them on-demand via subscription SaaS (70% gross margin) to high-resale-value bikes they manufactured themselves, notching LTV of $7K+—but post COVID, with CAC up by 20-30%, demand waning and the resale value of the bikes falling, their economics went upside down. Increased competition, price sensitivity, and churn combined with reduced engagement with Peloton from existing subscribers—average rides per month per subscriber fell from 22 in 2021 to 16.4 as of 2022. (link)

- Under new CEO Barry McCarthy, Peloton has explored new business models like gaming that can drive more software margins—unlike content which requires paying live instructors and 30%+ royalties to music labels—along with becoming an app store by up the Peloton ecosystem to third-party app developers. While their strictly closed ecosystem and constant pumping out of live content keeps users engaged, it also costs Peloton a lot to keep the engine running—something that’s hard to maintain as the company looks to dramatically cut costs. (link)

- Learning from Peloton’s mistakes, startups like Aviron and Ergatta (rowing), Playpulse (cycling) and Quell (boxing) are building around games instead of live trainer content to get better unit economics and the potential to monetize via add-ons and microtransactions. Games have no variable costs to deploy at scale and therefore better unit economics than live, trainer-led classes. (link)

- Whoop ($3.6B) started out selling a $500 wearable band, but pivoted to subscription SaaS in 2018, giving its band away for free, while charging for personalized analytics, coaching and community tools to customers for $18-30 per month. Whoop also allows users to sync data into their health profile from Strava, TrainingPeaks, Apple Health, and Equinox+.

- Strava ($1.5B) is hitting $170M~ ARR with their asset-light, software pure play fitness social layer indexed on interoperability with 3rd-party hardware includingApple Watch, Wahoo, Fitbit, Garmin, Whoop, Peloton, Zwift and more. Strava hit 100M users in May, doubling in two years, with 7B+ activities shared since its founding and 2.5B activities shared in the last 18 months. (link)

- Today, Apple is the lead platform on connected fitness with 100M+ deployed Apple Watches and 1B+ active iPhones locking users into Apple Health, but Oculus is emerging as the key fitness platform to win VR, with $1.5B in purchased content. Oculus users can track their usage of Beat Saber and FitXR either in the Oculus mobile app or sync it into Apple Health. (link)

- High margin software gives connected fitness companies margin to spend on CAC for a shot at the platform approach to become a “Nintendo” of connected fitness—vertically integrated platforms of hardware and software with enough niche interest to build a strong business. While Aviron wants to own the rowing use case, Whoop’s aim is to become Apple Health for the open ecosystem of connected fitness. (link)

- Startups are vying to be the “Xbox” that is the core console, identity & social layer and app store of this emerging ecosystem vs. being merely commoditized as a “Logitech” or “Razer” that sells hardware peripherals. With this focus on ecosystem and interoperability, the next era of connected fitness will look less like a skeuomorphic emulation of the gym and more like an Xbox—not an at-home arcade, but a platform that reinvents the medium, on top of which a whole universe of novel apps, games, and peripherals can emerge. (link)

For more, check out our full interview with Andy Hoang, CEO and co-founder of Aviron and this other research from our platform: