Revenue

$30.00M

2024

Funding

$47.80M

2025

Growth Rate (y/y)

200%

2024

Revenue

Sacra estimates Wander hit $30M in revenue run rate revenue in 2024, with a 30% month-over-month GMV growth rate.

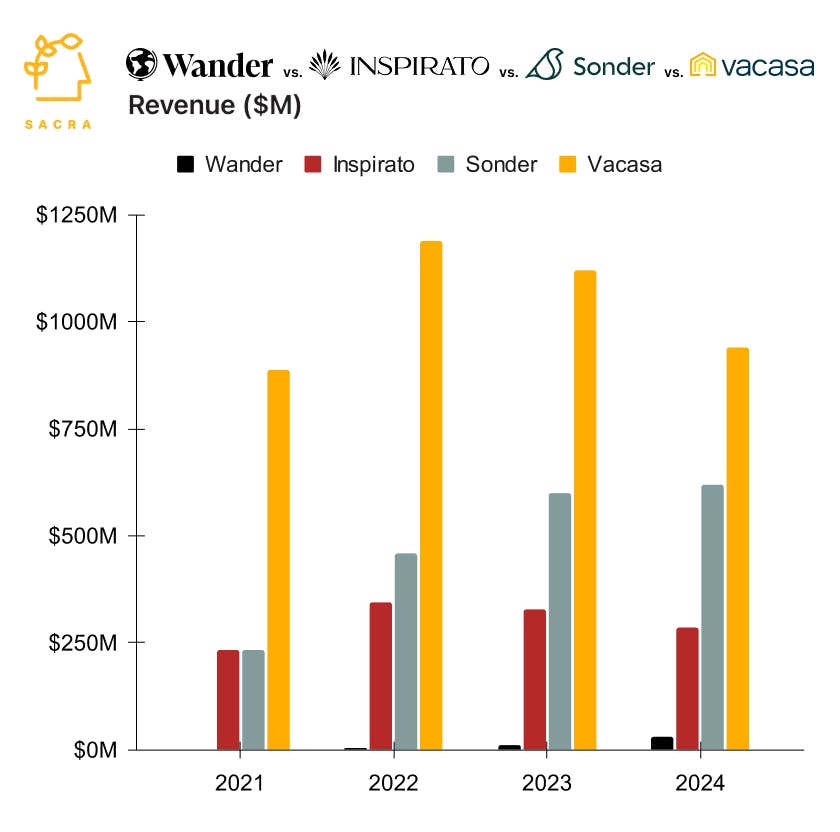

Compare to other vertically-integrated short-term rental competitors like Inspirato (NASDAQ: ISPOW) at $287M in TTM revenue (down 13% YoY), Sonder (NASDAQ: SOND) at $620M (up 3% YoY), and Vacasa (NASDAQ: VCSA) at $940M (down 16% YoY), which have struggled with profitability amid declining occupancy rates (Vacasa, ~40%), low revenue per available room (Sonder, ~$150) and high operating costs (Inspirato, 25% gross margin in 2023).

Wander's Eastern region properties generate roughly approximately $129,000 more in annual revenue per property than competitors, achieving 68% higher ADR ($1,028 vs $613). Western region properties generate $22,000 more in annual revenue than market averages, with an ADR of $823. A Hudson Valley case study showed Wander RevPAR of $860 versus market average RevPAR of $187 (+359% outperformance).

Revenue is primarily generated through a 10% service fee to guests (vs Airbnb's 13%) and management fees of 25-30% depending on the operating model. The company maintains 80% direct bookings through Wander.com, reducing OTA commission expenses. Properties average 78% occupancy rates versus competitors' 49%.

While gross margins are estimated between 50-60%, Wander likely operates at a net loss as it invests in growth.

Valuation & Funding

Wander has raised approximately $47 million in total funding since its founding in 2021. The company secured a $20 million Series A round in 2022 led by QED Investors, with participation from Redpoint Ventures and Authentic Ventures. A previous $7 million seed round included investments from Redpoint Ventures.

Product

Combining the visual, Instagram-native appeal of Airbnb (which hired professional photographers to enliven vacation rental listings) with the consistency of the hotel experience, Wander launched in 2021 as a vertically-integrated vacation rental company that acquired $2-3M, architecturally-unique properties in vacation hotspots (Big Sur, Joshua Tree), converted them to luxury rentals with hotel-grade amenities and monetized them with a 12% guest fee (compared to Airbnb’s 14%).

A consumer marketplace on the front end, on the back end, Wander acquired properties through its Wander Atlas REIT to fund acquisitions ($18M raised, ~7 homes), with another Wander subsidiary responsible for owning, renovating, managing, and eventually selling the properties (targeted 8% annual return).

Guests book through Wander's mobile app, which provides complete control over their stay experience. The app enables contactless check-in, smart home controls for lighting and temperature, and Tesla vehicle access for local exploration. Properties are equipped with dedicated workstations and enterprise-grade WiFi to accommodate extended "workcations."

