Revenue

$45.00M

2025

Valuation

$1.10B

2025

Funding

$15.45M

2019

Valuation: $650.00M in 2023

In March 2023, Substack launched an equity crowdfunding campaign on WeFunder to raise $5M at a $585M pre-money valuation and 30x multiple on $20M in TTM revenue, a flat round from their 2021 Series B led by Andreessen Horowitz where they raised $65M at a 102x multiple.

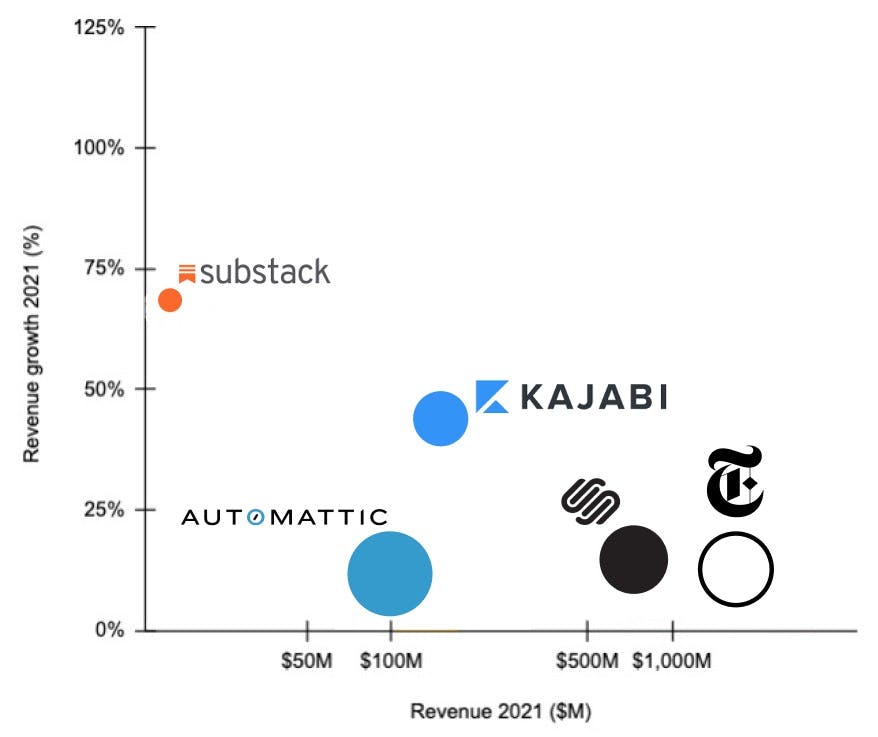

Compare that to the New York Times which is valued at $6.41B—about 2.8x on revenue of $2.31B, or The Athletic, which was acquired for $550M after doing $65M revenue in 2021 for an 8.5x multiple.

Scenarios: $79M to $406M ARR by 2028

To evaluate Substack's potential future value, we analyze scenarios projecting annual recurring revenue (ARR) through 2028, incorporating various growth rates and industry multiples. These projections consider both the company's current trajectory and comparable valuations in the digital media landscape.

| 2023 Revenue ($M) | $29M | ||

|---|---|---|---|

| 2023 Growth Rate (%) | 50.00% |

Substack's $29M revenue in 2023 reflects strong momentum with 50% year-over-year growth, though at a more modest pace compared to earlier years. This growth trajectory positions the company well in the digital media space, particularly among newsletter and content platform competitors.

| Multiple | Valuation |

|---|---|

| 1x | $29M |

| 5x | $143M |

| 10x | $285M |

| 15x | $428M |

| 25x | $713M |

Based on current revenue of $29M, valuations span from a conservative $29M at 1x to an ambitious $713M at 25x multiple. The higher-end valuation aligns with Substack's recent $585M pre-money valuation, though sits below the lofty 102x multiple from their 2021 Series B round.

| 2028 Growth Rate | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 |

|---|---|---|---|---|---|---|

| 10.0% | $29M | $40M | $52M | $62M | $71M | $79M |

| 15.0% | $29M | $40M | $53M | $66M | $79M | $91M |

| 20.0% | $29M | $40M | $55M | $70M | $86M | $104M |

| 35.0% | $29M | $42M | $59M | $82M | $113M | $152M |

| 50.0% | $29M | $43M | $64M | $96M | $144M | $216M |

| 55.0% | $29M | $43M | $66M | $101M | $156M | $242M |

| 65.0% | $29M | $44M | $69M | $111M | $182M | $300M |

| 70.0% | $29M | $44M | $71M | $117M | $196M | $332M |

| 80.0% | $29M | $45M | $74M | $128M | $225M | $406M |

Revenue projections show potential outcomes ranging from $79M at 10% growth to $406M at 80% growth by 2028, representing a 2.7x to 14x increase from 2023's $29M baseline. More aggressive growth scenarios above 50% could position Substack as a major player in digital media.

