The future of Plaid's $250M screen scraping business

Rohit Kaul

Rohit Kaul

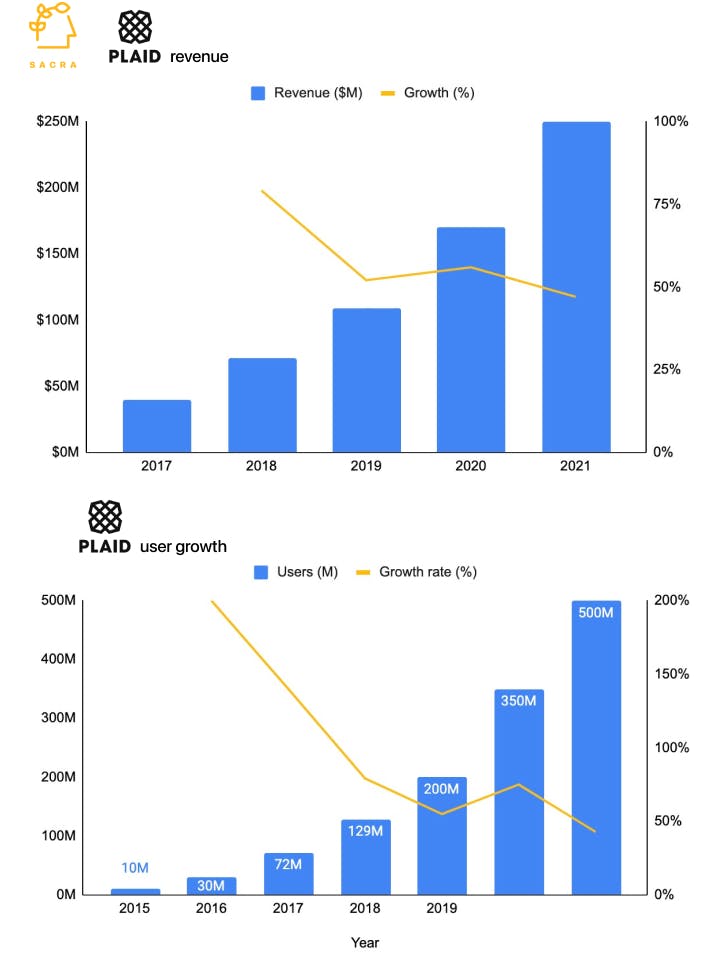

TL;DR: Plaid (dataset) indexed on the explosive growth of consumer fintech, growing 50% annually for the last 5 years and hitting $250M in revenue in 2021. But with data aggregation becoming a commodity, Plaid must now reinvent itself as a multi-product company. For more, check out our interview with Tony Xiao, founder of financial data aggregator Venice.

Get more private company metrics, insights, and analysis in your inbox.

Success!

Something went wrong...

- Plaid (2021 valuation: $13.4B) grew 47% in 2021 to reach $250M in revenue and crossed 500M+ connected bank accounts acting as a middleware for fintechs like Block (NYSE: SQ) and Robinhood (NASDAQ: HOOD) to connect to their customers’ bank accounts for moving money to their app or fast-tracking customer onboarding. Plaid made bank accounts programmable despite uncooperative banks by taking users' banking logins, scraping their account screens for their data, and exposing that data via API. (link)

- While aggregators like Yodlee (acquired for $660M by NYSE: ENV) pre-existed Plaid, Plaid’s Stripe-like pay-as-you-go pricing and easy-to-use documentation, compared with Yodlee’s annual fixed fee contracts and clunky documentation, got it immediate traction with young fintechs like Venmo (acquired by PayPal), Cash App, and Chime (2021 valuation: $25B). Plaid charges fintechs via monthly subscription SaaS with usage-based pricing for requests like connecting to their customers’ bank accounts, verifying balance in their accounts or getting historical transactions. (link)

- Plaid became a consumer brand—going beyond serving as a white-label account linking service—by putting its logo on the bank linking experience inside fintech apps, sitting in the middle of a 3-sided, Visa-like network of 500M customers, 11,000 banks, and 2,600 fintechs. Plaid indexed on the rapid growth of consumer fintechs, adding 500M bank accounts in the last 6 years, growing 90% annually, which attracted other fintechs who could easily onboard these large numbers of customers. (link)

