Revenue

$1.00B

2024

Valuation

$30.50B

2025

Funding

$3.76B

2024

Growth Rate (y/y)

138%

2024

Revenue

Sacra estimates that Anduril hit $1B in revenue in 2024, up 138% from $420M in 2023, off significant growth in new government contracts—new contracts exceeded $1.5B in 2024 from $675M in 2023, driven by major wins like the Marine Corps Bolt-M contract and the Pentagon's Replicator program. Anduril reportedly expects to burn $800M–$900M in cash during 2025 to fund major programs.

The company had roughly $750M in cash on its balance sheet as of Q1'24.

Anduril secured its first defense contract, a $12.5 million deal with the U.S. Marine Corps, about a year after the company was founded in 2017. By 2020, Anduril won a massive $1B System Integrator Partner (SIP) program contract—its first ACAT I, the biggest acquisition category—in a competitive showdown against defense primes.

Gross margins

Anduril's gross margin of 40-45% is significantly higher than traditional defense primes, who typically have margins in the 8-10% range, because Anduril sells its products as commercial items at a firm fixed price negotiated with the government, rather than the cost-plus model where margins are capped.

According to Scott Sanders, chief growth officer at Forterra and an early Anduril employee, this product-centric commercial model enables "SaaS-like margin profiles" even on hardware by having very low hardware costs.

Customer acquisition costs

While Anduril doesn't disclose customer acquisition costs, the sales cycles for defense are very long—18-24 months minimum to get into a major program, according to Sanders. Lots of investment in R&D, prototyping and field testing is required to win contracts. However, once secured, these contracts provide large, predictable multi-year revenue streams. Anduril's large fundraises have provided the capital needed to attack these long sales cycles.

Valuation & Funding

Anduril was last valued at $30.5B following its $2.5B Series G round led by Founders Fund in June 2025. This was up from $14B at its Series F in August 2024.

Earlier, the defense-tech firm hit $8.5B on a $1.48B Series E in December 2022 and was first marked around $4.7B after a $450M Series D in June 2021. Anduril has now raised $6.26B in total funding since its 2017 founding, with notable investors including Founders Fund, Sands Capital, Andreessen Horowitz, Fidelity Management & Research Company, and General Catalyst. At $1B in 2024 revenue, the latest valuation implies an approximate 30.5x revenue multiple.

Product

Anduril Industries was founded in 2017 in Irvine, California by Palmer Luckey, co-founder of Oculus VR, Brian Schimpf, and Trae Stephens, with the mission to build cutting-edge technology for defense and security.

Anduril is building Arsenal-1, a $1B, 5-million-square-foot autonomous weapons manufacturing facility in Ohio creating 4,000+ jobs, with production beginning July 2026. The company expanded internationally through partnerships with Rheinmetall for European markets and is considering UK manufacturing facilities to serve European defense budgets projected at €800B through 2027.

In October 2025, Anduril’s jet‑powered YFQ‑44A conducted its first “semi‑autonomous” flight in California, managing flight controls and throttle without a human pilot and landing at the push of a button; manufacturing of the prototype is slated to begin next year at an Ohio facility.

Lattice

The cornerstone of Anduril's suite of products is Lattice, an AI software platform designed to integrate data from a multitude of sensors and systems, enabling real-time situational awareness and data-driven decision-making.

Lattice is designed to ingest massive amounts of data from various sources, including cameras, radars, and other sensors, and apply advanced machine learning algorithms to detect, identify, and track multiple targets simultaneously.

This enables defense agencies and border control to effectively monitor vast areas with minimal human intervention, as Lattice can automatically alert operators to potential threats or anomalies.

Lattice can also perform complex tasks like object recognition, behavioral analysis, and predictive modeling. For example, Lattice can distinguish between different types of vehicles, identify suspicious patterns of movement, and even anticipate potential threats based on historical data and real-time intelligence.

Hardware ecosystem

To augment Lattice, Anduril has developed a series of other hardware products, including:

- Anvil: a kinetic counter-drone system deployed on the ground to knock out UAVs

- Ghost 4: autonomous tactical drone assembled in 3 minutes that can fly silently for 60 minutes

- Altius: a drone with 4 models that can deploy from air, land, and sea

- Dust: a ground-based sensor that detects and alerts users of targets

- Dive-LD: underwater autonomous vehicle that can do surveys and run surveillance at up to 6,000 meters (acquired via Anduril’s acquisition of Dive Technologies)

Autonomy

By leveraging machine learning, Anduril's drones, towers, and sensors can operate with minimal human intervention, freeing up personnel for other critical tasks.

