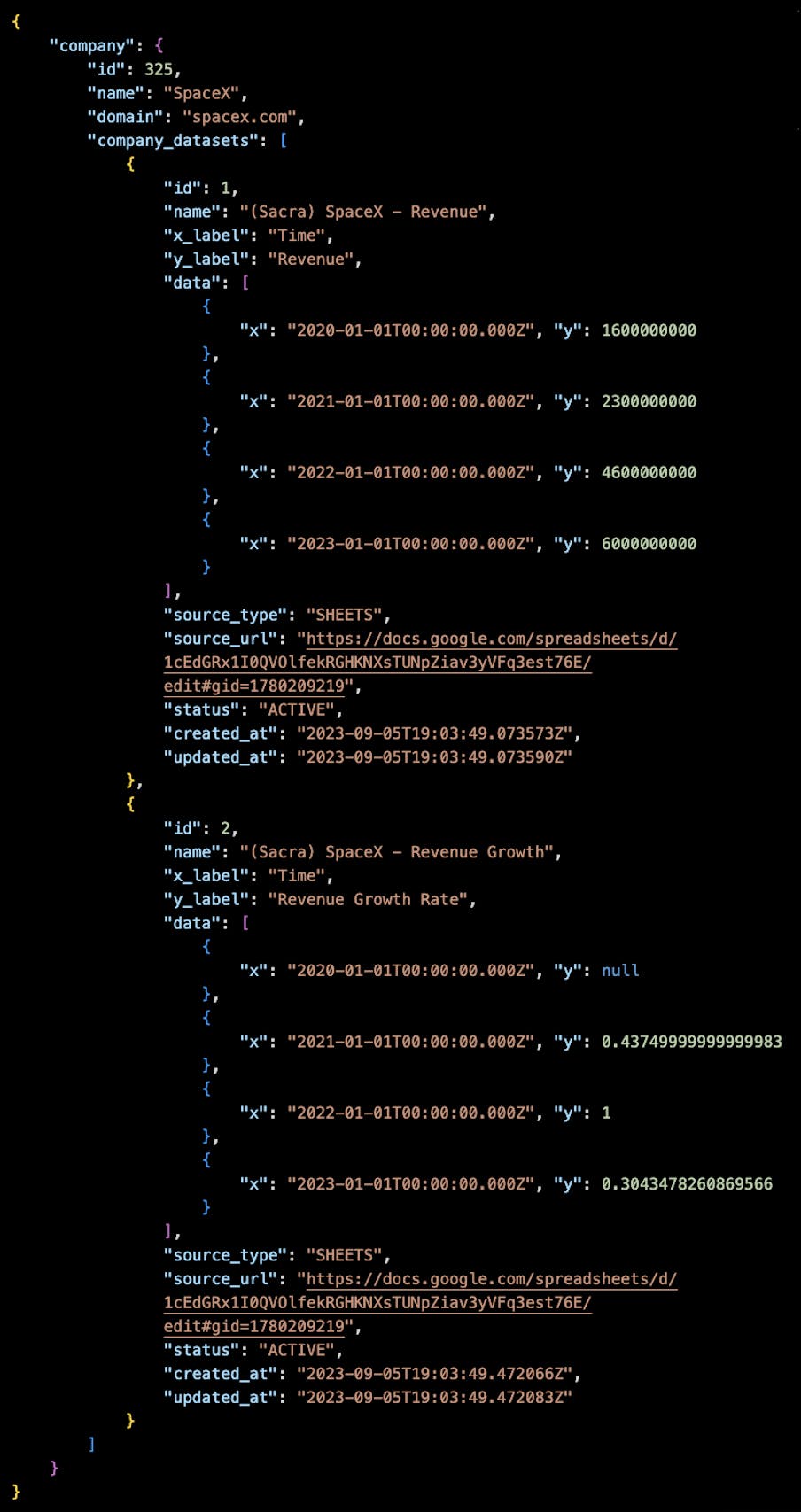

Sacra revenue data on startups, growth and pre-IPO companies is now available via our API. We cover roughly 60 companies like SpaceX, Gusto, Ramp and more.

Just pass in the company domain, e.g., spacex.com, to our Company API and you'll get the following response including time series revenue data:

We're excited to bring startup revenue data into every investing app, finance research & news app, employee compensation & option exercise app and more.

To get started on our API, email us at [email protected].

Private company data in every app

Historically, it's been hard to impossible to know how a startup is performing. That's made it harder for investors and employees to join startups and participate in the innovation economy.

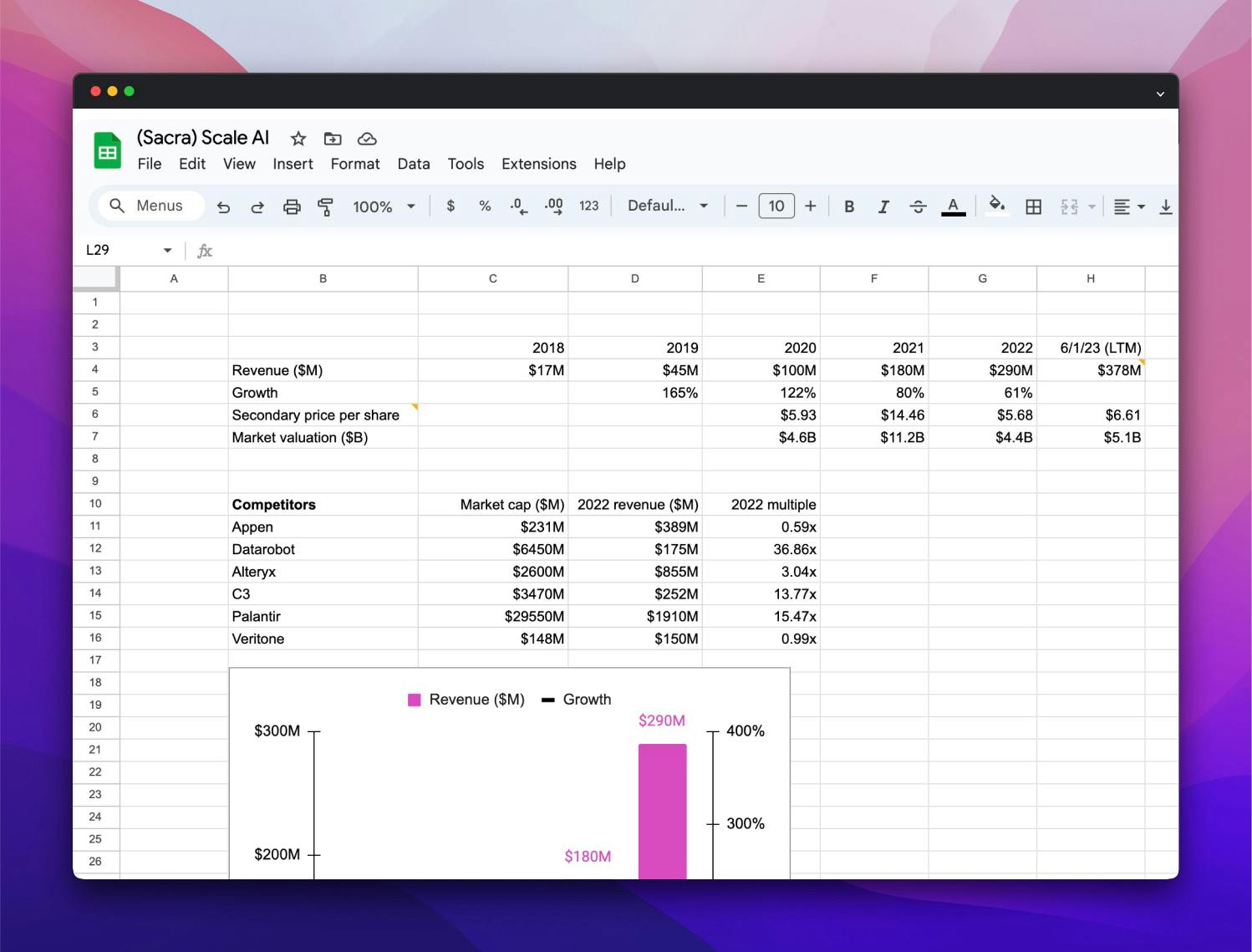

We started Sacra to change that. Over the course of the last 2 years, we've launched reports on Flexport, Scale AI, Databricks and Figma where we've sourced revenue data and built revenue models to estimate private company numbers.

We started to hear from our customers that making revenue numbers available made for a good first step, but they also wanted revenue numbers to be accessible, particularly programmatically via API.

That's why we decided to incorporate revenue data into our Company API—to bring startup revenue data into every investing app, finance research & news app, employee compensation & option exercise company and more.

We'd love to chat about your use case. Just email us at [email protected].

