Revenue

$300.00M

2025

Valuation

$2.30B

2024

Funding

$573.10M

2024

Growth Rate (y/y)

64%

2024

Revenue

Sacra estimates that Shield AI hit approximately $300M in revenue for the year ending March 2025, up from $267M in 2024. The company is targeting 70-100% annual revenue growth to reach $1B in revenue by the year ending March 2028. Hivemind software made up approximately 30% of the company's revenue in the 12 months ending March 2025, with the company targeting 50% software revenue by 2028.

Shield AI's growth trajectory has been enabled by a series of lucrative contracts and key acquisitions. The company received its first major contract in 2016 from the U.S. Department of Defense's Defense Innovation Unit (DIU) autonomy program. It acquired Heron Systems and aerospace company Martin UAV to further strengthen its product line and technological capabilities. In 2021, the company received a $7.2M contract from the U.S. Air Force. In 2022, they won another contract from the Air Force worth $60M.

In 2024-5, Shield AI has expanded internationally with new contracts including the Romanian Navy (~$30M), Japan's naval forces, Greece, Canada, and other allied nations. The company estimates that over half of its 2025 business is international, with hundreds of millions of dollars in new contracts across Asia, Europe, and the Middle East. The company started selling V-BATs to the Netherlands, Ukraine, and Egypt in 2025. In August 2025, Ukraine's Ministry of Defence formally named Shield AI one of its "verified business partners," allowing it to compete for state procurement contracts.

The company's $198M contract with the US Coast Guard demonstrates their ability to replace legacy systems like the $80M MQ-9B SeaGuardian and manned surveillance flights ($115K per mission) with off-the-shelf autonomous solutions priced around $1M per V-BAT unit. Shield AI either sells the V-BAT outright (at approximately $1M per unit, varying by volume and configuration) or serves as a contractor operating V-BATs for customers, with orders ranging from 4 to 300 aircraft.

Valuation & Funding

In March 2025, Shield AI raised a $240M Series F-1 led by L3Harris and Snowpoint, bringing its valuation to $5.3B. Shortly after, the company extended the round by raising an additional $300M, bringing its valuation to $5.6B and total funding to $1.4B in equity and $200M in debt.

Previous investors include Snowpoint Ventures, Riot Ventures, Disruptive, Homebrew, Point72 Ventures, Andreessen Horowitz, Breyer Capital, and SVB Capital.

The round is earmarked for scaling Hivemind Enterprise, the platform that enables defense primes to integrate Shield AI's autonomy software into their own aircraft. Shield AI is currently working with eight of the military's main 25 contractors, with Hivemind being incorporated into General Atomics' MQ-20 unmanned combat aerial vehicle, a Kratos BQM-177A target drone, and an Airbus H145 twin-engine light utility helicopter.

Product

Shield AI was founded in San Diego in 2015 by Ryan Tseng (founder of WiPower, acquired by Qualcomm), Brandon Tseng (former NAVY Seal), and Andrew Reiter (ex-Draper Labs) to build technologies like artificial intelligence-powered fighter pilots and drones for defense operations.

The core of Shield AI's product ecosystem is Hivemind, an AI and autonomy stack that serves as the "brains" for their drones and aircraft. Hivemind ingests data from onboard sensors—infrared cameras, radar, signals intelligence, and satellites—to build a model of its environment, then uses AI to navigate, plan routes, avoid threats, and execute missions without remote control.

Hivemind enables drones and aircraft to operate autonomously even in GPS- and communication-degraded settings. Machine learning algorithms help their drone and aircraft perform complex tasks, such as room clearing and navigating "fatal funnels"—areas during an active threat or military operation where the greatest numbers of fatalities tend to occur—without human intervention.

Shield AI's Nova-class autonomous quadcopter drones—enabled by Hivemind—serve as a reconnaissance tool in close-quarters combat scenarios. During military operations, Nova drones can fly into hostile buildings, take photos and create maps that are then transmitted to the soldiers on the ground, aiding their decision-making and mitigating the risk of physically entering the building. Israeli forces deployed Nova to explore Hamas' tunnel network below the Gaza Strip during October 2023 operations.

