Revenue

$130.00M

2021

Valuation

$2.00B

2021

Growth Rate (y/y)

277%

2021

Funding

$367.00M

2021

Valuation: $2.00B in 2021

Note: Revenue, growth rate and valuations estimated using publicly available information. Size of bubble indicates valuation.

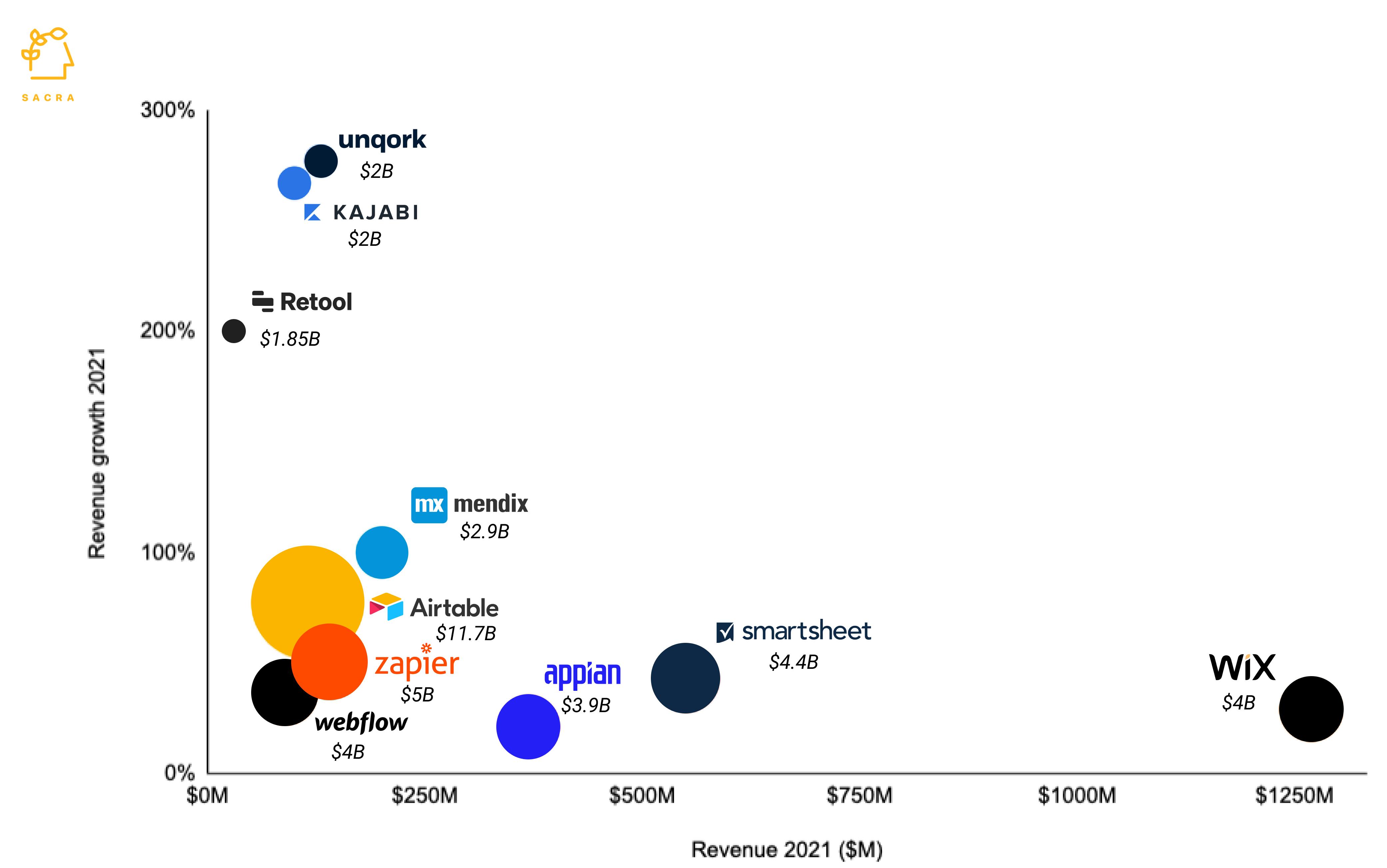

Unqork has raised $367M from investors like BlackRock, Goldman Sachs, and CapitalG. It was last valued at $2B, and we estimate its valuation to revenue multiple at 15x. This is similar to other enterprise no-code companies such as publicly listed Appian at 11x and privately held Mendix at 15x. Airtable (102x), Webflow (44x), and Zapier (36x) have much higher multiples that reflect the higher percentage of SaaS revenue compared to professional services revenue in their top-line.