For example, Ghost UAS can autonomously navigate to designated waypoints, avoid obstacles, and even coordinate with other drones to perform complex missions. Similarly, Sentry Towers can automatically detect and track targets, alerting operators only when a potential threat is identified.

This autonomy is a force multiplier, enabling a small team of operators to effectively control and monitor a large fleet of drones and sensors. It also reduces the cognitive burden on personnel, allowing them to focus on higher-level decision-making rather than mundane tasks.

In October 2025, Anduril previewed its new AI-powered EagleEye helmet and eyewear, with founder Palmer Luckey saying the company will deliver roughly 100 units to select U.S. Army personnel in Q2 2026; early variants include modular augmented reality glasses co-developed with Oakley and are expected to come in at about half of the Army’s originally anticipated $50,000–$80,000 per-unit IVAS cost.

Integration

Lattice serves as the central nervous system for this suite of hardware products, processing and analyzing data from the various hardware platforms to provide a comprehensive, real-time picture of the battlefield.

This integrated approach allows for seamless coordination between different assets and enables rapid, data-driven decision-making. For instance, if a Sentry Tower detects a suspicious vehicle, it can automatically dispatch a Ghost UAS to investigate, while simultaneously alerting nearby ground units via Dust sensors. If the vehicle is confirmed as a threat, Anvil can be deployed to neutralize it.

Counter-drones

While Anduril has become known for its drones, countering the threat of drones is becoming an even bigger business. In March 2024, Anduril secured a $642M contract with the Marine Corps to build AI-powered anti-drone systems to protect military installations from Group 1 and Group 2 drones (typically no heavier than 55 pounds and flying at a maximum altitude of about 3,500 feet).

This follows a previous $200M contract to develop counter-drone systems for the Marine Air Defense Integrated System (MADIS). The rapid growth in this segment reflects the emerging asymmetric threat posed by small commercial and homemade drones that have inflicted approximately 80% of all casualties on the battlefield in the Russo-Ukrainian War.

In February 2024, Anduril also expanded its partnership with Microsoft to advance the U.S. Army's Integrated Visual Augmentation System (IVAS) program, effectively taking over Microsoft's $22B contract to develop mixed-reality goggles for soldiers with integrated counter-drone capabilities.

In October 2025, the U.S. Army selected Anduril to deliver a modernized counter‑drone fire control system to replace Northrop Grumman’s FAAD C2, following DIU-led competitions focused on short‑range air defenses. In September–October 2025, Anduril also previewed its AI‑powered EagleEye headwear ahead of AUSA and secured additional next‑gen combat goggles prototype awards, while progressing U.S. manufacturing with site planning in Pickaway County, Ohio.

Business Model

SaaS + hardware

Anduril's business model is a sophisticated fusion of a SaaS platform (Lattice) and a suite of AI-powered hardware products that function as cross-sells and upsells.

At the heart of this model is Lattice, an AI software platform that integrates and analyzes data from various sensors and systems in real-time. Lattice is sold to defense and security customers as a subscription-based service, akin to a SaaS model. Customers pay a recurring fee to access Lattice's capabilities, which include object detection, tracking, and data fusion.

When a customer gets started with Lattice, Anduril can then offer them their hardware products as add-ons to enhance the capabilities and value of the platform as cross- and upsells. For example, a customer using Lattice for border surveillance might be upsold Sentry Towers to provide automated monitoring, or Ghost UAS for aerial reconnaissance.

This model allows Anduril to capture a larger share of the value chain by providing both the software and hardware components of the solution, increasing revenue per customer but also creating a more integrated and sticky product ecosystem that drives retention.

Secondly, by controlling both the software and hardware, Anduril can ensure optimal performance and compatibility between the different components. This is particularly important in a defense context, where reliability and seamless integration are critical.

In August 2025, Anduril opened a high-volume solid rocket motor (SRM) factory in Mississippi, becoming the United States’ third supplier of SRMs alongside Northrop Grumman and L3Harris’ Aerojet Rocketdyne.

