$100M/year Palantir for supply chain

Jan-Erik Asplund

Jan-Erik Asplund

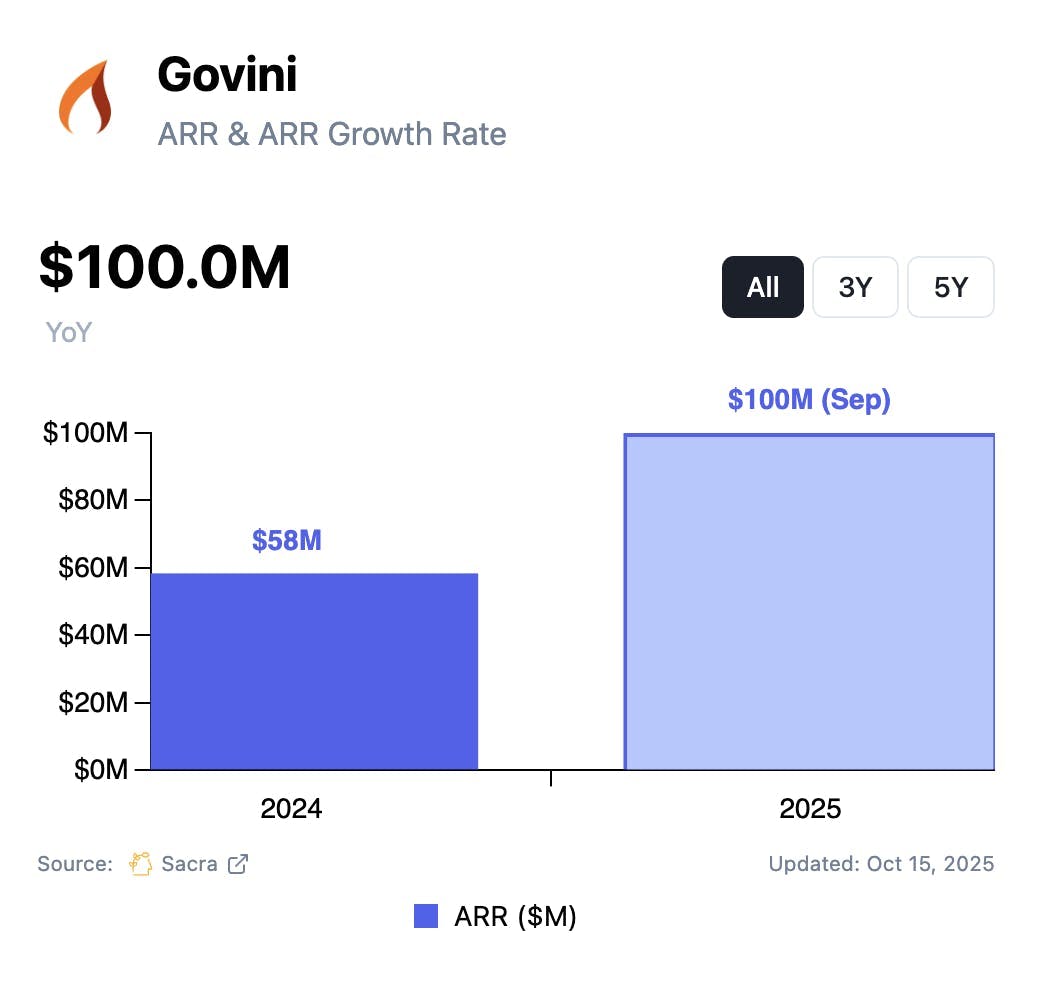

TL;DR: Emerging from the Pentagon's 2010s push to de-risk defense supply chains, Govini sells high-margin SaaS ($15K-$150K per seat) that helps agencies trace components, identify single-source vendors, and eliminate foreign exposure. Sacra estimates Govini hit $100M in annual recurring revenue (ARR) in October 2025, up from $58M at the end of 2024, raising $150M (Bain Capital) at a ~$1B valuation. For more, check out our full report and dataset.

Key points via Sacra AI:

- The 2010s push to modernize the DoD’s supply chain ran into a procurement system still run on spreadsheets where program managers can’t see which components came from single-source vendors or trace Chinese semiconductors buried deep in supply chains—inspiring Govini (2011) to launch as a SaaS platform where agencies upload bills of material and can trace where every part comes from, map vendor dependencies, and flag risks around counterfeits, foreign exposure, or obsolescence. Govini sells as a high-margin SaaS product ($15K–$150K per seat) through direct-to-agency contracts, selling initially into the Pentagon but expanding with contracts across intelligence agencies, DHS, and HHS, with the platform now managing over $140 billion in active defense programs.

