We’re thrilled to announce this week’s exclusive with Julia Lipton, founder and managing partner of Awesome People Ventures! Julia previously founded Soundboard, an advising firm which she helped act as a soundboard to Silicon Valley CEOs, helping them with everything from venture funding, to launching products, to getting acquired. Prior to launching Soundboard, Julia led growth and product teams at companies like OneMedical and Quixey. Awesome People Ventures is backed by Marc Andreessen, Tom Lee (founder of One Medical) and top founders and operators, and aims to invest in awesome companies across human health and happiness. Their existing portfolio includes companies like On Deck, neo.tax and Superpeer. As a founder, operator and now investor, we sat down to talk about:

- How the pandemic has changed deal flow ⏩

- Awesome People Ventures: why they’re on a mission to improve human health and happiness 🌏

- Her decision making framework for vetting decks ✅

- How Awesome People Ventures set up their back office 🖥

- Cap table advice ⼏

TCT: You’re the founder of Awesome People Ventures, an early-stage fund focused on world positive investments that is backed by Marc Andreessen, Chris Dixon, David Ulevitch and other top founders and operators. You’re almost 2 years in as a first time fund manager; what has been the most memorable moment, as well as the biggest surprise/challenge to date?

When I was angel investing I didn’t feel pressure to see every deal. I was just investing in friends and friends of friends. As a fund manager, I feel a fiduciary responsibility to get into the best deals.

The fast deal velocity and allocations wars in early-stage VC can be challenging. I review 100s of decks a week. Deals are happening faster than ever. Pre-pandemic, commute times and in-person meetings, naturally curbed deal velocity. In a Zoom world, founders can stack 20 meetings a day -- and deals travel fast.

Angels and VCs are trying to meet founders as early in their founder journey as possible — often before the company has an LLC. For companies with strong networks, rounds can happen in < 48 hrs. As a VC, if you don’t already know the founder, you may not get in. It’s nuts out there! Multiple times a week I hear, “we just started raising and our rounds is 2x oversubscribed.”

On a funnier note, one big surprise was pitching Marc Andreessen. He printed out my slide deck and took notes on the paper printouts. On my portfolio slide, he circled MEM. a16z ended up leading their Seed round a year later. Two of my six investments on that portfolio slide weren’t software. When I was pitching, all I could hear was Marc’s voice in my head saying “software is eating the world.” Notably, I primarily invest in only software now :)

“In the last hundred years, our society has not evolved as fast as our technology…. In the coming years, our society’s relationship to wellness and work will evolve dramatically as the next generation of founders build amazing companies that solve the most complex problems of our time - problems of human health and happiness.” - *APV’s mission statement

What’s a good example of how Awesome is executing on this mission, and what trends are you most excited about tackling in 2021?

Levels is a good example of a company executing on this mission. We’re still living in the dark ages of healthcare. Most people have no idea what’s happening in their bodies at any given time. Levels allows you to see how everything you eat impacts your glucose, and in turn, your mood, sleep, weight, energy, and risk of disease. Ultimately, they’re building a personalized software insights layer that will extend into the healthcare system. This video from our 2019 annual report covers this well.

How would you describe your operating style?

I’m constantly trying to balance being effective, efficient, giving, and compassionate. Part of my personal mission in VC is to show that I can generate top tier returns, while being a good person. What most people don’t know from Twitter is I’m extremely disciplined, numbers oriented, and care a lot about business first-principles. I’d describe my style as a blend between compassionate and hard driving.

You see hundreds of pitch decks every week. What’s your decision making process for vetting these ideas, and what does your funnel look like for this?

When a deck lands in my inbox, here’s my thought process:

- Do I invest in this industry? undefined

- Depending on the industry, would I invest in a company at this stage? If a company is too early or too late, I don’t want to waste the founders’ time. undefinedundefined

- Do I believe this is a $B+ (billion dollar plus) opportunity? undefinedundefined

- Do I believe in this approach? I’m always looking for a unique insight and unseens inflection point. undefined

- Does the team seem credible? undefined

- What additional info would I need to decide whether or not to take a meeting? undefined

You recently invested in On Deck’s $20M Series A. What excites you most about their vision of being the Stanford of the internet, and how do you see this changing venture and tech ecosystem?