| 2028 Growth Rate | 1x | 5x | 10x | 15x | 25x |

|---|---|---|---|---|---|

| 10.0% | $79M | $393M | $786M | $1.2B | $2B |

| 15.0% | $91M | $453M | $905M | $1.4B | $2.3B |

| 20.0% | $104M | $519M | $1B | $1.6B | $2.6B |

| 35.0% | $152M | $761M | $1.5B | $2.3B | $3.8B |

| 50.0% | $216M | $1.1B | $2.2B | $3.2B | $5.4B |

| 55.0% | $242M | $1.2B | $2.4B | $3.6B | $6B |

| 65.0% | $300M | $1.5B | $3B | $4.5B | $7.5B |

| 70.0% | $332M | $1.7B | $3.3B | $5B | $8.3B |

| 80.0% | $406M | $2B | $4.1B | $6.1B | $10.1B |

Projected 2028 valuations range from $79M at conservative growth/multiple assumptions to over $10B in aggressive scenarios. Mid-range scenarios with 35-50% growth and 10-15x multiples suggest potential valuations of $1.5-3.2B, positioning Substack competitively among established media companies.

Bear, Base, and Bull Cases: 5.5x, 7.2x, 9.5x

To evaluate Substack's potential trajectories, we examine three distinct scenarios reflecting different market conditions and execution outcomes. These cases - ranging from conservative growth amid market headwinds to accelerated expansion through successful platform scaling - provide structured insights into Substack's possible valuations and market position.

| Scenario | 2028 Growth Rate (%) | Multiple |

|---|---|---|

| Bear 🐻 | 15% | 5.5 |

| Base 📈 | 35% | 7.2 |

| Bull 🚀 | 65% | 9.5 |

Growth projections range from a conservative 15% with a 5.5x multiple in the bear case to an ambitious 65% growth with a 9.5x multiple in the bull case. The base case assumes moderate 35% growth and a 7.2x multiple, reflecting balanced expectations for Substack's platform scaling and market penetration.

| Bear 🐻 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 |

|---|---|---|---|---|---|---|

| Revenue | $29M | $40M | $53M | $66M | $79M | $91M |

| Growth | 50.00% | 40.59% | 32.50% | 24.41% | 19.17% | 15% |

| Base 📈 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 |

|---|---|---|---|---|---|---|

| Revenue | $29M | $42M | $59M | $82M | $113M | $152M |

| Growth | 50.00% | 45.97% | 42.50% | 39.03% | 36.79% | 35% |

| Bull 🚀 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 |

|---|---|---|---|---|---|---|

| Revenue | $29M | $44M | $69M | $111M | $182M | $300M |

| Growth | 50.00% | 54.03% | 57.50% | 60.97% | 63.21% | 65% |

Our bear, base, and bull cases for Substack reflect varying scenarios of platform growth and market positioning, from deteriorating network effects to successful transformation into a luxury publishing network

- In the bear case, Substack's growth declines to 15% by 2028, resulting in a $498M valuation ($91M revenue on a 5.5x multiple)

- In the base case, Substack maintains 35% growth as a premium newsletter platform, reaching a $1.1B valuation ($152M revenue on a 7.2x multiple)

- In the bull case, Substack achieves 65% growth through successful expansion across multiple content formats, commanding a $2.8B valuation ($300M revenue on a 9.5x multiple).

| Scenario | 1. Bear 🐻 | 2. Base 📈 | 3. Bull 🚀 |

|---|---|---|---|

| 2023 Revenue | $29M | $29M | $29M |

| 2023 Growth Rate (%) | 50% | 50% | 50% |

| 2023 Multiple | 5.5 | 7.2 | 9.5 |

| 2023 Valuation | $157M | $205M | $271M |

| 2028 Revenue | $91M | $152M | $300M |

| 2028 Growth Rate (%) | 15% | 35% | 65% |

| Multiple | 5.5 | 7.2 | 9.5 |

| 2028 Valuation | $498M | $1.1B | $2.8B |

The uncertainty around these three cases depends primarily on Substack's ability to retain top writers, maintain its premium positioning, and successfully expand beyond newsletters into a broader media network while managing writer burnout and platform competition risks.

- In the Bear case: Writer burnout and high-profile creator migrations to platforms with better economics (like Ghost or Beehiiv) lead to a deteriorating network effect, causing Substack to struggle maintaining its premium positioning and forcing it to compete purely as a commoditized newsletter tool.

- In the Base case: Substack maintains its position as the premium newsletter platform while gradually expanding its network effects through features like Chat and Recommendations, though without fully achieving its vision of becoming the definitive rebundled media network.

- In the Bull case: Substack successfully transforms from a newsletter platform into a full-fledged luxury publishing network across multiple content formats (newsletters, podcasts, video) and niches (sports, entertainment, politics), effectively becoming the modern equivalent of a decentralized New York Times with superior unit economics.

These final valuations present a range of outcomes for Substack, from a modest $498M in the bear case to $2.8B in the bull scenario. Even the conservative projection suggests meaningful growth, while the bull case would position Substack competitively against established media companies like The New York Times.

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.