Expanding its product line, Shield AI acquired Martin UAV in 2021 and introduced the V-BAT, a vertical take-off and landing (VTOL) aircraft. This VTOL capability makes V-BAT highly adaptable for various mission types and terrains, capable of flying up to 18,000 feet for 13 hours into enemy territory and taking off from ships or boats without a runway. In 2022, Brazil's defense unit placed an order for a batch of V-BATs, showing international interest in Shield AI's innovative solutions.

The V-BAT has proven particularly effective in combat after an eight-month iteration in 2024 to incorporate Hivemind for jamming resistance. Deployed in Ukraine throughout 2025, V-BATs executed more than 35 missions and identified over 200 Russian targets, including a notable April mission where a V-BAT flew 80 kilometers into Russian-held territory to identify and help destroy two military headquarters. Shield AI manufactures 200 V-BATs per year at its 200,000-square-foot "Batcave" facility outside Dallas and has established a deal with JSW to eventually produce them in India.

Shield AI has been developing the X-BAT, an autonomous VTOL fighter jet powered by Hivemind, for 18 months since early 2024. Unveiled in October 2025, the X-BAT targets first test flight in 2026, production starting in 2029, and full operational readiness in 2028. The company estimates it will take about $1B to reach operational capability and cites a range of 2,000+ nautical miles with full payload.

Shield AI expanded into the space domain in December 2025 through a partnership with Sedaro to use Hivemind as the preferred autonomy software for on‑orbit demonstrations. The collaboration anchors development and testing in Sedaro's high‑fidelity simulation platform, extending Shield AI's edge autonomy to satellites. It targets multi‑agent teaming and mission autonomy for proximity operations and defensive counter‑space in communications‑limited environments.

Business Model

Shield AI flips the traditional business model of defense contracting.

A typical defense contractor like Lockheed Martin or Boeing typically works with the Department of Defense by waiting for a request for proposal (RFP) and then starting their product development process. Cost-plus contracts then make sure those contractors are paid for all the expenses incurred during the process, with an extra “plus” on top to give them a 5-10% profit margin.

Shield AI, on the other hand, front-loads their R&D, taking on the risk of product development but with the benefit that they can present a pre-developed product line to the DOD and other allied military forces. That makes it easier for Shield AI and other aerospace and AI startups to sell into national governments, because there’s no history of cooperation to fall back on as with companies like Lockheed Martin, Raytheon, and Boeing.

Shield AI’s model is more akin to that of a tech company than a traditional defense contractor, and they are targeting a margin profile more akin to that of commercial tech companies than traditional defense contractors as well: in the 40-50% range, in stark contrast to the 5-10% of the defense industry.

Shield AI is now diversifying beyond hardware sales by licensing its Hivemind autonomy software to major defense contractors including Airbus, Kratos, and L3Harris. This software-as-a-service approach for autonomous navigation, takeoff, and landing capabilities creates the potential for 60%+ gross margins, contrasting with the lower-margin hardware business and positioning the company more like a traditional software company.

Competition

Shield AI’s key competition is the large defense primes like Boeing, Lockheed Martin, and Raytheon. 86% of all aerospace and defense revenues went to the 10 largest defense contractors as of 2016, reflecting advanced and continuing consolidation in the space.

Those large defense contractors aren’t unaware of the rapid advancement in technologies like unmanned aircraft and AI, each one starting its own venture capital arm to invest in startups that are working on these technologies—or building out their own versions of similar product lines.

Boeing, for example, already has an autonomous fighter jet in development known as the MQ-28 Ghost Bat. Kratos, the builder of the experimental, AI-run aircraft Valkyrie that the Air Force has now been testing for years, reported $900M of revenue in 2022. Attack drones built by General Atomics ($2.8B revenue in 2022) have already been used in combat across theaters in Iraq and Afghanistan.

Then there are other relatively software- and AI-first startups like Anduril. But while Anduril and Shield AI might compete for certain contracts, viewing them strictly as rivals overlooks the broader industry context and the ways in which their success benefits each other.

Much like how Uber's regulatory battles paved the way for Lyft in the ridesharing industry. Anduril's successes have demonstrated to government agencies that startups can be viable contractors, thus reducing perceived political risks for decision-makers and opening doors for other startups like Shield AI.

