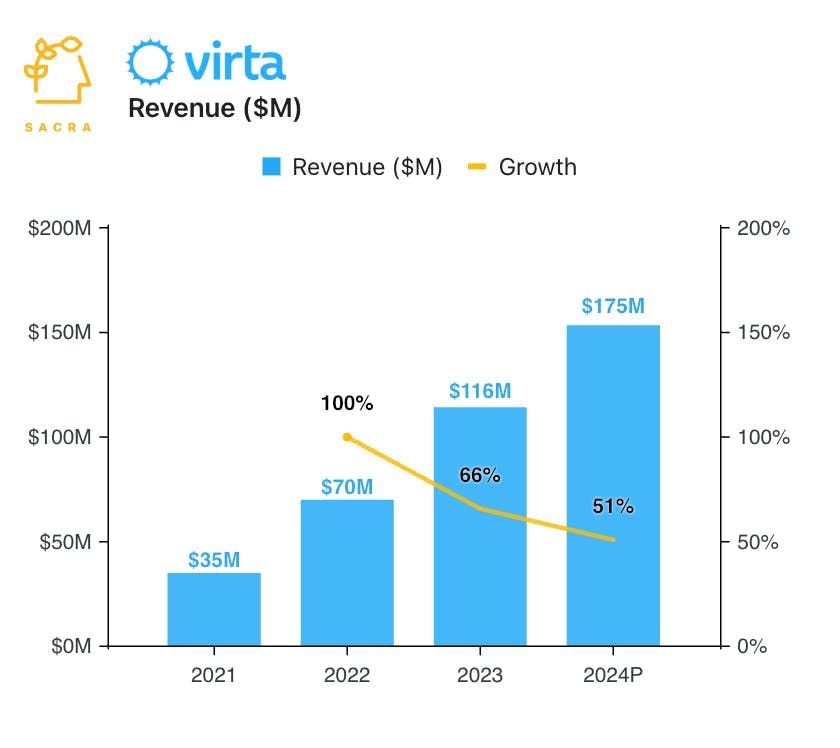

Virta Health at $175M revenue

Jan-Erik Asplund

Jan-Erik Asplund

TL;DR: Sacra estimates that Virta Health will hit $175M of revenue in 2024, up 51% YoY, with their ketogenic diet-based therapy for type 2 diabetes reversal. Now, as insurers and employers struggle to deal with the cost of providing GLP-1s, Virta’s obesity product is enjoying tailwinds as a pharma-free alternative. For more, check out our full report and dataset on Virta.

Key points via Sacra AI:

- Virta Health (2014) is a telehealth provider that sells type 2 diabetes reversal via the ketogenic diet as a benefit ($2.8K per patient with a $10-20K platform fee per year) into health plans and self-insured employers, delivering it through a combo of connected devices (glucose meter, ketone meter, scale), 2-4 daily health coach check-ins, and continuous physician oversight. Virta Health’s ops-heavy protocol saves customer money ($13,000 in gross savings per patient over 2 years) with low risk (100% of Virta’s fees are contingent on outcomes) and has proven to be sticky (90% year 1 retention), high ACV ($318K), and effective (60% of trial patients got off insulin), but with a potential lower ceiling on TAM because keto-based treatment is still outside the mainstream medical consensus.

- In 2022, Virta launched a second product for obesity ($900/year), with Sacra now estimating Virta will do $175M of revenue in 2024, up 51% YoY, with roughly 550 customers (~$318K ARPC) and 98,000 patients (~180 patients per customer) for blended average revenue per patient of $1.8K. Virta positions against diabetes maintenance companies focused on medication adherence and overall lifestyle improvements like Livongo (~$275M yearly revenue when acquired by Teladoc for $18.5B in 2020) and Omada at roughly $300M of revenue in 2023, up 50% YoY, with ~1,900 customers ($158K ARPC) and 300,000 enrolled patients (157 patients per customer) for average revenue per patient of about $1K.

- With Ozempic’s runaway success ($14B of sales in 2023) driving up employer health costs by ~10% YoY, Virta’s obesity product (growing 150% YoY) provides a cheaper, pharma-free alternative ($900/year vs. $3,000/year), with new employer signups for obesity now growing faster than their diabetes reversal product. Unlike Livongo and Omada's horizontal expansion into mental health and musculoskeletal care through acquisitions (myStrength for $30M, Lantern Health, Physera), Virta maintains strict focus on metabolic conditions treatable through ketosis—obesity first, with cardiovascular disease and non-alcoholic fatty liver disease as likely next targets.

For more, check out this other research from our platform:

- Virta Health (dataset)

- Noom (dataset)

- Hone Health: the $55M/year D2C testosterone startup

- Ro and the telehealth capital cycle

- Brendan Keeler, interoperability lead at HTD Health, on GTM for AI medical scribes

- Johannes Schildt & Claes Ruth, CEO and CFO of Kry, on the AI future of telehealth

- Andy Hoang, CEO of Aviron, on the unit economics of connected fitness

- Strava: the $265M/year Whole Foods of social networks

- Aviron and the Xbox of connected fitness

- Oura (dataset)