Scenarios: $2.7B to $46.6B ARR by 2026

To evaluate Unqork's potential future value, we've analyzed multiple scenarios based on varying growth rates and revenue multiples through 2026. These projections consider different market conditions, company performance factors, and industry comparables to estimate possible valuation outcomes.

| 2021 Revenue ($M) | $130M | ||

|---|---|---|---|

| 2021 Growth Rate (%) | 277.00% |

Unqork demonstrated remarkable revenue performance in 2021, reaching $130M with an impressive 277% growth rate. This explosive growth reflects strong enterprise customer acquisition and increased digital transformation demands across key sectors like asset management, insurance, and banking.

| Multiple | Valuation |

|---|---|

| 1x | $130M |

| 5x | $650M |

| 10x | $1.3B |

| 15x | $1.9B |

| 25x | $3.2B |

Based on Unqork's $130M revenue, valuations scale from $130M at a conservative 1x multiple to $3.25B at an aggressive 25x multiple. The current 15x multiple placing Unqork at $1.95B aligns with industry peers like Mendix, while falling well below the multiples of pure-play SaaS competitors.

| 2026 Growth Rate | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 |

|---|---|---|---|---|---|---|

| 10.0% | $130M | $397M | $966M | $1.8B | $2.5B | $2.7B |

| 25.0% | $130M | $402M | $1B | $1.9B | $3B | $3.8B |

| 50.0% | $130M | $411M | $1.1B | $2.3B | $4B | $6.1B |

| 120.0% | $130M | $435M | $1.3B | $3.4B | $8.1B | $17.9B |

| 275.0% | $130M | $489M | $1.8B | $6.9B | $25.9B | $97.2B |

| 255.0% | $130M | $482M | $1.8B | $6.4B | $22.8B | $80.9B |

| 235.0% | $130M | $475M | $1.7B | $5.9B | $19.9B | $66.8B |

| 215.0% | $130M | $468M | $1.6B | $5.4B | $17.3B | $54.6B |

| 200.0% | $130M | $463M | $1.6B | $5B | $15.5B | $46.6B |

Revenue projections span from a conservative $2.7B at 10% growth to an aggressive $97.2B at 275% growth by 2026, reflecting various market adoption scenarios. The base case of 50% growth yields $6.1B, while maintaining current growth rates could push revenue above $46B.

| 2026 Growth Rate | 1x | 5x | 10x | 15x | 25x |

|---|---|---|---|---|---|

| 10.0% | $2.7B | $13.7B | $27.4B | $41.1B | $68.5B |

| 25.0% | $3.8B | $18.8B | $37.7B | $56.5B | $94.2B |

| 50.0% | $6.1B | $30.3B | $60.7B | $91B | $151.7B |

| 120.0% | $17.9B | $89.5B | $178.9B | $268.4B | $447.3B |

| 275.0% | $97.2B | $486.2B | $972.4B | $1458.6B | $2431B |

| 255.0% | $80.9B | $404.5B | $809B | $1213.5B | $2022.5B |

| 235.0% | $66.8B | $333.8B | $667.6B | $1001.4B | $1668.9B |

| 215.0% | $54.6B | $273B | $545.9B | $818.9B | $1364.8B |

| 200.0% | $46.6B | $233.2B | $466.4B | $699.6B | $1166B |

Valuation projections demonstrate significant range based on growth scenarios and multiples - from $2.7B at conservative estimates (10% growth, 1x multiple) to over $2.4T under aggressive assumptions (275% growth, 25x multiple). Mid-range scenarios suggest valuations between $30-90B assuming moderate growth and industry-standard multiples.