TAM Expansion

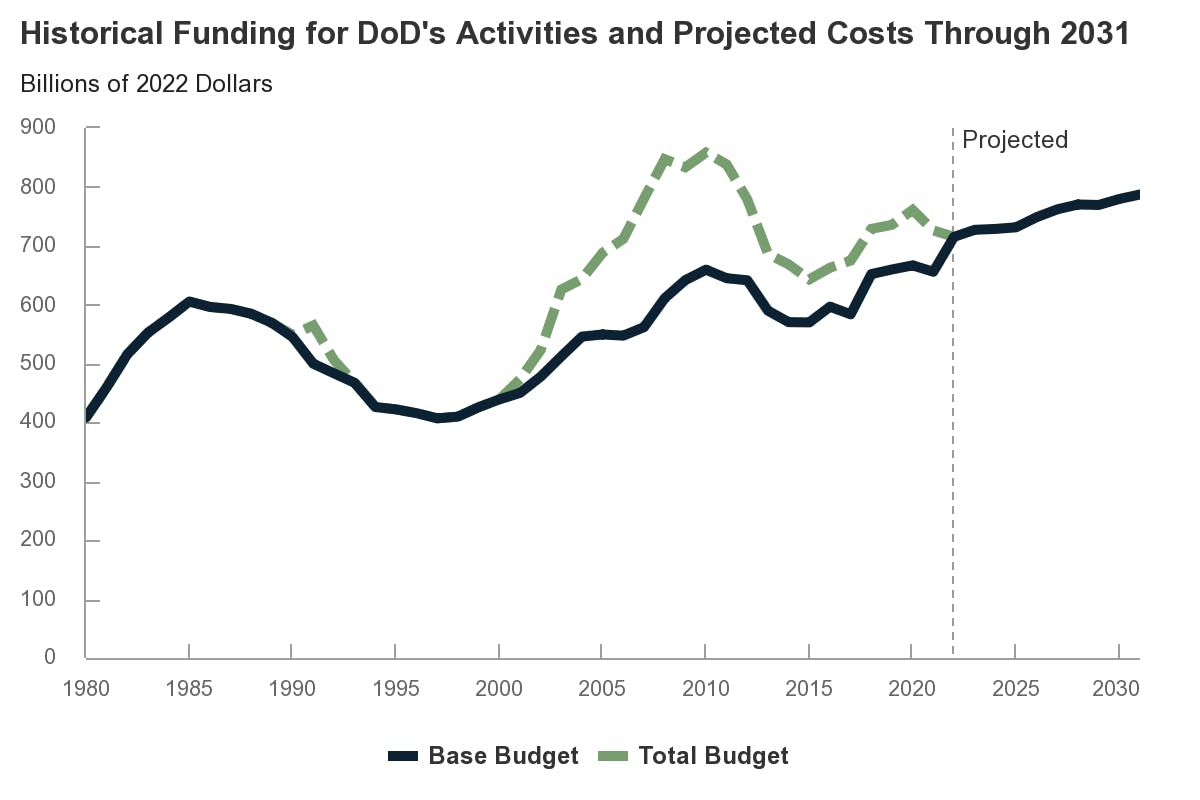

While Shield AI faces stiff competition from large defense contractors when it comes to rolling out the next generation of military hardware and software, the upside for Shield AI is that they operate in a huge and growing market.

The US is the largest military spender in the world by a large margin, and the US military budget makes up the largest share of the discretionary US federal budget spend.

The Pentagon has committed $9.4B in investment for autonomous drones in the next fiscal year (FY-2026) through both discretionary budgets and new mandatory spending initiatives.

With over $300M earmarked specifically for low-cost autonomous systems in 2026, Shield AI is positioned to capture share in the two key Pentagon categories: small unmanned aerial systems and long-endurance aerial systems for surveillance missions.

Risks

Friction and procurement practices: If the Pentagon's procurement practices remain rigid and continue to favor established defense contractors, Shield AI may find it difficult to secure long-term contracts that are crucial for its sustained growth and scalability.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.