Revenue

$128.25M

2023

Valuation

$3.00B

2023

Funding

$217.00M

2023

Growth Rate (y/y)

30%

2023

Revenue

Sacra estimates that Sentry hit $128M annual recurring revenue (ARR) on 50,000 customers by the end of 2023, growing 30% year-over-year, valued at ~23x its Series E financing at “over $3 billion” announced in May 2022.

As it has grown, Sentry has prioritized self-serve (70% of total revenue) and kept sales & marketing headcount low ($366K ARR per head), investing in product & engineering to launch new products & features into their existing SDK to drive usage and expand into adjacent use cases, not unlike Docker ($135M ARR, ~$1687 average revenue per org).

Valuation & Funding

Sentry is valued at $3 billion as of 2022, following their Series E funding round led by Accel and New Enterprise Associates. Based on 2022 data, when Sentry was at roughly $99M ARR, the company traded at a 30x revenue multiple. The company has raised $217 million in total funding across multiple rounds. Their most recent Series E round included participation from Bond and K5 Global Technology, joining existing investors Accel and New Enterprise Associates.

Business Model

Sentry employs a hybrid open-source and self-serve SaaS business model that is unique in the application performance monitoring (APM) space. While most APM vendors focus on sales-driven enterprise deals, Sentry has succeeded by making its product easily accessible to developers in organizations of all sizes.

The core of Sentry's business model is its open-source SDKs that developers can easily install in their code to start tracking errors. This removes friction from the adoption process—engineers can start using Sentry without needing to talk to sales or get budget approval. Sentry then monetizes through a cloud-hosted version of its product that provides additional features and scalability compared to its free on-premise offering.

This self-serve model accounts for 70% of Sentry's revenue. Developers or teams can sign up for Sentry's SaaS product directly through the website, paying only $26 per month for the basic tier. This affordable self-serve entry point allows Sentry to acquire customers very efficiently, without the high sales and marketing costs typical of enterprise software companies. Sentry then focuses on expanding usage within an organization to grow accounts over time.

However, Sentry isn't only focused on smaller customers. The company has a growing roster of large enterprise customers like Microsoft, Dropbox, and Disney that it acquires through bottom-up adoption. Because Sentry is so widely adopted by individual developers, it spreads virally within large organizations until it becomes the de facto monitoring tool. At that point, Sentry can land enterprise-wide contracts.

This bottom-up adoption model is more reminiscent of developer tools like Atlassian and GitLab than traditional top-down enterprise sales. Sentry is betting that in the age of cloud and DevOps, even the largest companies will increasingly buy software the way individual developers do - based on ease of use, openness, and value rather than vendor lock-in and custom support contracts.

Sentry's open source roots also contribute to efficient customer acquisition. Because its on-premise product is free and open source, many large enterprises adopt it and standardize on it internally. But as their usage grows, some of these companies find it more economical to pay for Sentry's hosted offering rather than operating it themselves. This provides Sentry with a built-in pipeline of large accounts.

With its unique self-serve approach and ability to acquire both enterprises and startups efficiently, Sentry has built a capital-efficient business growing at scale. The company generates roughly $366K in ARR per full-time employee, well above the the median for public SaaS companies.

Product

Sentry is an application monitoring platform that provides error tracking and performance monitoring for software teams. It was originally launched in 2012 as an open source side project focused on helping developers track and fix crashes and errors in their Python and Django applications.

