Revenue

$982.00M

2021

Valuation

$2.00B

2021

Growth Rate (y/y)

32%

2021

Funding

$143.00M

2021

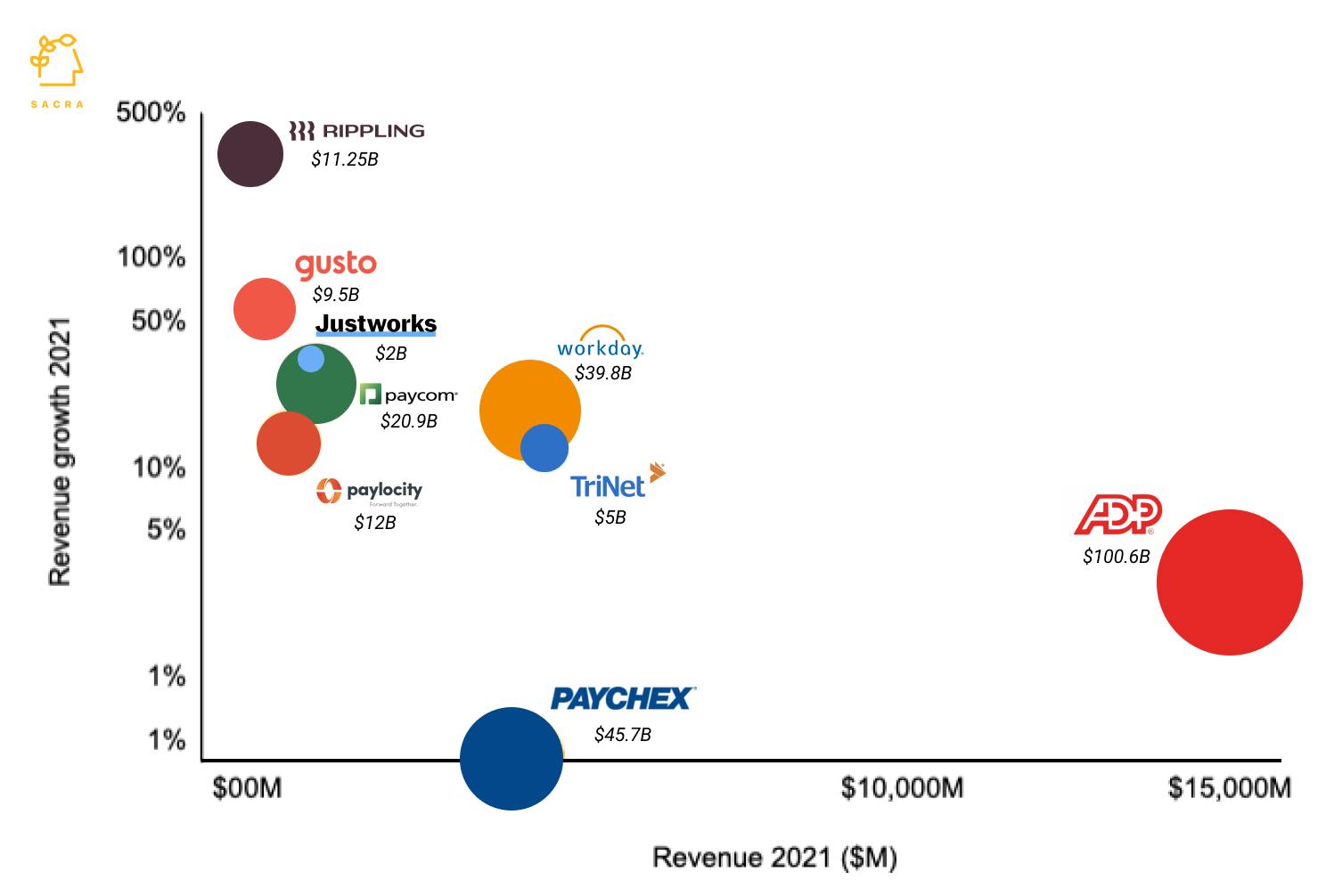

Valuation: $2.00B in 2021

Note: Revenue, growth rate, and valuation as per publicly available information. Size of the bubble indicates valuation. Vertical axis is in log scale for visual clarity.