Bear, Base, and Bull Cases: 8.5x, 12.0x, 15.0x

To provide structured analysis, we've developed bear, base, and bull case scenarios that consider key factors affecting Unqork's growth trajectory and market valuation. These cases reflect varying market conditions, enterprise adoption rates, and industry multiples to estimate potential outcomes through 2026.

| Scenario | 2026 Growth Rate (%) | Multiple |

|---|---|---|

| Bear 🐻 | 50% | 8.5 |

| Base 📈 | 80% | 12.0 |

| Bull 🚀 | 100% | 15.0 |

Growth projections range from 50% in the bear case to 100% in the bull case, with corresponding multiples of 8.5x to 15.0x reflecting varying market sentiment. Even the conservative bear case assumes continued strong growth, while the bull case anticipates sustained momentum and premium market positioning.

| Bear 🐻 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 |

|---|---|---|---|---|---|---|

| Revenue | $130M | $411M | $1.1B | $2.3B | $4B | $6.1B |

| Growth | 277.00% | 215.95% | 163.50% | 111.05% | 77.06% | 50% |

| Base 📈 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 |

|---|---|---|---|---|---|---|

| Revenue | $130M | $421M | $1.2B | $2.7B | $5.6B | $10B |

| Growth | 277.00% | 224.02% | 178.50% | 132.98% | 103.48% | 80% |

| Bull 🚀 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 |

|---|---|---|---|---|---|---|

| Revenue | $130M | $428M | $1.2B | $3.1B | $6.8B | $13.5B |

| Growth | 277.00% | 229.40% | 188.50% | 147.60% | 121.10% | 100% |

Our bear, base, and bull cases for Unqork reflect different scenarios for market adoption and competitive positioning in the enterprise no-code space

- In the bear case: Unqork struggles to maintain its growth trajectory, reaching $6.1B in revenue with a 50% growth rate and an 8.5x multiple, resulting in a $51.6B valuation by 2026

- In the base case: Unqork successfully expands its enterprise presence to achieve $10B in revenue with an 80% growth rate and a 12x multiple, leading to a $120.1B valuation

- In the bull case: Unqork becomes the enterprise standard for no-code development, generating $13.5B in revenue with a 100% growth rate and commanding a 15x multiple for a $202.9B valuation.

| Scenario | 1. Bear 🐻 | 2. Base 📈 | 3. Bull 🚀 |

|---|---|---|---|

| 2021 Revenue | $130M | $130M | $130M |

| 2021 Growth Rate (%) | 277% | 277% | 277% |

| 2021 Multiple | 8.5 | 12.0 | 15.0 |

| 2021 Valuation | $1.1B | $1.6B | $1.9B |

| 2026 Revenue | $6.1B | $10B | $13.5B |

| 2026 Growth Rate (%) | 50% | 80% | 100% |

| Multiple | 8.5 | 12.0 | 15.0 |

| 2026 Valuation | $51.6B | $120.1B | $202.9B |

The uncertainty around these three cases depends primarily on Unqork's ability to differentiate in the crowded no-code market, maintain its enterprise market position, and execute geographic expansion while balancing growth with profitability in an increasingly competitive landscape.

- In the Bear case: Unqork struggles to differentiate itself in an increasingly crowded no-code market, with its enterprise-focused strategy proving too narrow as competitors offer similar drag-and-drop interfaces and security features at lower price points, leading to longer sales cycles and compressed multiples closer to typical SaaS companies.

- In the Base case: Unqork successfully maintains its enterprise market position by leveraging its strong presence in regulated industries like finance and insurance, while gradually expanding into new verticals and geographic regions, justifying multiples in line with established enterprise software companies.

- In the Bull case: Unqork's no-code platform becomes the de facto enterprise standard for application development, successfully expanding beyond the US into rapid-growth markets while moving downstream to capture mid-market companies with a self-serve model, all while maintaining its premium positioning in highly regulated industries.

These final valuations present a wide range of potential outcomes for Unqork. Even the bear case projects a substantial valuation of $51.6B in 2026, while the bull case at $202.9B would position Unqork as a major player in the enterprise software market.

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.