Arctic Wolf at $438M ARR

Jan-Erik Asplund

Jan-Erik Asplund

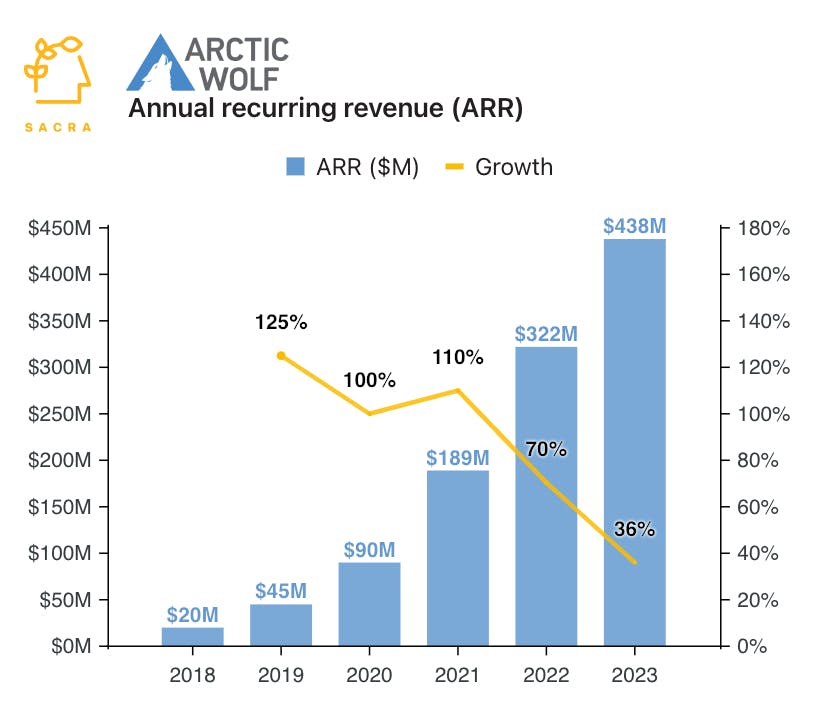

TL;DR: Sacra estimates that Arctic Wolf hit $438M in annual recurring revenue (ARR) in 2023, up 36% year-over-year, with over 5,000 customers across 30 countries. Initially serving SMBs, Arctic Wolf is now aggressively expanding upmarket to compete for enterprise contracts against companies like CrowdStrike (NASDAQ: CRWD) and SentinelOne (NYSE: S). For more, check out our full report and dataset on Arctic Wolf.

Key points via Sacra AI:

- Arctic Wolf (2012) pioneered the managed detection response (MDR) category as a fully outsourced, white-glove cybersecurity service for businesses that can’t afford or don’t want to manage their own in-house team —companies pass along their logs, integrate with all their existing security tools, and install Arctic Wolf’s endpoint-monitoring agent. Arctic Wolf found early traction with 100-500 person businesses as a cheap way to outsource security at about $30K/year vs. hiring a team of $100K/year security analysts.

- In 2016, data breaches went from an annoyance to a mission-critical risk as the number of ransomware attacks exploded (638M breaches, up 16,689% year-over-year) and today Sacra estimates that Arctic Wolf hit $438M in annual recurring revenue (ARR) in 2023, up 36% year-over-year. Internally, while still a services-heavy business, Arctic Wolf is driving towards SaaS-like gross margins of 70-80% by automating the work of their human analysts—with big potential upside from AI.

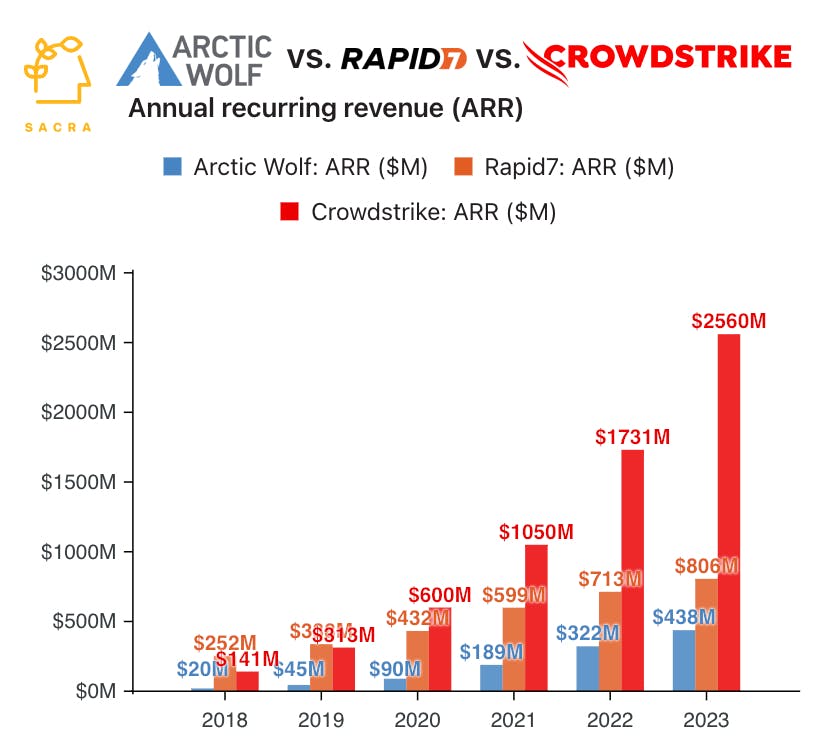

- Since Arctic Wolf's launch in 2012, many other players have entered the hot MDR market—newer startups like Expel and Rapid7 as well as established companies like CrowdStrike (NASDAQ: CRWD), SentinelOne (NYSE: S), and Palo Alto Networks (NASDAQ: PANW) all launching their own MDR services as part of their cybersecurity bundles. Compare Arctic Wolf to Rapid7 (NASDAQ:RPD) at $805M ARR, up 13% year-over-year with 11,000 customers to ArcticWolf’s ~5,000, and CrowdStrike, one of the leaders in MDR with their Falcon Complete product, at $3.7B in ARR, up 33% year-over-year, serving 60% of the Fortune 500.

For more, check out this other research from our platform:

- Arctic Wolf (dataset)

- Israel’s YC of cybersecurity

- Wiz (dataset)

- Cribl (dataset)

- Rubrik (dataset)

- BigID (dataset)

- Snyk (dataset)

- Noname Security (dataset)

- Lacework (dataset)

- Anduril (dataset)

- Ross Fubini, Managing Partner at XYZ Capital, on the defense tech opportunity

- Scott Sanders, chief growth officer at Forterra, on the defense tech startup playbook

- Zachary Friedman, associate director of product management at Immuta, on security in the modern data stack