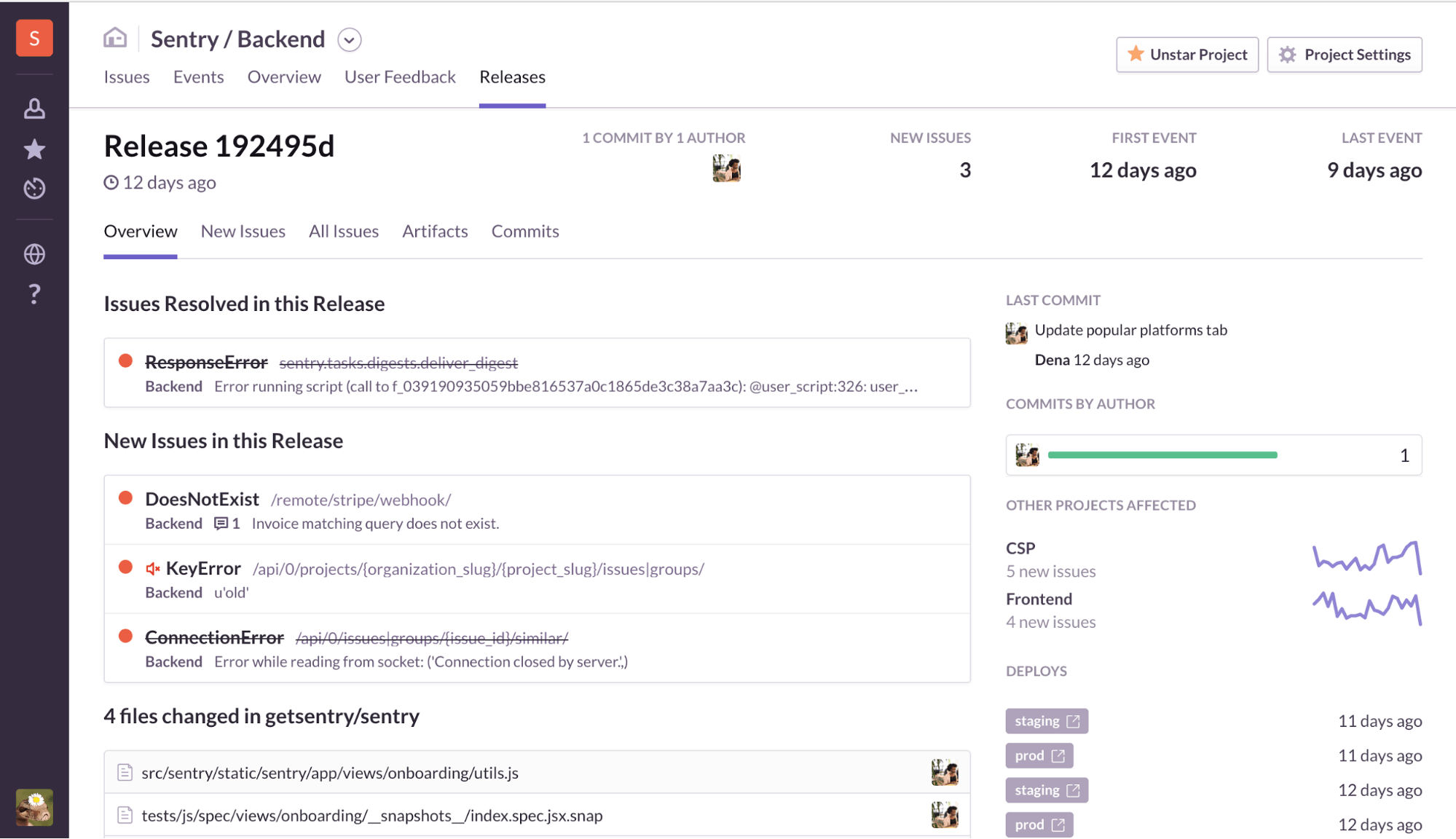

Developers install Sentry's SDK in their application code, and it automatically captures crashes and exceptions in real-time, organizing them into issues grouped by error type and application release. This gives engineers stack traces, device details, and user breadcrumbs to help them quickly identify, triage, and resolve errors. Before Sentry, teams relied on manual log parsing to find errors.

Over time, Sentry has expanded from error tracking to become a full-fledged application performance monitoring (APM) platform. In addition to capturing errors, Sentry now instruments applications to collect performance metrics, enabling developers to set up alerts for latency regressions, visually identify performance bottlenecks, and trace issues back to problematic commits in their codebase.

Competition

Sentry faces competition from open source error tracking tools, incumbent observability platforms, and emerging startups bundling error monitoring into broader offerings.

Datadog and New Relic

Established observability vendors like Datadog and New Relic have expanded into error tracking. Datadog offers error monitoring as part of its APM product, leveraging its strengths in log management and tracing to provide rich context around errors. New Relic launched a dedicated Errors Inbox in 2021 to help engineers triage and resolve errors from across the stack.

For customers already using these platforms, the integrated error tracking is appealing. Datadog and New Relic can correlate errors with infrastructure metrics, logs, and traces out of the box. However, their error UIs and workflows are less mature than Sentry's. Teams serious about error monitoring often use Sentry alongside a general observability tool.

Startups re-bundling APM

A new crop of startups are challenging the unbundled model by combining error tracking, logging, tracing and other observability features into unified platforms. Highlight.io, for example, ingests errors, logs and metrics to automate incident response. By combining data types, these tools promise to help engineers resolve errors faster.

This integrated approach could threaten Sentry's position, but the market is still early. Most teams continue to use best-of-breed tools for each data type. Sentry's brand is synonymous with error tracking and it integrates with popular logging and tracing tools. As the observability space evolves, Sentry will need to clearly articulate its unique value and potentially expand its capabilities.

Open source

Several open source projects provide error tracking capabilities similar to Sentry. Bugsnag is an open source error reporting library that supports many of the same languages and frameworks as Sentry. GlitchTip is an open source Sentry alternative that aims to be simpler to set up and maintain. These open source options appeal to cost-conscious teams willing to manage their own infrastructure.

TAM Expansion

Sentry is expanding its total addressable market (TAM) by moving upmarket from error tracking to application performance monitoring (APM). With its launch of performance monitoring capabilities, real-time alerts, and code-level trace analysis, Sentry can now sell a higher-tier APM product at a significantly higher average revenue per user (ARPU) than its traditional error tracking offering.

While Sentry built a sizable business in error tracking, that market is relatively small compared to the APM space—error tracking is around $1BM annually, while APM and observability is a roughly $50B market growing at 11% year-over-year. As Sentry reaches saturation in error tracking, expanding into APM opens up a substantially larger opportunity.

Sentry's initial error tracking product was priced affordably for individual developers and small teams, with an ARPU of around $1,500. However, APM products are sold to entire engineering organizations, with market leaders like Datadog and New Relic realizing an ARPU of $50,000-$100,000. If Sentry can successfully move upmarket and establish itself as a viable APM vendor, it has the potential to grow ARPU by an order of magnitude.

From a competitive perspective, Sentry is well-positioned to capture APM market share as an insurgent. While incumbents like New Relic have dominated APM historically, Sentry has two key advantages:

1) As a developer-first product with a free and low-cost self-serve tier, Sentry can acquire customers very efficiently and cost-effectively through bottom-up adoption. This product-led growth model is well-suited to reaching mid-market and startup customers that are priced out of enterprise APM tools.

2) With tracing, metrics, and logs combined in a single platform, Sentry can provide a more complete and integrated view of application performance than legacy APM tools. This allows customers to standardize on Sentry rather than stitching together multiple monitoring systems.

The key to growing ARPU for Sentry will be leveraging its large base of self-serve error tracking users to upsell APM and converting open source users of its on-premise product to paying cloud customers. If Sentry can execute on this "land and expand" strategy, it has a substantial growth opportunity in APM.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.