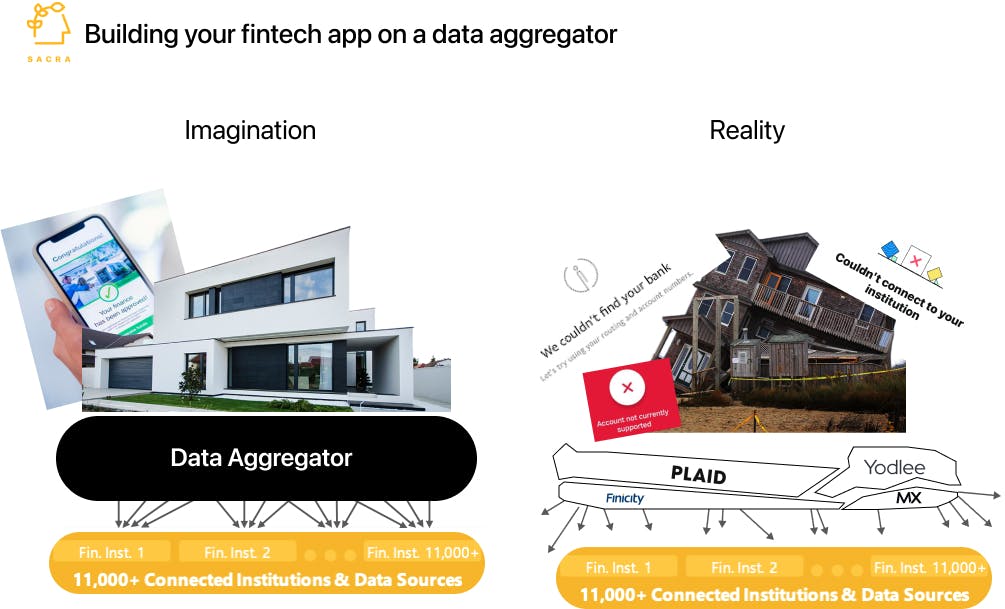

- In recent years, data aggregation has stagnated and become commoditized—the major players Plaid, Yodlee, Finicity (acquired by Mastercard for $825M) and MX (2020 valuation: $1.9B) build proprietary connections with only the top ~500 banks while outsourcing development to offshore software companies in India or reselling connections from other data aggregators for the long tail of 11,000+ banks. When Stripe entered the space with its data aggregator Stripe Financial Connections, it decided just to wrap and resell Finicity and MX. (link)

- Recent fintechs—like Ramp (2022 valuation: $8.1B), founded in 2019, which uses a combination of Finicity and Teller (Founders Fund, raised $11M)—often opt to use two or more providers to build for optionality and redundancy to deal with the threat of vendor lock-in and the high 40% instance of bank connections failing. When using multiple aggregators, developers spend 20% to 30% of their time building and maintaining customizations, multiplexers, and retries rather than building new features. (link)

- To discourage screen scraping, large banks like Capital One (NYSE: COF) and Wells Fargo (NYSE: WFC) offer APIs to Plaid but surface bare minimum information like 90 days transaction history without any metadata, reducing Plaid’s data quality compared to what it pulled through screen scraping. Furthermore, these banks have contracts with Plaid’s competitors as well, denying Plaid the ability to differentiate on the exclusivity of connections. (link)

- Plaid’s pricing power is limited, given its bank coverage and data quality are as good or bad as other aggregators, capping the returns it can get from building up to its scale of 500M customer accounts. Plaid is valued at $27 per linked account, while payment network Visa is valued at $125 per card and Mastercard (NYSE: MA) at $142, even though all three make money by charging a tax on bank transactions. (link)

- Early stage startups offer different spins on data aggregation, like Teller, which only uses bank APIs, Front API (raised $6M), which works across assets like crypto, and Venice, which offers a universal API of data aggregators. Plaid, Yodlee, and MX et al's issues with data quality and reliability have driven fintechs towards services that can promise better data aggregation for specific types of assets or use cases. (link)

- Plaid’s leading install base of 2,600 fintech customers and 500 million linked bank accounts—representing 40% of US bank account holders—gives it the opportunity to bundle and sell in a family of products for income and payroll verification (Income and Deposit Switch) and ACH payments (Signal, Guarantee, Identity Verification, and KYC monitor). On payroll APIs, Plaid goes up against Pinwheel ($500M), Argyle (raised $77M), and Atomic (raised $68M) which have made headway with leading neobanks and fintechs. (link)

- Plaid is moving deeper into the data aggregation value chain by giving fintechs not just a dump of banking transactions, but enriched and structured data, e.g., SKU-level information for each transaction, so they can see e.g. the actual name of the merchant—Walmart vs. Netflix—and type of transaction: one-off vs. recurring subscription. This makes it easier for fintechs to build personal finance management features into their apps to help their customers better understand their account statements and manage their financial health. (link)

- Plaid’s big bet is to become a Visa-like mediator of a modern Account-to-Account payment network powering the fintech ecosystem—built on ACH, not credit—by making ACH payments faster and safer through new products like Signal (fraud risk assessment) and Guarantee (100% promised funds). Plaid aims to attract merchants to its ACH network through its fintech customers like Block (2M+ merchants) by leveraging ACH’s much lower processing fee than cards to build a frictionless payment experience via customer accounts linked with Plaid.

For more check out our full interview with Tony Xiao, founder of Venice, our coverage of Plaid, its dataset, and this other research from our platform.

- Jeremy Zhang, CEO of Finch, on building a universal API for employment systems

- Karim Atiyeh, co-founder and CTO of Ramp, on the future of the card issuing market

- Bo Jiang, co-founder and CEO of Lithic, on the key primitives in card issuing

- Aaron Huang, Head of Commercial at Productfy, on choosing the right fintech customers

- Peter Zhou, CEO of Rutter, on building the Plaid for ecommerce

- Banking-as-a-Service: The $1T Market to Build the Twilio of Embedded Finance [2021]