Revenue

$225.00M

2023

Valuation

$6.30B

2025

Growth Rate (y/y)

13%

2025

Funding

$1.10B

2025

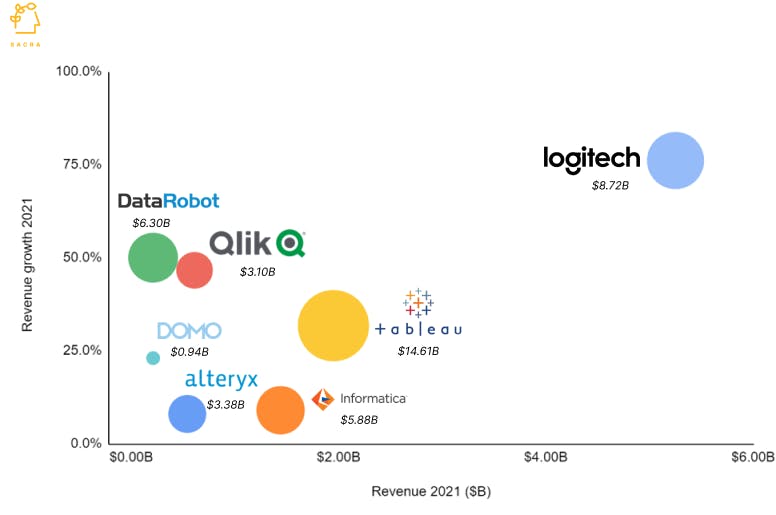

Valuation: $6.30B in 2023

DataRobot has raised $1.1B from notable investors such as New Enterprise Associates, Sapphire Ventures, and Tiger Global Management. The company was last valued at $6.3B, putting its valuation/revenue multiple at 30x.

In the AI/ML landscape, multiples typically fall in the range of 2.2x to 6x, with the majority of companies below 15x. For instance, Alteryx,an end-to-end data science Auto-ML solution, has a multiple of 6.57x, while Informatica, a leader in enterprise cloud data management, has a multiple of 4.75x.

Scenarios: $322M to $864M ARR by 2028

To evaluate DataRobot's future potential, we analyze multiple scenarios projecting revenue growth from 2023 to 2028. These scenarios incorporate various growth rates and industry-standard multiples, considering both conservative and optimistic market conditions in the evolving AI/ML landscape.

| 2023 ARR ($M) | $225M | ||

|---|---|---|---|

| 2023 Growth Rate (%) | 12.50% |

DataRobot's current ARR of $225M represents modest growth of 12.50% year-over-year, reflecting a significant slowdown from historical performance. This conservative growth trajectory aligns with recent market challenges and positions the company below typical AI/ML industry expansion rates.

| Multiple | Valuation |

|---|---|

| 1x | $225M |

| 5x | $1.1B |

| 10x | $2.2B |

| 15x | $3.4B |

| 25x | $5.6B |

Given DataRobot's current ARR of $225M, valuations span from $225M at a conservative 1x multiple to $5.6B at 25x. While the higher multiple approaches the company's last valuation of $6.3B, industry peers like Alteryx and Informatica typically trade at more modest 4-7x multiples.

| 2028 Growth Rate | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 |

|---|---|---|---|---|---|---|

| 5.0% | $225M | $249M | $270M | $289M | $306M | $322M |

| 7.0% | $225M | $250M | $274M | $297M | $320M | $343M |

| 9.0% | $225M | $251M | $278M | $306M | $334M | $365M |

| 11.0% | $225M | $252M | $282M | $314M | $349M | $387M |

| 15.0% | $225M | $255M | $290M | $331M | $380M | $437M |

| 19.0% | $225M | $257M | $298M | $349M | $412M | $491M |

| 24.0% | $225M | $260M | $308M | $372M | $456M | $565M |

| 31.0% | $225M | $264M | $322M | $406M | $522M | $684M |

| 40.0% | $225M | $270M | $341M | $452M | $617M | $864M |

Revenue scenarios show potential growth paths ranging from a modest $322M at 5% growth to an ambitious $864M at 40% growth by 2028. Even conservative projections indicate steady expansion, while aggressive scenarios suggest nearly 4x revenue growth over the five-year period.

| 2028 Growth Rate | 1x | 5x | 10x | 15x | 25x |

|---|---|---|---|---|---|

| 5.0% | $322M | $1.6B | $3.2B | $4.8B | $8B |

| 7.0% | $343M | $1.7B | $3.4B | $5.1B | $8.6B |

| 9.0% | $365M | $1.8B | $3.6B | $5.5B | $9.1B |

| 11.0% | $387M | $1.9B | $3.9B | $5.8B | $9.7B |

| 15.0% | $437M | $2.2B | $4.4B | $6.6B | $10.9B |

| 19.0% | $491M | $2.5B | $4.9B | $7.4B | $12.3B |

| 24.0% | $565M | $2.8B | $5.7B | $8.5B | $14.1B |

| 31.0% | $684M | $3.4B | $6.8B | $10.3B | $17.1B |

| 40.0% | $864M | $4.3B | $8.6B | $13B | $21.6B |

Projected 2028 valuations range from $322M at conservative growth (5%) and multiple (1x) to $21.6B under aggressive scenarios (40% growth, 25x multiple). Most realistic scenarios fall between $1.8B-$5.8B, aligned with industry-standard multiples and moderate growth expectations.

