Anthropic vs. OpenAI

Jan-Erik Asplund

Jan-Erik Asplund

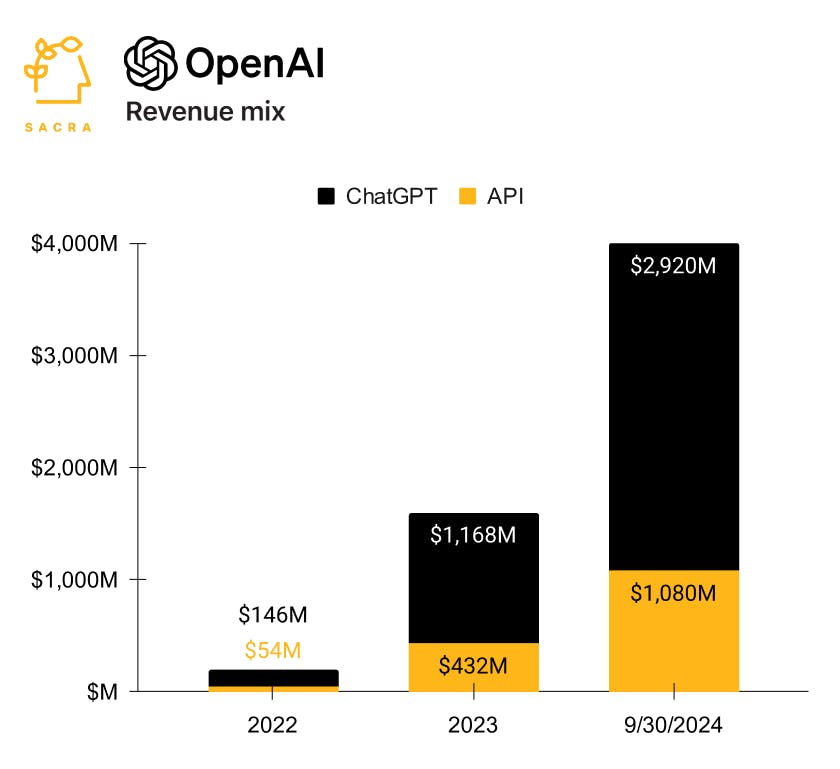

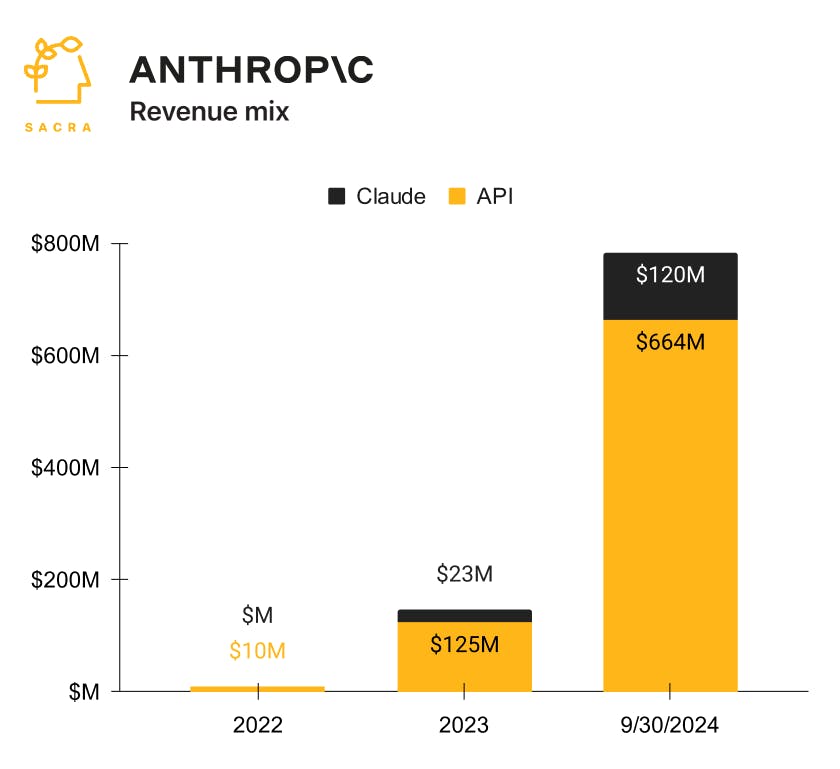

TL;DR: Claude 3.5 Sonnet has Anthropic's API business surging, hitting a Sacra-estimated $664M ARR this year (up 5x this year to date) and narrowing the gap with OpenAI's—meanwhile, OpenAI is doubling down on dominating consumers with ChatGPT ($2.9B ARR, up 2.5x) and its impending integration into Apple Intelligence. For more, check out our full reports on OpenAI (dataset) and Anthropic (dataset).

Key points via Sacra AI:

- Launched in June, Claude 3.5 Sonnet has blown the doors open for Anthropic's API business, growing 5x this year to date to $664M ARR versus OpenAI's API businesses' 2x growth to $1.08B ARR. Combining frontier models with developer experience, Anthropic has led on long context windows—making it much easier for developers to do multi-shot prompting and retrieval-augmented generation (RAG)—and prompt caching (cutting model costs up to 90%) while staying neck-and-neck on reasoning benchmarks and multimodal.

