The Free Press at $20M/year

Jan-Erik Asplund

Jan-Erik Asplund

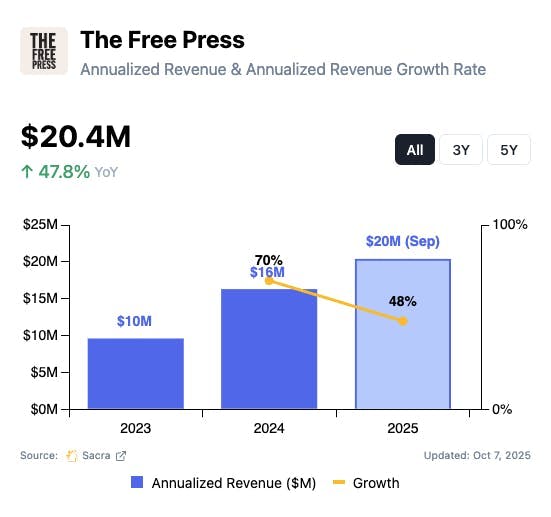

TL;DR: Founded by ex-NYT journalist Bari Weiss as an anti-woke Substack for “disaffected centrists,” The Free Press became the platform’s top earner before being acquired by Paramount-Skydance for $150M (7.5x revenue) to install Weiss as CBS News editor-in-chief. Sacra estimates The Free Press hit $20M in annualized revenue in September 2025, up 48% year-over-year. For more, check out our full report and dataset.

Key points via Sacra AI:

- Founded by ex-New York Times op-ed writer Bari Weiss after resigning over the paper’s “illiberal” turn, The Free Press (2021) launched as an anti-woke newsletter built on Substack for “disaffected centrists” that found product-market fit publishing transgender-critical whistleblowers, essays on cancel culture, and investigations of bias inside legacy institutions like the New York Times & NPR. Subscriptions are the majority of revenue, with readers getting select articles, podcast episodes, and YouTube videos for free, while $10/mo or $100/yr—10% of which goes to Substack—unlocks all articles, paywalled podcast episodes, subscriber-only livestreams, archives, and commenting, but TFP podcasts & documentaries also monetize via dynamic ads & YouTube ads respectively, while live event (“America Debates”) tickets go for between $40 and $300+.

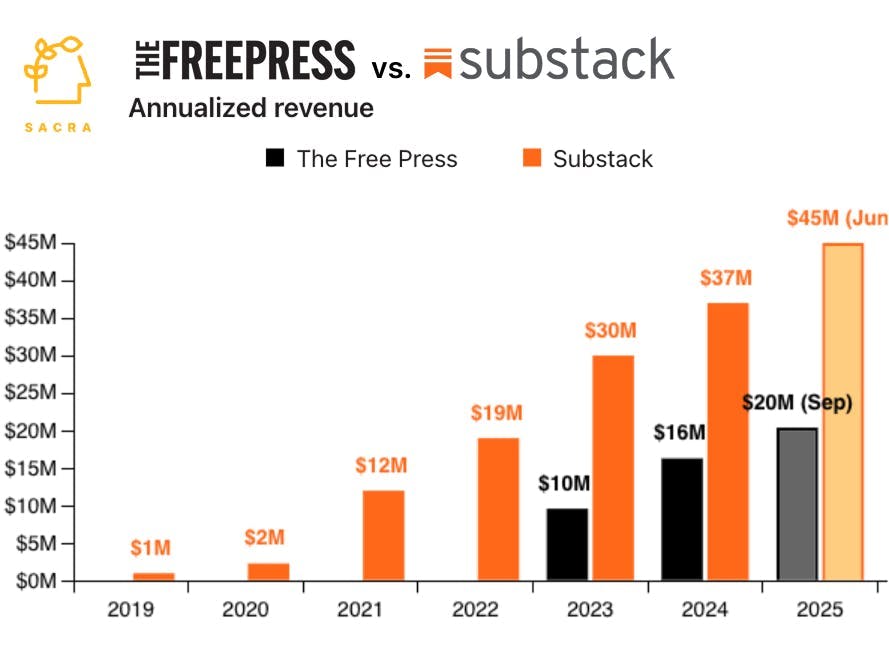

- Becoming the #1 Substack by revenue on the strength of articles about NPR being leftwing (4,765 likes), a negative review of Ta-Nehisi Coates’s new book (2,325 likes), and a positive review of Trump’s anti-gender-affirming care EO (2,099 likes), Sacra estimates The Free Press hit $20M in annualized revenue in September 2025 with 170K paid subscribers, up 48% year-over-year and up from $16.3M at the end of 2024, now acquired by Paramount Skydance for $150M (7.5x revenue) in a deal that installs founder Bari Weiss as Editor-in-Chief of CBS News. Compare to the short-form-oriented newsletter brand Axios (~$100M revenue in 2022, acquired by Cox for $525M, 5.3x revenue), subscription sports publisher The Athletic (~$65M revenue in 2021, acquired by NYT for $550M, 8.5x), newsletter platform Substack ($45M annualized revenue in 2025, valued at $1.1B, 24x), and the New York Times’ multi-product, news & gaming-centric platform ($2.68B TTM revenue, $9.0B market cap, 3.4x).

- While The Free Press’s acquisition burnishes Substack’s brand halo and cultural status as a luxury publisher, it exposes the clash between 1) Substack’s strategy of paying prestige writers via Substack Pro (which led to $5.2M in negative revenue for 2021) to quit their jobs and start newsletters, and 2) Substack’s business model of taking 10% of GMV, which at scale, incentivizes those same writers to migrate to Beehiiv or Kit—or use their Substack-earned credibility to return to their legacy jobs with leverage. Meanwhile for Paramount, paying $150M for The Free Press is as much regulatory arbitrage as it is media M&A, with Paramount using the acquisition to signal viewpoint diversity and placate President Trump's FCC during its $8B Skydance merger review, alongside settling Trump’s lawsuit with CBS & appointing a new conservative ombudsman to address allegations of liberal bias at CBS News.

For more, check out this other research from our platform:

- The Free Press (dataset)

- Substack (dataset)

- Justin Gage, founder of Technically, on how Substack earns its 10% take rate

- Beehiiv (dataset)

- ConvertKit vs. Beehiiv vs. Substack

- Nathan Barry, CEO and founder of ConvertKit, on ConvertKit’s path to $100M in revenue

- ConvertKit (dataset)

- Stan (dataset)

- OnlyFans (dataset)

- ConvertKit at $38M ARR

- Substack: the $19M/year content LVMH