Sacra revenue data with Caplight pricing data

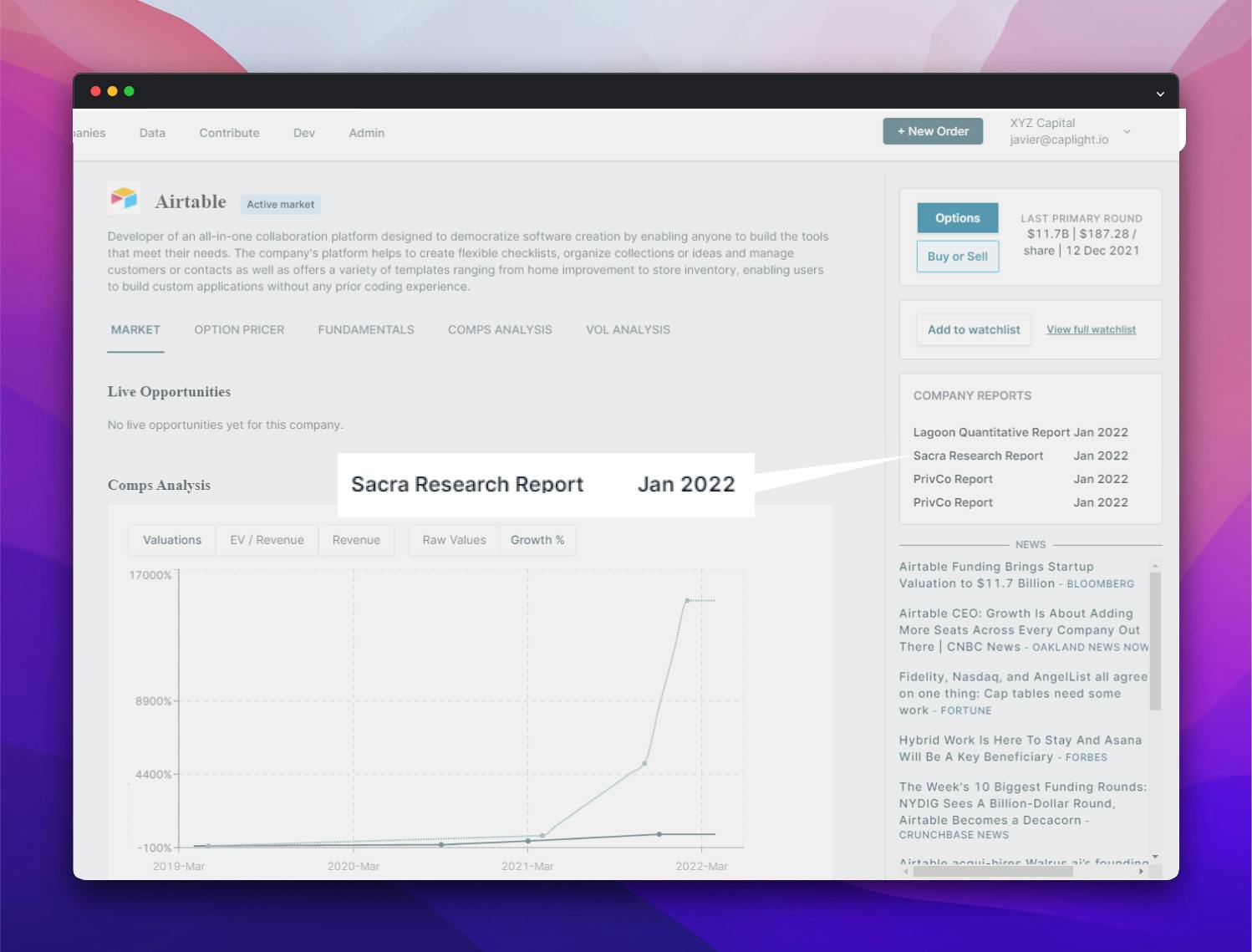

Caplight, a leader in private markets investing for institutional investors, uses Sacra research in its app.

Instead of merely serving a trading venue, Caplight offers research, data, tools and more to engage and educate investors, building relationships and trust with institutional investors so that Caplight becomes the natural place to trade.

When a Caplight investor wanted a list of pre-IPO companies trading in the secondary market at 5-10x at enterprise value to revenue to firm up their bid orders, Caplight turned to Sacra revenue data.

It combined its real-time pricing data with Sacra's revenue data to calculate EV/Revenue ratios for the companies available to trade on its platform—values previously unavailable to private markets trading venues.

As Javier Avalos, co-founder and CEO at Caplight told us, "Private market investors deserve consistent and reliable data to support their investment decisions. For decades, access to this data has been reserved for the small handful of insiders, making it difficult for the wider universe of institutional investors, brokers and accredited investors to gain the market intelligence necessary to participate in private market investing."

"Sacra is changing that dynamic by building robust research reports on private companies, including top-down looks into sector trends that drive private company success and bottom-up analysis of how individual private companies are faring."

Talk to us

Our mission is to bring more participation in private markets through research, analysis and data.

We'd love to chat with you about your use case for our API. Just email us at [email protected].