$216B drone navy

Jan-Erik Asplund

Jan-Erik Asplund

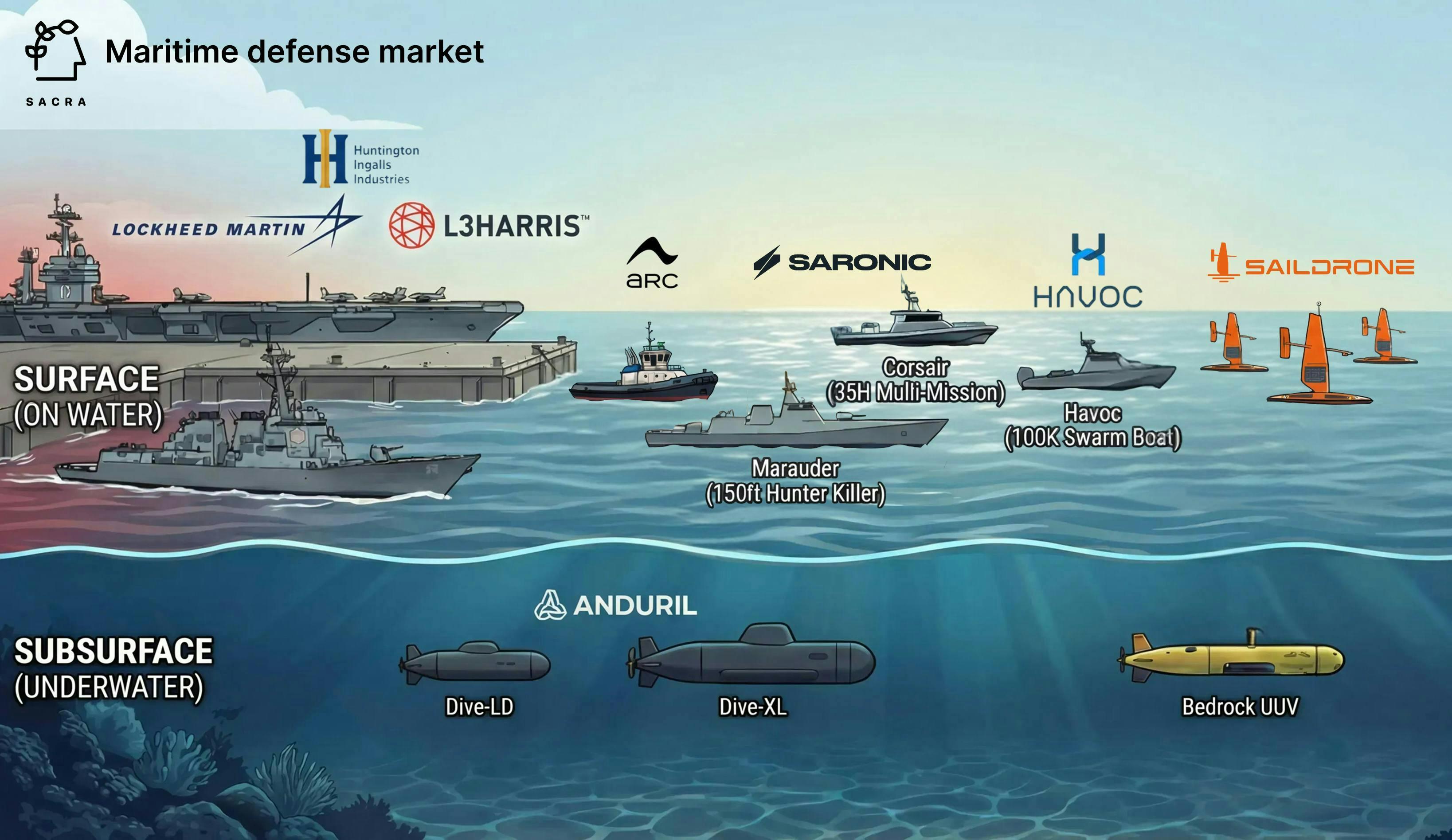

TL;DR: China's 100x shipbuilding advantage and Ukraine's success sinking warships with $250K sea drones are forcing the U.S. Navy to shift from ~$13B aircraft carriers to networks of $100-400K autonomous surface vessels from startups like Saronic, Saildrone & HavocAI. For more, check out our full reports on Saronic (dataset), Saildrone (dataset), and HavocAI.

Key points via Sacra AI:

- For 80 years, the U.S. Navy projected power through $13B Ford-class aircraft carriers and $2.5B Arleigh Burke destroyers, but China's shipyards now outproduce U.S. yards by more than 100x in tonnage & China's fleet already exceeds the U.S. by ship count. Ukraine's use of $250K sea drones to sink Russian warships demonstrated that swarms of cheap, expendable vessels can neutralize billion-dollar platforms, inspiring a doctrinal shift from concentrated fleets to distributed networks of hundreds of autonomous surface vessels that can be built in months rather than years and lost without crippling the mission.

