Revenue

$2.00B

2023

Valuation

$3.63B

2024

Funding

$569.95M

2024

Growth Rate (y/y)

54%

2023

Revenue

Sacra estimates that GrubMarket generated $2B in revenue in 2023, up 54% year-over-year from $1.3B in 2022 and up 10x growth from 2020.

This rapid expansion has been driven by a combination of organic growth and strategic acquisitions, with the company having completed over 90 acquisitions to date.

Revenue mix

GrubMarket's revenue is generated through multiple streams, including:

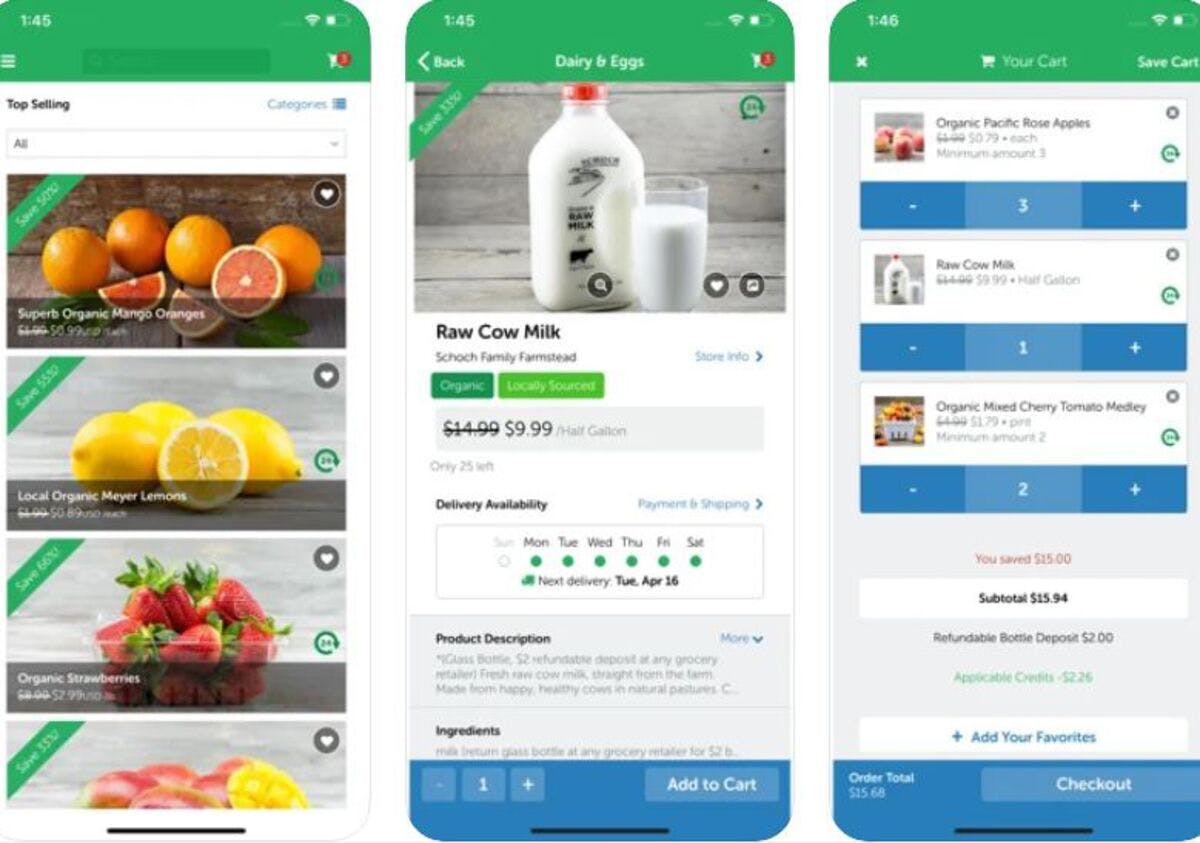

B2B eCommerce: GrubMarket's eCommerce platform connects farmers and food producers directly with businesses such as grocery stores, restaurants, and meal kit companies.

B2C eCommerce: The company's consumer-facing eCommerce platform delivers fresh produce and other food products directly to consumers' doorsteps.

SaaS revenue: GrubMarket's proprietary software, WholesaleWare, provides food industry wholesalers and distributors with tools for financial management, inventory management, online ordering, and logistics.

The company's diverse revenue mix has provided resilience and flexibility, allowing GrubMarket to adapt to changing market conditions and consumer preferences.

Customer base

GrubMarket serves a wide range of customers, including over 500 grocery stores, 8,000 restaurants, and 2,000 corporate offices. Its impressive customer list includes Whole Foods, Costco, Walmart, Kroger, Albertsons, Blue Apron, and Hello Fresh, among others.