Justworks has raised $143M from investors such as FirstMark Capital, Union Square Ventures, and Bain Capital. Its last private valuation was $1.43B, and it filed an S-1 to go public in Jan 2022 at a valuation of $2B.

This puts its valuation to revenue multiple at 2x, which is much lower than other HR tech companies. Justworks’s revenue mix makes its business model akin to an insurance distributor than a SaaS company and it is getting valued as such.

TriNet, which is also a PEO company, has a multiple of 1.1x as insurance-related low margin revenue forms 86% of its top line. Paycom, with 98% SaaS revenue has 19.8x multiple and Paylocity with 93% SaaS revenue has 18.9x multiple.

Scenarios: $2.2B to $6.1B ARR by 2026

To evaluate Justworks's future potential, we analyze multiple scenarios projecting the company's growth from 2021 to 2026. These scenarios consider various growth rates and revenue multiples, taking into account both its PEO business model and the broader HR tech market dynamics.

| 2021 Revenue ($M) | $982M | ||

|---|---|---|---|

| 2021 Growth Rate (%) | 32.27% |

Justworks demonstrated strong performance with $982M in revenue for 2021, achieving a robust 32.27% growth rate. This growth trajectory, while healthy, reflects its position as a mature PEO provider balancing both insurance-related and SaaS revenue streams.

| Multiple | Valuation |

|---|---|

| 1x | $982M |

| 5x | $4.9B |

| 10x | $9.8B |

| 15x | $14.7B |

| 25x | $24.6B |

Given Justworks's current revenue, valuations span from a conservative $982M at 1x multiple to $24.6B at 25x multiple. The lower multiples reflect its PEO/insurance distributor model, while higher multiples would position it more in line with pure-play SaaS HR tech companies like Paycom and Paylocity.

| 2026 Growth Rate | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 |

|---|---|---|---|---|---|---|

| 10.0% | $982M | $1.2B | $1.5B | $1.7B | $2B | $2.2B |

| 13.0% | $982M | $1.2B | $1.5B | $1.8B | $2.1B | $2.4B |

| 17.0% | $982M | $1.3B | $1.6B | $1.9B | $2.3B | $2.6B |

| 23.0% | $982M | $1.3B | $1.6B | $2B | $2.5B | $3.1B |

| 30.0% | $982M | $1.3B | $1.7B | $2.2B | $2.9B | $3.8B |

| 34.0% | $982M | $1.3B | $1.7B | $2.3B | $3.1B | $4.2B |

| 39.0% | $982M | $1.3B | $1.8B | $2.5B | $3.4B | $4.7B |

| 44.0% | $982M | $1.3B | $1.8B | $2.6B | $3.7B | $5.3B |

| 50.0% | $982M | $1.3B | $1.9B | $2.8B | $4.1B | $6.1B |

Revenue projections span from $2.2B to $6.1B by 2026, reflecting scenarios from conservative 10% growth to aggressive 50% growth rates. Even at the lowest projected growth rate, revenue more than doubles from 2021, while the most optimistic scenario shows a 6.2x increase over the five-year period.

| 2026 Growth Rate | 1x | 5x | 10x | 15x | 25x |

|---|---|---|---|---|---|

| 10.0% | $2.2B | $10.8B | $21.6B | $32.4B | $54B |

| 13.0% | $2.4B | $11.8B | $23.6B | $35.4B | $58.9B |

| 17.0% | $2.6B | $13.2B | $26.4B | $39.6B | $66B |

| 23.0% | $3.1B | $15.6B | $31.2B | $46.7B | $77.9B |

| 30.0% | $3.8B | $18.8B | $37.5B | $56.3B | $93.8B |

| 34.0% | $4.2B | $20.8B | $41.5B | $62.3B | $103.9B |

| 39.0% | $4.7B | $23.5B | $47.1B | $70.6B | $117.7B |

| 44.0% | $5.3B | $26.6B | $53.1B | $79.7B | $132.8B |

| 50.0% | $6.1B | $30.6B | $61.2B | $91.8B | $153B |

Projected 2026 valuations range from $2.2B at conservative growth/multiple assumptions (10% growth, 1x) to $153B under aggressive scenarios (50% growth, 25x). Even modest growth scenarios suggest significant upside from the 2021 $2B valuation, while ambitious projections position Justworks as a potential industry leader.

