Startups are value stocks now

Jan-Erik Asplund

Jan-Erik Asplund

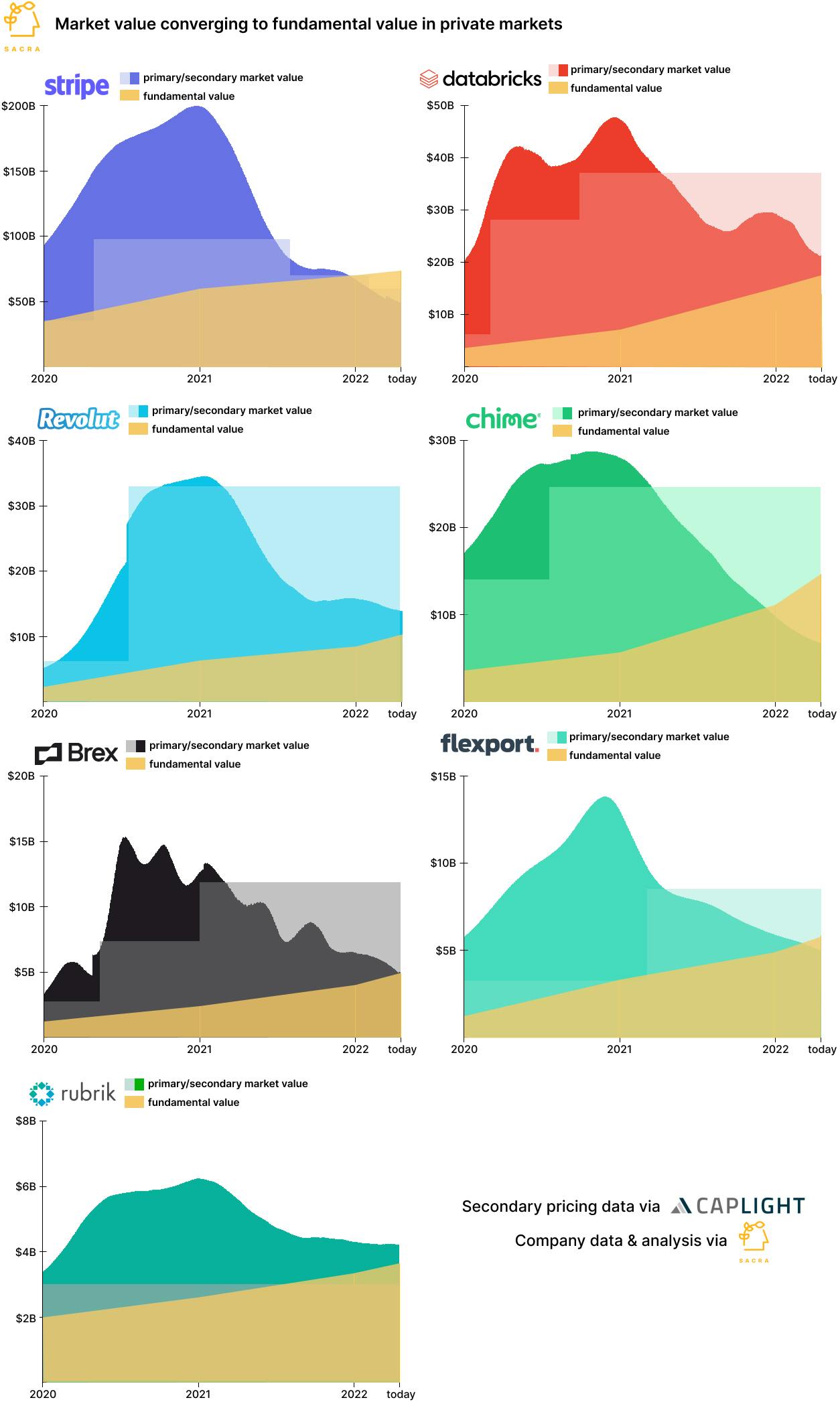

TL;DR: While the headline story is the dramatic 75% decline in the value of private stock, the underlying shift that’s being missed is that fundamental value continues to compound in the top private names. Now, we’re seeing secondary rebound as investors see the option to buy up private stock at value prices. For more, check out our full dataset on market value vs. fundamental value behind the graphic below.

Key points from our research:

- Historically, secondary shares in privates, often common stock, have traded at a ~20% discount to the last primary preferred round—but that flipped in 2020-2021 as capital inflows dramatically increased into scarce private stock. Compare February 2011 when Chris Sacca picked up Twitter shares at a 7% discount on their last preferred price of $3.7B with January 2022, when investors bought Stripe ($14B revenue in 2022) secondary at $199B for a 453% premium on their last preferred price of $36B. (link)

- In the bull run of 2020-2021, the market price of private stock became dominated by its option value rather than its fundamental or intrinsic value (per Tribe Capital’s framework on price & valuation), with every company promising to accelerate revenue growth at scale by colonizing adjacent markets and building superapps. See corporate card Brex (dataset), which raised at a 100x revenue multiple in April 2021 on $94M of net interchange revenue and traded at an even higher 162x in secondary markets, pricing in Brex’s next acts of banking and enterprise SaaS even though they didn’t yet exist. (link)

- Sharp interest rate hikes and steep declines in public tech stocks, with the Nasdaq 100 falling 30% through June, made secondary buyers scarce, with bids as a percentage of total volume at 22% as of Q2’22. This thinning of the order book sent market prices plummeting, with hyped companies like Stripe (down 75% from $199B to $49B) and Chime (down 75% from $28B to $7B) and Revolut (down 60% from $34B to $14B) the biggest downgrades. (link)

- Meanwhile, top privates have continued to compound revenue and grow fundamental value during the bear market, like Databricks, which grew 80% YoY to $1.4B ARR to a fundamental valuation of ~$14B based on a top-quartile SaaS 12x price/sales multiple. With its option value trending down to a 50% premium to its fundamental value trading at $21B (15x multiple), Databricks compares favorably with Snowflake (NASDAQ: SNOW) on fundamentals and market price at $48B (23x multiple) on $2B revenue growing 70% YoY. (link)

- As fundamental value converges upwards with market price, deep value is being uncovered in private markets with companies that saw some of the biggest drop offs in market value in 2022 now priced at or under their fundamental value, like Flexport (now worth $5.8B at 1x multiple, up 17% from their $5B market valuation) and Stripe (now worth $74B at 5x multiple, up 49% from their $49B market valuation). Buy side demand has begun to rebound with the ratio of bids to total volume at 36% as of Q1’23 (up 71% YoY) and the average bid size up 18% to $11.4M, per Caplight. (link)

For more, check out our dataset of market price vs. fundamental price and this other research from our platform:

- The Privately-Traded Company: The $225 Billion Market for Pre-IPO Liquidity

- Javier Avalos, co-founder and CEO of Caplight, on building synthetic derivatives of private stock

- Charly Kevers, CFO at Carta, on progressive price discovery and investor relations

- Databricks (dataset)

- Chime (dataset)

- Stripe (dataset)

- Revolut (dataset)

- Brex (dataset)

- Flexport (dataset)

- Rubrik (dataset)