Through multiple acquisitions from California to New York, the company continues to expand at a rapid pace. GrubMarket now operates in all 50 U.S. States and has a global presence in Argentina, Canada, Chile, Colombia, Egypt, India, Mexico, South Africa, and Spain, with plans to expand further across the U.S., Canada, South America, Europe, Africa, and other parts of the world.

Valuation & Funding

In March 2025, GrubMarket raised a Series G of approximately $50 million at a post-money valuation above $3.5 billion. The company has raised over $560 million in total funding from prominent investors including Tiger Global, GGV Capital, and Battery Ventures.

Strategic investors in the company include General Mills' venture arm, while other notable backers comprise Y Combinator and Celtic House Asia Partners. The company has attracted a diverse mix of venture capital, strategic, and institutional investors across multiple funding rounds.

Product

GrubMarket was founded in 2014 in San Francisco, California by Mike Xu.

At the core of GrubMarket's offering is its online marketplace that connects farmers and food producers directly with businesses.

In addition to their B2B marketplace, GrubMarket has launched several other products, including:

B2B eCommerce: A customizable online ordering system for businesses such as grocery stores, restaurants, and meal kit companies.

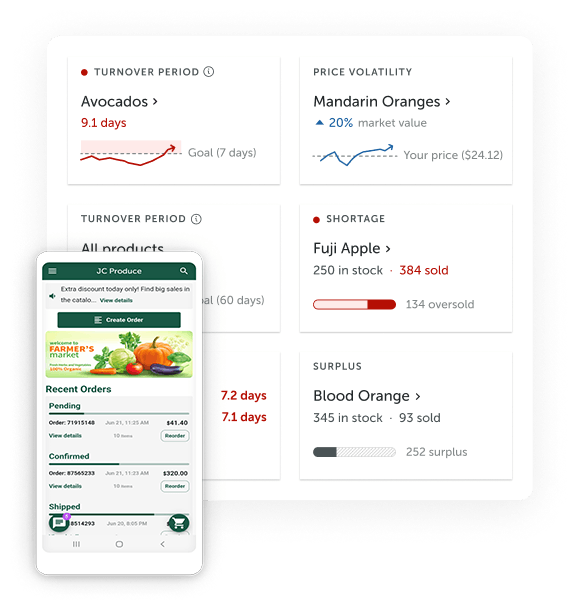

WholesaleWare: A proprietary SaaS platform that provides food industry wholesalers and distributors with tools for financial management, inventory management, online ordering, and logistics.

GrubAssist AI: GrubAssist is GrubMarket's their AI software built specifically for the food supply chain, designed to help employees make better purchasing and selling decisions and offer better customer service.

In November 2025, GrubMarket acquired Procurant, a SaaS platform for fresh procurement and FSMA 204 traceability. The deal expands GrubMarket’s software suite with tools for order management, quality control, and supplier connectivity, and is positioned to integrate with WholesaleWare and GrubAssist AI to offer AI-powered procurement and reporting across the network.

GrubMarket has continued its aggressive acquisition strategy, announcing the acquisition of two major food supply chain software providers in December 2025: Seasoft and Senergy. These acquisitions bolster GrubMarket's software offerings for the seafood and fresh produce industries, respectively, further integrating technology into its B2B marketplace and expanding its enterprise customer base.

Business Model

GrubMarket's business model is centered around its marketplace and SaaS platform, which streamlines the food supply chain by connecting farmers, producers, and suppliers directly with businesses and consumers.

Hybrid B2B and B2C model

GrubMarket's marketplace operates as a hybrid, serving both B2B and B2C segments. This allows the company to capture value at multiple points along the food supply chain.

On the B2B side, GrubMarket provides a platform for farmers and producers to sell their products directly to businesses such as grocery stores, restaurants, and meal kit companies. This eliminates intermediaries and enables suppliers to access new markets and achieve better prices for their products.

For B2C, GrubMarket operates a consumer-facing ecommerce marketplace that delivers fresh produce and other food products directly to individuals and families. This farm-to-table model provides consumers with access to high-quality, locally-sourced products at competitive prices.

By serving both B2B and B2C segments, GrubMarket can achieve greater scale, diversify its revenue streams, and create a more resilient business model.

Software-as-a-Service (SaaS)

In addition to its marketplace, GrubMarket offers a proprietary SaaS solution called WholesaleWare. WholesaleWare provides food industry wholesalers and distributors with tools for financial management, inventory management, online ordering, and logistics.

