Scale AI for Chinese restaurants

Jan-Erik Asplund

Jan-Erik Asplund

TL;DR: By routing phone-in orders to a Filipino call center, Tarro helps small Chinese restaurants save $30,000+ in annual labor costs. Sacra estimates Tarro reached an $85M revenue run rate at the end of 2024, growing 118% YoY, with 3,500 restaurant customers, ~50% gross margin and $24K average revenue per customer. For more, check out our full report and dataset on Tarro.

Key points via Sacra AI:

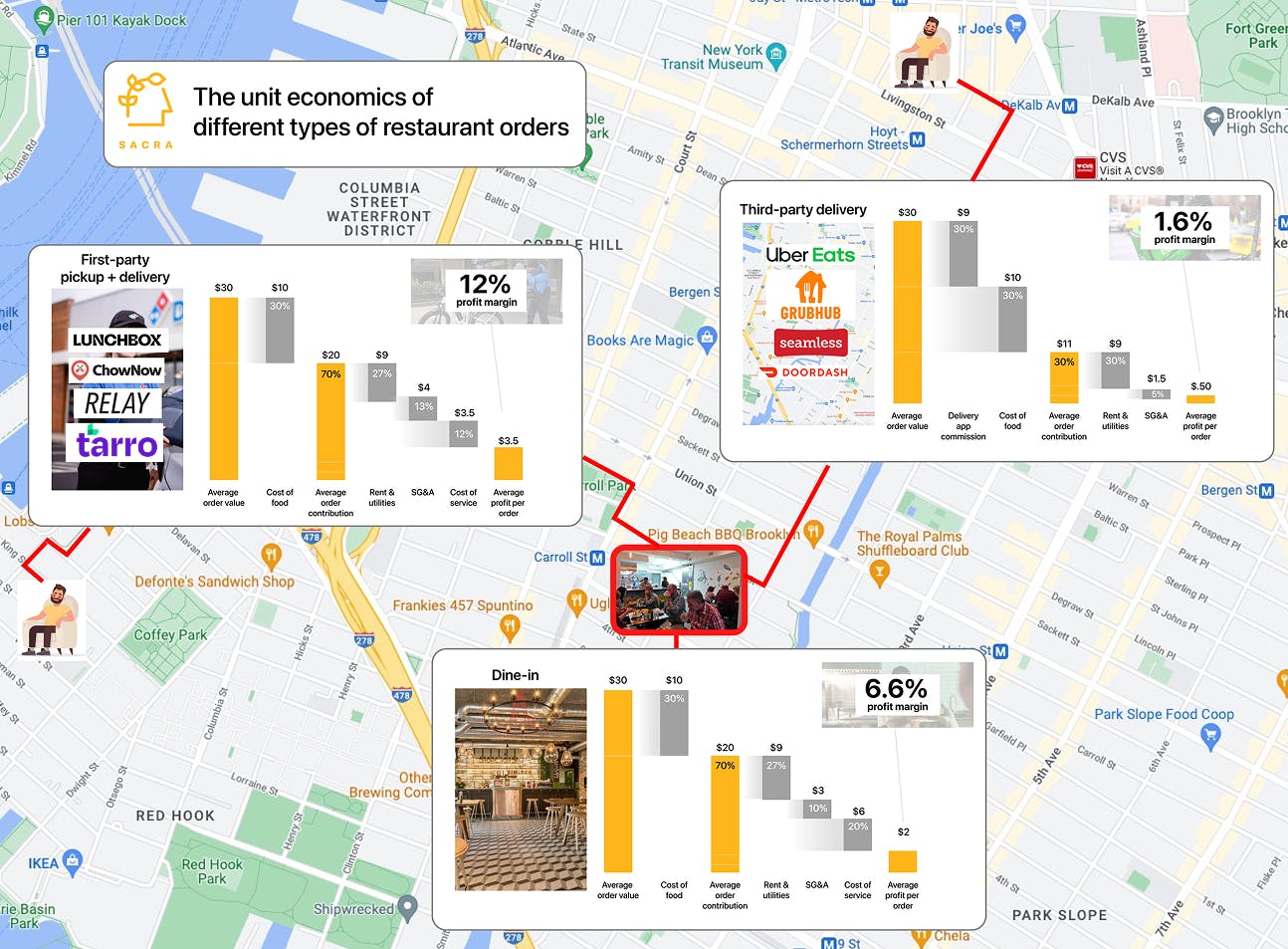

- Founded in 2012, Tarro found product-market fit in 2015 with software that re-routes phone-in orders to Chinese restaurants in the U.S to a 24/7 call center in the Philippines, giving small, family restaurants access to an always-on, English-speaking remote assistant.Tarro lands inside restaurants with outsourced phone order-takers who are 5-10% cheaper than domestic labor, and they expand by selling into additional services like marketing ($8,500/year) and delivery services launched in September 2024 (effective take rate of ~15% vs. the 20-30% commission of Uber Eats or DoorDash)—with an average revenue per customer of $24K.

- As their customer base has grown to 3,500 restaurants across delivery & takeout-heavy cuisines Chinese, sushi & pizza, Sacra estimates Tarro reached an $85M revenue run rate at the end of 2024, accelerating to 118% YoY growth with ~50% gross margin, last valued at $450M (41x multiple on ~$11M ARR) when growth private equity funds Integrity Capital Partners and Cohesive Capital Partners took a minority position in 2022. Compare to AI voice ordering competitor Olo (NYSE: OLO) at at $272M revenue (+19% YoY) with 55% gross margin and 700 customers for $389K ACV, SoundHound (NASDAQ: SOUN) at $67M revenue (+46% YoY) with 49% gross margin and 200 customers for $335K ACV, and Presto (taken private in January) at $19M revenue (-35% YoY) with 6% gross margin, which eliminated its pay-at-table business (90% of revenue) in 2024, pivoting to focus on voice ordering.

- While recent "Shopify for restaurants" SaaS like ChowNow (General Catalyst, $94M raised) and Lunchbox (Coatue, $72M raised) focused on giving restaurants websites with online ordering & delivery to own and grow revenue through digital, the next wave of vertical SaaS built on voice AI —companies like Tarro, SoundHound, Presto and Hi Auto—look to save restaurants that run at 3-5% margins $30,000+ in labor costs per year, as a wedge into selling in automation across the stack. Like Scale AI with data labeling, Tarro benefits from the opportunity to dramatically increase its margins by replacing Filipino call center workers ($3-4/hr) with AI ($0.30-0.40/hr), but to pull that off, it must disrupt its own business model (priced as a discount on the cost of labor) and completely refactor its software & people infrastructure (built on an offshoring model).

For more, check out this other research from our platform:

- Tarro (dataset)

- Grubmarket (dataset)

- Weee! (dataset)

- Swiggy (dataset)

- Chris Webb, CEO of ChowNow, on the new restaurant stack

- Hadi Rashid, co-founder of Lunchbox, on vertical SaaS for restaurants

- Weee! vs. Instacart

- Instacart vs Amazon vs Uber

- Mike Bell, CEO of Miso Robotics, on automating across the value chain of fast casual food

- Former corp dev at a European on-demand unicorn on dark store unit economics

- ChowNow, Lunchbox, and the $12B product-market fit of pizza that launched food delivery

- ServiceTitan: the $577M/year vertical SaaS for your lawn

- Warren Brown, VP of Product at Order, on 4 ways to monetize payments in vertical SaaS

- Ameet Shah, partner at Golden Ventures, on the economics of vertical SaaS marketplaces