PandaDoc at $100M ARR

Jan-Erik Asplund

Jan-Erik Asplund

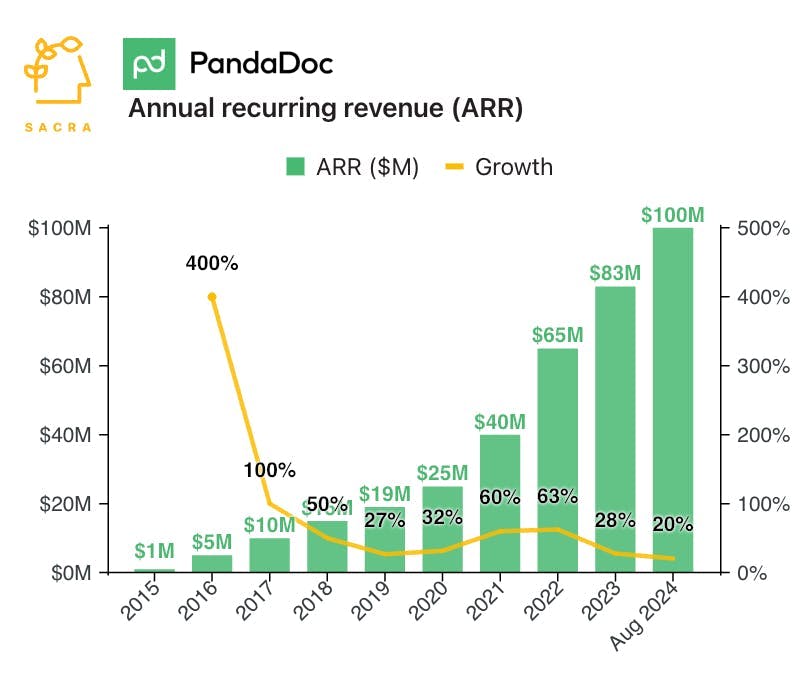

TL;DR: Sacra estimates that PandaDoc hit $100M in annual recurring revenue (ARR) in August 2024, up 20% from $83M at the end of 2023, as they aggressively colonized sales data rooms, CPQs, payments and notarization. For more, check out our full PandaDoc report and dataset.

Key points via Sacra AI:

- Founded in 2011 in Belarus, PandaDoc found product-market fit undercutting DocuSign (NASDAQ: DOCU) on price, offering unlimited docs and e-signatures as part of a SaaS subscription vs. DocuSign’s $5 per e-signature, hitting $1M ARR after 6 months and $5M ARR after 18 months. Circa 2010, a wave of startups from the former Soviet Bloc, like Estonia’s Pipedrive (founded in 2010), Romania’s UiPath (founded in 2005) and Russia’s Miro (founded in 2011, $560M ARR in 2023), used top-quality, low cost technical talent to build feature-parity, aggressively priced cloud SaaS companies that competed globally from day one.

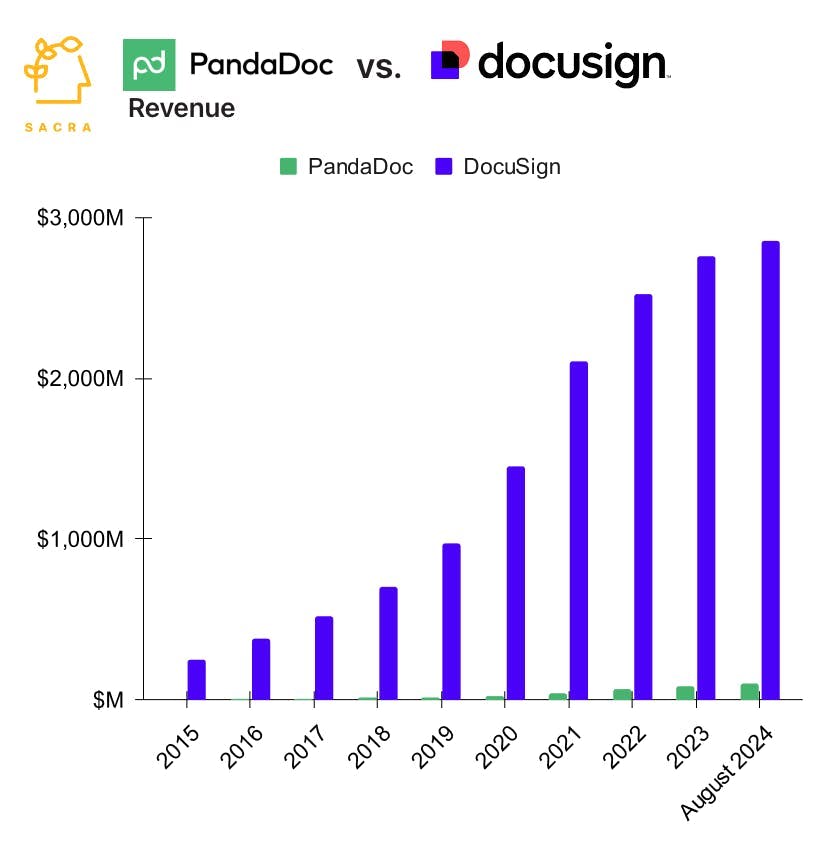

- Sacra estimates that PandaDoc hit $100M in annual recurring revenue (ARR) in 2023, up 20% from $83M at the end of 2023, valued at $1B as of their 2021 Series C for a 25x multiple on their $40M ARR in 2021, with 56,000 customers for average revenue per customer (ARPC) of about $1.8K. Compare to e-signature and contract leader DocuSign (NASDAQ: DOCU) at $2.8B of revenue, up 3.55% from the end of 2023, valued at $12.58B for a 4.5x revenue multiple, and document storage & workflow company Dropbox (NASDAQ: DBX) at $2.53B in revenue, up 1.3% from the end of 2023, valued at $8.15B for a 3.2x revenue multiple.

- Standalone e-sign companies like PandaDoc expand their TAM by aggressively colonizing sales data rooms (DocSend), CPQs (DealHub), payments (Stripe Payment Links), and notarization (Notarize). Meanwhile, larger software bundles have acquired e-sign players—like Adobe's 2011 acqusition of EchoSign, Dropbox's 2019 acquisition of HelloSign, and Box’s 2021 acquisition of SignRequest—to drive retention by owning the complete lifecycle of critical documents like contracts and proposals.

For more, check out this other research from our platform: