Volume 3: inspired by a lollipop

Remember when your parents used to drag you to the bank? The long lines, the suits, the stuffy atmosphere.

You know what made it tolerable?

The free lollipop the teller gave you.

A simple value add that made your experience at the bank that much more pleasurable.

Alex Adelman doesn’t just remember this experience.

It was the inspiration for him and Matt Senter to launch Lolli, a rewards application that allows users to earn “free” bitcoin when shopping online.

A new kind of “banking” experience that he’s betting big on.

Lolli recently closed an oversubscribed $3m seed-II funding round on Monday, May 11th (coincidently on the day of Bitcoin’s third “halving”).

The @trylolli team and I are excited to announce the close of our oversubscribed $3 million Seed funding round led by @FoundersFund.

— §Alex Adelman 🍭 (@alexadelman) May 11, 2020

Other strategic investors include @MichellePhan, @aplusk & @guyoseary's Sound Ventures, @Craft_Ventures, and more.https://t.co/stx5hAIUq8

For this week’s exclusive we’ll dive into Alex’s background, Lolli’s Cap Table, and the massive opportunities ahead for Bitcoin.

Background:

A Charlotte native, Adelman went on to attend UNC-Chapel Hill before graduating with a degree in economics. He then ventured to NYC where he went on to co-found his first company, Cosmic Cart, with Matt Senter in 2014. Cosmic Cart first launched at Disrupt NY Battlefield with the goal of creating a “universal shopping cart” that would allow companies to sell their goods anywhere online. Cosmic Cart caught the attention of publishers (as well as consumers), making it easier than ever to buy and sell items online. Cosmic Cart was then acquired by POPSUGAR in 2016 (later acquired a second time by Ebates). Talk about a great checkout process.

The Inspiration for Lolli

Shortly after, Adelman and Senter teamed up once again to tackle a new consumer phenomenon on the rise: Bitcoin.

“We strongly believe in bitcoin’s power as a global alternative currency and universal store of value and want to share it with the world.”

-Lolli website

But, they faced two massive hurdles: mass adoption and education.

In order to make this work, they would need to tackle both issues at once:

- Make it easy for people to acquire Bitcoin

- Educate consumers on the power behind Bitcoin

Not to mention, this has to be scalable on both fronts.

How could they achieve this? By recreating that same lollipop experience at the bank. Out of this idea, Lolli was born in March of 2018.

Once you download the Lolli extension on your web browser, you can start shopping online and receive up to 30% back in Bitcoin rewards. They are making it easy to access Bitcoin (for free), while educating the market on the power behind the crypto currency. They have 500+ retail partners on their website, including Nike, Expedia, Postmates and more.

Their new funding round will help Lolli launch a mobile app this summer and expand internationally.

Who’s on the Cap Table?

Lolli Investors - Seed II - May 11th, 2020 (via Crunchbase)

Version One Ventures (Partner: Angela Kingyens)

Sound Ventures (Partner: Maaria Bajwa)

Pir Granoff

Pathfinder (Lead Investor)

Michelle Phan

Guy Oseary

FJ Labs (Partner: Fabrice Grinda)

Digital Currency Group

Craft Ventures (Partner: Jeff Fluhr)

Company Ventures

Chapter One Ventures

Bain Capital Ventures

Adam Leber

Abe Burns

Congrats, Alex and team. Excited to watch Lolli (and Bitcoin) grow.

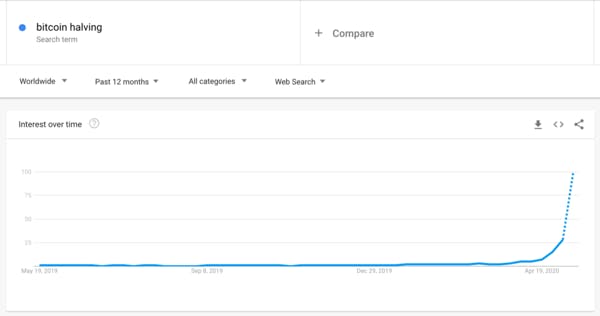

The Bitcoin opportunity ahead

In case you muted “Bitcoin” on Twitter, the third Bitcoin “halving” occurred on Monday, May 11th. This means that the number of new bitcoins entering circulation every 10 minutes has dropped by 50% (now 6.25, down from 12.5). It’s kind of a BFD because if demand remains strong, (while supply remains limited) the price should change. This “halving” event happens every 4 years until the last halving in 2140.

via: Google Trends

The last Bitcoin halving was in July 2016, when Bitcoin was ~$650/coin. Over the next 17 months, Bitcoin went on a tear, reaching an all-time high of $20,000 per coin in late 2017. Will we see a similar parabolic bull run this time? Time will tell.