GrubMarket charges a recurring subscription fee for access to its SaaS platform, which is priced based on the size and complexity of the customer's operations. This provides a predictable and scalable revenue stream for the company.

For its eCommerce transactions, GrubMarket earns a commission on each sale, typically ranging from 10-15%. This aligns GrubMarket's success with that of its suppliers and customers - as transaction volume grows, all parties benefit.

Horizontal integration

To further strengthen its position in the food supply chain, GrubMarket has pursued a strategy of vertical integration through acquisitions. The company has acquired over 90 companies across the food ecosystem, including farms, producers, wholesalers, and distributors.

Notable acquisitions include:

Bengard Marketing, Inc. (2024): One of the largest importers of South American stone fruit

PA China Farm (2023): A prominent wholesale distribution business based in Philadelphia, Pennsylvania

Performance Produce (2024): A vertically integrated fresh produce business based in Salisbury, North Carolina

Salix Fruits (2023): A global fresh fruit importer and exporter based in Argentina

These acquisitions allow GrubMarket to control more of the supply chain, ensuring quality, consistency, and efficiency from farm to table. They also provide opportunities for cost synergies and economies of scale, as GrubMarket can consolidate operations and leverage its technology platform across a larger network.

Competition

GrubMarket faces competition from a variety of players in the food supply chain and technology sectors, each vying for a piece of the $1.3+ trillion US food market.