The facility is expected to reach an annual production capacity of 6,000 tactical motors by the end of 2026, with over 700 motors already passing static test firing. These motors serve a range of applications from missile interceptors to deep-space probes.

R&D upfront

Anduril Industries flipped the traditional business model of defense contracting—instead of waiting for Requests for Proposals (RFPs) from governmental agencies, Anduril has gone after a strategy where they take on the R&D burden upfront, allowing them to offer pre-developed, cutting-edge solutions to the Department of Defense and other allied military forces worldwide.

This product-centric approach is a key differentiator for Anduril. By taking on the R&D risk, Anduril can get to market much faster than going through the traditional multi-year government acquisition process.

Fixed pricing

By eschewing cost-plus contracts and instead doing their R&D upfront and then selling their products for a fixed price, Anduril can target much higher margins than the industry-standard 8-10%.

By selling its products as commercial items at a fixed price, Anduril can earn "SaaS-like" 40-50% gross margins on its hardware-software systems, with low hardware costs and high software content.

Despite the one-off nature of hardware sales, continuous upgrades are a key part of Anduril's model. The company employs a "phrasing as a service" approach where its software-defined systems are constantly updated with new features and capabilities as part of an ongoing, fixed-price service contract.

This ensures that Anduril's products don't go obsolete and that customers benefit from the latest breakthroughs without having to buy a whole new system.

Vertical integration

Anduril pursues vertical integration to industrialize defense tech, not just assemble components.

In parallel, Anduril is building domestic manufacturing capacity (e.g., Arsenal‑1 in Ohio; SRM factory in Mississippi) to shift from bespoke prototypes to mass‑producible, expendable systems with lower unit costs and faster iteration.

In October 2025, Anduril announced the acquisition of American Infrared Solutions (AIRS) to bring cooled‑IR camera manufacturing in‑house and integrate AIRS technology into products like Iris and Wisp, advancing its vertical integration in sensors.

Competition

Defense primes

Anduril's primary competition comes from the large defense primes such as Lockheed Martin, Boeing, Raytheon, and Northrop Grumman.

As Ross Fubini, founder of XYZ Venture Capital and an early Anduril investor, explains: "Anduril's primary competition is the difficulty of displacing these primes, which also has to do with the attribute I said before, its biggest challenge is just changing the world of procurement so that we can get the best products out for the cheapest price."

The 10 largest defense contractors account 80%+ of all aerospace and defense revenues, reflecting the advanced and continuing consolidation in the sector. These incumbents benefit from massive scale, entrenched customer relationships, and deep political influence.

The primes are also not ignoring the rapid technological advancements in areas like unmanned systems, artificial intelligence, and software-defined hardware. Each of the major primes has established its own venture capital arm to invest in startups innovating in these fields.

They are also developing their own competing product lines in-house. For instance, Boeing is developing an autonomous fighter jet called the MQ-28 Ghost Bat.

The primes rely on the traditional cost-plus contracting model, where they have little incentive to innovate rapidly or drive down costs. Their offerings tend to be bespoke one-off products designed to detailed government specifications, rather than more flexible and iteratively developed commercial items.

Sustaining their large overhead requires continually winning large contracts, incentivizing political maneuvering over pure technological superiority.

Startups

Anduril's most direct startup competitor is arguably Shield AI, which is applying autonomy and AI to power unmanned defense systems.

Founded by a team that includes former Navy SEALs, Shield AI has won several high-profile contracts for its AI pilots and is now expanding into additional domains like space and underwater.

Other startups like Palantir (data analytics), SpaceX (launch and satellites), and Relativity Space (3D-printed rockets) are also challenging the primes in their respective domains.

While each of these companies may compete with Anduril for some contracts, they are also collectively validating the thesis that software-first startups can win against the primes by moving faster and leveraging best practices from the commercial world.

Finally, the market that these defense startups are going after isn't best understood as a single monolithic market, which means that there's plenty of room for many of them to win.

Early Anduril employee Scott Sanders frames the competitive landscape this way: "The DOD is not a unified market. It's not. You can have two program managers across the hall from each other, and they have completely different acquisition strategies about complete different things, using different colors of money. It's a conglomeration of micro markets, and they're all very different."

TAM Expansion

Geographical expansion

Anduril is riding Europe's defense wake-up call by building local production and R&D hubs to satisfy sovereignty agendas as the EU proposes €800B in new military spending by 2027.