There are 3 trends related to On Deck that I think are super exciting:

- The decline of traditional higher education is giving rise to new models — The top U.S. colleges were all founded 200+ years ago, established to train citizens for the industrial-era. We’re seeing a new wave of education institutions for the post-industrial era. The next big winners in education will be virtual-first and bundle curriculum and community.

- Continuous education is the future - The average person changes careers every 5 years. The future of education will grow with people throughout their careers and help them achieve their goals -- whether that start a company (On Deck Founders fellowship), uplevel in their jobs (On Deck Designers), or practice a very tactical skill (On Deck Speaking).

- Remote work as the new norm — On Deck is "Silicon Valley in the Cloud.” Particularly among the tech industry, it's become clear that location will become less important. Having access to high-quality talent globally is a tremendous advantage for founders, investors, and employees.

How do you define success in terms of fund performance? How often do you calculate fund performance?

The best funds 3x-5x+. Success is being in the top 10% of funds. I try not to calculate my fund performance because returns often take ~10 yrs to shake out. That said, I check my markups and IRR more often than is rational (artifact from my days running growth and revenue teams!).

What was your first 100x/10x and how did you get into that deal?

These deals haven’t exited yet, so it’s too early to call them wins -- and certainly don’t want to jinx them. All my 10x+ markups have come from friends who invited me into the deal. They wanted me involved based on my growth background or experience in healthcare and wellness.

How do you stay organized with your investments (managing notes and SAFEs, pipeline, etc)?

This is a constant work in progress.

Sign Up Today!