Bear, Base, and Bull Cases: 5.5x, 7.5x, 9.5x

To assess Justworks's potential trajectories, we analyze three distinct scenarios based on market dynamics and growth execution. The bear case reflects conservative PEO multiples, while the base case assumes successful hybrid positioning, and the bull case anticipates strong SaaS-like characteristics and market leadership.

| Scenario | 2026 Growth Rate (%) | Multiple |

|---|---|---|

| Bear 🐻 | 15% | 5.5 |

| Base 📈 | 25% | 7.5 |

| Bull 🚀 | 40% | 9.5 |

Growth projections span from conservative to ambitious, with the bear case assuming 15% growth and a 5.5x multiple reflecting PEO-like valuations, while the bull case targets 40% growth and a 9.5x multiple based on successful SaaS transformation. The base case balances these extremes with 25% growth and a 7.5x multiple.

| Bear 🐻 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 |

|---|---|---|---|---|---|---|

| Revenue | $982M | $1.3B | $1.6B | $1.9B | $2.2B | $2.5B |

| Growth | 32.27% | 27.63% | 23.64% | 19.65% | 17.06% | 15% |

| Base 📈 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 |

|---|---|---|---|---|---|---|

| Revenue | $982M | $1.3B | $1.6B | $2.1B | $2.6B | $3.3B |

| Growth | 32.27% | 30.32% | 28.64% | 26.96% | 25.87% | 25% |

| Bull 🚀 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 |

|---|---|---|---|---|---|---|

| Revenue | $982M | $1.3B | $1.8B | $2.5B | $3.4B | $4.8B |

| Growth | 32.27% | 34.35% | 36.14% | 37.92% | 39.08% | 40% |

Our bear, base, and bull cases for Justworks reflect different trajectories based on its ability to expand beyond its core PEO business and capture higher-margin revenue streams

- In the bear case, Justworks reaches a $13.7B valuation by 2026 with $2.5B revenue growing at 15% and maintaining a PEO-like 5.5x multiple due to continued dependence on insurance revenue

- In the base case, Justworks achieves a $24.7B valuation with $3.3B revenue growing at 25% and commanding a 7.5x multiple through balanced growth in both insurance and SaaS offerings

- In the bull case, Justworks reaches a $45.8B valuation with $4.8B revenue growing at 40% and earning a 9.5x multiple through successful expansion into high-margin fintech products and global payroll solutions.

| Scenario | 1. Bear 🐻 | 2. Base 📈 | 3. Bull 🚀 |

|---|---|---|---|

| 2021 Revenue | $982M | $982M | $982M |

| 2021 Growth Rate (%) | 32% | 32% | 32% |

| 2021 Multiple | 5.5 | 7.5 | 9.5 |

| 2021 Valuation | $5.4B | $7.4B | $9.3B |

| 2026 Revenue | $2.5B | $3.3B | $4.8B |

| 2026 Growth Rate (%) | 15% | 25% | 40% |

| Multiple | 5.5 | 7.5 | 9.5 |

| 2026 Valuation | $13.7B | $24.7B | $45.8B |

The uncertainty around these three cases depends primarily on Justworks's ability to expand beyond insurance revenue, successfully launch higher-margin fintech products, maintain growth in the competitive HR tech landscape, and leverage its PEO model while building out its SaaS offerings.

- In the Bear case: Justworks remains predominantly dependent on its low-margin insurance revenue (90% of revenue), fails to meaningfully expand its high-margin SaaS offerings, and faces increasing competition from well-funded competitors like Gusto and Rippling, justifying a lower 5.5x multiple.

- In the Base case: Justworks successfully maintains its current growth trajectory and gradually expands its SaaS revenue mix while leveraging its PEO model to offer new financial services, but still operates in a competitive landscape with mixed margins, supporting a 7.5x multiple.

- In the Bull case: Justworks successfully expands into higher-margin fintech products, captures significant market share in the growing global payroll space, and meaningfully increases its SaaS revenue contribution while maintaining its insurance business as a strategic advantage, warranting a 9.5x multiple.

These final valuations present a significant range for Justworks. Even the bear case projects substantial growth to $13.7B by 2026, while the bull case at $45.8B would position Justworks as a major player in HR tech, driven by successful expansion beyond its PEO foundations.

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.