- On the consumer side, OpenAI's ChatGPT continues to dominate, growing a Sacra-estimated 2.5x this year to date to $2.9B ARR—dwarfing Claude's 5x growth to $120M ARR—with its competitive set more Google (incumbent at $328B TTM revenue, up 6.8% YoY) and Perplexity (insurgent at $45M ARR, up 543% year to date) than Anthropic. Tilting B2B towards work, Anthropic's competitive set for Claude has started to look more like Gemini for Google Workspace and Glean ($39M ARR in 2023, up 290%), as they make it easier to do RAG over documents and codebases (Projects) and add SSO, role-based permissions, and audit logs (Claude Enterprise).

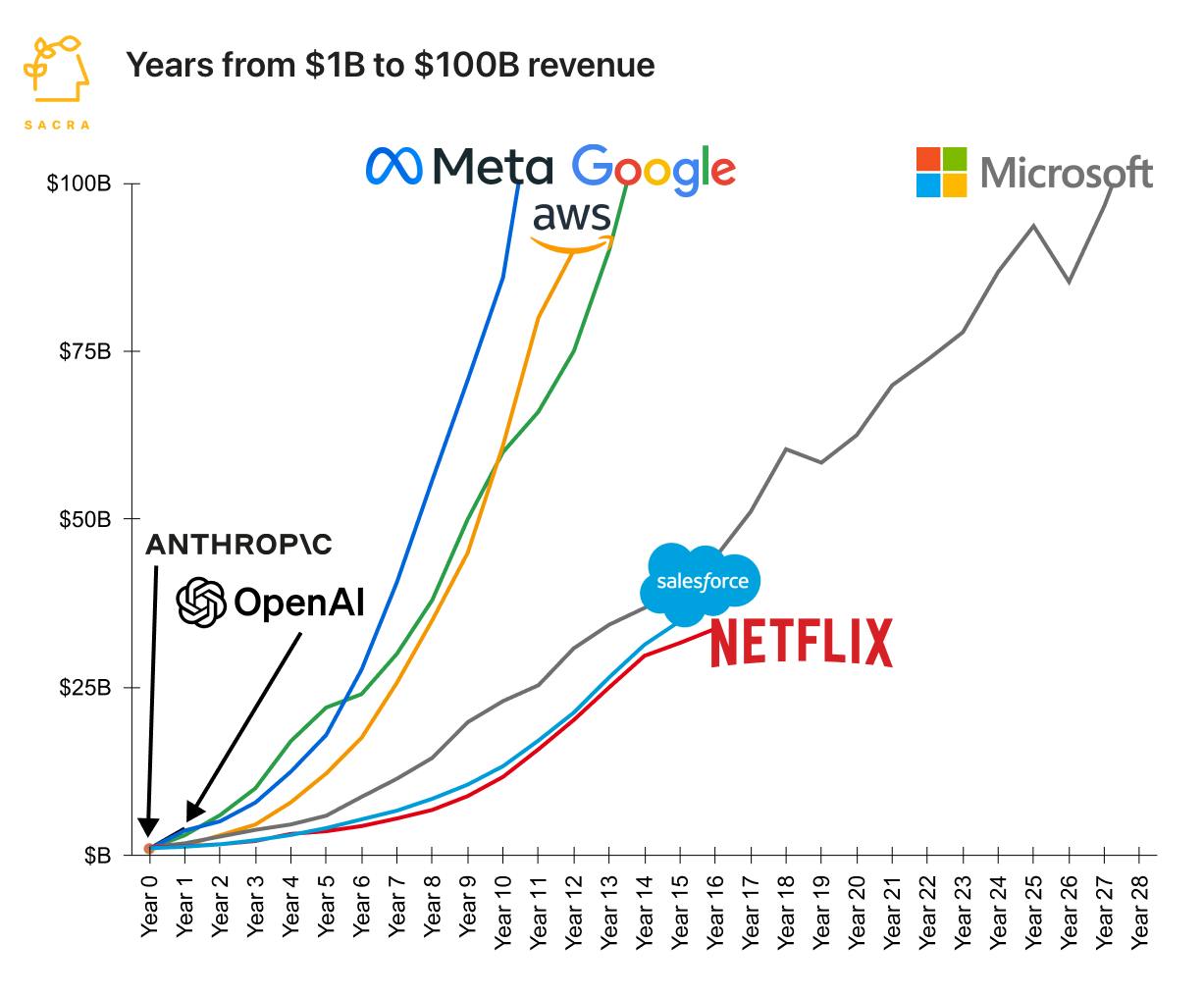

- At $1B revenue scale, OpenAI's 4x YoY growth to $4B matches and exceeds Meta, Google & AWS’s—which decelerated before settling into 20-35% YoY growth—but lacks the monopoly-profit generating free cash flow machine behind it that enabled those companies to maintain that growth rate for 10+ years through $100B in revenue. With $5B in losses for 2024, expected to rise to $14B in 2026, OpenAI continues to index heavily on growth and shows the potential for a longer runway of >100% YoY growth—particularly as its partnership with Apple Intelligence kicks in—betting that scale will win the market.

For more, check out this other research from our platform:

- Anthropic (dataset)

- OpenAI (dataset)

- OpenAI vs. Anthropic vs. Cohere [2023]

- CoreWeave: the $465M/year cloud GPU startup growing 1,760% YoY

- Edo Liberty, founder and CEO of Pinecone, on the companies indexed on OpenAI

- Pinecone: the MongoDB of AI

- Will Bryk, CEO of Exa, on building search for AI agents

- AI talking heads growing 1024%

- Kyle Corbitt, CEO of OpenPipe, on the future of fine-tuning LLMs

- Together AI: the $44M/year Vercel of generative AI

- Scale (dataset)

- Databricks (dataset)

- Hugging Face (dataset)

- Groq