After signing its first major European defense deal to sell ~$38M of Altius drones to the UK for use in Ukraine in March 2024, Anduril announced plans to build a UK drone factory and partner with European defense companies.

This localization strategy mirrors approaches used by American defense primes like Boeing (~35% of defense revenue from international sales), Lockheed (~27%), and Northrop (14%), who have successfully sold into Europe, the Middle East, and Asia-Pacific since the 1950s.

By opening subsidiaries like Anduril UK and Anduril Australia (established 2022), building overseas factories, and partnering with primes like Rheinmetall (Germany), European countries can "buy European" while getting the advantages of American technology.

In November 2025, Anduril expanded its Asia‑Pacific footprint, opening its Australian Ghost Shark factory with the first XLUUV off the line and readiness for undersea acceptance testing, and signaled entry into Japan while already establishing offices in Taiwan and South Korea.

Anduril has also launched a joint venture with UAE defense firm EDGE Group to build autonomous drones in Abu Dhabi, with EDGE investing around $200 million and an unnamed UAE entity placing 50 orders for the “Omen” system.

The partnership includes a 50,000‑square‑foot R&D hub to serve Middle East customers, with production targeted by end of 2028 and applications spanning maritime surveillance, humanitarian relief, and airborne connectivity; Anduril has invested about $850 million into the technology behind the new drones.

The U.S. defense budget

Domestically in the U.S., Anduril stands to win big from the DoD’s plans to cut the Pentagon’s budget by ~$250B by trimming 8% per year for the next 5 years.

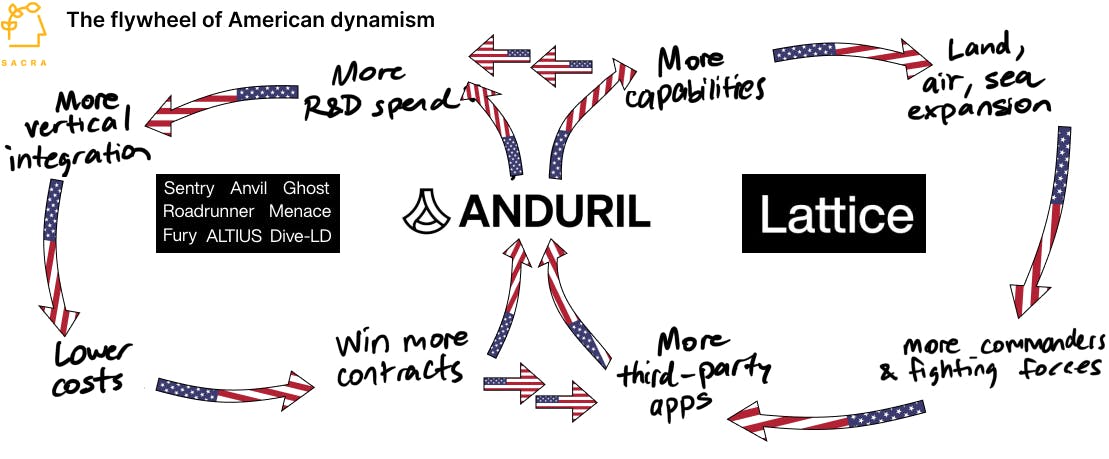

Anduril's entire model of American Dynamism undercuts stagnant incumbents on long cost-plus contracts by building & taking on the risk & cost of R&D upfront, then selling finished products.

Allocation is moving away from superprojects like Lockheed Martin’s F-35 program ($2T lifetime cost) and towards the 17 areas the Pentagon has exempted from any cuts, like drones (Anduril, Shield AI, Neros), training (Red 6), nuclear modernization (Kairos Power, Oklo), unmanned ocean vessels (Anduril, Saronic, Saildrone) and homeland missile defense (Anduril, Epirus).

Across many of these categories, Anduril is today a market leader.

Risks

Friction and procurement practices: If the Pentagon's procurement practices remain rigid and continue to favor established defense contractors, Shield AI may find it difficult to secure long-term contracts that are crucial for its sustained growth and scalability.

Government largesse: It’s been typical practice for the DOD to spread contracts around the country to different contractors as part of winning political support and decentralizing their supply chain. These kinds of market dynamics could limit Anduril’s growth and ability to dominate in defense/aerospace.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.