Who’s accumulating Bitcoin?

via: https://decrypt.co/28396/grayscale-holds-3-7-billion-and-its-nearly-all-bitcoin

Paul Tudor Jones, an American hedge fund manager, has 2% of his financial portfolio in #Bitcoin.

— Trust - Crypto Wallet (@TrustWalletApp) May 11, 2020

Sounds like he's ready for the #BitcoinHalving2020.

Slowly but surely, the urge to own #BTC and #crypto in general is spreading. pic.twitter.com/o5hjxIkz0e

Looking for the next Lolli?

Early stage Bitcoin and blockchain companies that we’re watching:

HQ: Redwood City, California

Founder: Alex Fedosseev

Latest Funding: $8.5M Series A announced on February 21st, 2020.

Surge signal: 860% monthly visits growth

Why we like it: blockchain powered platform that unified the values of data and advertising into an all-in-one engagement driven model. It claims to amplify your advertising campaigns 5x-10x compared to static banners.

HQ: Dallas, Texas

Founders: Alex Treece, Christopher Brown, William Dias

Latest Funding: $2.5M Seed Round announced on March 20th, 2020.

Surge signal: 298% monthly visits growth

Why we like it: API for connecting to any crypto exchange, wallet, protocol or account. With the rise of API-first builds, this will help usher in a new era of digital banking, lending, financial tracking and more across multiple platforms. Integrations with Coinbase, Binance, Gemini and more.

HQ: Draper, Utah

Founder: Austin Woodward

Latest Funding: $5M Seed Round announced on January 6th, 2020.

Surge signal: N/A website traffic

Why we like it: they are referred to as the “TurboTax” of crypto and have the software to back this up. The IRS has been vocal about reporting crypto transactions, and with the tax extension this year, they are ripe to see a spike in customers in the coming months.

That’s all for now, stay tuned for next week’s exclusive.

Data Sources: Crunchbase, SimilarWeb

The Cap Table is a resource to help you get, and stay, on the capitalization table.

What did we miss? Email us at [email protected]

Notable Deals 5/8-5/15

DEAL OF THE WEEK:

In last week’s edition we featured former CSO of Carta, Sumeet Gajri. This week, Carta takes the cake with a whopping $180mm raised, led by Lightspeed Venture partners

Series Seed

- Azul 3D raises $8,000,000 led by | Azul 3D is a 3D printing company that allows users to print 3D structures from a wide pallet of materials.

- Dyno Therapeutics raises $9,000,000 led by CRV, Polaris Partners | Dyno Therapeutics is a biotechnology company that uses artificial intelligence (AI) to gene therapy.

- Immunai raises $20,000,000 led by TLV Partners, Viola Group | Immunai is a biotech startup that developing a proprietary corpus of immune-centric human tissue analyses.

- Monument raises $7,500,000 led by Collaborative Fund | Monument is an alcohol addiction treatment platform for those looking to change their relationship with alcohol.

- Quartz Systems, Inc.raises $7,750,000 led by Baseline Ventures, Lemnos VC | Quartz identifies, tracks, and understands everything that moves on a construction site

Series A

- Briq raises $10,000,000 led by Blackhorn Ventures | Briq is a financial forecasting and data intelligence platform for the construction industry.

- Clyde raises $14,000,000 led by Spark Capital | Clyde is a platform that connects small retailers to insurance companies to launch and manage product protection programs.

- Kriya Therapeutics raises $80,500,000 led by QVT Financial | Kriya Therapeutics is a next-generation gene therapy company focused on designing and developing transformative new treatments.

- Morning Consult raises $31,000,000 led by Advance Venture Partners, Lupa Systems | Morning Consult is a technology company that offers global data intelligence & insights across business, economics, & politics.

- Northspyre raises $7,500,000 led by Craft Ventures | Northspyre is a cloud based intelligence platform.

- Parsec raises $7,000,000 led by Makers Fund | Parsec is a cloud gaming platform that allows gamers to play on their own machines remotely or access cloud gaming PCs.

- Pathology Watch raises $5,000,000 led by Rock Creek Capital, Springtide | PathologyWatch delivers an intuitive and easy-to-implement digital pathology solution for dermatologists.

- Quantum Motion Technologies raises $9,751,875 led by INKEF Capital | Quantum Motion Technologies is building a universal quantum computer in Silicon, using CMOS compatible processes.