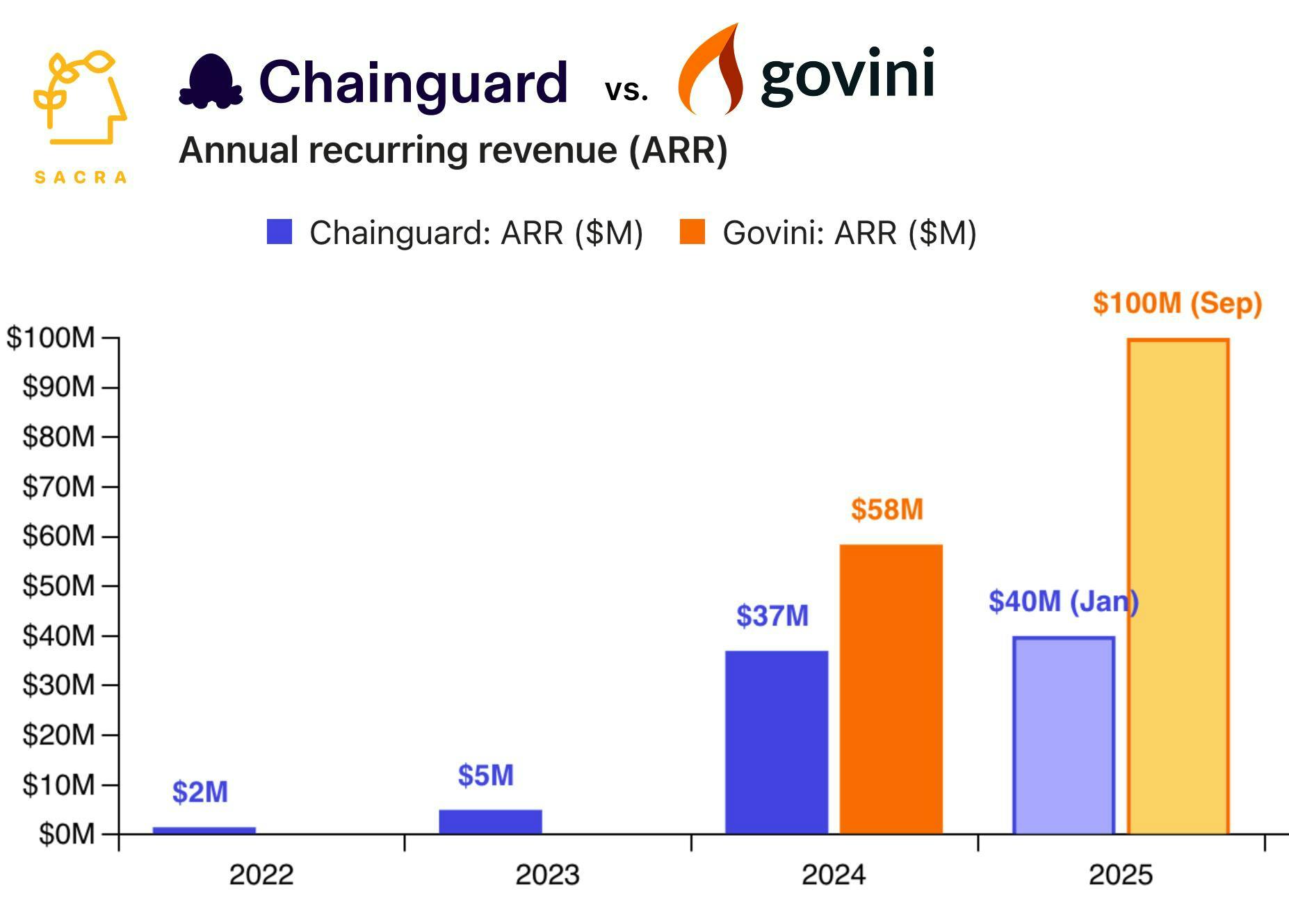

- Supply chain independence became a key issue post-COVID when it became clear how federal agencies were dependent on China for critical components, with Sacra estimating that Govini hit $100M in annual recurring revenue (ARR) in October 2025, up from $58M at the end of 2024, raising a $150M growth round (Bain Capital) at a ~$1B valuation (10x revenue multiple). Compare to software supply chain startup Chainguard at $40M ARR as of January 2025, up from $37M at the end of 2024, valued at $3.5B for a 87.5x multiple, government data incumbent Palantir at $3.44B TTM revenue, up 20% year-over-year, valued at $426B for a 124x revenue multiple and defense tech leader Anduril at $1B revenue in 2024, up 138% YoY, valued at $30.5B for a 30.5x multiple.

- Awarded in April 2025, Govini's $919M government-wide Blanket Purchase Agreement gives any federal agency a pre-approved fast track to buy Govini in weeks vs. running a multi-year procurement process, effectively making Govini the default supply chain SaaS provider for the entire U.S. government just as Blue List procurement restrictions expand outwards from the DoD to all defense contractors (Oct 2024) to all federally funded agencies (late 2025). At the same time, Govini is expanding from back-office procurement analytics into real-time battlefield operations, with the U.S. Army now integrating Govini to power live inventory tracking, predictive demand planning & optimized resupply—a beachhead that opens up the potential for Govini to expand its contracts with the Navy & Air Force into their $100B+ annual budgets.

For more, check out this other research from our platform:

- $40M/yr Vanta for containers

- Chainguard (dataset)

- Saronic (dataset)

- Saildrone at $43M/year growing 231% YoY

- Saildrone (dataset)

- America First vs. American Dynamism

- Anduril (dataset)

- Anduril at $1B/yr

- SpaceX (dataset)

- Anduril, SpaceX, and the American dynamism GTM playbook

- The biggest mistake defense startups make

- Ross Fubini, Managing Partner at XYZ Capital, on the defense tech opportunity

- Shield AI (dataset)

- Scott Sanders, chief growth officer at RRAI, on the defense tech startup playbook