- Trump's "One Big Beautiful Bill" allocated $5.7B specifically to maritime autonomous systems including $1.5B for small unmanned surface vessels, $2.1B for medium unmanned surface vessels, and $1.3B for unmanned underwater vehicles, while the Navy's Force Design plan calls for more than 150 new platforms as the service gameplans for Taiwan invasion scenarios where traditional carrier groups are liabilities. Unlike aerial drones where incumbents like General Atomics dominate, the Navy's push for maritime autonomy creates a rare opening for startups because legacy primes like Lockheed Martin (NYSE: LMT, $72B TTM revenue) and L3Harris (NYSE: LHX, $21B TTM revenue) have bundled vessels into multi-year, multi-hundred-million-dollar cost-plus contracts while startups sell complete autonomous systems at fixed prices like Saronic ($400K per unit) and HavocAI ($100K per unit).

- The unmanned maritime market is sorting into three mission-driven segments based on endurance, speed, and depth, with 1) Saildrone ($43M revenue in 2024, up 231% YoY) building wind-and-solar-powered surveillance drones that sail for 365 days on less than 100 watts, 2) Saronic ($12.5M revenue in 2024) building hybrid attack-and-recon boats that run for 4 weeks at a time, and 3) Anduril ($1B revenue in 2024, up 138% YoY) building heavyweight undersea strike vehicles that slot into the Navy's big-ticket submarine budget. Each segment maps to different Navy procurement categories and operational requirements, with Saildrone's ultra-endurance vessels replacing $35,000/day manned research ships for persistent maritime domain awareness, Saronic's Spyglass and Corsair replacing manned patrol boats for river operations and coastal defense, and Anduril's Dive-LD and Dive-XL complementing Virginia-class submarines for offensive strike missions.

- Saronic's trajectory from founding in September 2022 to a $392M Navy production contract in under three years represents the fastest revenue ramp of any defense contractor in history, with the company securing its first Navy contract within 90 days of founding and generating $17M in contract awards within its first 18 months by building autonomous surface vessels ranging from 6-foot scout boats (Spyglass) to 35-foot multi-mission platforms (Corsair) to 150-foot hunter-killers (Marauder). Like Anduril and Shield AI, Saronic flips the traditional defense business model by front-loading its own R&D and selling complete, off-the-shelf systems under fixed-price contracts rather than billing cost-plus for development, with the company acquiring Gulf Craft's Louisiana shipyard in April 2025 to scale production from prototypes to hundreds of vessels monthly as it projects $400M in revenue for 2025 off large programs with the Navy and USSOCOM.

- While Saronic and Saildrone sell hardware, Shield AI ($300M TTM revenue in March 2025, up from $267M revenue as of the end of 2024) is building the autonomy software layer for ship-launched maritime surveillance with "Hivemind," an AI pilot deployed on Coast Guard cutters and Navy vessels that handles takeoff, navigation, and landing without GPS, pilots, or communication, which partners like Airbus, Kratos, and L3Harris are now licensing to run on their own platforms. The software licensing model creates the upside of a 60%+ gross margin business on top of Shield AI's core V-BAT drone sales, with the company's $198M Coast Guard contract demonstrating how its $1M vertical-takeoff drones launched from ship decks replace legacy systems like the $80M MQ-9B SeaGuardian and manned maritime surveillance flights costing $115K per mission for the same 13+ hour persistent patrol capability.

- The same autonomous platforms winning Navy contracts are finding commercial pull in offshore wind, port operations, and subsea infrastructure, with Saildrone charging science agencies like NOAA and NASA $2,500/day for ocean data collection versus $35,000/day for traditional manned research vessels, Bedrock Ocean Exploration ($58.5M raised, Primary Venture Partners) mapping the ocean floor 10x faster than traditional methods for both offshore wind developers and the U.S. Navy, and Arc Boat ($100M raised, Lowercarbon Capital) landing a $160M contract with West Coast port operator Curtin Maritime for eight hybrid-electric tugboats replacing aging diesel vessels that handle cargo ships at the Port of Los Angeles. Dual-use business models insulate startups from defense budget cycles while expanding their addressable market, with Saildrone selling the same wind-and-solar-powered platform to NOAA for climate science, NASA for hurricane tracking, the US Navy 5th Fleet for monitoring Iranian activity in the Arabian Sea, and the Danish Armed Forces for Baltic patrol.

- As the U.S. validates autonomous maritime systems in operational deployments, allied navies are following with their own procurement, with Shield AI signing contracts with the Romanian Navy ($30M), Japan's naval forces, Greece, and Canada, while Saronic has opened a Sydney office to support AUKUS field tests with the Australian navy ($16B budget), hired two retired Royal Navy admirals to lead UK engagement ($14B budget), and is pitching swarming USVs in Japan ($44B), Singapore ($23B), and the UAE ($10B). The AUKUS alliance (Australia, UK, U.S.) coordinates defense procurement across member nations, meaning a single platform sale to the U.S. military now potentially unlocks procurement pathways across dozens of allied nations facing the same doctrinal pressure to shift from exquisite crewed vessels to distributed autonomous networks.

For more, check out this other research from our platform:

- Saronic (dataset)

- Saildrone at $43M/year growing 231% YoY

- Saildrone (dataset)

- America First vs. American Dynamism

- Anduril (dataset)

- Anduril at $1B/yr

- SpaceX (dataset)

- Anduril, SpaceX, and the American dynamism GTM playbook

- The biggest mistake defense startups make

- Ross Fubini, Managing Partner at XYZ Capital, on the defense tech opportunity

- Shield AI (dataset)

- Scott Sanders, chief growth officer at RRAI, on the defense tech startup playbook