To get these right in your inbox

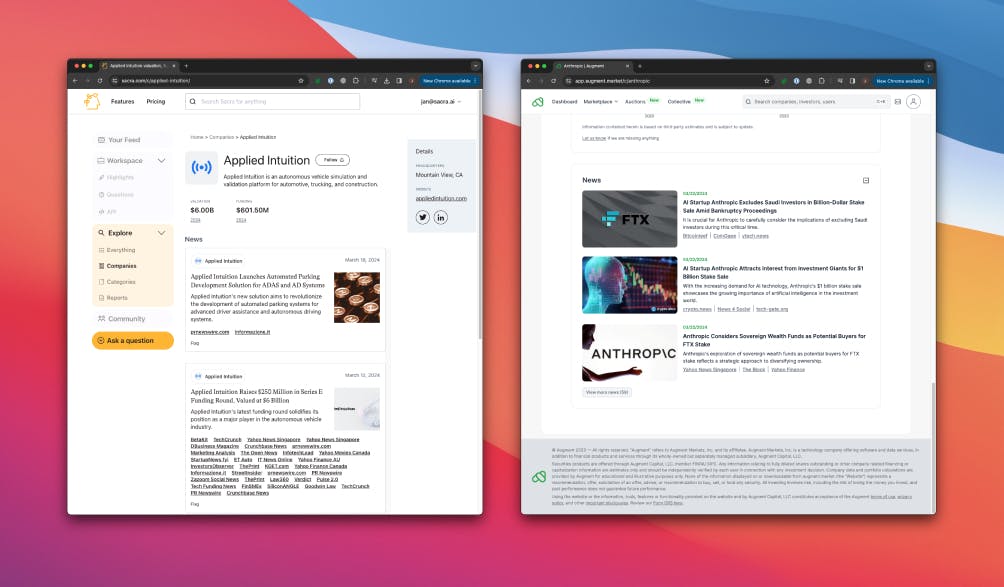

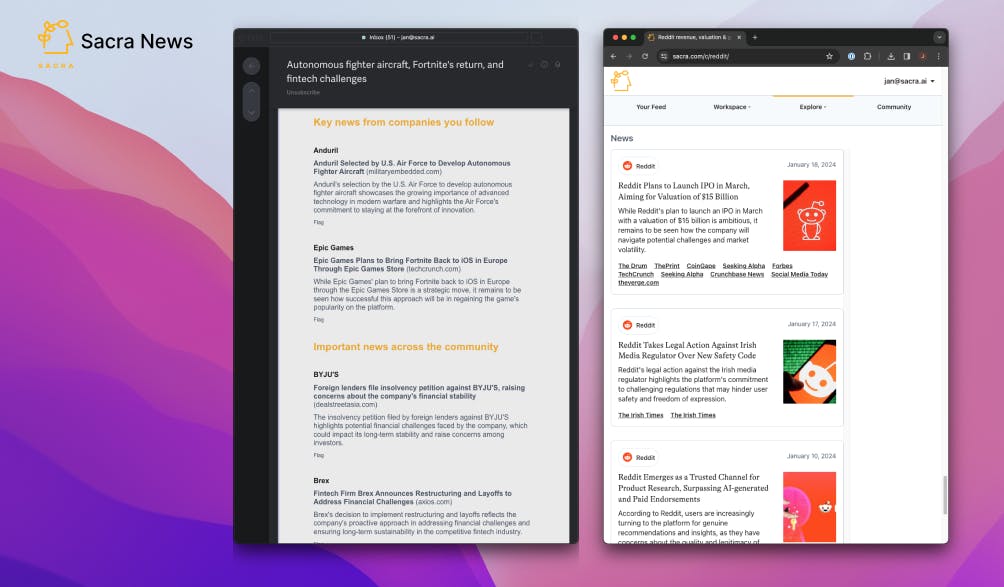

Back office - AngelList runs my back office, admin, and legal. I could have never started a fund without them. I don’t think they get enough credit for the proliferation of micro funds and emerging managers. Before AngelList, legal, set, and admin fees were so high that it wasn’t feasible to set up and run a micro fund.

Notes - I start the day by reading my pre-brief meeting notes in Mem. Mem is my note taking tool of choice. I invested in the pre-seed and seed. My EA in the Philippines gets all the credit for preparing them while I’m asleep. We use standard templates for new company meetings, new talent meetings, and other meetings The other meetings template is the simplest and includes: name, date, action items, overview, content from last email. Each person’s name is linked to a name page. Each name page has the person’s: name, type (Founder, Talent, VC/Angel, LP, Team), Linkedin URL, company name, company website, job title, deck (if applicable), portfolio (if applicable), referral, first intro email, links to all meeting notes.

Database - This is a major WIP. When a new deal comes into my inbox I label it “New Deal.” That triggers a zap to create a new deal in Airtable. From there, a team member in the Philippines augments the data by adding industry, stage, founder LI, etc. It’s a little unwieldy given that we can get 10+ deal referrals a day.

The goal is for Airtable to be the source of truth and help us make relevant angel and talent intros for founders. We have Airtable automations set up to send deals to people on founders’ wish lists. That said, we’re still working on this workflow. Admittedly I find myself doing a lot of the matching manually.

What’s your secret for getting on the cap table?

Honestly, just being a nice, genuinely helpful person.

We also make 🔥 intros to people in the awesome people community. Last year I made over 1,000 intros - including co-founders, VCs, and talent.

What’s your biggest cap table “mistake”?

I won’t name company names, but my worst investments fall into 2 categories:

- Didn’t trust my gut

- Slow teams

When possible, I try to spend time with companies before investing to get a sense of their shipping velocity and ability to navigate from 0 to 1. There are other hacks for this, like asking for past investor updates or seeing what they’ve shipped week over week for the past month.

I’ve also made the mistake of investing into hot rounds or co-investing with top tier leads when I didn’t truly believe.

I hope I never make either of these mistakes again.

What changes would you like to see across the venture ecosystem?

I think venture is one of the most old school broken industries of all time. The good news is it’s evolving fast. The days of old school institutional LPs funding a few old school VCs funding a narrow set of founders, are numbered. We’re seeing more diversity across founders, capital sources, and round composition. I’m specifically interested in the rise of SPVs, angel only rounds, founders-backing-founders, party rounds with customers, etc. This breaks the old school institutional chain above.

In the startup world today, GPs and founders make almost all of the money. The rest of the startup ecosystem doesn’t see upside proportional to their work. In an ideal world, value creation, attribution, and distribution would align. I’m working on some stealth related projects for Awesome People Ventures fund 2.

What are you passionate about outside of work?

Spending as much time as possible in a state of awe and appreciating life. This translates to spending time alone in nature, traveling, dancing, doing yoga, swimming, and walking. Life is such a gift.

Follow Julia on Twitter (@JuliaLipton) for more insights into angel investing, fundraising, and all things startups!