Wander differentiates itself through strict quality control and consistency. Each property undergoes extensive vetting and renovation to meet brand standards before joining the platform. The company provides 24/7 concierge support and maintains partnerships with local service providers to deliver hotel-like amenities. Properties are located in scenic destinations chosen for their combination of natural beauty and reliable infrastructure to support remote work.

The platform has expanded to include Wander Team, a service targeting companies seeking locations for corporate retreats and team gatherings.

Business Model

To scale the supply side from 10 to now 330+ properties, Wander moved in 2023 from its asset-heavy approach to a fully-managed model where it lists and manages properties on behalf of property owners and monetizes through 20-25% revenue share.

Properties are standardized with smart home technology, premium amenities, and consistent branding. Each location includes a Tesla for guest use, high-speed internet, and dedicated workspaces. The company initially owned properties directly but has pivoted to an asset-light model where it partners with luxury homeowners, requiring $15,000-30,000 in property upgrades to meet brand standards.

Wander differentiates itself through its tech platform, which enables seamless booking and property management. The company drives 80% of bookings directly through Wander.com, reducing reliance on third-party platforms. Properties achieve 78% occupancy rates and command a 33.5% premium on daily rates versus competitors, averaging $900 per night.

Competition

Wander operates in the luxury short-term rental market, competing across both traditional hospitality and tech-enabled property management segments.

Traditional hospitality competitors

Four Seasons and Ritz-Carlton set the standard for luxury hospitality experiences, with consistent service quality and amenities. Marriott's Homes & Villas division specifically targets the high-end vacation rental market through partnerships with professional property managers. These established brands have strong loyalty programs and direct booking channels, with Marriott achieving around 50% direct bookings compared to Wander's 80%.

Tech-enabled property managers

Vacasa manages over 44,000 properties but targets a broader market segment with lower average daily rates ($287 vs Wander's $900). Sonder and Mint House focus on urban markets with apartment-style units. OneFineStay and Inspirato operate membership models for luxury properties but have faced challenges with supply exceeding demand. AvantStay targets luxury group travel with a $500 million fund for property acquisition.

Distribution platforms

While Airbnb and VRBO dominate overall vacation rental distribution, they function primarily as marketplaces rather than direct competitors. However, their Luxe and Premier Partner programs respectively target the same high-end travelers as Wander. These platforms typically charge 13-15% guest fees compared to Wander's 10%.

The competitive landscape is shifting as traditional hospitality brands expand into vacation rentals and tech-enabled managers struggle with profitability. Wander's vertical integration model - controlling properties, operations, and distribution - represents a different approach from both pure marketplace and traditional hospitality models.

TAM Expansion

The upside case for Wander is that by aggregating the supply of the top 1% of vacation rentals, they can drive predictable high-value bookings through their own channel (80% of bookings are direct vs. ~50% for Sonder), maximizing their pricing power (33% higher average daily rate than competitors) and funding the strong management services necessary to drive repeat business.

The challenge is that Wander’s differentiated supply of unique, remote properties makes it hard to drive efficiencies across cleaning, maintenance, and guest support—unlike regional/urban-focused providers which serve dense clusters of properties in close proximity.

Wander has tailwinds from the growing luxury short-term rental market and remote work trends, with opportunities to expand into adjacent markets like corporate retreats, real estate investment products, and international destinations:

Luxury vacation rental market

The global luxury vacation rental market is projected to reach $82 billion by 2031, growing at 13% annually. Wander's tech-enabled, vertically integrated model positions it to capture market share from both traditional hotels and inconsistent vacation rentals. Their properties already generate 60% more annual revenue than competitors, demonstrating strong product-market fit in the luxury segment.

Corporate retreat and group travel

The launch of Wander Team targets the growing corporate off-site and retreat market. As companies embrace remote and hybrid work, demand for unique team gathering spaces continues to rise. Wander's combination of reliable WiFi, dedicated workspaces, and luxury amenities makes their properties ideal for this use case.

Real estate investment platform

Through Atlas REIT, Wander has created a new investment vehicle for accredited investors to gain exposure to the short-term rental asset class. This opens up additional revenue streams beyond property management fees. The platform could expand to offer different investment products and tiers, similar to how Pacaso has evolved in the fractional ownership space.

Geographic expansion

While currently focused on U.S. coastal markets, Wander has significant room for international growth. The company plans to expand into Mexico and Canada by early 2025, with potential for further expansion into European and Asian luxury destinations. Their standardized operating model and technology platform can be replicated across new markets while maintaining consistent quality.

Risks

Asset-light transition challenges: Wander's pivot from owning properties to an operator/franchise model introduces significant execution risk. While this shift reduces capital requirements, it could weaken quality control and brand consistency that have been core differentiators.

The transition requires building new capabilities in property owner relations and maintaining standards across a more distributed portfolio. Success depends on convincing high-end property owners to adopt Wander's model while maintaining the premium guest experience.

Luxury market concentration: Wander's focus on ultra-premium properties ($900+ ADR) in select markets creates vulnerability to regional economic shifts.

Their 33.5% ADR premium over competitors could become unsustainable in a downturn, particularly as they expand into new markets. High fixed costs in luxury service delivery could squeeze margins if occupancy rates fall from their current 78% level.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.