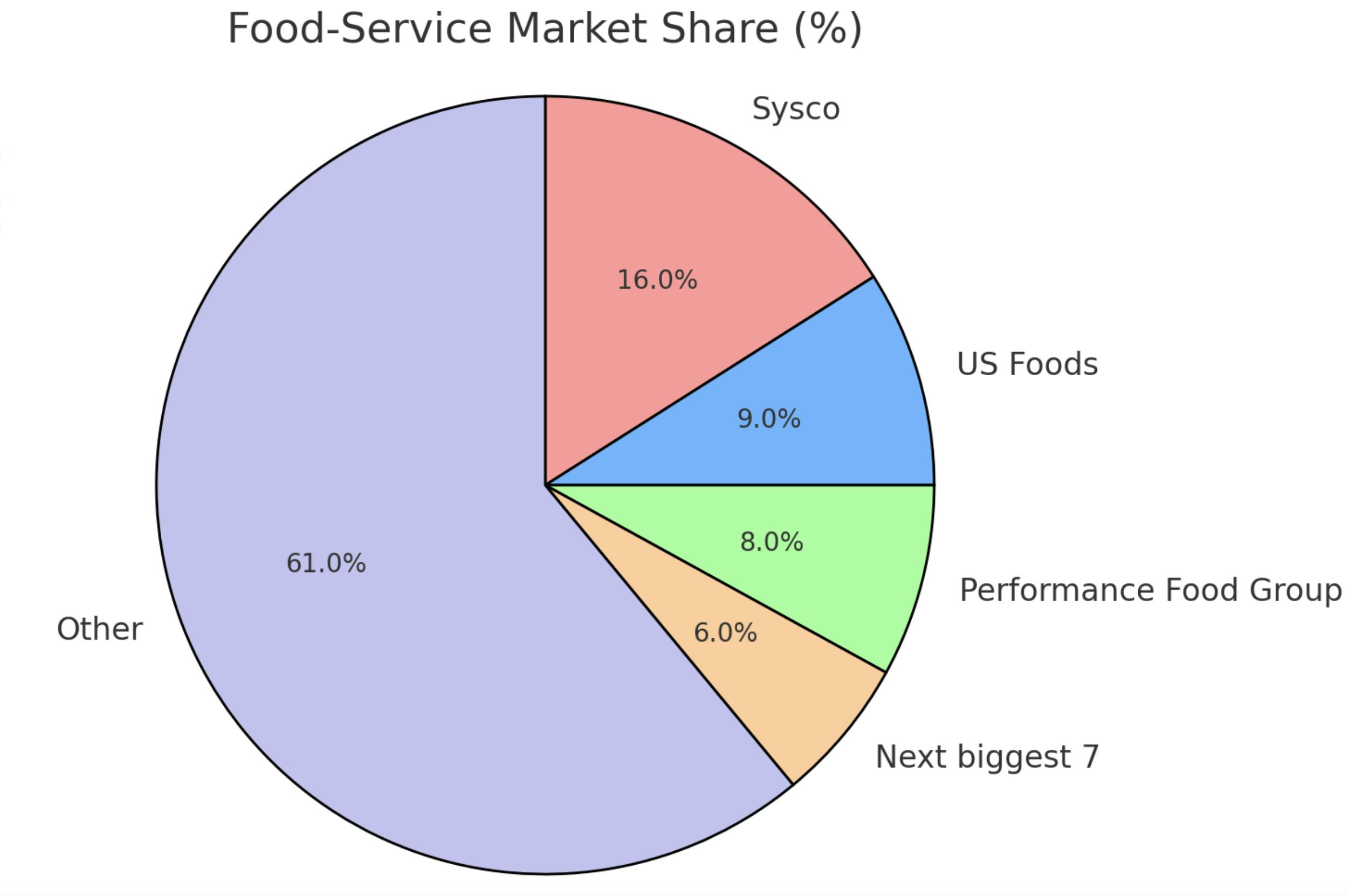

Traditional wholesalers and distributors

GrubMarket's primary competition comes from traditional wholesale food distributors, such as Sysco, US Foods, and Performance Food Group.

These large, established players have extensive supplier networks, well-developed logistics capabilities, and long-standing customer relationships.

They benefit from economies of scale, allowing them to offer competitive pricing and a wide range of products.

Many of these companies have also been investing in digital technologies to streamline operations and improve customer experience.

GrubMarket also competes with a fragmented landscape of regional and specialty food distributors. These companies often focus on specific geographic markets or product categories, such as produce, meat, or artisanal goods.

Examples include Baldor Specialty Foods in the Northeast, Hardie's Fresh Foods in Texas, and Chefs' Warehouse, which specializes in serving high-end restaurants.

These regional and specialty players often have strong local relationships and deep expertise in their specific niches. They may be able to offer more personalized service and curated product selections compared to the large broadline distributors.

Online food marketplaces

GrubMarket also faces potential competition from online food marketplaces and delivery platforms, such as Amazon Fresh, Instacart, and DoorDash.

These companies have disrupted the traditional grocery and restaurant industries by providing consumers with convenient, on-demand access to a wide variety of food products.

While these platforms primarily focus on B2C sales, some, like Amazon Business and Cheetah, are also targeting the B2B foodservice and wholesale markets.

The strengths of these online marketplaces include their robust technology platforms, extensive consumer reach, and logistics capabilities. They have also been aggressive in partnering with and acquiring food businesses to expand their offerings and vertically integrate.

Food tech startups

Finally, GrubMarket competes with a growing number of food technology startups that are using software to go after various aspects of the food supply chain.

Examples include:

Choco: A platform for restaurants to order from suppliers

Shelf Engine: An AI-powered platform for optimizing grocery store inventory

Afresh: An AI-based solution for fresh food forecasting and ordering

AgroScout: A platform that uses drones and computer vision to monitor crop health

These startups are often focused on specific pain points or inefficiencies in the food supply chain, such as procurement, inventory management, or food waste reduction.

TAM Expansion

Geographic expansion

GrubMarket has already made significant strides in expanding its presence beyond the US market.

The company now operates in several countries across Europe, South America, and Asia, including Canada, Mexico, Argentina, Chile, Colombia, South Africa, India, and Spain.

This international expansion enables GrubMarket to tap into new markets and diversify its supplier network.

For example, the acquisition of Salix Fruits, a global fresh fruit importer and exporter based in Argentina, has given GrubMarket access to a wide range of produce items from over 20 countries.

GrubMarket has also been actively expanding its operations in Europe.

In March 2023, the company announced that it had started supplying fresh produce to Ukraine and Romania through its Salix Fruits business.

GrubMarket recently opened a new office in Egypt, further strengthening its presence in the Middle East and North Africa (MENA) region.

This expansion allows the company to source high-demand Egyptian citrus for its global customer base and positions it well to capitalize on the growing food market in the MENA region.

The digitization of food wholesale

The food wholesale and distribution industry is undergoing a digital transformation, with traditional manual processes giving way to data-driven, automated systems. The overall global food tech market is expected to reach $342.52 billion by 2027, growing 6% CAGR.

GrubMarket's WholesaleWare platform positions them at the forefront of this trend, providing a comprehensive suite of tools for food wholesalers and distributors.

The future of foodservice

The foodservice industry is another major market for GrubMarket, with the global food service market expected to reach $4.4 trillion by 2027.

GrubMarket's customer base includes over 500 grocery stores, 8,000 restaurants, and 2,000 corporate offices, demonstrating its strong presence in the foodservice sector. As foodservice businesses increasingly adopt digital solutions and seek out reliable, high-quality ingredients, GrubMarket's addressable market within this sector will continue to grow.

GrubMarket's recent acquisition of Butter, a food service-focused SaaS serving small to medium-sized food wholesalers, marks a big move from GrubMarket to position itself more strongly in this space.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.