- QurAlis raises $42,000,000 led by Dementia Discovery Fund, INKEF Capital, LS Polaris Innovation Fund, Mission BioCapital | QurAlis is a operator of a biotechnology company intended to discover and develop potential precision therapeutics for ALS.

- Resilia raises $8,000,000 led by Callais Capital Management, Mucker Capital | We help accelerate the formation process for new organizations, and ensure existing organizations execute their mission and drive results.

- SiMa.ai raises $30,000,000 led by Dell Technologies Capital | SiMa.ai is the machine learning company enabling high performance compute at the lowest power.

- Span.IO raises $10,000,000 led by ArcTern Ventures | Span.IO develops products to enable rapid adoption of renewable energy and deliver an intuitive interface for the home.

- Stellar Health raises $10,000,000 led by Point72 Ventures | Stellar Health empowers providers to deliver high-quality care through real-time notifications and meaningful incentives.

- Ten-Nine Technologies raises $5,000,000 led by i2E Management Company | Ten-Nine Technologies is develops breakthrough materials for the energy and chemical industries across a broad range of applications.

- Vise raises $14,500,000 led by Sequoia Capital | Vise is an AI-driven portfolio management platform built and designed for financial advisors.

Series B

- Carbon Health raises $28,000,000 led by Data Collective DCVC | Carbon Health is a tech-enabled healthcare company that transforms the primary care and urgent care experience.

- FortressIQ raises $30,000,000 led by M12, Tiger Global Management | FortressIQ defines security, insights, and governance in enterprise business automation and AI.

- GrowFlow raises $8,400,000 led by TVC Capital | GrowFlow is a customer-driven, B2B SaaS platform providing compliance, inventory management for cannabis and hemp businesses.

- Lilt raises $25,000,000 led by Intel Capital | Lilt is a company developing an artificial intelligence-powered enterprise language software.

- Liongard raises $17,000,000 led by Updata Partners | Liongard unifies and automates the management and protection of modern IT environments at scale for MSPs and Enterprise IT Operations.

- MemVerge raises $19,000,000 led by Intel Capital | MemVerge is an inventor of Memory-Converged Infrastructure (MCI)

- Nanit raises $21,000,000 led by Jerusalem Venture Partners (JVP), Rho Capital Partners, RRE Ventures, Upfront Ventures | Nanit is a startup developing smart baby monitor and sleep tracker devices.

- Paradox raises $40,000,000 led by Brighton Park Capital | Paradox Olivia is the AI assistant that allows you to focus on what you do best, while she focuses on candidate capture.

- Semperis raises $40,000,000 led by Insight Partners | Semperis develops enterprise identity protection and cyber resilience for cross-cloud and hybrid environments.

- Sleeper raises $20,000,000 led by Andreessen Horowitz | Sleeper is a sports platform intended for fantasy leagues and eSports.

- Traitify raises $12,318,200 led by JMI Equity | Traitify is a personality data company building the personality data genome for the employment marketplace.

- UpKeep raises $36,000,000 led by Insight Partners | UpKeep is a platform developed for technicians and maintenance workers that provides them with a computerized maintenance management system.

Doing More with Less: A Model for Growth in Economic Recession

Series C

- DigitalOcean raises $50,000,000 led by Access Industries | DigitalOcean provides a cloud to simplify app creation for new generations of developers — from individual developers to startups and SMBs.

- Pillar Biosciences raises $29,700,000 led by ORI Capital | Pillar Biosciences specializes in sequencing technology platform and proprietary data analysis toolkit.

- Quizlet raises $30,000,000 led by General Atlantic | Quizlet is a San Francisco-based company that uses activities and games to help students practice and master what they’re learning.

- SirionLabs raises $44,000,000 led by Avatar Capital, Tiger Global Management | SirionLabs is a provider of a SaaS enterprise contract management (CLM) platform for enterprises to manage the contracting lifecycle.

- Slice raises $43,000,000 led by Kohlberg Kravis Roberts | Slice transforms independent pizzerias with the tech, data, marketing, and shared services needed to serve today’s digital-minded customers.

- Tock raises $10,000,000 led by Valor Equity Partners | Tock is a cloud-based platform with flexible data structures that provide comprehensive restaurant and event booking services.

Series D

- Expel raises $50,000,000 led by CapitalG | Expel is a SOC-as-a-service platform that provides security monitoring and response for cloud, hybrid and on-premises environments.

- Rebag raises $15,000,000 led by Novator | Rebag is an online luxury handbag authority that rethinks the role of luxury in the secondary market.

Series F

- Carta raises $180,000,000 led by Lightspeed Venture Partners | Carta is building a global ownership management platform to help companies, investors, and employees manage their equity.