Bear, Base, and Bull Cases: 8.5x, 11.5x, 14.5x

To provide comprehensive valuation insights, we analyze bear, base, and bull case scenarios incorporating market dynamics, competitive positioning, and growth potential. These cases, applying multiples of 8.5x, 11.5x, and 14.5x respectively, reflect varying levels of market confidence and DataRobot's execution capabilities.

| Scenario | 2028 Growth Rate (%) | Multiple |

|---|---|---|

| Bear 🐻 | 17% | 8.5 |

| Base 📈 | 22% | 11.5 |

| Bull 🚀 | 27% | 14.5 |

Even in the conservative bear case with 17% growth, DataRobot maintains a healthy 8.5x multiple, reflecting continued market confidence. The base and bull scenarios demonstrate increasing optimism, with multiples expanding to 11.5x and 14.5x respectively, though still below the company's peak 30x valuation.

| Bear 🐻 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 |

|---|---|---|---|---|---|---|

| Revenue | $225M | $256M | $294M | $340M | $396M | $463M |

| Growth | 12.50% | 13.71% | 14.75% | 15.79% | 16.46% | 17% |

| Base 📈 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 |

|---|---|---|---|---|---|---|

| Revenue | $225M | $259M | $304M | $363M | $438M | $535M |

| Growth | 12.50% | 15.05% | 17.25% | 19.45% | 20.87% | 22% |

| Bull 🚀 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 |

|---|---|---|---|---|---|---|

| Revenue | $225M | $262M | $314M | $386M | $484M | $614M |

| Growth | 12.50% | 16.40% | 19.75% | 23.10% | 25.27% | 27% |

Our bear, base, and bull cases for DataRobot reflect varying scenarios of market positioning and growth trajectory in the evolving AI/ML landscape

- In the bear case, DataRobot struggles against larger tech competitors, reaching a $3.9B valuation by 2028 ($463M revenue at 8.5x multiple with 17% growth)

- In the base case, DataRobot maintains its market position through innovation and partnerships, achieving a $6.1B valuation ($535M revenue at 11.5x multiple with 22% growth)

- In the bull case, DataRobot's MLOps and Location AI initiatives drive significant expansion, resulting in an $8.9B valuation ($614M revenue at 14.5x multiple with 27% growth).

| Scenario | 1. Bear 🐻 | 2. Base 📈 | 3. Bull 🚀 |

|---|---|---|---|

| 2023 ARR | $225M | $225M | $225M |

| 2023 Growth Rate (%) | 13% | 13% | 13% |

| 2023 Multiple | 8.5 | 11.5 | 14.5 |

| 2023 Valuation | $1.9B | $2.6B | $3.3B |

| 2028 Revenue | $463M | $535M | $614M |

| 2028 Growth Rate (%) | 17% | 22% | 27% |

| Multiple | 8.5 | 11.5 | 14.5 |

| 2028 Valuation | $3.9B | $6.1B | $8.9B |

The uncertainty around these three cases depends primarily on DataRobot's ability to differentiate against larger tech competitors, maintain its market position through product innovation and partnerships, and successfully expand into new verticals through MLOps and Location AI initiatives while accelerating growth in enterprise AI adoption.

- In the Bear case: DataRobot struggles to differentiate itself from larger tech competitors like AWS and Microsoft Azure, while continuing to see declining growth rates and market share erosion in the increasingly crowded AutoML space, leading to lower valuations more in line with traditional SaaS companies.

- In the Base case: DataRobot successfully maintains its position as a leading independent AutoML platform through continued product innovation and strategic partnerships, while achieving moderate but steady growth in the 15-20% range as enterprise AI adoption continues.

- In the Bull case: DataRobot's MLOps and Location AI initiatives drive significant expansion into new verticals and enterprise use cases, while its automation-first approach proves increasingly valuable as AI adoption accelerates, leading to renewed growth acceleration and premium valuations in line with top AI companies.

DataRobot's final valuations reflect significant uncertainty, ranging from $3.9B in the bear case to $8.9B in the bull case by 2028. Even the conservative scenario suggests moderate growth, while the optimistic case would position DataRobot as a leading AI/ML platform with strong market validation.

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.